The Italian tourism sector has experienced profound transformations from 2020 to 2025, shaped by global events and evolving traveler behaviors. The COVID-19 pandemic initially led to a dramatic contraction in booking windows, followed by a phased recovery. While overall booking windows have generally shortened, reflecting a preference for spontaneity, peak season travel in Italy still encourages earlier bookings. Concurrently, the median length of stay has normalized for shoulder seasons but remains robust for summer leisure, driven by a desire for more immersive experiences. Italian hospitality businesses must now adopt agile strategies, including dynamic pricing, value-added offerings, and targeted vacation rental marketing, to effectively manage demand and optimize revenue in accordance with Italy’s booking behavior.

Understanding key metrics, such as booking windows (the time between booking and arrival) and median length of stay (LoS), is vital for effective revenue management and marketing in Italy’s hospitality industry. These insights offer foresight into demand patterns, enabling the optimization of inventory, pricing, and promotions for Italian vacation rentals. This report analyzes these metrics from April 2020 to June 2025, offering a comprehensive view of Italy’s evolving travel landscape and Italy’s booking behavior.

Understanding the Data: Italy’s Booking Behavior 2020-2025

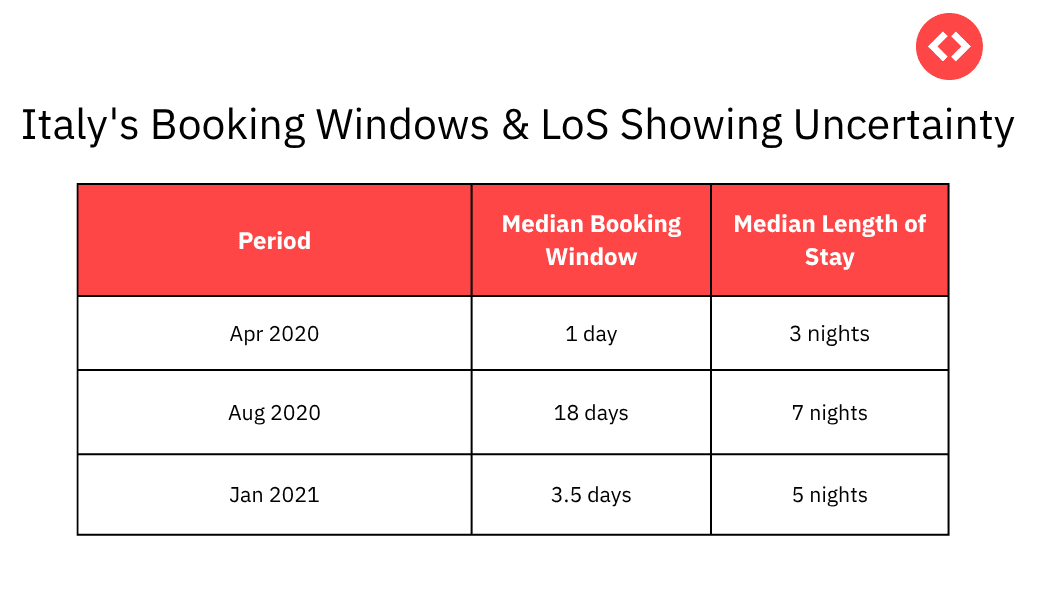

To gain a comprehensive understanding of Italy’s booking behavior, let’s examine the data for both the median booking window and the median length of stay from April 2020 to June 2025. This allows us to observe three distinct phases in Italian travel trends:

1. Crisis & Uncertainty (2020 – Early 2021)

In the early stages of the COVID-19 pandemic, traveler behavior was driven by uncertainty. The booking window was often very short—just a few days—due to travel restrictions and last-minute decision-making. However, those who did travel often stayed longer, especially during summer months. This reflects a trend toward slow travel and maximizing fewer travel opportunities.

Read More: Maximize Bookings During Slow Season In Italian Urban Cities

2. Recovery & Confidence (Mid 2021 – 2022)

As COVID-19 restrictions lifted, traveler confidence grew. We observe a notable increase in booking windows, particularly during the peak summer months. Guests were booking vacations up to 2 months in advance, signaling the return of planning and anticipation in travel behavior. The length of stay remained consistently high (6–7 nights), especially in July and August.

3. Stabilization & Hybrid Habits (2023 – 2025)

In recent years, we have observed a slight decrease in the average length of stay, particularly during off-peak months, while the booking window remains relatively long. Travelers are still planning ahead, but opting for shorter, more frequent trips. This points to the rise of “bleisure” travel and remote work flexibility, allowing guests to blend work and leisure across multiple shorter stays throughout the year.

PriceLabs Market Dashboard

Ready to unlock the power of data? Try PriceLabs Market Dashboards today and turn insights into action for your vacation rental success!

Try Now!Why Have Italian Travel Trends Changed So Significantly?

