Running an independent hotel is a demanding job. On top of that, the lines separating hotels and apartments are blurring, creating a single, hyper-competitive booking landscape. Your competition isn’t just the branded hotel chain down the street anymore; it’s the serviced-apartment complex on the next block. To win, you need to shed traditional thinking and embrace a data- and technology-driven strategy.

This article, based on a recent PriceLabs webinar with industry experts Carlos Avila (AR Revenue Marketing) and Daniel Polo (SocialTur), provides the tactical steps you need to optimize your revenue in this new, hybrid world.

Understanding the New Hybrid Reality

The hospitality industry has fundamentally shifted. Following the pandemic, both accommodation types evolved to meet changing traveler needs, leading to significant market overlap:

- Hotels are incorporating apartment features (e.g., small kitchenettes) to appeal to longer-stay guests.

- Apartments are adopting hotel services (e.g., daily housekeeping, standardized guest experiences, remote digital check-in) to professionalize their offering.

This blurring means the property type no longer drives the customer’s choice, but by the purpose of their trip.

Key Takeaway: “The demand is very, very similar between both types of assets. What a guest wants—a place to sleep, and the optional added services—is what drives the final decision.” — Carlos Avila

A central-city hotel will now compete directly with an apartment for a spontaneous weekend getaway, while a family planning a week-long stay will weigh the cost-effectiveness and space of an apartment against the convenience of a full-service hotel.

Transform your hospitality approach today

Discover actionable strategies tailored for small hotel owners and managers creating unforgettable stays for your guests & expanding revenues for your hotel!

Start your 30-day FREE trial now!Hotel vs. Apartment: The Key Data Differentiators

Based on real-world portfolio performance, there are distinct revenue trade-offs between asset types:

| Metric | Apartment Portfolios (STR) | Hotel Portfolios | Why the Difference? |

| Length of Stay (LOS) | 11% Higher | Lower | Apartments satisfy the need for a ‘home concept’ and space for longer trips. |

| Occupancy | 9% Higher | Lower | Longer stays result in fewer gaps in the calendar. |

| Average Daily Rate (ADR) | Lower | 12% Higher | Guests are willing to pay a premium for full service, 24-hour reception, and communal spaces. |

| Profitability | High RevPMS (Revenue per Square Meter) is harder to achieve due to lower ADR. | Higher RevPMS (up to 47% higher in some cases) due to higher ADR in a smaller footprint. |

The Operational Cost Insight: Apartment owners must factor in higher one-time cleaning costs for larger units, which makes accepting one-night stays at a lower price point much more challenging than it is for a hotel.

3 Pillars of Your Strategic Rate Fence

Before an algorithm can run autonomously, you must define the boundaries of your pricing strategy. You, the owner/manager, provide the expertise that the data alone cannot capture.

- The Minimum Price (Your Floor)

- This is the lowest rate you are willing to accept. It must cover your absolute minimum operational costs (cleaning, utilities, staff) and a desired profit margin.

- Actionable Advice: Know your true minimum. If the market is aggressive and the algorithm pushes rates below your floor, it is better to remain unbooked than to sell at a loss or at a negligible margin that strains your team.

- The Base Price (The Algorithm’s Anchor)

- This is the starting point for all calculations. The dynamic pricing tool uses this rate to apply all increases and decreases based on demand, market, and occupancy.

- Actionable Advice: Set this with extreme care. Your Base Price should be determined via meticulous forecasting based on historical data. If the base price is wrong, all subsequent dynamic pricing decisions will be flawed.

- The Maximum Price (Breaking the Ceiling)

- This is the highest rate the system is allowed to sell at.

- As a Revenue Manager, your goal is to optimize revenue. While you should aim to remove this limit, if you (or your property owner) feel a sense of “vertigo” when rates hit a new high, set a slightly higher Max Price and expand the limit gradually over time. This builds confidence while still capturing more revenue than static rates.

Mastering the Booking Window & Cannibalization

A considerable portion of revenue is often booked in the last 7–14 days. Your strategy must reflect this rapid decision-making while managing the risk of your own properties undercutting each other.

