For years, the Cornwall short-term rental market has been the crown jewel of the UK’s staycation industry. But if you’ve been looking at average annual occupancy or average nightly rates to benchmark your property’s success, you are likely missing the most important part of the story. In a market defined by extreme seasonality, the average is a liar—it smooths out the peaks and hides the valleys where profit is actually made or lost.

As we look at the 2025 data from PriceLabs STR Index, the shape of the Cornwall year is changing. While the summer remains a powerhouse, the shoulder seasons are becoming more volatile. For property owners, success in this new environment requires moving away from set-it-and-forget-it pricing and toward a data-driven strategy that treats each week of the year as a unique market.

Dynamically Price Your Property and Get FREE Custom Reports Tailored To Your Property!

Use PriceLabs Dynamic Pricing to competitively and dynamically price your property according to demand shifts and analyze past performance to set a strong pricing strategy for your property.

Create your Account NowNumber of Active Listings Has Been Lower Than Previous Years

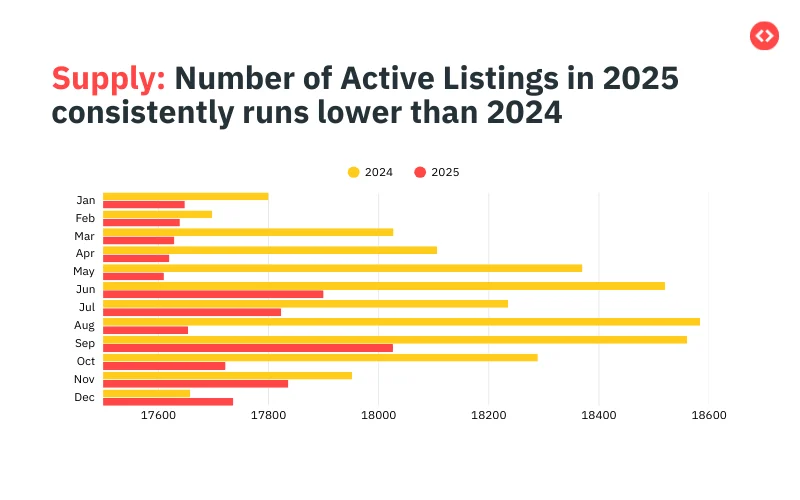

One of the most interesting trends heading into 2025 is the contraction of supply. Conventional wisdom suggests that the STR market is constantly oversaturated, but the data shows that the number of active listings in Cornwall in 2025 has consistently run lower than in 2024.

By December 2025, the market settled at 17,736 total active listings. Throughout the year, the supply remained below 18,000 in the first half, peaking near 18,600 during the height of summer in 2024, whereas 2025 supply levels struggled to reach those heights.

For owners, this lower supply should be a competitive advantage. However, lower supply doesn’t automatically mean higher profits if your pricing strategy isn’t aligned with the shifting shape of demand.

Dynamically Price Your Property and Get FREE Custom Reports Tailored To Your Property!

Use PriceLabs Dynamic Pricing to competitively and dynamically price your property according to demand shifts and analyze past performance to set a strong pricing strategy for your property.

Create your Account NowThe 2025 Cornwall Short-term Rental Market Trends in Peak and Low Seasons

The data reveals a sharp seasonal peak that remains the lifeblood of the region. However, the shoulder months are where the real risk lies.

1. The Summer Strength

August remains the undisputed champion of the Cornwall calendar. In 2025, occupancy hit a staggering 79% during this peak month. Looking at booked nights, the Summer season (June–August) saw 255,255 nights booked. While this is a massive number, it is actually 8% lower than the same period in 2024.

2. The Autumn Cliff

The most concerning data point for property owners is the performance of the Autumn season (September–November). In 2025, Autumn saw 128,265 booked nights, a 13% drop from 2024. This was the largest seasonal decline of the year.

Owners who rely on historical pricing from 2024 are likely overpricing their homes in Autumn, leading to empty calendars during a period that used to be a reliable secondary revenue stream.

3. Winter and Spring Realities

Winter (December–February) recorded the lowest overall demand with 122,022 booked nights, down 8% year-over-year. Spring (March–May) showed more resilience, with 200,398 booked nights, representing the smallest year-over-year decline at just 4%.

Understanding Cornwall Short-term Rental Booking Window Trends

Why is the average such a dangerous metric? Because guests book different seasons in entirely different ways. The data shows that quieter months rely on shorter, more reactive booking windows.

- Summer Planning: Families booking for July and August often plan months in advance to secure the best properties near the coast.

