The short-term rental market’s seasonal fluctuations present both significant opportunities and operational challenges for multi-unit vacation rental property managers. Understanding these patterns is crucial for maximizing revenue and maintaining portfolio performance year-round. Seasonality in short-term rentals refers to the regular fluctuations in demand, pricing, and occupancy rates tied to the time of year, holidays, events, and regional travel patterns. By leveraging data-driven insights and strategic planning, managers can optimize operations to capture peak-season gains while maintaining profitability during slower periods. This comprehensive approach to seasonal management enables portfolio-wide success across diverse markets and property types.

Understanding Seasonality in Short-Term Rentals

Seasonality fundamentally shapes the short-term rental landscape, creating predictable patterns that directly influence occupancy rates, pricing power, and revenue cycles. Weather patterns, holiday schedules, and local events are the primary drivers of these yearly demand shifts, with each factor contributing to distinct booking behaviors across markets.

For multi-unit vacation rental property managers, understanding these seasonal dynamics is essential for strategic planning and resource allocation. The ability to anticipate demand fluctuations allows managers to adjust pricing strategies, marketing efforts, and operational procedures to maximize performance during both peak and off-peak periods.

What Seasonality Means for Multi-Unit Property Managers

Managing seasonal variation across multiple properties requires sophisticated, data-informed decision-making processes. Unlike single-property owners who can rely on local market knowledge, multi-unit property managers must navigate diverse seasonal patterns across different locations, property types, and guest demographics simultaneously.

The complexity increases when managing properties in markets with contrasting seasonal patterns—such as beach destinations that peak in summer alongside urban properties that maintain more consistent demand year-round. This diversity creates opportunities for portfolio-level optimization, where strong performance in one market can offset slower periods in another.

Successful multi-unit property management during seasonal fluctuations requires tailored revenue management, flexible minimum-stay policies, and targeted marketing campaigns that adapt to local market conditions. The growing importance of operational efficiency, driven by competitive pressures and the need for scalable solutions, makes technology integration essential for effectively managing these complexities.

