Mexico City isn’t just a global cultural hub; it’s now one of Latin America’s most dynamic and sought-after short-term rental (STR) markets. Property managers are navigating Mexico City’s short-term rental trends for 2025, which showcase a fascinating landscape where demand continues to soar, new rules are constraining supply, and the need for an optimized pricing strategy is more critical than ever.

For savvy property managers, 2025 is a year of opportunity. Strong market occupancy signals readily available demand. The focus is no longer just on getting a booking, but on getting the optimal rate for that booking. If you’re relying on static rates, you’re almost certainly leaving money on the table.

In this guide, including real-time insights from PriceLabs World STR Index, we break down the latest trends in Mexico City to help you with your revenue management strategy.

Mexico City Short-term Rental Trends (2024–2025)

The underlying strength of the Mexico City short-term rental market in 2025 is defined by an intriguing dynamic: stable pricing and superior demand absorption. This combination is responsible for the market’s continued vitality and is a critical insight for your revenue strategy.

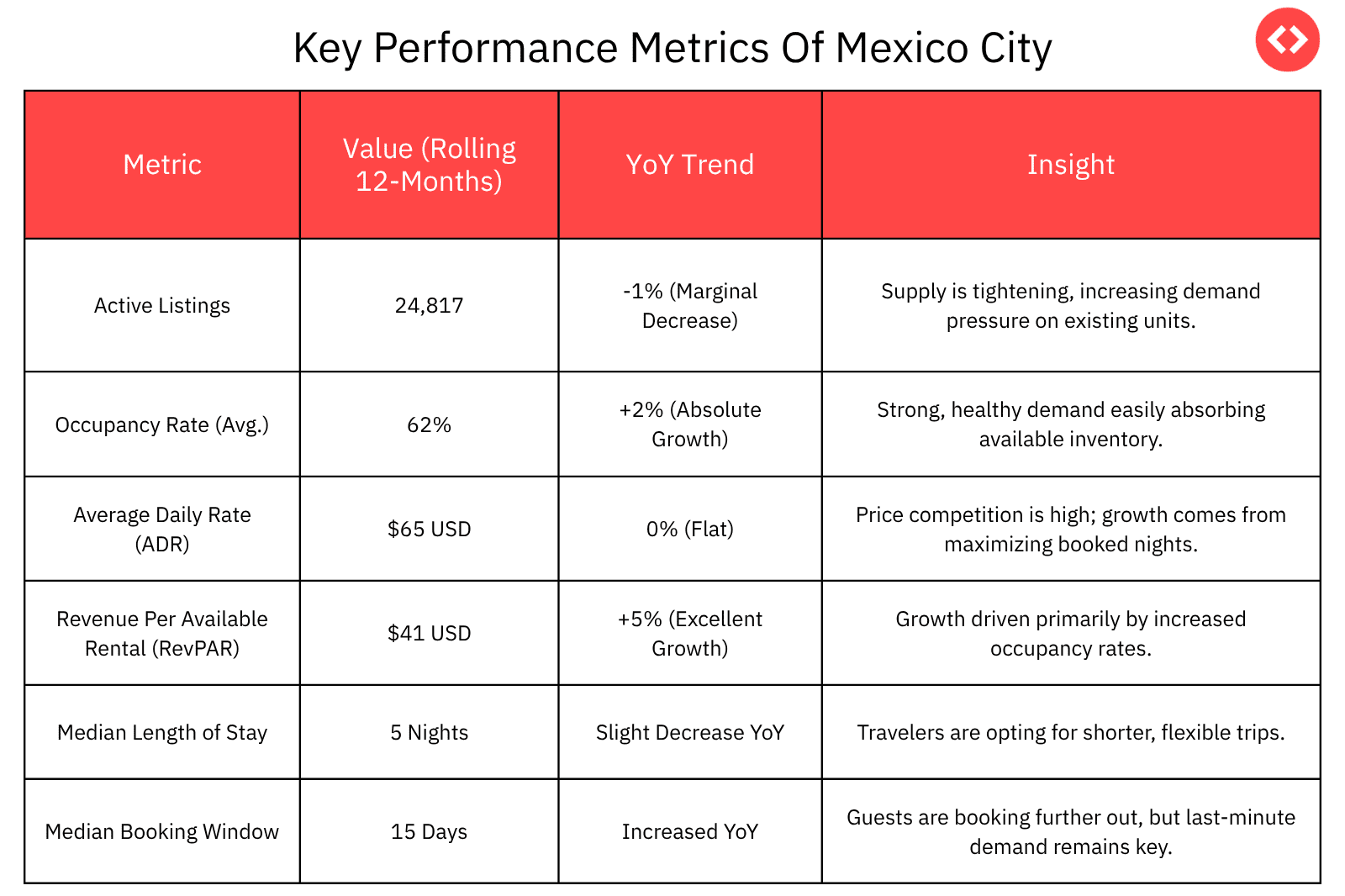

Our data reveals the following critical formula at work:

- RevPAR Growth is Purely Operational (+$41 USD, +5% YoY Growth): RevPAR (Revenue Per Available Rental) is the gold standard of performance. Since ADR held flat, the entire 5% RevPAR growth is attributable solely to the 2% jump in Occupancy.

