Managing a property is about keeping every dollar accounted for. But what happens when you’re juggling 10, 20, or even 50 units? Between untracked cleaning costs, small repairs, and missed reimbursements, your books can quickly become a messy financial puzzle, and your cash flow takes a major hit.

A study by TopKey found that short-term rental (STR) managers lose an estimated 10–20% of their monthly spend per property to “expense leakage”—unbilled or unreimbursed costs like seasonal deep cleans, emergency repairs, or recurring supplies. For a U.S. property manager, that’s $800 to $1,600 per unit per month, adding up to nearly $19,200 annually per property in lost revenue.

Property managers across the U.S. are unknowingly losing thousands of dollars every year. This comprehensive vacation rental accounting guide is designed to help you plug those leaks, track expenses accurately, recover every last reimbursement, and keep your profits healthy and scalable.

What Makes Vacation Rental Accounting So Challenging?

Managing finances for STRs is fundamentally different from a traditional long-term rental or real estate portfolio. The high-velocity nature of the business and unique financial layers create several pain points.

- Multiple, Layered Income Streams: Unlike a single monthly rent check, STR revenue is a mix of nightly rates, cleaning fees, pet deposits, early check-in fees, and upsells.

- Complex Fee Structures: You’re dealing with OTA commissions (Airbnb, Vrbo, etc.), credit card processing fees, management fees, and dynamic pricing adjustments.

- State-by-State Compliance: Accounting laws vary significantly by jurisdiction. In some states, it’s a legal requirement to keep owner funds separate. Even where it’s not, failing to do so can expose you to legal liabilities.

- Frequent Transactions: Dozens of monthly bookings automatically generate hundreds of financial entries. Reconciling each one manually is a full-time job in itself.

- Owner Trust Accounting: You’re handling money that isn’t fully yours. Accuracy isn’t optional; it’s the foundation of owner trust and the core of your business reputation.

- Seasonality and Cash Flow: Spiky revenue flows across the year make forecasting and budgeting difficult without a clear, granular view of your finances.

These layers make accuracy and consistency crucial for staying compliant with U.S. regulations, such as 1099 reporting and trust fund segregation.

How Should You Structure Your Chart of Accounts?