- Off-Season Spontaneity: During the quieter months, guests are reactive. They book closer to the arrival date, often influenced by weather forecasts or last-minute school holiday decisions.

If your property has the same minimum-stay or advance-booking requirements in November as in August, you are effectively locking out the most likely guests for that season.

Dynamically Price Your Property and Get FREE Custom Reports Tailored To Your Property!

Use PriceLabs Dynamic Pricing to competitively and dynamically price your property according to demand shifts and analyze past performance to set a strong pricing strategy for your property.

Create your Account NowWhy Last Year’s Strategy Dates Quickly in Cornwall?

Many owners fall into the trap of using last year’s calendar as a template. However, seasonal patterns might repeat, but the specific events that drive revenue shift every single year.

1. Shifting School Holidays

School holidays are the primary driver of STR demand in Cornwall. Because these dates shift slightly every year, a high-demand week in 2024 might be a standard quiet week in 2025.

2. The Power of Events

Events can reshape otherwise quiet periods. Whether it’s a food festival in Padstow, a surfing competition in Newquay, or a major concert, these demand spikes behave differently from the rest of the year.

As Dainius Podolinskis, Director of Stay in London, noted, professional tools can pick up demand spikes for events like Wimbledon or major concert tours before a human operator ever could. In Cornwall, missing an event spike means missing a weekend where you could have achieved 100% occupancy at a premium rate.

3. Weekdays vs. Weekends

The performance of weekdays, unlike weekends, is another area where averages fail. In the shoulder seasons, your weekend occupancy might remain high while your Tuesday nights sit empty. A dynamic strategy adjusts for this, perhaps lowering midweek rates to attract digital nomads or retirees while keeping weekend rates high for city-breakers.

The Financial Impact: From Guesswork to Growth

Transitioning from manual pricing to a dynamic, data-driven approach isn’t just about saving time; it’s about the bottom line. According to Dainius Podolinskis, Director of Stay in London, owners who switch to automated, event-detecting systems see:

- 10-30% Revenue Uplift: By capturing the true ceiling of peak weeks and the reactive demand of quiet weeks.

- 6+ Hours Saved Weekly: No more manual scouring of competitor sites or local event calendars.

- 100% Occupancy During Events: Ensuring your home is priced perfectly for the highest-demand moments of the year.

Conclusion: Don’t Let the Average Lie to You

As 2025 demand continued to run below 2024 levels, the margin for error has narrowed. You can no longer afford to price your property based on what it did last year or what the average home in your town is doing.

In a seasonal market, context matters more than totals. By breaking your year into smaller parts—weeks, days, and events—you can ensure your property remains competitive in the low seasons and highly profitable in the highs.

Dynamically Price Your Property and Get FREE Custom Reports Tailored To Your Property!

Use PriceLabs Dynamic Pricing to competitively and dynamically price your property according to demand shifts and analyze past performance to set a strong pricing strategy for your property.

Create your Account NowFrequently Asked Questions

Why is the “average” annual occupancy rate misleading for my Cornwall property?

The average is a liar because it flattens the extreme volatility of a seasonal market. In Cornwall, a yearly average masks the hidden shape of the year—the difference between a 79% occupancy peak in August and the significant drops seen in the shoulder seasons. Relying on a single annual number prevents you from seeing that Autumn demand has dropped by 13% or that guest booking windows change based on the month.

How has the supply of holiday rentals in Cornwall changed recently?

Contrary to the feeling of an oversaturated market, the number of active listings in 2025 has consistently run lower than in 2024. As of December 2025, there were 17,736 total listings in the market. This contraction in supply means there is less competition for those owners who use precise, data-driven pricing to capture remaining demand.

What is the Autumn Cliff, and how should I handle it?

The Autumn Cliff refers to the sharpest demand decline of the year, with booked nights down 13% compared to 2024. While the summer peak remains sharp, demand outside of those months is running noticeably lower. To handle this, owners must move away from last year’s strategy, which dates quickly, and instead use shorter, more reactive pricing to attract off-season guests who book much closer to their arrival date.

Do local events really impact my revenue that much?

Absolutely. Event spikes behave very differently from standard weeks and can reshape otherwise quiet periods. Professional operators using dynamic pricing tools often see 100% occupancy during local events and a 10–30% overall revenue uplift by picking up these demand surges before the competition does.

How does guest booking behavior change between summer and winter?

Guest behavior is not static; it changes with the seasons and conditions. High-demand summer weeks are often booked far in advance by families. However, during the low season, guests tend to book closer to arrival, making shorter “booking windows” the norm in quieter months. If your booking rules don’t adapt to these different timelines, you risk missing out on spontaneous off-season travelers.