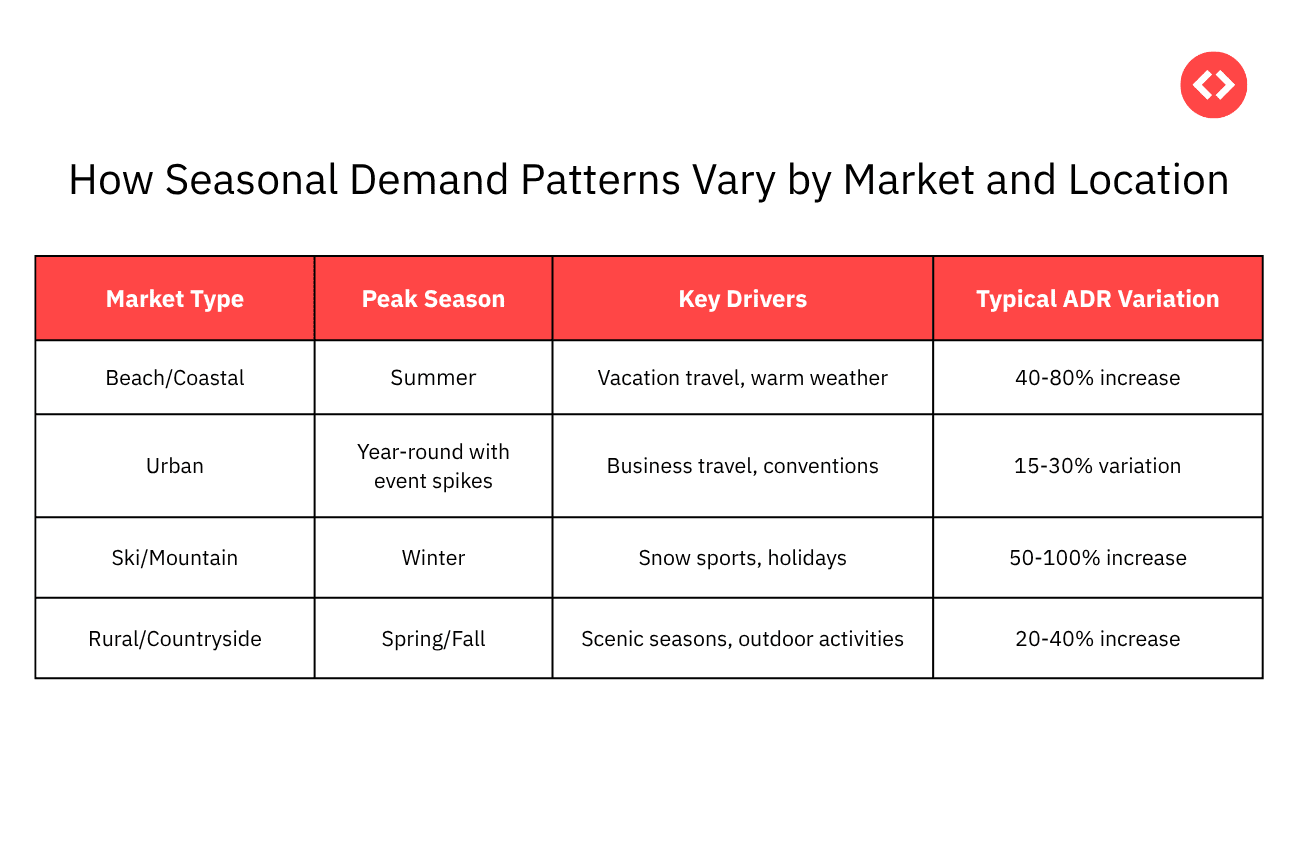

How Seasonal Demand Patterns Vary by Market and Location

Market-specific factors create distinct seasonal patterns, making one-size-fits-all approaches ineffective for diversified portfolios. Coastal properties, like those in Italian coastal towns, typically experience summer peaks driven by vacation travel, while ski destinations, like US ski markets, see winter demand surges. Urban markets often maintain steadier occupancy with smaller seasonal variations, though they may experience spikes during major events or conventions.

Key Metrics to Inform Seasonal Strategies

Tracking the right performance metrics provides the foundation for evidence-based seasonal strategy development. These metrics enable managers to identify trends, benchmark performance, and make informed adjustments to optimize revenue across all seasons.

Effective seasonal management relies on understanding how occupancy rate trends, average daily rate fluctuations, and insights into revenue per available rental work together to reveal portfolio performance patterns. Each metric provides unique insights that, when combined, create a comprehensive view of seasonal dynamics.

Occupancy Rate Trends Across Seasons

Occupancy rate measures the percentage of available rental nights booked during a given period and serves as a fundamental indicator of demand strength across seasons. Monitoring occupancy trends helps managers identify both opportunities for revenue growth and periods requiring intervention to maintain performance.

Seasonal occupancy fluctuations can be dramatic, with some markets experiencing 80-90% occupancy during peak periods and dropping to 30-40% during off-seasons. For eg., Understanding these patterns enables proactive planning for marketing campaigns, pricing adjustments, and operational modifications.

Historical occupancy data segmented by high and low seasons reveals booking patterns that inform future strategy development. Properties in weather-dependent markets typically exhibit the most pronounced seasonal variations, while urban locations may show more consistent occupancy with milder seasonal dips.

Average Daily Rate Fluctuations

Average Daily Rate (ADR) represents the average earnings per rented unit per night, excluding unbooked units, and serves as a critical metric for understanding pricing power across seasons. ADR fluctuations reflect the market’s willingness to pay premium rates during high-demand periods and the need for competitive pricing during slower periods.

Dynamic pricing strategies, such as those offered by PriceLabs, that adjust rates based on real-time demand and competitor activity have proven essential for maximizing ADR potential. Markets with strong seasonal patterns often support ADR increases of 40-80% during peak periods, while maintaining competitive rates during off-seasons requires careful balance to sustain occupancy.

Tracking ADR by season and property type reveals pricing opportunities and helps identify underperforming assets that may benefit from repositioning or strategic improvements. Successful ADR management involves understanding both local market conditions and broader travel demand patterns.

