The Greek vacation rental market remains one of Europe’s most resilient leisure-driven short-term rental (STR) markets. With iconic destinations such as Santorini, Crete, Paros, and Naxos attracting international tourists, honeymooners, and families alike, demand is expected to remain steady in 2025.

At the same time, property managers face new challenges, including increased competition from rising listing supply, shorter booking windows, and softer occupancy compared to the highs of last year. On the upside, average daily rates (ADR) are growing, helping maintain revenue performance.

This report explores the latest 2025 trends in occupancy, ADR, RevPAR, booking behavior, and supply across Greece’s top vacation rental markets, while highlighting how dynamic pricing strategies are proving essential for maximizing returns.

Greek Vacation Rental Market Trends 2025

Tools like the World STR Index and PriceLabs Market Dashboard provide property managers with a clear view of evolving demand and performance. Here are the key vacation rental trends shaping Greece’s short-term rental market in 2025.

1. Occupancy trends in Greece

Summer Peaks Still Lead

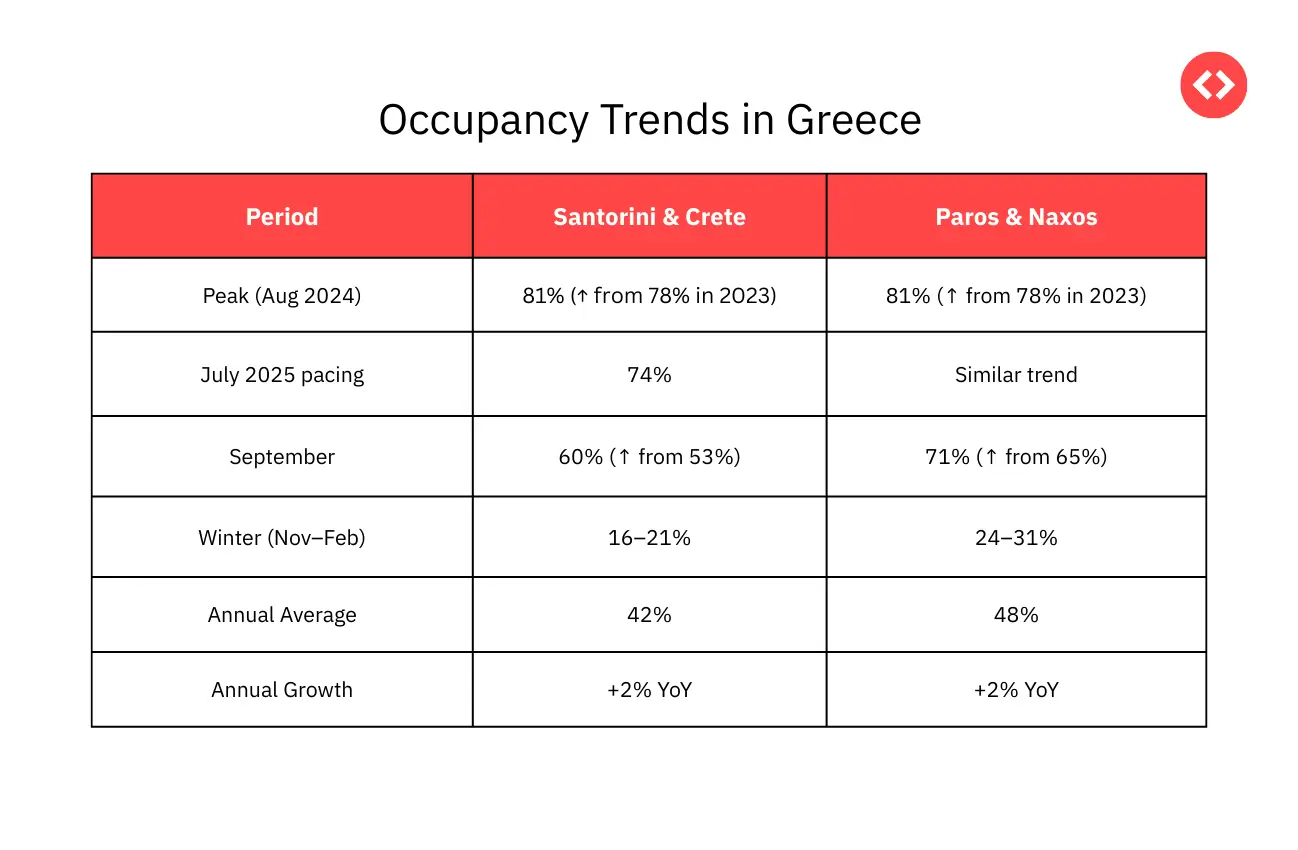

As expected, the Greek islands remain heavily summer-driven markets, with occupancy peaking in July and August.

- Santorini & Crete: August 2024 closed at 81% occupancy, up from 78% in 2023, while July 2025 is already pacing at 74%. September is also showing year-over-year improvement, climbing from 53% to 60%.

- Paros & Naxos: The trend is similar, with August 2024 also at 81% (vs. 78% in 2023) and September improving from 65% to 71%.

This shows that core summer demand remains resilient, with steady growth across both major and boutique island markets.

Winter Weakness

Outside the high season, however, occupancy remains soft.

- Santorini & Crete: The winter months (November–February) experience a range of occupancy from 16–21%, with December and January reaching their lowest points.

- Paros & Naxos: Occupancy stabilizes slightly higher, averaging 24–31% over the same period, but still far below summer levels.

This highlights the significant reliance on the summer window, with winter seeing a sharp drop-off in demand.

Insights:

Occupancy is holding steady, with modest year-over-year growth, but the seasonality gap remains extreme. Property managers will need to:

