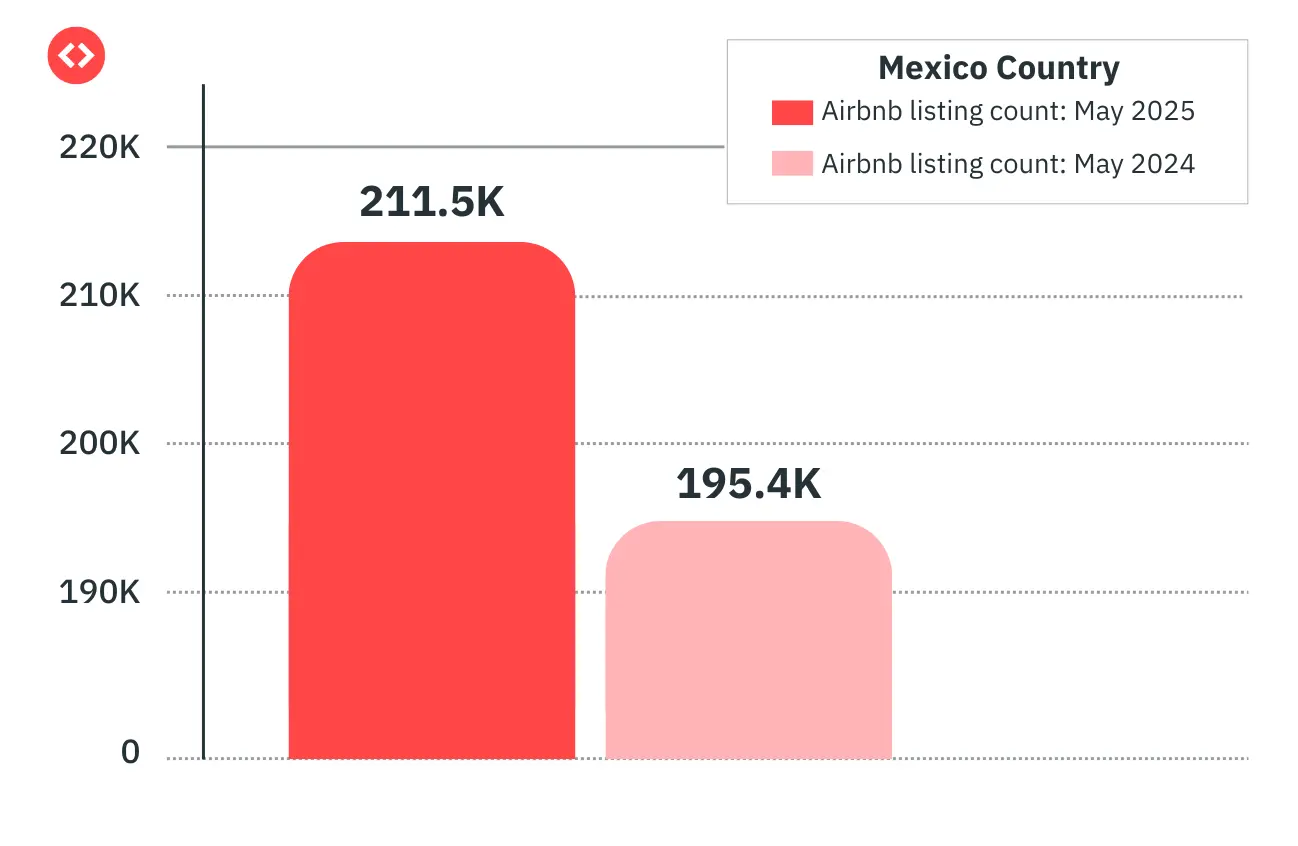

Mexico City market outlook for 2025 is a strong but highly competitive position. Demand is on the rise—8% growth in Airbnb listings in Mexico Country—and occupancy has grown faster in Mexico City than in any other major Mexican city. At the same time, listings have slightly declined, creating opportunities for well-positioned hosts to capture more bookings.

Yet, performance gains aren’t automatic. Average Daily Rates (ADR) have seen slight downward pressure, and RevPAR growth has been driven more by occupancy than price increases. With guest booking windows lengthening and competition from professionally managed listings increasing, hosts need to be deliberate about pricing, minimum stays, and booking strategies.

The latest PriceLabs data offers a clear picture of where the market is heading in 2025—and what adjustments will help you stay ahead. This article breaks down key performance trends, common pricing pitfalls, and the actions you can take now to secure more bookings and higher revenue in the year ahead.

Mexico City Market Outlook 2025

Mexico City’s STR market has outperformed most regional competitors over the past year, making it one of the strongest short-term rental destinations in Mexico for 2025.

Supply and Demand

Listings: Down 1% year-over-year (May 2024–April 2025).

Booked Nights: Up 8%, indicating demand growth despite fewer active listings.

Occupancy rate: Increased 6%, the highest among major Mexican cities.

Pricing and Revenue Metrics

ADR: Marginal decline of 1%, signaling mild pricing pressure but better resilience than Monterrey (–4%) and Guadalajara (–8%).

RevPAR: Up 8%, driven primarily by occupancy gains.

Demand is increasing faster than supply, which creates space to grow revenue. However, pricing discipline is essential while occupancy gains are strong, ADR has been flat to slightly negative, meaning rate optimization should be a key focus in 2025.

Pricing & Booking Trends

Understanding how guests are booking—and how other hosts are pricing—can help you capture more demand without leaving revenue on the table. PriceLabs data for the Mexico City market outlook shows several notable trends for 2025.

