The recently proposed “One Big Beautiful Bill Act” (OBBB) has generated buzz across the real estate and hospitality sectors, and for good reason. Designed to re-incentivize property investment and stimulate the economy, the impact of the big beautiful bill for short-term rentals (STR) is especially significant. At the center of the changes is the reinstatement of 100% bonus depreciation, a provision with the potential to reshape how hosts, investors, and operators approach property acquisition and upgrades.

This article breaks down the key features of the One Big Beautiful Bill, explores its specific impact on STR operators, and offers insights into how hosts can capitalize on the new incentives while also being aware of the possible downsides.

What Is the “One Big Beautiful Bill Act” for Short-Term Rentals?

The “One Big Beautiful Bill” — informally dubbed OBBB — is a tax reform package that aims to revitalize investment activity through several investor-friendly provisions. While it includes various tax relief measures for small businesses and individuals, one of its most impactful elements for the STR industry is the restoration of 100% bonus depreciation.

This change, along with increased state and local tax deductions and expanded treatment of STR losses, opens up new tax planning strategies for hosts and investors alike. However, the policy also raises concerns around affordability and market saturation.

100% Bonus Depreciation (Restored)

What Does it Mean?

Under the OBBB, STR owners can now write off the full cost of qualifying property improvements in the year they are made, instead of depreciating them over several years. This applies to assets and amenities with a useful life of fewer than 20 years, such as:

- Appliances

- Furniture

- Fixtures and lighting

- Renovations and cosmetic upgrades

Example: A Furnished STR in Houston

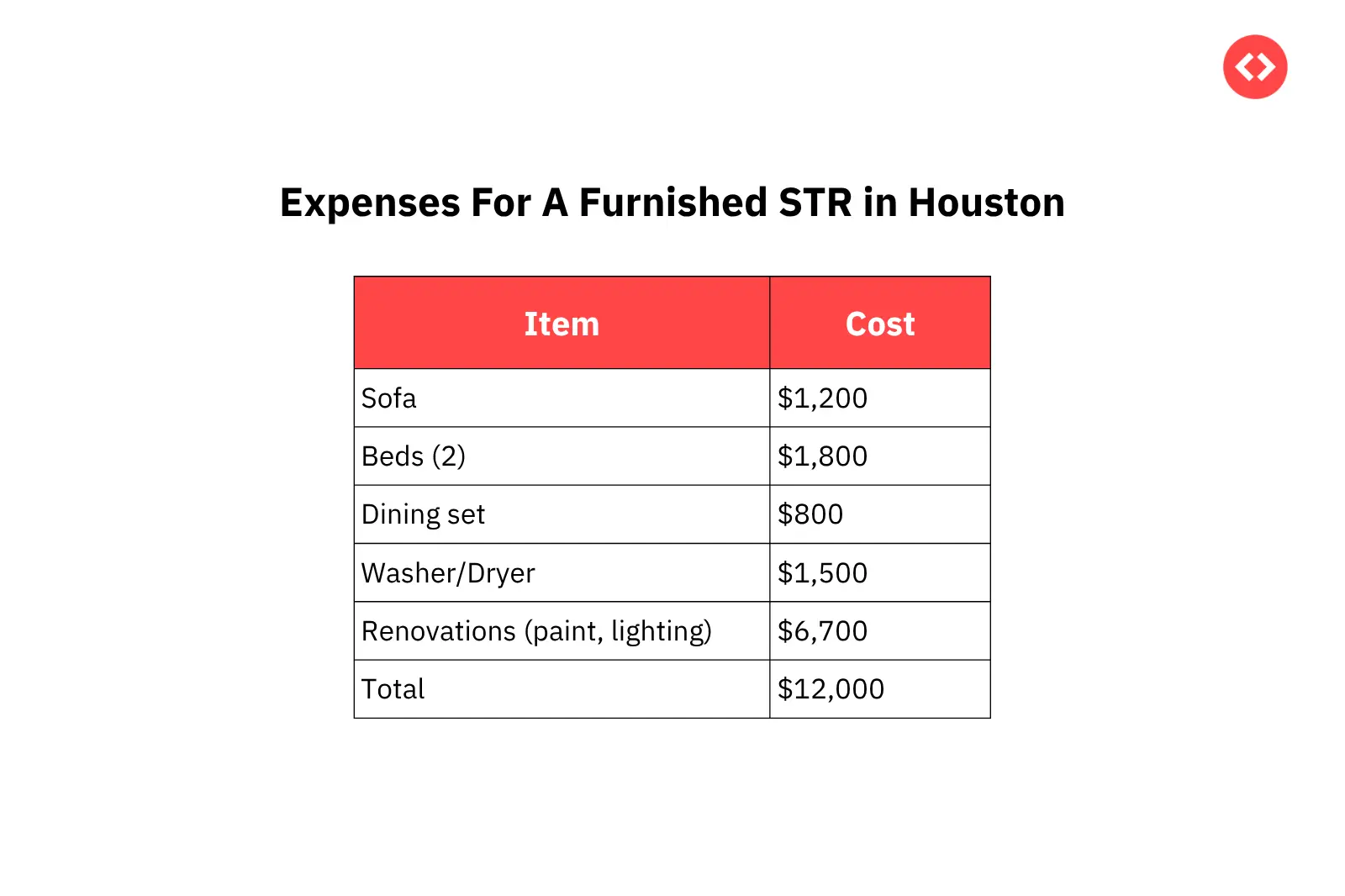

Let’s say you invest in furnishing and improving a new STR unit. Here’s how it might look:

Before the OBBB: This $12,000 would have to be depreciated over 5–7 years, resulting in a deduction of only ~$2,000 this year.

