At PriceLabs, we spoke to ~100 revenue managers around the world to understand what 2026 will look like and what makes the top performers stand out. In turn, we developed this revenue management self-assessment scorecard for revenue managers who actually own their outcomes.

We didn’t ask about software features or passing trends. We focused on judgment, decision-making under pressure, and the choices that drive actual results. This report is divided into two parts:

- Survey Results: How top RMs are preparing for automation, market swings, and operational complexity—and where even the best are currently exposed.

- The Revenue Management Self-Assessment Scorecard: A tool to determine if you are operating at a top 1% level or if your results are being limited by habit, process, or decision-making gaps.

What the Survey Really Revealed

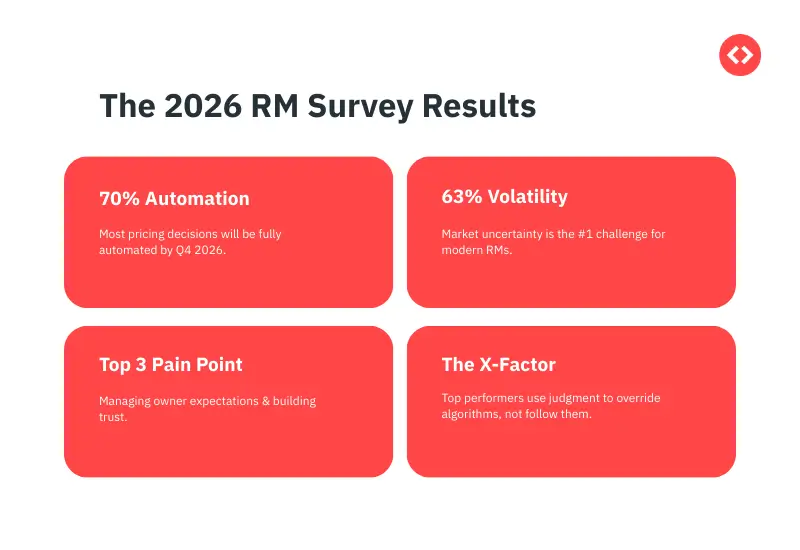

- Automation is mainstream: Most RM’s expect 60-70% of pricing decisions to be fully automated by Q4 2026. Pricing and data reporting tools are handling most of the automation but revenue managers still need to guide the strategy.

- Economic volatility dominates focus: 63% of managers say market uncertainty is their top challenge. Even the best tools require skilled interpretation to navigate shifting conditions.

- Owner communication is critical: Managing owner expectations consistently ranks in the top three pain points. Algorithms provide rates, but managers are the ones who translate them into trust and clarity.

- Judgment drives differentiation: Across the industry, managers agree that top performers know when to override automation, not who blindly follow it. Tools provide insight; judgment turns it into advantage.

Join the 100+ RMs who are redefining the role.

PriceLabs provides the data; you provide the judgment. See how our industry-leading analytics can help you defend your price integrity and maximize your contribution margin.

Start Your Free Trial NowRevenue Management Self-Assessment Scorecard and How to Use It

This is not a benchmark against other RM’s or companies. It’s a benchmark against what 2026 will demand of the role.

For each section:

- Score yourself from 0–5

- Be honest.

- Anything below 3 isn’t a weakness, it’s an opportunity to improve!

Think of this less as a checklist, and more as a conversation you’d have with yourself after a long, difficult season.

The 2026 Vacation Rental Revenue Manager Scorecard

1. Pricing Strategy (Not Pricing Activity)

The Question:

Can you explain your pricing philosophy without opening your pricing tool?

Why This Is on the Scorecard

Our survey shows automation is rising quickly but confidence in why prices are what they are is not. That gap matters.

As Dacil Rodriguez (Seven Revenue Rules) put it:

“Top-tier revenue managers will be the ones who can leverage AI without outsourcing judgment to it”

Score Yourself

- 5 – Our strategy is a written doctrine that dictates how our pricing tool is configured.

- 3 – We follow best practices and respond well to signals

- 1 – Pricing is largely reactive, even if automated

Reflection Prompt:

Look at last month’s pricing strategy. Which ones were based on analysis, intuition, or habit? For each, ask yourself: if the outcome had gone the other way, would I still stand by the decision or would I just blame the tool?

2. Demand Shaping (Where Most RM’s Struggle)

The Question:

Can you influence demand intentionally instead of just reacting to bookings?

Why This Matters in 2026

Fast bookings don’t always mean high revenue, and slow bookings don’t always mean low revenue.

Top revenue managers don’t chase the curve. They shape demand to optimize revenue and portfolio strategy. Many RM’s still raise or lower rates purely based on how quickly reservations come in, missing the bigger picture.

Score Yourself

- 5 – We actively shape lead time, length of stay, and guest mix

- 3 – We sometimes hold rates, but usually react

- 1 – Any slowdown triggers discounts

As Purushottam Deshpande (Revopt) said:

“Being able to adapt to the dynamic marco trends/patterns . Over the past 12 months, I have seen demand trends fluctuate quite a bit across US, CA, Middle east and Australia. If one is able to spot the trends early on, he/she will be able to deliver better results.”

Reflection Prompt

Look at your portfolio’s booking patterns. Which decisions were deliberate attempts to shape demand, and which were just reactive moves to visible pace or occupancy? Be honest: are you managing demand, or just chasing it?

3. Discount Discipline (The Quiet Damage)

The Question:

Can every discount be defended out loud?

Why This Made the Scorecard

Discounting feels tactical.

Its consequences are structural.