- Explore long-term stay strategies for the winter months to help fill otherwise low-demand periods. The demand is intensifying. To close gaps, operators will need to attract last-minute bookings and expand strategies for shoulder months.

- Lean on seasonal pricing strategies to maximize summer peaks.

- Incentivize shoulder-season stays (Apr–Jun, Sep–Oct) through discounts and flexible policies.

Unlock Hidden Market Opportunities with PriceLabs Market Dashboards

Stay ahead of the competition by tracking real-time demand, pricing trends, and occupancy shifts in your market. With Market Dashboards, property managers like you can make smarter decisions, identify revenue opportunities, and confidently navigate changing regulations.

Start Your Free Trial2. ADR (Average Daily Rate) Trends

While occupancy is showing signs of plateauing, ADR continues to trend upward across the Greek islands, particularly in premium markets.

- Santorini & Crete: Rates are gradually climbing, with August 2025 pacing at €195 (+4% YoY) and September at €172 (+3% YoY). The annual ADR range now sits between €150 and €195, reflecting steady but controlled growth on the larger islands.

- Paros & Naxos: Boutique destinations are seeing much sharper increases. August 2025 is pacing at €273 (+16% YoY), while June 2026 is already pacing at €339 (+78% YoY). Annual ADRs here are averaging between €250 and €300, and forward-looking data suggest even higher peaks for summer 2026.

This widening gap between the central and more minor islands underscores a clear trend: travelers are willing to pay significantly more per night in boutique, supply-constrained markets. Paros and Naxos, in particular, benefit from limited inventory and strong international appeal, allowing property managers to sustain premium pricing well above the levels seen in Santorini and Crete.

Insight:

With occupancy flattening, rate strategy is becoming the key lever for revenue growth. Managers in larger markets should focus on incremental ADR gains, while those in boutique destinations can capitalize on scarcity-driven pricing power.

Read More: Portugal Vacation Rental Market 2025: A Complete Guide

3. RevPAR Trends

RevPAR continues to highlight the balance between occupancy and rate strategy, showing diverging performances across the islands.

- Santorini & Crete: Summer remains the anchor, with August 2025 pacing at €130 (-1% YoY). September provides a stronger picture, improving to €70 (+4% YoY). On an annual basis, RevPAR is effectively flat at +1% YoY, suggesting that higher ADRs are offsetting softer occupancy in several months.