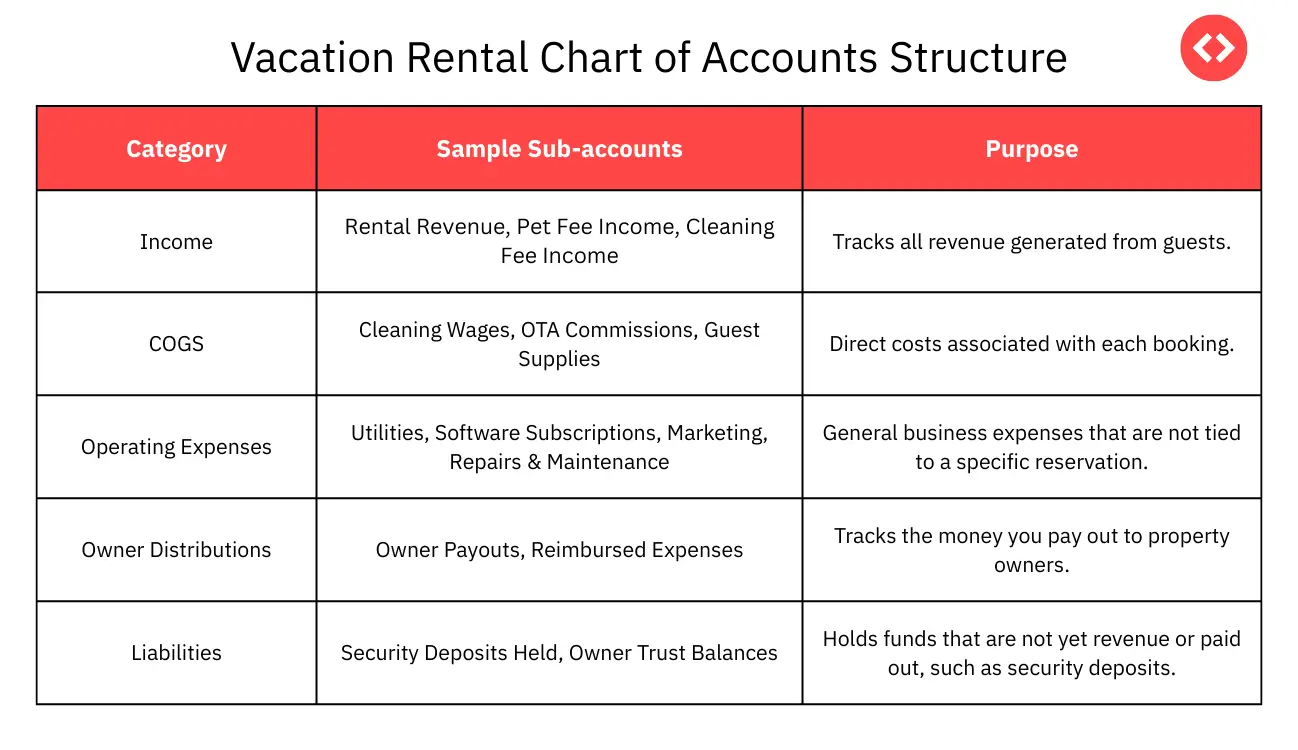

Your Chart of Accounts (CoA) is the backbone of your vacation rental bookkeeping. It categorizes every transaction, keeps trust and operational funds properly separated, and serves as the foundation for accurate owner reporting and financial insights.

A well-structured CoA allows you to:

- Track Property-Level Performance: Understand which properties are your top earners and which are underperforming.

- Separate Operational vs. Trust Funds: Legally and ethically keep your money distinct from your owners’ money.

- Understand Cost Drivers: Pinpoint where your money is going (e.g., cleaning, repairs, marketing).

- Report Transparently to Owners: Provide clear, professional statements that justify your management fees.

Here’s a simple table structure for your CoA:

Pro Tip: Look for a vacation rental accounting software that can auto-generate a CoA template in QuickBooks or Xero. This can save you countless hours and reduce the risk of miscategorization, ensuring your books are set up correctly from day one.

How Can You Simplify Monthly Reconciliation?

A typical month-end without automation is a nightmare. It often involves:

- Exporting transactions from your PMS and bank.

- Manually sorting through 100+ digital and physical receipts.

- Tagging each expense to the correct property.

- Splitting shared expenses (e.g., internet, pest control) across multiple units.

- Generating individual owner statements.

- Manually processing payouts.

This can take 2–3 full days and still leave significant room for error.

The solution is a three-way integration between your dynamic pricing tool, your property management system (PMS), and your accounting software (like QuickBooks or Xero).

How the Automated Flow Works:

- A guest books (via Airbnb, Vrbo, etc.). The booking data, including all fees, flows into your PMS.

- PriceLabs syncs pricing details nightly, pulling from your PMS. This ensures your rates are always optimized and your PMS has a clear, documented record of the final price.

- The PMS formats reservation data into transactional line items aligned with your CoA categories.

- The PMS automatically syncs that data into QuickBooks or Xero:

- Income → mapped to revenue accounts.

- Cleaning fees, platform fees → mapped to separate income/COGS accounts.

- Deposits and proceeds → mapped to liability and owner trust accounts.

This entire process is done automatically—no more manual exports, no more tagging, and a significant reduction in reconciliation errors.

Bonus Insight: PriceLabs integrates directly with Booking.com and connects with over 150 PMSs and channel managers, making it easy to keep your Airbnb, Vrbo, and other OTA listings updated, regardless of the platform. The pricing data flows cleanly and accurately, providing a single source of truth for your income.

Ready to Automate Your Pricing & Your Books?

Stop leaving money on the table and hours on the calendar. PriceLabs integrates seamlessly with your PMS to standardize rates, streamline your accounting, and boost your bottom line—all on autopilot.

Start Your Free TrialProtect Owner Funds: The Role of Trust Accounting and Owner Statements

What is trust accounting, and why is it important for vacation rentals? In many U.S. states, trust accounting is legally required. Even when it isn’t, it’s a best practice that protects you and your owners by ensuring you:

- Separate Client Funds: Keep money that belongs to your owners (e.g., guest payments) in a separate bank account from your own operational funds.

- Prevent Overdraws: Never accidentally use one property’s funds to cover expenses for another.

- Maintain Accurate Records: Ensure owner statements are accurate, auditable, and compliant with local regulations.

Best Practice: Open a separate bank account specifically for trust funds. Then, automate your owner statements to pull income, expenses, and net distributions per property directly from your accounting software. This ensures complete transparency and builds a foundation of trust with your property owners.