Over time, it:

- Trains guests to wait

- Compresses booking windows

Score Yourself

- 5 – Discounts are targeted, time-bound, and intentional

- 3 – Discounts exist but aren’t rigorously governed

- 1 – Discounts exist because “they usually help”

Reflection Prompt

Audit every discount applied in the last quarter. Which ones were strategically justified, and which were habitual, panic-driven, or based on gut feeling?

4. Channel Economics (Revenue vs Reality)

The Question:

Do you know which channels truly create value?

Why This Is Hard

OTAs make revenue visible.

They hide the cost.

By 2026, top revenue managers will actively trade volume for contribution margin and be comfortable explaining why.

Score Yourself

- 5 – Channel strategy is margin-led

- 3 – We know costs but rarely act on them

- 1 – We optimize gross revenue and hope margin follows

Reflection Prompt

For each channel you manage, ask yourself: Am I optimizing for real profit, or just chasing bookings that look good on a dashboard? If leadership measured me solely on contribution margin tomorrow, which choices would I revisit?

5. Metrics That Actually Change Behavior

The Question:

Which metric would you keep if you had to delete 80% of your dashboard?

Why This Matters

Most dashboards explain the past.

Very few shape decisions.

Score Yourself

- 5 – Metrics directly influence action

- 3 – Metrics are mostly explanatory

- 1 – Metrics exist for reporting

As Neil Watson (Bear Revenue) said:

“Being able to speak to the numbers, share the insights, and equip property managers to confidently speak to their property owners in an informed way will be key”

Reflection Prompt

Open your monthly report/dashboard. Which vacation rental metrics actually drove a decision last month, versus those that were just “nice to know” or presented to leadership? If you could only act on one metric tomorrow, which would it be, and what would break if the others disappeared?

6. Ops Integration (The Hidden Revenue Risk)

The Question:

Does operations understand why prices change?

Why This Is No Longer Optional

Guest experience now feeds:

- Reviews

- Visibility

- Price tolerance

Revenue strategies that ignore ops don’t fail immediately, they decay quietly.

Score Yourself

- 5 – Pricing and ops are tightly aligned

- 3 – Alignment exists until pressure hits

- 1 – Ops reacts after the fact

Reflection Prompt

Examine the last time a pricing change caused friction with operations. Could you trace the impact clearly from pricing to guest experience to revenue? Where have you assumed ops will “figure it out” and how much revenue might have silently slipped because of that assumption?

7. Owner Confidence (The Survey-Proven Constraint)

The Question:

Do owners trust your decisions when results dip?

Why This Came Through Strongly in the Survey

Beyond economic uncertainty, managing owner expectations emerged as one of the most consistent pressure points.

This isn’t about performance.

It’s about credibility during volatility.

As Evan Haskell (Syncronest) said:

“Revenue managers that build very strong relationships with their clients and also do a great job from a technical standpoint are the ones who are going to dominate the market.”

Score Yourself

- 5 – Owners understand strategy, not just outcomes

- 3 – Owners trust success, panic during dips

- 1 – Owners frequently override decisions

Reflection Prompt

Pick the last three times results underperformed expectations. Could you explain why the strategy still works to each owner — or did you rely on luck, charm, or the hope they wouldn’t ask questions? Which decisions would you be embarrassed to defend in a real meeting?

How to Read Your Score (Be Honest)

- 30–35 → You’re operating at a strategic level most won’t reach

- 22–29 → Strong operator, vulnerable to 2026 pressure

- 15–21 → Efficient, but reactive

- Below 15 → Optimizing a model that’s already expiring

The Point of This Exercise

This scorecard isn’t meant to flatter you.

It’s meant to answer one uncomfortable question our survey raised:

“What would separate the top performers from the rest of the pack in 2026?”

As Mike Savage (Synergy Stays) said:

“Innovation, not just implementation will separate top RM’s from the rest. Good revenue managers have a strong understanding of revenue management principles and maintain consistent rhythms. Great revenue managers are committed to the relentless pursuit of what’s possible and will continuously redefine best practices in revenue management.”

In 2026, the best revenue managers won’t win by reacting faster.

They’ll win by:

- Making harder calls

- Defending price integrity

- Explaining volatility with confidence

- Saying no when it’s easier to say yes

- And being willing to look wrong short-term to be right long-term

Frequently Asked Questions

1. What is a Revenue Management Self-Assessment and why do I need one?

A Revenue Management Self-Assessment is a structured audit of your decision-making processes rather than just your software settings. In 2026, as pricing automation becomes the industry baseline, your competitive advantage shifts from having a tool to how you guide it. This assessment helps you identify if you are operating strategically or simply reacting to market noise.

2. How often should I use the Scorecard to audit my strategy?

We recommend taking this self-assessment quarterly. Market conditions in 2026 are highly volatile, and “strategic drift”—where habit takes over for judgment—happens slowly. A quarterly check ensures your pricing philosophy, channel economics, and owner communication remain aligned with current demand.

3. If 70% of pricing is automated, what does a Revenue Manager actually do?

The role is shifting from “tactical executor” to “strategic pilot.” While the algorithm handles high-frequency rate changes, the RM is responsible for demand shaping, defending price integrity against panic-discounting, and translating complex data into trust for property owners. The tool provides the speed; you provide the direction.

4. How can I improve my score in “Owner Confidence”?

Owner trust is built on transparency during volatility. Instead of reporting just “occupancy,” start reporting on contribution margin and demand trends. When you can explain why you are holding rates despite a dip in pace, you move from being a “vendor” to a “trusted advisor.”

5. What is the difference between pricing activity and pricing strategy?

Pricing activity is the act of moving rates up or down (often handled by automation). Pricing strategy is the underlying doctrine—your “why.” It includes your stance on discount discipline, your desired guest mix, and your willingness to trade short-term volume for long-term brand equity and profit.