- Paros & Naxos: The smaller islands continue to outperform. In 2024, RevPAR rose +10% YoY, driven primarily by aggressive ADR growth. Annual averages now sit in the €70–€111 range, with summer peaks above €150 and shoulder seasons outperforming the larger islands. Even with some occupancy softness, Paros and Naxos are delivering double-digit revenue gains year over year.

Insights:

Revenue is being preserved — and in some cases expanded — through higher nightly rates. But this reliance on ADR as the primary lever introduces vulnerability: if demand softens suddenly, RevPAR could decline sharply. For managers, the challenge will be balancing revenue optimization with occupancy stimulation, especially in the shoulder and off-season months.

Read More: Vacation Rental Trends in Croatia: Insights from 2025

4. Booking Window Trends in Greece

One of the most significant shifts in the Greek vacation rental market is the shortening booking window—a trend we’re also seeing across Southern Europe, including Portugal and Italy.

The median booking window for August 2024 is 51 days, a slight decrease from 54 days in 2023. While peak summer travelers continue to plan, shoulder-season and winter guests are booking closer to their travel dates—sometimes just weeks or even days before arrival.

Looking at the broader trend:

- Summer (June–August): Bookings are made well in advance (70–82 days), giving managers a longer runway to optimize pricing.

- Shoulder months (September–November): Booking windows are closing quickly, with stays often reserved just 15–37 days in advance.

- Winter (December–February): The window is at its shortest, ranging from 6 to 13 days, making demand unpredictable.

- Spring (March–May): Booking patterns are more stable, with travelers planning approximately 30–53 days.

Insight:

Shorter booking windows lead to revenue volatility, particularly outside peak seasons. Property managers can’t rely on static pricing strategies—they need dynamic pricing tools that respond in real time to capture last-minute bookings without undervaluing early reservations.

Tools like PriceLabs help managers adjust automatically based on demand signals, seasonality, and pacing, ensuring rates remain competitive whether a guest books three months ahead or three days before arrival.

5. Length of Stay Trends

Length of stay (LOS) is gradually increasing across the Greek islands, signaling a shift in traveler behavior toward longer, more immersive trips.

- Median LOS: Across both Santorini/Crete and Paros/Naxos, the median length of stay has risen from 6 nights in 2023 to 7 nights in 2024.

- Crete: Continues to lead the market in extended stays, averaging 7–10 nights. This reflects its appeal to families, digital nomads, and travelers seeking a slower, more destination-focused experience.

- Santorini & Paros: Trips remain shorter, typically 3–5 nights, catering to leisure travelers on tighter itineraries. However, luxury demand is pushing ADRs higher, meaning shorter stays still deliver substantial revenue per booking.

Insight:

Length-of-stay discounts are an effective lever in Crete, where families and remote workers are driving longer bookings. In Santorini and Paros, bundling premium experiences—such as wine tours, sailing trips, or spa packages—helps maximize value from shorter leisure stays.

6. Listing Growth in Greece

Supply continues to climb across the Greek vacation rental market, adding pressure to occupancy rates and intensifying competition among operators.

- National Growth: Active listings in Greece reached 30,991 in May 2025, up from 28,029 in May 2023, marking a +7% increase in the past year.

- Seasonality Impact: Inventory typically peaks in August–September, with over 32,000 active listings recorded in late summer 2024 before easing back during the winter months.

- Smaller Markets Growing Faster: Paros and Naxos have seen above-average expansion, with listings growing from 6,206 in May 2023 to 7,033 in May 2025 (+13% growth). This is nearly double the national pace, creating sharper competition in these destinations.

Insights:

More listings mean greater competition, particularly in smaller island markets where demand is not growing at the same pace as supply. Operators who thrive will be those who:

- Adapt pricing dynamically to shifting demand.

- Ensure regulatory compliance, especially in markets facing stricter short-term rental oversight.

- Differentiate through guest experience, offering curated stays, local partnerships, and premium services.

