Poland’s vacation rental market is evolving at an unprecedented pace. From bustling cities like Warsaw and Kraków to scenic tourist destinations, property managers are navigating a landscape shaped by growing competition, changing traveler behaviors, and increasingly strict short-term rental regulations. Occupancy patterns are shifting, booking windows are shortening, and travelers are willing to pay more during peak periods—but only if properties meet their expectations.

For property managers and revenue managers, this dynamic environment presents both challenges and opportunities. Understanding the latest market data, optimizing pricing strategies, and staying compliant with regulations are no longer optional—they are essential for maximizing revenue and maintaining a competitive edge. In this blog, we’ll break down the latest occupancy, ADR, and RevPAR trends in Poland, explore how dynamic pricing and STR regulations are shaping the market, and provide actionable insights for managers looking to thrive in this complex landscape.

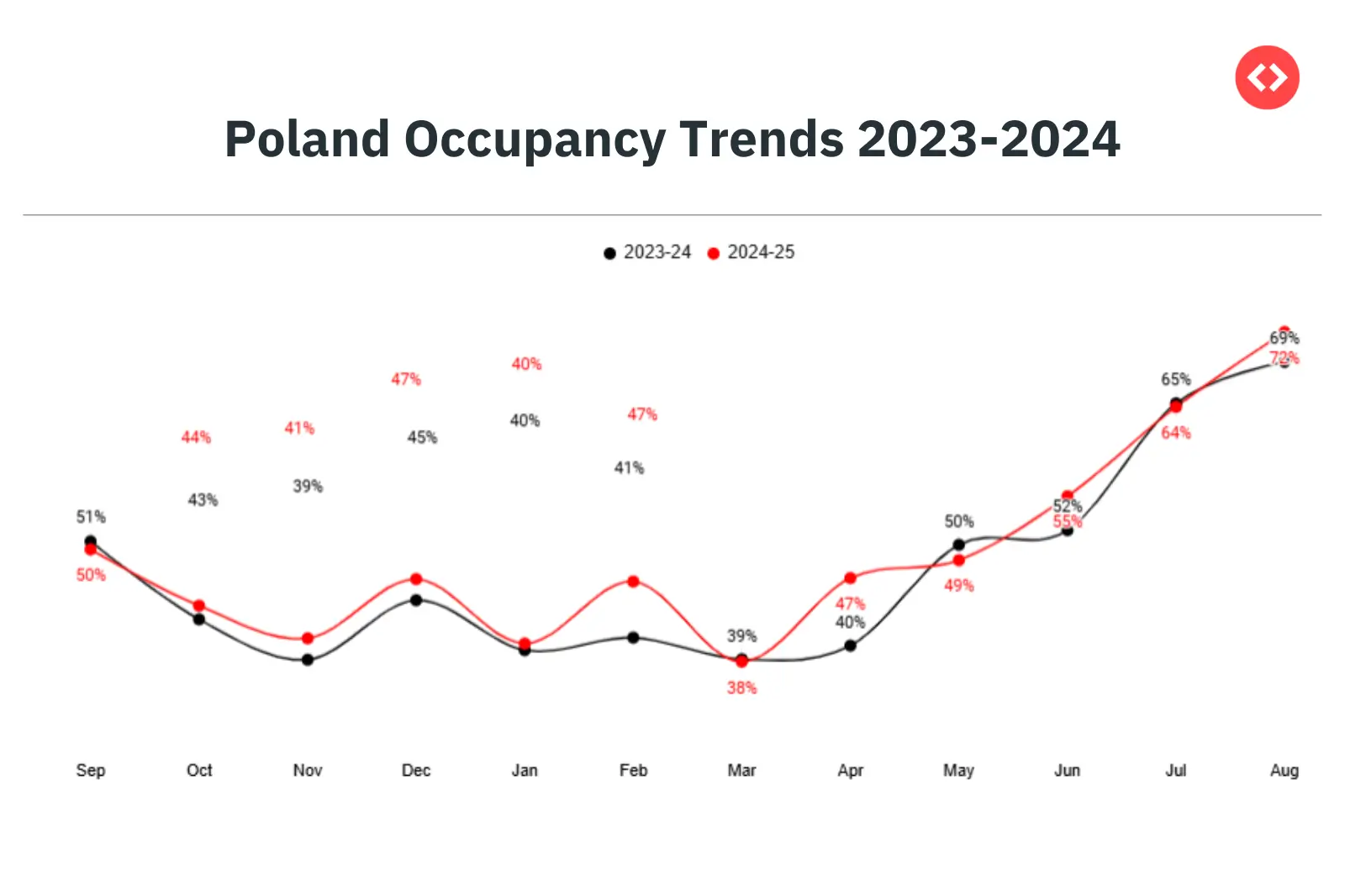

Occupancy Trends: Growth with Seasonal Fluctuations

Occupancy rates in Poland have remained relatively stable, with slight growth year-over-year. The graph below shows occupancy from September 2024 to August 2025 compared to the previous year:

Key Insights:

- Stability in winter months: Occupancy in January remains steady, highlighting that off-peak periods can still provide a predictable baseline demand.