Length of Stay (LOS)

The 3–4 day stay segment generated the highest number of stay nights over the past year. Targeting this segment with optimized rates and flexible booking rules can help capture a larger share of mid-length trips.

Booking Window

The average booking window increased by 10% in the last 12 months, meaning guests are booking earlier. A longer lead time gives you more room to test rates and adjust based on pacing before check-in dates.

Dynamic Pricing Adoption

Maximize Your Vacation Rental Return with Dynamic Pricing!

Boost occupancy & optimize revenue with PriceLabs’ Dynamic Pricing & Revenue Management tool. Implement a smart pricing strategy based on market conditions, seasonality & competition for excellent ROI.

Get Started Now40% of listings in Mexico City use moderate to high dynamic pricing.

Hosts using moderate or high dynamic pricing saw:

17% higher occupancy

30-45% higher ADR compared to static pricing.

51–71% higher RevPAR compared to static pricing.

Despite these benefits, the majority of listings (36%) still rely on static or low dynamic pricing, leaving significant performance gains untapped.

Takeaway for Hosts: To compete effectively, aim to:

- Align pricing and minimum stays with the 3–4 day booking sweet spot.

- Adjust rates proactively for the longer booking window trend.

- Adopt at least moderate dynamic pricing to match top-performing peers and boost both occupancy and revenue.

You can use the World STR Index by PriceLabs to track your market’s performance, understand demand, and gain insights similar to those we’ve discussed in this article.

The World STR Index by PriceLabs is a free tool for tracking short-term rental market performance worldwide. It offers data from 2021 to the next year, refreshed monthly.

Key features include:

- Compare: Compare year-over-year metrics like active listings, occupancy rates, RevPAR, and ADR.

- Trend: Visualize how metrics have changed over the past years.

- Pacing: Compare upcoming year metrics to the previous year for occupancy, ADR, and RevPAR.

4 Common Pricing Pitfalls & How to Avoid Them

Mexico City market outlook is competitive in 2025, with booked nights rising 8% and occupancy growing faster than in any other major Mexican city. But market growth doesn’t guarantee higher income. Many hosts still underperform because their pricing strategies aren’t in sync with guest behavior, seasonal patterns, or market shifts.

Based on PriceLabs data, here are four high-impact pricing pitfalls to avoid—along with precise, actionable steps to turn them into revenue opportunities.

1. Ignoring Seasonality

Why this hurts performance: Mexico City’s demand patterns are far from flat. Between seasonal tourism peaks (e.g., Easter week, summer holidays, Dia de los Muertos) and business travel cycles, demand can swing significantly.

- If you price too low in high season → You sell out early and miss last-minute booking premium rates.

- If you price too high in low season → Your property sits vacant while competitors secure discounted bookings.

Historical pacing charts show that occupancy spikes during peak seasons fill earlier, while low-season bookings are price-sensitive and often happen closer to check-in.

How to fix it:

- High season: Raise rates progressively as availability shrinks. Focus on being “last to book” at the top of the rate curve.

- Low season: Offer competitive early rates and promotions to lock in demand before competitors drop prices.

- Track both citywide trends and your property’s historical seasonality for precision.

2. Rigid Minimum Stay Rules

Why this hurts performance: A fixed year-round minimum length of stay (LOS) doesn’t reflect how demand shifts across seasons.

- Too high in low season → Blocks short-stay bookings and lowers occupancy.

- Too low in high season → Increases turnovers, cleaning costs, and operational strain without maximizing revenue per stay.

In Mexico City, the 3–4 day LOS generates the most total stay nights, making it the “sweet spot” for 2025.

How to fix it:

- In high season, lengthen minimum stays to capture high-value multi-day bookings with fewer turnovers.

- In low season, drop restrictions to attract short, gap-filling stays.

- Review LOS performance quarterly to adapt rules.

3. Ignoring the Booking Window

Why this hurts performance: Without tracking the booking window (how far in advance guests book), hosts risk:

- Discounting too early, selling out at lower-than-necessary rates.

- Keeping prices too high until the last minute, leading to unsold nights.

Mexico City’s average booking window increased by 10% in the last year, meaning guests are planning further ahead.

How to fix it:

- For early bookers: Keep rates strong and avoid heavy discounts far in advance.

- For last-minute gaps: Adjust pricing dynamically 7–14 days before check-in to attract remaining demand.

- Use pacing reports to compare your property’s booking curve with the market.

4. Not Using Revenue Management Tools

Why this hurts performance: Manual pricing can’t keep up with daily shifts in demand, local events, competitor changes, and seasonal patterns.

Static pricing in Mexico City underperforms dynamic pricing by 17% in occupancy and 51–71% in RevPAR.

How to fix it:

- Adopt a dynamic pricing platform that automatically updates rates based on demand, events, competitor pricing, and occupancy pacing.

- Set seasonal and event-based min/max limits to protect margins.

- Review automated changes regularly to ensure alignment with your business goals.

Final Thoughts: Demand and Occupancy Are Increasing. Mexico City is Stronger Than Ever.

Mexico City’s short-term rental market is entering 2025 in a position of strength. Demand is rising, occupancy growth is the highest among major Mexican destinations, and ADR stability offers room for strategic price increases. For hosts, the opportunity lies in turning these market conditions into measurable revenue gains.

With demand outpacing supply, 2025 is a year where well-prepared Mexico City hosts can grow both occupancy and revenue. The difference between average and top performance will come down to data-driven pricing decisions, flexibility in booking rules, and smart use of technology to stay ahead of the market.