Do’s and Don’ts for Booking Window Promotions

| Strategy | DO’S | DON’TS |

| Long-Term (Early Bird) | DO price as expensively as possible to prevent under-protection (selling out too quickly). DO prioritize non-refundable offers to mitigate high cancellation risk. | DON’T use flexible cancellation policies. Early reservations have a high tendency to cancel and re-book. |

| Short-Term (Last-Minute) | DO apply a Last-Minute Discount (10-15% in the final 7–14 days) to sell perishable inventory. DO drop the Minimum Length of Stay (MLOS) for apartments to one night in the final few days to compete with hotels. | DON’T discount so steeply that it causes your early-bird guests to cancel and re-book cheaper, as this damages goodwill and revenue. |

Preventing Portfolio Self-Competition

Manage multiple properties (hotel rooms, apartments, or both) in the same area. You must prevent them from competing against each other and driving prices down—a phenomenon known as cannibalization.

This is where automated occupancy adjustments are essential:

- For Hotels (Room-Based Occupancy Adjustments – MROBA): Use this to drive rates on a specific room type. If 8 out of 10 Double Rooms are sold, the remaining 2 are automatically priced higher, regardless of how full your Single Rooms are.

- For Apartments (Portfolio-Based Occupancy Adjustments – POBA): Group all units with similar features (e.g., all 2-bedroom units in the district) into a single portfolio. As this portfolio fills up, the algorithm increases the price of the remaining units in that group. This ensures you are maximizing revenue across your entire asset cluster.

The Ultimate Edge: Prioritizing the Direct Channel

While OTAs are crucial for visibility (a guest sees you on Booking.com and then Googles your name), your profitability depends on maximizing the direct booking channel.

- The Power of Value: Don’t just compete on price. Your direct booking engine must offer tangible value that an OTA cannot:

- Exclusive rates on specific room or apartment types.

- Special, all-inclusive packages (e.g., dinner, local experience, spa).

- More flexible or guaranteed better cancellation policies.

- Richer, more detailed property information (like distance to attractions).

- Feed the Machine: Work closely with your PMS (Property Management System) to ensure you are entering the most granular data possible (e.g., distance to landmarks, occupancy details such as 2 adults + 1 child + 1 baby). This detailed information is what allows you to be found by metasearch engines (like Google Free Listings) and modern AI/LLM searches.

