Cartagena, the jewel of the Caribbean coast, remains Colombia’s premier leisure-driven short-term rental (STR) market. Its UNESCO World Heritage status, stunning colonial architecture, and high-end coastal properties ensure strong, year-round international demand.

However, the market is facing a transition. While demand (booked nights) is up, property managers must navigate increasing supply pressure and declining Average Daily Rates (ADR) and Revenue Per Available Rental (RevPAR). Success in 2025 is less about chasing occupancy and more about precision pricing to protect your revenue margins.

In this data-driven guide, powered by PriceLabs STR Index, we break down the latest performance metrics and offer actionable strategies for property managers in Cartagena.

Cartagena Short-term Rental Trends 2024-2025 (Market Snapshot)

The Cartagena short-term rental market for 2025 is defined by a critical paradox: booked nights are up, but profitability is down. This trend signals an ongoing pricing war that is severely damaging revenue margins across the market. Understanding this dynamic is crucial for protecting your bottom line.

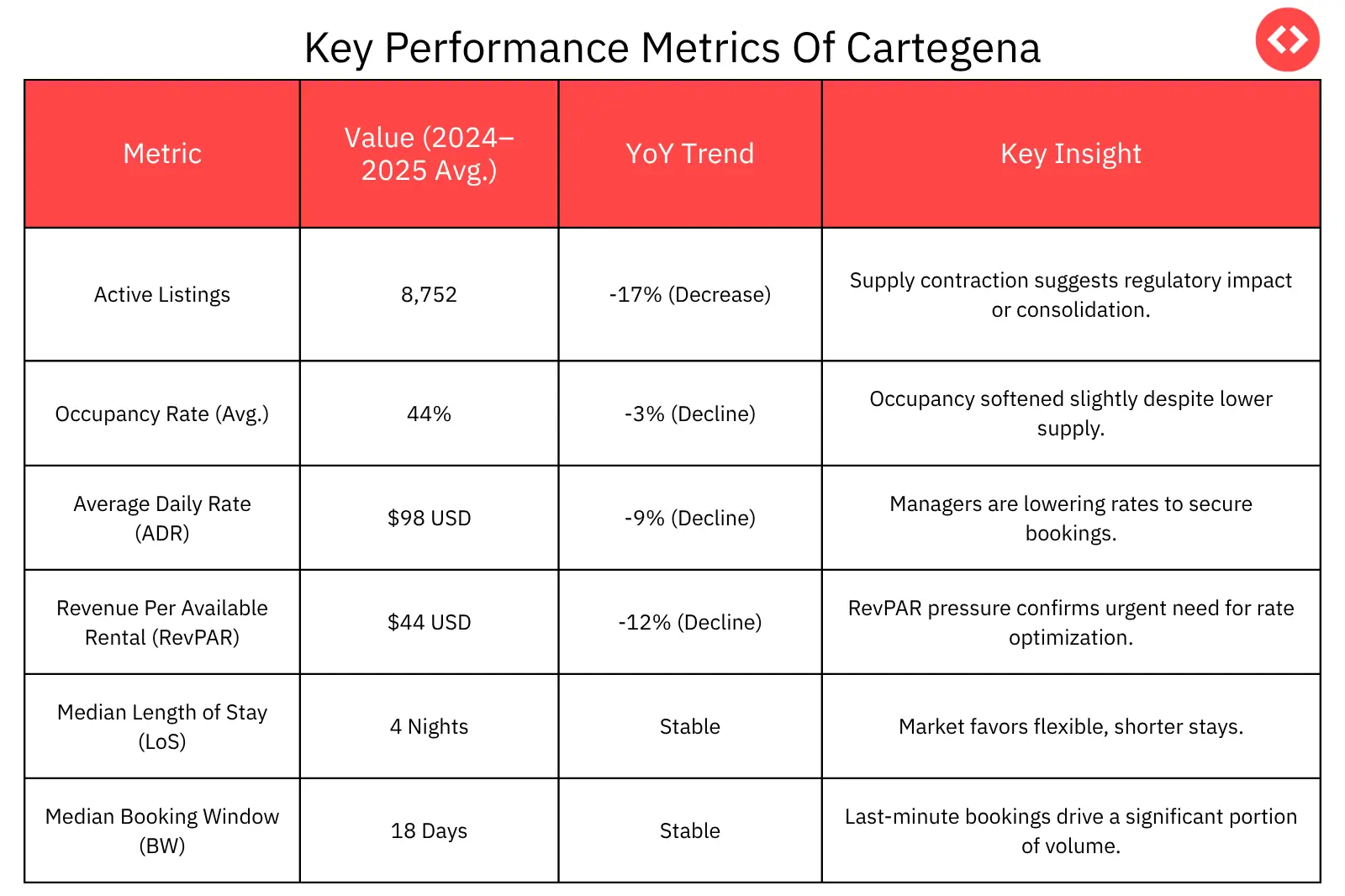

Our data reveals the following breakdown of the market’s current financial health:

- ADR is Falling (-9% YoY to $98 USD Average): This is the most unambiguous indication of market distress. Property managers are aggressively cutting rates to secure bookings, leading to a race to the bottom. The average guest is now receiving a significant discount compared to last year. This aggressive rate-cutting is what is destroying market-wide profitability.

- Occupancy is Stable/Softening (-3% YoY to 44% Average): Despite deep price cuts, occupancy has not spiked significantly to offset them; it has actually dipped slightly. This confirms that price cuts are not driving massive new demand but are merely redistributing existing demand at a lower revenue point. The market is failing to capitalize on the volume it is seeing.

- RevPAR is Under Severe Pressure (-12% YoY to $44 USD Average): As the product of ADR and Occupancy, RevPAR summarizes the financial damage. The 12% decline in RevPAR means that for every available night, properties are generating 12% less revenue than they were a year ago.