Revenue Per Available Rental (RevPAR) Insights

Revenue per available rental (RevPAR) combines occupancy rate and ADR to reveal total revenue performance per available unit over a specific period. RevPAR provides the most comprehensive view of property performance by accounting for both pricing success and booking frequency.

This metric proves especially valuable for multi-unit property portfolio benchmarking and season-over-season comparisons. Properties with high ADR but low occupancy may show similar RevPAR to those with moderate rates but strong booking consistency, revealing different optimization opportunities.

RevPAR analysis can uncover underperformance patterns and guide strategic interventions. Properties consistently underperforming market benchmarks on RevPAR may require operational improvements, pricing adjustments, or changes to marketing strategy to reach their potential.

Turn Seasonal Volatility into Profit.

Stop guessing on seasonal pricing. With PriceLabs, analyze your market’s specific seasonal trends today, and get a tailored strategy to maximize RevPAR during peaks and maintain occupancy during dips.

Start Your Free TrialData-Driven Approaches to High Season Strategies

High-season periods offer the greatest revenue opportunities for short-term rental properties, making data-driven optimization crucial to maximizing returns. Successful high-season strategies combine dynamic pricing, strategic event planning, and advanced yield management techniques to capture peak demand effectively.

The key to high-season success lies in identifying peak periods early, understanding market drivers, and implementing flexible pricing strategies that respond to real-time demand signals. These approaches enable managers to optimize both occupancy and rates during the most profitable periods.

Identifying Peak Periods and Market Drivers

Detecting high-demand windows requires analyzing historical booking data alongside external market factors such as local events, holidays, and seasonal attractions. Recurring demand drivers create predictable patterns that enable proactive planning and strategic positioning.

Local events, school breaks, and holiday periods are primary demand catalysts, often triggering booking surges weeks or months in advance. Collaborating with local tourism boards and event organizers provides insights into upcoming attractions that may drive demand spikes.

Creating comprehensive event calendars that include major holidays, local festivals, sporting events, and conference schedules enables strategic pricing and marketing alignment. Properties near major attractions or event venues can particularly benefit from understanding and preparing for these demand drivers.

Dynamic Pricing to Maximize Revenue During High Demand

Dynamic pricing, such as that provided by PriceLabs, automatically adjusts rental rates based on real-time supply, demand, and competitor activity to optimize overall revenue performance. This approach proves particularly effective during high-demand periods when pricing power increases significantly.

The implementation process involves inputting relevant market data, analyzing demand patterns and competitive positioning, adjusting pricing rules based on insights, and continuously monitoring and iterating based on performance results. This systematic approach ensures rates remain competitive while maximizing revenue potential.

Research consistently shows that adopting dynamic pricing ranks among the most effective strategies for optimizing income in the short-term rental sector. Properties using dynamic pricing typically achieve 10-25% higher revenue compared to those using static pricing approaches.

Leveraging Local Events and Holidays for Revenue Boosts

Aligning pricing and marketing strategies with market-specific events creates opportunities for significant revenue increases during predictable demand spikes. Major local events often trigger substantial, measurable demand shifts that savvy managers can capitalize on effectively.

Successful event-driven strategies involve monitoring local event calendars, launching targeted marketing campaigns, and optimizing minimum stay requirements during peak periods. For example, properties near music festivals or major conferences can implement premium pricing and extended minimum stays to maximize revenue per booking.

Event-specific marketing campaigns that highlight property proximity to attractions or special amenities can drive booking conversions and justify premium rates. Properties that proactively market around local events typically achieve higher occupancy and ADR during these periods.

Optimizing Low-Season Performance Using Data

Off-peak periods require different strategic approaches to maintain occupancy and protect revenue as demand naturally decreases. Data-driven low-season optimization involves price flexibility, targeted marketing, and enhanced guest experiences to attract bookings during slower periods.

Successful low-season management balances competitive pricing with value-added services and experiences that differentiate properties from competitors. The goal is sustaining cash flow and market presence while preparing for the next high season cycle.

Adjusting Pricing for Off-Peak Demand

Rate flexibility during low seasons helps attract price-sensitive travelers and prevents extended vacancy periods that can significantly impact annual revenue. Strategic price reductions, extended stay discounts, and flexible booking terms can stimulate demand during naturally slower periods.