As Greece heads into another high-demand summer, property managers face a crowded playing field where pricing agility and strong branding will determine who captures the most bookings.

The Role of Dynamic Pricing in Greece

Dynamic pricing is no longer optional—it is the defining driver of performance across Greek short-term rentals. By aligning rates with real-time demand, operators in markets such as Paros, Naxos, Santorini, and Crete are seeing clear and consistent uplifts in occupancy, ADR, and RevPAR.

Occupancy Impact: Filling Nights That Would Have Stayed Empty

Dynamic pricing not only maximizes peak demand in July and August but also cushions the shoulder and off-season periods when demand is weaker.

Insight: Operators using dynamic pricing consistently capture an additional 20–22% occupancy compared with static pricing. The benefit is most visible in shoulder months, such as March and November, where dynamic strategies deliver 62–75% occupancy compared to just 38–46% without pricing tools.

ADR Impact: Pricing Power, Especially in Peaks

Average Daily Rate (ADR) also benefits from dynamic tools, particularly in high-demand months.

Insight: Moderate strategies often outperform “high” dynamic approaches on ADR because they balance competitiveness with price optimization. For example, in December and January, moderate dynamic pricing delivered ADRs above €530, while static listings averaged just €283–€392.

RevPAR Impact: Where Dynamic Pricing Truly Pays Off

Revenue per Available Rental (RevPAR) captures both occupancy and rate—making it the clearest indicator of dynamic pricing’s impact.

Insight: The RevPAR uplift is staggering. Even “low” adoption of dynamic tools generates 82% higher RevPAR than static pricing. For operators using moderate strategies, the uplift reaches +133%, meaning more than double the revenue potential compared with those who leave pricing untouched.

Why This Matters

The Greek vacation rental market is increasingly competitive, with supply growth outpacing demand in many island destinations. Static pricing strategies leave significant revenue on the table, especially as booking windows shorten and travelers book more last-minute.

Dynamic pricing offers a dual benefit:

- Protects yield in the high season by ensuring rates reflect the market’s willingness to pay.

- Captures incremental demand in off-season by flexing rates downward just enough to win bookings that would otherwise go elsewhere.

Bottom line: In markets like Santorini, Crete, Paros, and Naxos, dynamic pricing isn’t just an optimization tool—it’s a survival strategy.

Maximize Your Revenue with PriceLabs Dynamic Pricing

Stop leaving money on the table. PriceLabs Dynamic Pricing adjusts your nightly rates automatically based on demand, seasonality, and market trends—so you can boost occupancy, increase revenue, and save hours of manual work.

Start Your Free TrialShort-Term Rental Regulations in Greece — 2025 Update

Starting October 1, 2025, Greece will roll out some of the most comprehensive short-term rental (STR) regulations in Europe. The reforms, passed by the Greek parliament, reflect the government’s attempt to balance the rapid growth of STR supply with housing affordability, neighborhood sustainability, and tourist safety.

For operators, these rules introduce new compliance costs but also bring market-wide standardization—potentially favoring professional managers over casual hosts.

Key Regulatory Changes

Greece has introduced several updates to its short-term rental (STR) framework that property managers and hosts need to be aware of:

- Mandatory Registration – All STRs must now be registered with the Greek Tax Authority’s STR Registry (AMA number), and this registration number must be displayed on every listing.

- Safety & Quality Standards – Properties must meet minimum safety requirements, including liability insurance, certification by a licensed electrician, fire extinguishers and smoke detectors, emergency escape signage, pest control certificates, and a stocked first aid kit with emergency contacts.

- Property Type Restrictions – Only “primary use” spaces are allowed as STRs. Industrial or warehouse conversions are permitted if compliant; however, basements and semi-basements are prohibited unless they meet strict lighting and ventilation requirements.

- Taxation Changes – The daily tourist tax has increased significantly, ranging from €1.50 to €8 in peak season (April–October) and €0.50 to €2 in the off-season.