(Data based on market performance from PriceLabs STR Index for the 12-month period ending September 2025.)

What this means for property managers

- Protect Your Rate: The most concerning trend is the 9% drop in ADR and 12% drop in RevPAR. This is a classic indicator of managers competing aggressively on price, leading to lower margins across the board. The goal is to maximize profit, not just fill calendars.

- Target Short, Flexible Stays: With a stable 4-night median Length of Stay, optimize your property’s appeal for week-long vacations and extended weekenders. Use automated minimum stay adjustments to be flexible during the low season (May, September, October).

- Master the Last-Minute Window: The 18-day booking window is short. This means a substantial chunk of bookings occurs within two weeks of arrival. Dynamic pricing is essential to capture the highest possible rate from spontaneous travelers without resorting to manual, deep discounts.

Seasonal Highs and Demand Drivers

Cartagena’s calendar is defined by two primary peak periods tied to the end and start of the year.

January is unquestionably the high season, with the highest occupancy (57%) driven by international holiday traffic. December (New Year’s) is close behind.

Insights & Takeaways:

- Plan for December/January: These months are non-negotiable for premium pricing. Your dynamic pricing software customizations should be set to hold premium rates and extend minimum stay requirements (5-7 nights) months in advance to maximize revenue during this crucial window.

- Aggressive Low Season Strategy: The May and October lows are deep (occupancy drops to 33–38%). During these months, strategically lower your minimum rate and introduce specific discounts for longer stays (7+ nights) to attract digital nomads or budget-conscious international travelers.

Short-Term Rental Regulations in Cartagena

Colombia maintains national regulations that heavily influence the STR market, and Cartagena enforces explicit rules designed to protect residents and tourist zones.

Key Regulatory Requirements:

- RNT Registration (National Tourism Registry): All hosts and properties in Colombia must register with the RNT and display this unique ID on platforms like Airbnb. Failure to register can result in significant fines and operation suspension.