- Peak season dominance: The summer months (July–August) consistently exhibit the highest occupancy rates, often exceeding 70%. This reflects strong tourist demand during school holidays and vacation periods.

- Shoulder season growth: February and April are showing notable increases (+6% and +7%, respectively), suggesting opportunities to capture bookings outside of peak months.

Looking at future occupancy pacing, we see early booking trends for the coming year:

What This Tells Us:

- Early bookings are currently lower than the final occupancy rate, a common occurrence in Poland’s vacattion rental market. Historically, last-minute bookings fill in a significant portion of available nights, particularly during high-demand periods.

- Off-peak months, such as September, October, and November, are pacing slowly, which indicates that proactive pricing, targeted marketing, and last-minute promotions will be crucial to capture both early and late bookings.

What This Means for Property Managers

- Monitor and Adjust Regularly: With occupancy spread unevenly across months and high last-minute booking trends, managers must track bookings daily and adopt dynamic pricing.

- Leverage Shoulder Seasons: Months like February, April, and November show room for growth. Special offers, seasonal discounts, or package deals can help attract more guests during shoulder seasons.

- Plan for Peak Season: Although July–August occupancy is high, dynamic pricing can help maximize revenue by adjusting rates for weekends, special events, and holiday periods.

- Optimize Marketing Efforts: Low pacing months indicate a need for targeted campaigns on OTAs and social media to stimulate early bookings.

- Balancing Pricing and Occupancy: Utilizing dynamic pricing tools, such as PriceLabs, ensures that even when early bookings are slow, rates remain competitive enough to convert last-minute demand without sacrificing revenue.

ADR Trends: Guests Willing to Pay More

The Average Daily Rate (ADR) in Poland has shown consistent growth over the past year, signaling strong revenue potential for property managers. When we examine ADR trends by month, we observe that February and August experience the most significant growth.

Key Insights:

- Peak and Holiday Demand: The highest ADR growth in February and August aligns with holiday travel and peak tourist periods. Travelers are willing to pay a premium during these months, creating opportunities to maximize revenue per booking.

- Impact of Limited Supply: Certain Polish cities with stricter STR regulations or high tourist demand experience a constrained supply of legal rentals. This limited availability supports higher ADR, even when occupancy is not at full capacity.

- Revenue Management Potential: Although occupancy may fluctuate, the ADR growth suggests that well-priced listings can generate substantial revenue without requiring full occupancy.

What This Means for Property Managers

- Strategic Pricing is Crucial: Managers should leverage dynamic pricing tools to capture peak willingness to pay, adjusting rates for weekends, holidays, and events.

- Balance Occupancy and ADR: Even in shoulder seasons or off-peak months, slight rate increases combined with promotions or flexible stay requirements can improve overall revenue.

- Capitalize on Limited Supply: Listings in regulated or high-demand areas can command higher rates without sacrificing bookings, provided managers maintain compliance and visibility on booking platforms.

- Forecasting Revenue: ADR growth trends help managers predict revenue potential more accurately and plan marketing, staffing, and operational budgets accordingly. Tools like the World STR Index and Revenue Estimator help you identify these trends, which in turn inform your pricing strategy.

Unlock Market Insights with PriceLabs Market Dashboards

Want to stay ahead of the competition? With PriceLabs Market Dashboards, you can track local demand patterns, benchmark against competitors, and spot booking trends before anyone else. From occupancy rates to ADR shifts, get the data you need to set the right pricing strategy and maximize revenue.

Explore PriceLabs Market DashboardsRevPAR Trends: Measuring Real Revenue Growth

Revenue per Available Room (RevPAR) is a key performance metric that combines occupancy and ADR, showing the actual revenue generated per available night. Unlike occupancy or ADR alone, RevPAR reflects the overall financial performance of a property.

Key Insights:

- Balanced Revenue Growth: The data shows that managers who optimize both occupancy and ADR achieve the strongest RevPAR growth. For instance, February’s 40% increase reflects higher rates combined with improving occupancy, while August demonstrates how peak-season pricing amplifies revenue.