After the OBBB: You deduct the full $12,000 in Year 1.

If you’re in a 32% tax bracket, that’s a $3,840 reduction in taxes owed.

Why Does It Matter?

This immediate tax benefit dramatically improves cash-on-cash return for new and existing operators. According to Daniel Zammata, Senior Solutions Consultant at PriceLabs, “This is the most impactful change. It will likely motivate real estate investors and Airbnb operators to launch new listings — now that they can fully write off their upfront investments in the first year.”

Short-term Rental Losses Can Offset All Income

In another major shift, short-term rental (STR) losses are now deductible from all income, not just rental income. This change is especially impactful for part-time hosts or side-hustle investors who maintain full-time jobs.

Example:

If you’re a salaried employee earning $90,000/year and your short-term rental operates at a $15,000 loss due to startup costs and seasonal downtime, you can now deduct that full amount from your employment income, significantly reducing your tax burden.

Kyle Driskell, Senior Solutions Consultant at PriceLabs, adds, “This could be impactful for hosts that still work another job. If their STR loses money, they can deduct those losses from their regular income when filing.”

This incentivizes new entrants who might have hesitated before due to uncertain early-year profits.

Higher SALT Deduction: A Boost for High-Tax Markets

The bill also raises the State and Local Tax (SALT) deduction cap to $40,000 — a boon for operators in high-property-tax states like California, New York, and New Jersey.

For short-term rental owners in these markets, where property taxes can be steep, this change could make STR operations more financially viable by significantly reducing federal tax liabilities.

Potential Drawbacks: Regulation and Saturation Concerns

While the tax advantages are clear, industry experts caution that these incentives could have some unintended consequences.

1. Affordable Housing Pressure

With more investors likely to enter the STR space to capitalize on these tax breaks, housing stock in high-demand urban areas could shrink further, exacerbating affordability issues.

2. Market Saturation and Lower ADRs

A surge in new STR listings — without corresponding demand — may reduce Average Daily Rates (ADR). This could make it harder for hosts to maintain profitability, especially in already competitive markets.

3. Increased Tax Complexity

Though the bill is designed to reduce tax burdens, it introduces complexity in reporting. To qualify for the full benefits, hosts may need to work closely with CPAs and ensure strict record-keeping.

As Kyle Driskell notes, “Tax reporting to qualify for the positives is going to be a lot more difficult.”

What Hosts Should Do Now?

Whether you’re new to hosting or managing a growing portfolio of properties, here’s how to prepare:

1. Work with a Tax Professional

Understanding depreciation rules and filing STR losses correctly can be tricky. A CPA with experience in short-term rental taxation is essential.

2. Plan Upgrades Strategically

If you were holding off on furnishing or renovating your property, now may be the time. Use the 100% bonus depreciation rule to make major investments before year-end.

Use PriceLabs Market Dashboard to find amenities that work for you and your market using data-driven insights custom made for your market

Use PriceLabs Market Dashboard and Neighborhood Data to track competitor pricing and demand shifts, analyze past performance, and market amenities to set a strong pricing strategy for your property.

Create Your Dashboard Now!3. Reevaluate Your Market

Before expanding or acquiring new listings, assess local STR saturation and regulation trends. Some cities may clamp down harder on STRs if inventory spikes.

4. Track Expenses Diligently

Detailed receipts, invoices, and records will be critical in substantiating your deductions during an audit.

Use Dynamic Pricing and Get Regular Reports of Your Market with PriceLabs Portfolio Analytics.

Static pricing hurts your listing. Boost occupancy & revenue with PriceLabs’ Dynamic Pricing & Revenue Management tool. Optimize your pricing strategy based on market conditions, seasonality & competition for outstanding guest reviews. Get instant reports with Portfolio Analytics.

Get Started NowFinal Thoughts: A Mixed Blessing for the STR Industry

The One Big Beautiful Bill for short-term rentals has the potential to supercharge growth by lowering tax barriers and boosting investor returns. Restoring 100% bonus depreciation and allowing broader STR loss deductions bring immediate benefits to property owners. However, it also raises questions about market sustainability, equity, and regulation.

Hosts who adapt strategically — leveraging the positives while preparing for the pitfalls — will be best positioned to thrive in this evolving landscape.