- Tourist Zones Only: Cartagena limits STR operations to officially designated tourist zones (like the Walled City, Bocagrande, and Getsemaní). Operating outside these areas is highly restricted.

- Condo/Building Approval: Critically, if a property is in a condominium (horizontal property regime), short-term rentals must be explicitly permitted in the building’s public deed. If not, the administration can legally prohibit STR operations.

- Guest Registration: Hosts must record and report all guests (national and foreign) using the Tarjeta de Registro de Alojamiento (TRA) system.

What this means for property managers

Compliance is a competitive firewall. The -17% drop in active listings suggests many properties have been removed due to non-compliance (RNT, condominium rules, etc.). Compliant managers have a significant advantage: less competition allows their well-priced listings to capture the majority of the strong tourist demand.

The Dynamic Pricing Impact: Outperforming in a Down Market

In a market where average ADR and RevPAR are declining, the difference between properties using dynamic pricing and those using static rates is stark—and it’s growing.

The financial disparity is undeniable:

- RevPAR Advantage: Cartegena short-term-rental trends suggest that properties that use a high level of dynamic pricing achieve an astounding $77 USD RevPAR, a 185% advantage over properties that use no dynamic pricing ($27 USD).

- Occupancy Leap: High-dynamic-pricing users achieve nearly double the occupancy (63%) compared to no-dynamic-pricing users (32%), proving that a market-based pricing strategy is essential for converting demand at the local level.

Reinforcing the Value: Dynamic pricing ensures your rate accurately reflects real-time demand. It automatically raises prices based on the customizations you set during the high-demand New Year’s and Carnival weeks. It strategically lowers them during the low-occupancy months of May and September, maximizing your overall revenue per available rental.

STOP PRICING BLINDLY: Execute Your Strategy with Dynamic Pricing

The RevPAR drop in Cartagena’s market is a clear sign that static pricing is failing. Ready to confidently set premium rates for your property during high demand periods? Start maximizing your ADR and short-term rental profitability today.

Start Your Free Trial NowNeighborhood and Segment Insights

Demand in Cartagena is highly segmented by neighborhood, creating varying pricing power:

- Old City (Ciudad Amurallada) & Getsemaní: These areas command the highest ADRs ($120–$180+ per night) due to their historic charm, proximity to major attractions, and suitability for luxury travelers and large groups. Getsemaní also attracts a strong bohemian and digital nomad crowd.

- Bocagrande: The modern, beachfront area appeals to families and tourists seeking beach access and modern amenities.

Frequently Asked Questions (FAQs)

1. What are the best months to charge premium rates in Cartagena?

The peak season in Cartegena starts in December (late half) and January, with very high demand through Carnival in February. Properties must hold the highest rates and minimum stay requirements for this period. Shoulder seasons like March and July also allow for premium weekend rates.

2. How do the RNT and Condominium regulations affect profitability?

These strict rules limit the legal supply of STRs. While this makes compliance mandatory and potentially costly, it benefits legal operators by reducing competition. You can command higher ADRs because your inventory is more reliable and exclusive than unregistered properties.

3. How can I boost bookings during the low season?

Focus on the digital nomad segment during May, September, and October. Highlight reliable, fast Wi-Fi and dedicated workspaces, and offer generous, automated 7-day and 30-day discounts to convert slow dates into stable mid-term reservations.

4. What is the key to pricing success in a market with declining ADR?

The key is dynamic pricing. Do not manually lower your floor price. Instead, use a tool like PriceLabs to let rates float down slightly during low demand to secure occupancy. In contrast, aggressively spiking rates on last-minute, high-demand days reverses the negative ADR trend for your property.

Conclusion: Data-Driven Pricing is Non-Negotiable

The Cartagena short-term rental market is healthy in terms of booked nights, but under pressure on price. The significant 185% RevPAR advantage achieved by properties using dynamic pricing proves that sophisticated revenue management is the only way to thrive when market-wide ADR is falling.

To protect your margins and capture the maximum revenue from every booking, you must leverage automation and market data.