- Seasonal Revenue Opportunities: RevPAR growth is most substantial during holiday and peak-demand months, but moderate increases in shoulder seasons indicate that strategic pricing and promotions can generate meaningful revenue even outside peak periods.

What This Means for Property Managers

- Revenue Optimization is Multifaceted: Focusing solely on occupancy or ADR is insufficient. Managers must strike a balance between the two to maximize RevPAR and overall profitability.

- Leverage Data-Driven Pricing: Continuous monitoring of market trends, competitor rates, and booking windows enables managers to make informed pricing decisions that consistently drive revenue.

- Plan Operationally: Higher RevPAR provides flexibility for investment in guest experience, property maintenance, and marketing initiatives, which in turn support sustained growth.

- Targeted Strategies for Off-Peak Months: Even when occupancy is lower, adjusting rates strategically can improve revenue performance, filling gaps without significantly discounting listings.

Length of Stay Trends

The average length of stay (LOS) in Poland’s vacation rental market is approximately 4.3 nights, slightly shorter than last year. This indicates that travelers are increasingly opting for shorter, more flexible trips rather than extended stays.

What this means for property managers:

- Shorter stays create opportunities to fill mid-week gaps between longer bookings, increasing overall occupancy.

- Managers may need to adjust minimum stay rules, especially during shoulder seasons or weekdays, to attract guests who are looking for brief visits.

- Properties that can accommodate short stays without increasing operational costs—such as flexible cleaning schedules or self-check-in—are likely to capture more bookings.

- Understanding LOS patterns can also help with dynamic pricing adjustments, as shorter stays may be more sensitive to rate changes.

Booking Window Trends

The average booking window—the time between when a guest books and their actual stay—is around 15 days. Compared to previous years, this represents a slight decrease, indicating that guests are booking closer to their travel dates.

What this means for property managers:

- With shorter lead times, managers must continuously monitor bookings and be prepared to adjust pricing in real-time.

- Last-minute promotions or flexible cancellation policies can help capture guests who are booking spontaneously.

- Shorter booking windows also emphasize the importance of dynamic pricing tools, which automatically adjust rates based on current demand, competitor activity, and upcoming events.

- Understanding these trends allows managers to optimize occupancy, particularly during periods of fluctuating demand or in markets with increasing competition.

Supply Trends: Increasing Competition

Poland’s active vacation rental listings have grown substantially over the past few years:

What This Means for Property Managers

- Differentiation is Key: Stand out in a crowded market—pricing alone isn’t enough; focus on quality and guest satisfaction.

- Competitive Pricing: Use dynamic pricing to adjust rates in real-time based on demand, events, and seasonality.

- Enhanced Guest Experience: Invest in making your listing stand out with professional photography, compelling descriptions, unique amenities, and personalized services.

- Targeted Marketing: Optimize visibility across OTAs and direct booking channels. Highlight compliance and unique features to stand out in a market with 78,878 active listings in 2025, up from 66,019 in 2023

The Impact of Dynamic Pricing

Dynamic pricing has become a critical tool for vacation rental property managers in Poland, and the data clearly shows its impact. Properties that implement high-level dynamic pricing consistently outperform those with moderate adjustments or static rates across occupancy, ADR, and RevPAR.

Why Dynamic Pricing Works

- Captures Last-Minute Demand: Poland’s average booking window is around 15 days, with many guests booking close to their travel dates. Dynamic pricing ensures rates are competitive and attractive for these last-minute travelers.

- Adapts to Seasonal and Event-Based Fluctuations: Major cities and tourist hotspots in Poland experience seasonal peaks and local events that drive short-term demand spikes. Dynamic pricing automatically adjusts rates in response to these patterns, maximizing revenue without manual intervention.

- Optimizes Revenue Continuously: By constantly analyzing market trends, competitor rates, and occupancy levels, dynamic pricing allows managers to maximize revenue per available night rather than leaving money on the table with static pricing.

Boost Your Bookings with Dynamic Pricing

Poland’s vacation rental trends show just how much occupancy, rates, and booking behavior can improve with Dynamic Pricing. With PriceLabs Dynamic Pricing, you’ll always stay one step ahead—automatically adjusting your prices to capture demand, boost RevPAR, and keep your calendar full, no matter the season.

Sign Up For Free trialWhat This Means for Property Managers in Poland

- Revenue Growth: Properties utilizing dynamic pricing experience significantly higher RevPAR, indicating that even modest occupancy gains are amplified through optimized rates.