Stop Revenue Drains: How Do You Prevent Expense Leakage?

Expense leakage occurs when reimbursable costs are not billed. This is a silent profit killer that can cost you thousands of dollars annually.

Common culprits of expense leakage include:

- Cleaning charges that aren’t correctly linked to reservations.

- Emergency repairs during a guest’s stay are never reimbursed.

- Utility overages in high season that aren’t passed on to the owner.

- Small, unreimbursed supply runs (e.g., lightbulbs, toiletries).

Here’s a table that illustrates the financial impact:

To combat this, use expense automation tools that tag transactions and match them to the correct property or reservation. For instance, teams at Arrived were able to recover an estimated $250K–$350K per year and automate expense reconciliation, capturing charges they were previously missing.

Track the Right KPIs: How To Track Vacation Rental Performance?

Once your books are clean and automated, you can finally track the financial metrics that actually grow your business.

Tracking these KPIs makes cash flow projections more accurate, helps you provide clear and transparent financial statements to owners, and lets you quickly spot underperforming properties so you can adjust pricing or expenses as needed. This data-driven approach clearly shows owners the value of your management fees and services.

Dynamic Pricing: A Surprising Tool for Accounting Sanity

You might think dynamic pricing is just about increasing occupancy or ADR, but it’s also a financial sanity-saver.

How does dynamic pricing help with accounting? With tools like PriceLabs’ Dynamic Pricing, rate changes are automatically documented in your PMS. This ensures that:

- You can easily map actual earnings to each booking, reducing reporting errors.

- Variable pricing helps you forecast cash flow more accurately during peak and off-peak seasons.

- You can set floor prices based on your actual cost data (cleaning, utilities) to further protect your profit margins.

Ready to Simplify Your Pricing and Your Accounting?

Take the guesswork out of rates and the headache out of bookkeeping. With PriceLabs, you can automate your pricing, sync seamlessly with your PMS, and keep your finances organized—so you earn more while doing less.

Start Your Free TrialSo, Do You Really Need Full Accounting Automation?

This is the key question. Can you manage with a dynamic pricing platform like PriceLabs integrated with your PMS, while continuing to handle accounting manually?

It’s time to automate if you’re:

- Managing more than 10 properties.

- Spending 10+ hours a month reconciling books.

- Getting frequent owner queries about missing or confusing statements.

- Losing money on underreported cleaning or repair costs.

- Using multiple spreadsheets to manage different financial aspects.

A full accounting automation setup, often a combination of a PMS, a dynamic pricing platform, and a dedicated accounting software (like QuickBooks), eliminates manual data entry, automates expense allocation, and generates real-time dashboards.

Stop Letting Poor Accounting Undercut Your Business

Good accounting is your safety net, not just a necessary evil. It’s the springboard for growth, helping you scale with confidence.

With the right processes and tools—a PMS for bookings, PriceLabs for pricing, and a robust accounting tool—you can:

- Reclaim Lost Revenue: Plug expense leaks and recover money you’re unknowingly losing.

- Build Owner Trust: Provide transparent, accurate, and professional financial reporting.

- Scale Confidently: Make data-driven decisions based on a clear, real-time understanding of your business’s financial health.

Review your Chart of Accounts and calculate your potential expense leakage. That’s your baseline for financial clarity. From there, decide whether full automation or a partial setup (PMS + dynamic pricing or PMS + accounting automation) makes the most sense for your business.

Frequently Asked Questions: Common Questions about Vacation Rental Accounting

1. What’s the best vacation rental accounting software for property managers?

For property managers in the U.S., QuickBooks is the most widely used and recommended software. Its power lies in its integrations with property management systems (PMS) and other tools, which significantly reduce manual data entry and ensure clean, auditable books.

2. How do I know if I’m losing money through expense leakage?

A simple way to check is to review your reimbursable expenses (like cleaning, repairs, and supply costs). If you’re not consistently tagging and charging these per property or per reservation, you are very likely leaking 5–10% of your earnings.

3. Can dynamic pricing tools like PriceLabs really help with accounting?

Yes. PriceLabs helps standardize and document rate tracking, which makes it much easier to match booking income with nightly rates during reconciliation. This reduces errors, improves cash flow forecasting, and gives you a clear financial record for every reservation.