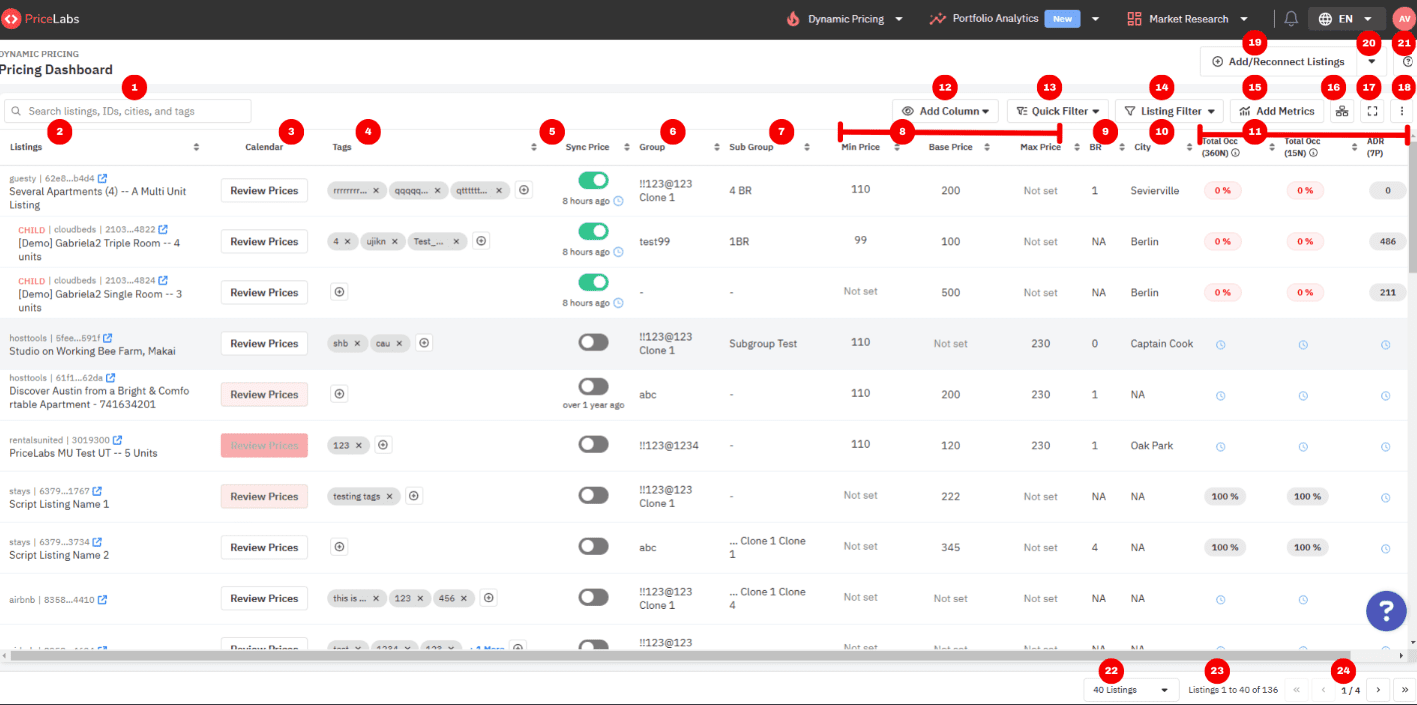

The PriceLabs Connection: Automation and Supervision

The key to navigating this hybrid market is knowing when to let the automation work and when to intervene.

Rule of Thumb: If you find yourself manually changing prices every single day, your foundational strategy is flawed. You are fighting the algorithm instead of guiding it.

The dynamic pricing tool is designed to work autonomously, but you must monitor its results against your goals.

How PriceLabs Helps:

- Custom Demand Factor: PriceLabs defaults to weighing your market data 90% towards vacation rentals (STR) and 10% towards hotels. If you are an independent hotel competing heavily against apartments, you can contact support to adjust this to a 50/50 split, ensuring your rates react to both market types.

- Goals and Forecast Tracking: Utilize the Report Builder tool within PriceLabs to upload your internal revenue targets (your Forecast). This allows you to measure your current booking pace against your targets, indicating when and where you need to adjust your pricing parameters—not daily prices.

- Preventing Cannibalization: Leverage the Portfolio Occupancy Based Adjustment (POBA) feature to group your properties and manage their pricing collectively, ensuring that competition is external, not internal

Wrapping Up

Today, the independent hoteliers are competing in a blended marketplace. To succeed, you must embrace the hard data: accept that apartments get longer stays and higher occupancy, while hotels command higher ADRs and RevPMS. The winning strategy involves setting an intelligent Min/Base/Max price fence, using automation like POBA to control internal competition, and leveraging your direct channel with unbeatable value.

Focus on setting your parameters correctly, let the algorithm do the heavy lifting, and only intervene when your data-driven forecast shows you are deviating from your revenue goals.

Frequently Asked Questions (FAQs)

Q: What is the main difference between a hotel and an apartment pricing strategy?

A: The main difference lies in the Minimum Length of Stay (MLOS) and the Minimum Price. Apartments often have higher fixed costs (larger unit, professional cleaning) that make accepting a low-priced, one-night stay unprofitable. Hotels typically have lower cleaning costs per night, giving them more flexibility to drop the MLOS and sell one-night inventory at the last minute.

Q: Should I exclude my other properties from my PriceLabs competitive set?

A: No, in almost all cases. If you have 14 units in the same building, they should be in the comp set. Use the Portfolio Occupancy Based Adjustment (POBA) feature to ensure that as your units sell, the remaining ones increase their price collectively. This prevents internal cannibalization while maximizing the group’s revenue.

Q: How often should I check my dynamic pricing settings?

A: Your core settings (Min, Base, Max, and Occupancy Adjustments) should only be reviewed and adjusted when your actual booking pace or your Forecast shows a significant deviation from your goals. You should be supervising the strategy, not influencing (manually changing daily rates) it.