- Rental Limits & Neighborhood Freezes – Rentals are capped at 90 days per year, reduced to 60 days on small islands. In high-density areas like central Athens, where STRs exceed 5% of the housing stock, new permits will be frozen.

- Incentives for Long-Term Rentals – Owners converting STRs to long-term leases can benefit from a three-year income tax exemption if they commit to a minimum of three years.

- Multi-Property Licensing & Taxation – Hosts with more than two properties must register as legal entities and will be taxed at higher rates, similar to hotels.

- Enforcement & Penalties – Non-compliance is subject to fines of up to €5,000, which double for repeat violations.

Market Impact: What the Data Shows

The reforms come at a critical moment: Greece’s STR supply has been surging, outpacing demand in several destinations.

- Nationwide listings grew +7% year-over-year (2024–2025), reaching more than 31,000 active rentals by August 2024 before softening slightly in early 2025.

- Smaller markets like Paros and Naxos are experiencing faster supply growth than demand, with active listings up 12%+ YoY—putting pressure on occupancy and pricing.

This means the regulation is likely to have two immediate effects:

- Consolidation: Casual and non-compliant hosts may exit the market due to compliance costs, while professional operators benefit from reduced competition.

- Shift to Longer Stays & Higher ADRs: With stricter limits and higher taxes, managers will lean on dynamic pricing and bundled services (e.g., tours, premium amenities) to protect margins.

Why This Matters

The new framework pushes Greece closer to hotel-style regulation, raising the bar for compliance while attempting to curb overtourism and housing displacement. For professional operators, the changes are not only survivable but potentially advantageous:

- Fewer casual competitors means more room for structured, compliant businesses.

- Data-driven pricing tools will become essential to offset tax hikes and caps.

- Differentiation through guest experience will separate thriving operators from those squeezed out.

Bottom line: regulation in Greece is no longer a distant concern—it’s here. The property managers who adapt fastest will not only stay compliant but also turn regulation into a competitive edge.

How Property Managers Can Maximize Revenue in the Greek Vacation Rental Market in 2025

With demand in Greece remaining steady but competition intensifying, property managers must operate with greater sophistication than ever before. Between rising supply, shorter booking windows, and stricter regulations, success will depend on how well operators balance compliance, pricing, guest experience, and marketing.

Here are five strategies for maximizing revenue in Greece’s 2025 short-term rental market:

1. Leverage Dynamic Pricing to Capture Demand Shifts

Static pricing leaves revenue on the table. As seen in both Santorini and Paros, operators using moderate dynamic pricing strategies achieve up to a 133% RevPAR uplift compared to static pricing.

- Peaks: Protect yield by setting rate floors during July and August.

- Shoulders: Flex rates downward in September–October and March–May to win price-sensitive bookings.

- Winter: Utilize automated last-minute discounting to convert guests who book 6–13 days before their stay.

2. Adapt to New Regulations Proactively

With new STR rules rolling out in October 2025, compliance will separate thriving managers from those exiting the market.

- Register properties early and clearly display AMA numbers to build trust with guests.

- Use regulatory caps (90/60 days) strategically—front-load availability into high-yield periods, while pushing long stays in off-season months.

- Consider converting underperforming units into long-term rentals to benefit from 3-year tax exemptions.

3. Differentiate with Guest Experience & Bundles

In markets like Santorini, where stays are short (3–5 nights), bundling experiences and offering short-term rental upsells can lift ADR and RevPAR without relying solely on occupancy.

- Offer premium packages, including sailing tours, vineyard tastings, and wellness/spa add-ons.

- Partner with local businesses to create curated itineraries that stand out on OTAs.

- For Crete and Naxos, promote extended-stay discounts (7–10 nights) to attract families and remote workers.

4. Optimize Marketing & Distribution

Visibility drives bookings—especially with supply up +7% nationally and +13% in Paros/Naxos.

- Invest in direct booking channels to reduce OTA dependency and increase margins.

- Use professional photography, drone shots, and translated listing descriptions to capture international travelers.