- ADR is Flat (0% YoY) at $65 USD: The Average Daily Rate has remained virtually unchanged year-over-year. This is not a sign of weak demand, but rather a highly competitive market where managers are cautious about raising their base prices, fearing a loss of bookings to similar listings. The market is efficiently converting bookings at a reliable, median rate.

- Occupancy is the Growth Catalyst (62% Average, +2% Absolute YoY Growth): This steady, impressive increase in booked nights is the market’s primary engine. Travelers are flocking to Mexico City, and properties are filling their calendars efficiently. This 2% absolute growth in occupancy is a clear signal of strong, sustained underlying demand that is easily absorbing the available supply, even with regulatory pressure.

What this means for property managers

- Occupancy is the Revenue Engine: The +5% RevPAR growth confirms the market’s strength. Since the ADR is flat, this growth is all about filling nights efficiently. Property managers must focus on conversion and achieving the highest possible occupancy.

- Target the Core Segment: The median length of stay remains robust at 5 nights. This confirms the city’s draw for mid-week business, short cultural trips, and longer digital nomad stays. Use smart pricing to capture these flexible-stay guests.

- Agility is Key to Rate Growth: The 15-day booking window means last-minute pricing is critical. If your pricing isn’t adjusting in real-time, you’re missing out on the high rates that pop up just before major events or high-demand weekends.

Seasonal Highs and Demand Drivers

The Mexico City market exhibits clear seasonality, with certain months generating strong demand spikes that property managers must capitalize on.

November often leads the year in both occupancy (73%) and strong ADR, driven by Dia de Muertos and key holiday travel. February and March are also strong, benefiting from excellent weather and events like Festival Vive Latino.

Key Traveler Segments:

- Digital Nomads: The 5-night median stay suggests mid-term stays (7+ nights or 30+ nights) are a major factor. Use mid-term discounts during the softer summer months (May–September) to ensure stable occupancy.

- Cultural & Business Travelers: Strong occupancy in the 70% range across the core months indicates high traffic from tourists seeking culture and professionals attending conferences. Focus on high-quality amenities, such as fast, reliable Wi-Fi and well-appointed workspaces.

Navigating Short-Term Rental Regulations in Mexico City

Regulatory measures in Mexico City are the single most significant factor influencing future market supply.

While the final implementation of the most restrictive rules is currently subject to ongoing legal challenges, property managers must prepare for the core requirements:

- Mandatory Registration: All hosts and properties must register with the city’s new Host Registry and display a unique registration number on all online listings.

- The 180-Day Cap: The most debated rule is the potential limitation that a property cannot be rented on STR platforms for more than 180 days (six months) per year. This is designed to push inventory back into the long-term rental market.

What this means for property managers

- Compliance is a Competitive Advantage: Being a fully legal and registered operator will soon be non-negotiable. Managers should prioritize documentation and compliance strategies now to gain a competitive edge over non-compliant properties.

- Revenue Management is Essential: If the 180-day cap is enforced, you must generate a full year’s revenue in half the time. Static pricing is a major liability. Using Dynamic pricing—charging higher rates for high-demand nights and lower rates for low-demand periods — will help you price your property to capture the most demand at optimal rates.

The Dynamic Pricing Advantage: A Clear RevPAR Boost

In this high-demand, high-competition market, dynamic pricing is the key differentiator. PriceLabs data shows a compelling gap between properties that proactively adjust rates and those that don’t:

Properties using a High Dynamic Pricing strategy achieved an average RevPAR of $72 USD, which is a staggering 148% advantage over properties using No Dynamic Pricing ($29 USD). They accomplish this by capturing a higher ADR while simultaneously gaining a massive 17 percentage-point occupancy advantage.

STOP LEAVING MONEY ON THE TABLE: Maximize Mexico City's High Occupancy

Mexico City’s market is seeing healthy occupancy, but without dynamic pricing, you’re missing out. Start maximizing your ADR and short-term rental profitability today.

Start Your Free Trial NowFrequently Asked Questions (FAQs)

1. When is the most profitable time of year for a Mexico City rental?

The most profitable months are generally November and February/March, due to a combination of high demand (occupancy in the 70s) and strong rates. Aggressively raise rates for long weekends and major events using PriceLabs dynamic pricing.

2. How will the 180-day rental cap impact my pricing strategy?

If enforced, the cap requires you to maximize revenue on every available night. You must use pricing automation to aggressively increase rates on peak days and events, ensuring you achieve your annual revenue goal in a shorter window.

3. How can I boost bookings during the low season (Summer)?

The summer months of May through July are typically softer. Focus on attracting digital nomads and long-stay guests by offering competitive 7-day and 30-day discounts. Ensure your amenities (fast Wi-Fi, dedicated workspace) are highlighted to target this crucial segment.

4. Is the booking window getting shorter or longer?

The median booking window has actually increased to 15 days. This means your pricing needs to be agile and responsive to capture last-minute demand (1–7 days out) and reward early planners (30+ days out) with appropriate discounts, a process best handled by dynamic pricing.

Conclusion: Data is Your Competitive Edge

The Mexico City short-term rental market is strong, resilient, and entering a new phase of regulatory-driven competition. The days of set-it-and-forget-it pricing are over. With occupancy rates up and a considerable revenue gap between top and bottom performers, success in 2025 hinges on precision revenue management.