Four key reasons explain these shifts in Italy’s booking behavior:

- Revenge Travel & Renewed Confidence: After years of restrictions, travelers flocked back to Italy with urgency, eager to make up for lost time. This surge in “revenge travel” led to a boom in early bookings, especially during peak seasons. As travel rules stabilized and vaccination rates improved, guests resumed planning their trips with greater confidence.

- Remote Work & the Rise of Bleisure: With flexible work now a norm, travelers aren’t tied to rigid schedules. Off-season travel increased as guests combined business with leisure, extending their stays or returning more frequently for shorter visits. This blurred the line between vacation and work, fueling the popularity of “bleisure” stays in Italian cities and countryside alike.

- Price Sensitivity & Strategic Planning: Inflation and rising travel costs have made travelers more budget-conscious. Many are booking further in advance to snag deals, but shortening their stays to control costs, impacting both the length of stay and last-minute booking behavior.

- A New Type of Guest: The modern traveler isn’t just a summer tourist. Italy now attracts digital nomads, solo adventurers, hybrid workers, and weekenders—each with different habits and expectations. This diversification has created complex booking patterns that property managers must now monitor and respond to in a dynamic manner.

How to Leverage Shifting Italy’s Booking Behavior: Strategic Actions for Property Managers

Staying competitive in the vacation rental market means staying in tune with changing Italy booking behavior. Here’s how property managers can act on current travel trends to improve occupancy and revenue throughout the year.

1. Set Minimum Stay Rules Based on Seasonality

Adjust your minimum stay restrictions to reflect seasonal travel patterns:

- During peak months, such as July and August, when travelers typically stay 6–7 nights, consider enforcing longer minimum stay requirements.

- During shoulder seasons, such as March and October, consider reducing the minimum stay to 2–3 nights to attract short-stay guests, including last-minute bookers and bleisure travelers to accommodate shorter trips and the growing bleisure travel trend..

By aligning your policies with Italian travel behavior, you improve occupancy and attract a wider range of guests.

Read More: Short-Term Rental Laws in Italy in 2025

2. Use Dynamic Pricing to Respond to Booking Window Trends

Don’t rely on static pricing. Use dynamic pricing tools to:

- Raise rates for bookings made well in advance during high-demand periods.

- Offer discounts for last-minute reservations (typically 7–14 days before check-in) to fill gaps.

Tools like PriceLabs automate these pricing shifts based on live demand data, helping you stay competitive in the Italian short-term rental market.

3. Offer Mid-Term and Workcation Rate Plans

Create rate plans specifically for weekly or mid-term stays (7–30 nights) to attract digital nomads and remote workers.

- These guests prefer flexible, home-like accommodations and tend to book outside of traditional peak seasons.

- Mid-term stays reduce turnover costs and help maintain occupancy during slower travel periods.

This strategy taps into emerging Italy booking behavior while building more predictable income.

4. Track Monthly Booking Trends

Instead of relying on annual averages, analyze your own booking window and length-of-stay data every month.

- Compare this to broader Italian vacation rental trends to identify patterns early.

- Use these insights to adjust pricing, promotions, and stay requirements accordingly.

When you monitor changes in real-time, you respond faster and outperform your competitors.

5. Drive Early Bookings with Targeted Incentives

Encourage early planning by offering clear benefits for advance reservations:

Time your promotions around the 27–40 day window before check-in, when travelers are most likely to book.

Use early-bird discounts, value-added packages, or flexible cancellation policies.

Frequently Asked Questions

Has Italian tourism fully recovered to pre-pandemic levels?

While Italy’s tourism sector has shown remarkable recovery with increasing arrivals and longer booking windows, certain segments and overall visitor numbers are still on a trajectory to fully match or exceed pre-2020 peaks. The data from 2024 and 2025 projections show a strong rebound, but behavior has shifted.

What is “bleisure travel” and how does it affect Italian vacation rentals?

“Bleisure travel” is the combination of business and leisure, where travelers extend work trips for personal enjoyment or combine remote work with a vacation. This trend contributes to shorter, more frequent stays in off-peak seasons, creating new opportunities for property managers to offer mid-term rates and attract digital nomads.

How far in advance should guests book a vacation rental in Italy now?

For the peak summer months (July/August), guests are booking significantly in advance, often 1.5 to 2 months (e.g., 50-60+ days) prior to their stay. For shoulder seasons, it’s typically 3-5 weeks out (21-35 days), while last-minute bookings can still occur, especially for shorter stays.

What impact has inflation had on the behavior of Italian travelers?

Rising travel costs due to inflation have made travelers more mindful of their budgets. This often leads them to book further in advance to secure better deals, while also reducing their length of stay to manage overall expenses, which in turn influences both booking windows and stay durations.

Final Thoughts On Italy’s Short-term Rental Booking Behavior

The post-2020 travel era in Italy has ushered in a more structured, yet flexible guest behavior. Property managers who adapt to these changing patterns—using dynamic pricing, flexible policies, and market data—will be better positioned to attract the right guests at the right time.

Staying ahead of the curve means more than just filling your calendar—it means understanding when and how your guests want to book, and meeting them there.