Lowering minimum-stay requirements and offering discounts for extended bookings aligns with industry trends toward longer guest stays and improves occupancy rates. Demand pacing dashboards and competitor benchmarking ensure pricing remains appropriately responsive to market conditions.

Temporary promotional pricing and flash deals can create urgency and drive bookings during particularly slow periods. These tactics work best when combined with targeted marketing to reach relevant guest segments actively searching for accommodations.

Targeted Marketing to Maintain Occupancy

Targeted marketing involves segmenting audiences and customizing outreach based on location, season, and guest preferences to improve booking conversion rates. During low seasons, focusing on local and drive-to markets often proves more effective than pursuing distant travelers.

Effective low-season marketing campaigns include email outreach to past guests, local social media advertising, partnerships with area attractions, and special offers for specific traveler segments. These approaches help maintain visibility and attract bookings when organic demand decreases.

Marketing messages during off-peak periods should emphasize value, unique local experiences, and seasonal advantages such as lower crowds or special events. Properties that successfully market their off-season benefits often maintain stronger occupancy than those relying solely on pricing adjustments.

Enhancing Guest Experience to Drive Repeat Bookings

Guest experience encompasses the amenities, personal touches, and service quality that influence satisfaction and the likelihood of booking again. During low seasons, exceptional experiences become even more important for building loyalty and generating repeat business.

Unique experiences, curated amenities, and attentive communication distinguish successful properties from competitors, particularly during slower periods when price competition intensifies. Properties that invest in improving the guest experience often see higher repeat booking rates and more positive reviews.

Strategies for enhancing guest experience include gathering and acting on guest feedback, offering loyalty incentives for return visits, updating amenities during slower months, and providing personalized recommendations for local activities. These investments in guest satisfaction pay dividends in the form of increased lifetime customer value.

Integrating Technology to Manage Seasonal Fluctuations

Technology integration provides critical advantages for managing seasonal volatility across multi-unit property portfolios. AI-powered tools, channel management systems, and automated pricing platforms, like PriceLabs, enable faster, more accurate responses to changing market conditions while reducing manual workload.

The strategic benefits of technology adoption extend beyond operational efficiency to include improved decision-making, enhanced guest experiences, and competitive advantage in rapidly changing markets.

Role of AI-Powered Revenue Management Tools

AI-powered revenue management uses machine learning algorithms to predict trends, optimize pricing, and improve portfolio outcomes at scale. These systems process vast amounts of market data to identify patterns and opportunities that manual analysis might miss.

Evidence consistently shows that AI and smart technology adoption drive superior guest experiences and competitive advantages in short-term rentals. Properties using AI-powered revenue management typically achieve higher RevPAR and more consistent performance across seasonal cycles, as seen in Poland.

Implementation involves selecting appropriate tools, integrating data sources, setting performance parameters, training team members, and monitoring results for continuous improvement. This systematic approach ensures technology investments deliver measurable returns.

Benefits of Multi-Channel Distribution to Reduce Vacancy

Multi-channel distribution increases property visibility across multiple booking platforms, driving more reservations and helping diversify demand year-round. This approach reduces dependence on any single platform while maximizing market reach.

A channel manager enables property managers to update availability and rates across multiple booking platforms simultaneously, reducing double bookings and manual errors while ensuring consistent information across all channels.

Multi-channel best practices include regular photo updates across platforms, accurate amenity descriptions, synchronized calendar management, and platform-specific optimization strategies. Properties effectively managing multiple channels typically achieve 15-30% higher occupancy rates than single-channel listings.

Automating Seasonal Pricing and Inventory Adjustments

Automated pricing systems, such as those from PriceLabs, reduce manual workload while improving reaction speed to market changes. Beyond pricing, automation can manage inventory availability, minimum stay requirements, and booking rules based on seasonal demand patterns.

Successful automation implementation includes setting up rule-based pricing adjustments, configuring inventory management protocols, establishing performance-monitoring systems, and maintaining audit trails to track rule effectiveness. This systematic approach ensures automation enhances rather than replaces strategic thinking.