- Operational Efficiency: Automated pricing eliminates the need for constant manual monitoring, allowing managers to focus on enhancing the guest experience, marketing, and property maintenance. Tools like PriceLabs Dynamic Pricing help you automate your pricing while providing complete control over your revenue strategy through a plethora of customizations.

- Competitive Advantage: As Poland’s vacation rental market becomes increasingly saturated—with nearly 79,000 active listings in 2024–2025—dynamic pricing is no longer optional. Properties that do not adjust rates dynamically risk being underbooked or undervalued compared to competitors.

- Strategic Flexibility: Managers can set minimum and maximum rates, adjust for weekends, holidays, and special events, or implement length-of-stay rules, all while leveraging real-time data to maximize bookings and revenue.

Dynamic pricing is the backbone of a profitable revenue management strategy in Poland. Managers who adopt this approach can respond to market changes promptly, optimize earnings across both peak and off-peak periods, and gain a competitive edge in a highly regulated market.

STR Regulations in Poland: Shaping Supply and Pricing

Short-term rental (STR) regulations in Poland, particularly in major cities such as Warsaw, Kraków, and Gdańsk, have had a noticeable impact on the vacation rental market, influencing both supply and pricing trends.

Key Regulatory Measures:

- Nationwide STR Register: A mandatory registration system for all short-term rentals is expected to be implemented in 2025, requiring hosts to provide detailed property information and obtain a unique ID for online listings. Non-compliance can result in substantial financial penalties.

- Rental Day Limits and Local Controls: Major tourist cities, such as Gdańsk and Sopot, may impose annual caps on the number of nights a property can be rented. This is intended to protect long-term residents and prevent over-tourism in high-demand areas.

- Enforcement, Audits, and Tax Compliance: STR tax enforcement will become stricter, with routine audits and mandatory data sharing by platforms like Airbnb and Booking.com. Hosts must maintain transparent records and submit accurate tax declarations.

- EU Single Registry Law: Poland’s reforms align with EU Regulation (EU) 2024/1028, requiring hosts to display registration numbers and platforms to submit data to central digital hubs. This harmonizes STR data collection across EU member states.

- Local Ordinances and Best Practices: Cities retain the flexibility to impose zoning rules, registration requirements, fees, and night limits. Compliance includes municipal audits and adherence to fire safety, insurance, and other local regulations.

Impact on Market Trends:

- Limited Legal Supply Drives ADR Growth: Although occupancy rates are relatively stable (+2% year-over-year), the Average Daily Rate (ADR) has grown significantly, particularly in peak months such as February and August. With fewer legally compliant units available, demand for permitted properties allows managers to maintain higher rates.

- Stabilized Occupancy Despite Increased Listings: While active listings in Poland have grown sharply—from 66,000 in 2023 to over 78,000 in 2024– 25—the regulations restrict the number of properties that can operate fully. This helps maintain moderate occupancy growth and prevents oversaturation in key tourist areas.

- Revenue Optimization Opportunities: RevPAR growth (+28% forecasted for 2025–26) indicates that managers who comply with regulations and optimize pricing can capture higher revenue per available night, even in a competitive market.

What This Means for Property Managers

- Compliance is Essential: Managers must ensure all listings meet local licensing, registration, and safety requirements. Non-compliance risks fines and damage to reputation, which can affect long-term bookings.

- Leverage Legally Compliant Listings: In regulated markets, compliance can become a competitive advantage, as guests increasingly seek verified and trustworthy accommodations.

- Strategic Pricing in Limited Supply Markets: With fewer legal listings, dynamic pricing can help managers capitalize on high-demand periods without reducing occupancy.

- Targeted Marketing for Differentiation: Highlighting compliance, safety measures, and verified guest experiences can help a property stand out, particularly when regulations constrain supply.

In essence, STR regulations in Poland are reshaping the market, controlling supply, supporting higher rates, and creating opportunities for compliant property managers to optimize revenue while maintaining guest trust.

Conclusion

Poland’s vacation rental market offers stable occupancy, growing ADR, and strong RevPAR opportunities, but competition and regulations are shaping the landscape. Property managers who:

- Monitor occupancy and booking trends

- Implement dynamic pricing strategies

- Differentiate listings through guest experience and marketing

- Maintain full compliance with STR regulations

…will be best positioned to maximize bookings and revenue in 2025–26.

Dynamic, data-driven management is no longer a choice—it’s a necessity for thriving in Poland’s evolving vacation rental market.