- Tailor vacation rental marketing by season: highlight beaches and nightlife in summer, but emphasize “slower, immersive stays” for winter and shoulder months.

5. Manage Operations Like a Hospitality Business

As regulations push STRs closer to hotel standards, property managers must elevate their service and operations.

- Standardize safety features (such as insurance, detectors, and first-aid kits) not just for compliance, but also as a marketing differentiator.

- Implement guest communication tools to manage late check-ins, upsells, and repeat stays.

- Track performance with dashboards (e.g., PriceLabs, STR Index) to benchmark against competitors and adjust strategy in real time.

Conclusion

The Greek vacation rental market in 2025 is characterized by slowing occupancy but accelerating ADR growth. Santorini and Crete remain the largest and most stable markets, while Paros and Naxos are increasingly premium destinations commanding higher nightly rates.

For property managers, the lesson is clear: revenue growth will not come solely from occupancy. Success will depend on adopting dynamic pricing, aligning strategies with evolving booking behaviors, and tailoring offerings to both extended-stay and short-break travelers.

With competition rising and seasonality remaining sharp, property managers who adopt data-driven strategies will be best positioned to capitalize on Greece’s strong demand from travelers year after year.

Frequently Asked Questions

1. What are the main vacation rental market trends in Greece for 2025?

In 2025, Greece’s vacation rental market is characterized by steady summer demand, rising ADR (Average Daily Rate), softer winter occupancy, shorter booking windows, and increasing competition from new listings. Santorini and Crete remain stable, while Paros and Naxos are seeing sharper ADR growth due to limited supply.

2. How is occupancy trending for Greek vacation rentals in 2025?

Occupancy is steady but highly seasonal. Peak summer months (July–August) still reach 80% or higher, while winter months drop as low as 16–31%. Paros and Naxos show slightly stronger winter resilience than Santorini and Crete.

3. What is happening with ADR (Average Daily Rate) in Greece’s short-term rental market?

ADR is climbing across all islands. Larger destinations, such as Santorini and Crete, average €150–€195 per night, while boutique islands like Paros and Naxos command €250–€300+, with forward-looking data indicating even higher peaks into 2026.

4. How do RevPAR trends compare between Santorini/Crete and Paros/Naxos?

Santorini and Crete are flat on RevPAR growth (+1% YoY), relying mostly on ADR to offset soft occupancy. In contrast, Paros and Naxos are seeing double-digit RevPAR growth, driven by aggressive rate increases and sustained summer demand.

5. How are booking windows changing in Greece?

The booking window is shrinking. Summer trips are typically booked 70–80 days in advance, whereas winter stays are often reserved just 6–13 days before arrival. This trend increases volatility, making dynamic pricing crucial.

6. What is the average length of stay in Greek vacation rentals?

The median length of stay has increased from 6 to 7 nights. Crete sees the longest stays (7–10 nights), while Santorini and Paros typically attract shorter trips (3–5 nights) with higher ADRs.

7. How much is vacation rental supply growing in Greece?

Active listings have grown by +7% year-over-year, reaching over 30,000 in 2025. Smaller islands, such as Paros and Naxos, are growing even faster (+13%), creating sharper competition in boutique markets.

8. What new regulations affect short-term rentals in Greece from October 2025?

Key rules include mandatory STR registration (with an AMA number), stricter safety standards, rental caps (90 days or 60 days on small islands), higher tourist taxes, freezes on new permits in high-density neighborhoods, and heavier taxation for hosts with multiple properties.

9. How will these regulations impact the Greek vacation rental market?

STR regulations in Greece are affecting the vacation rental market. Casual hosts may exit due to compliance costs, while professional operators stand to benefit from less competition. The market is likely to see more consolidation, stronger ADRs, and a push toward longer stays and bundled guest experiences.

10. Why is dynamic pricing essential for Greek property managers in 2025?

Dynamic pricing helps managers maximize ADR during peak months while filling occupancy gaps in the off-season. Data shows that operators using moderate dynamic strategies achieve up to a 133% higher RevPAR compared to static pricing.