Properties using comprehensive automation typically respond to market changes faster than those relying on manual processes, leading to improved revenue capture during both high and low seasons.

Building Financial and Operational Resilience Across Seasons

Intelligent planning, powered by data analytics and automation, enables short-term rental operators to maintain profitability and growth across both peak and off-peak cycles. Building resilience requires strategic financial planning, operational efficiency, and proactive maintenance scheduling.

Resilient operations balance revenue optimization with cost management, ensuring properties remain competitive and profitable regardless of seasonal demand fluctuations.

Planning Cash Flow to Manage Seasonal Variability

Effective cash flow management involves creating financial models that incorporate historical seasonal patterns while projecting future revenue and expenses. Understanding seasonal cash flow cycles enables better planning for operational costs, property improvements, and business growth investments.

Data-driven 90-day strategic planning helps underperforming properties regain profitability by identifying specific improvement opportunities and tracking progress against measurable goals. This approach provides structure for navigating seasonal transitions while maintaining financial stability.

Cash flow planning templates should include seasonal revenue projections, fixed and variable expense categories, reserve fund allocations, and contingency planning for unexpected market changes. Regular financial reviews ensure plans remain relevant as market conditions evolve.

Streamlining Operations During Low Demand Periods

Operational efficiency becomes particularly important during low-demand periods when revenue decreases but many fixed costs remain constant. Strategic operational adjustments can significantly improve profitability during slower seasons.

Optimizing vacation rental cleaning schedules, consolidating maintenance activities, and cross-training team members creates flexibility while reducing operational costs. Software features supporting task automation, portfolio analytics, and role-based access control enable efficient multi-unit property management at scale.

Operational streamlining actions during slow periods include renegotiating vendor contracts, implementing energy-efficiency measures, optimizing staffing levels, and investing in training programs to improve service quality and operational efficiency.

Using Data to Inform Maintenance and Upgrades Timing

Low-occupancy windows provide ideal opportunities for property improvements without sacrificing revenue. Strategic timing of maintenance and upgrades maximizes return on investment while minimizing operational disruption.

Top-performing managers use portfolio data and guest feedback to prioritize improvements with the greatest impact on future performance. Major renovations, technology upgrades, and amenity additions are best scheduled during naturally slower periods.

Frequently Asked Questions

How Does Seasonality Impact Pricing and Occupancy in Short-Term Rentals?

Seasonality creates predictable fluctuations in both pricing and occupancy, with peak periods supporting higher rates and more frequent bookings. In contrast, off-peak periods require adaptive pricing and marketing strategies to sustain occupancy. Weather patterns, holidays, and local events drive these cycles, with some markets experiencing ADR variations of 40-80% between peak and off-peak periods like in the case of Portugal vacation rental market.

What Are the Most Important Metrics to Track Seasonal Trends?

The most critical metrics for assessing seasonal trends include occupancy rate, average daily rate (ADR), and revenue per available rental (RevPAR). These metrics work together to reveal shifts in demand patterns and earning potential throughout the year, enabling data-driven strategy adjustments and performance optimization.

How Can Multi-Unit Property Managers Effectively Adjust Strategies for Different Seasons?

Effective seasonal strategy adjustment involves implementing dynamic pricing based on real-time market data, launching targeted marketing campaigns for specific seasons and guest segments, and optimizing operational procedures, including minimum stay requirements and booking policies. Success requires understanding local market patterns and maintaining flexibility to respond to changing conditions.

What Role Do Local Events Play in Seasonal Rental Demand?

Local events and holidays often create significant demand spikes that savvy managers can capitalize on through strategic pricing and marketing alignment. Major festivals, conferences, sporting events, and holiday periods can drive booking surges and support premium pricing, making event calendar monitoring essential for revenue optimization.

How Can Technology Help Manage Seasonal Fluctuations More Effectively?

Technology solutions, including AI-powered revenue management tools like PriceLabs, automated pricing systems, and multi-channel distribution platforms, enable faster, more accurate responses to seasonal market changes while reducing manual workload. These tools process market data at scale to identify optimization opportunities and automatically implement strategic adjustments, typically improving revenue performance by 10-25% compared to manual management approaches as can be seen in Greek vacation rental market analysis.