Portugal vacation rental market remains one of Europe’s strongest short-term rental (STR) markets, drawing international tourists, digital nomads, and extended-stay travelers alike. Its year-round appeal ensures steady demand, but property managers in 2025 face a market defined by pronounced seasonality, stricter regulations, and growing competition.

At the same time, dynamic pricing (DP) has emerged as a decisive factor in maximizing both occupancy and revenue. This article explores the latest trends in occupancy, ADR (average daily rate), RevPAR (revenue per available room), booking behavior, and regulations—while showing how dynamic pricing continues to give STR operators a measurable competitive advantage.

Portugal Vacation Rental Market Trends 2025

Tools like the World STR Index and PriceLabs Market Dashboard enable property managers in Portugal and beyond to analyze market trends, monitor demand, and optimize revenue strategies. Using these insights, we’ve outlined the key vacation rental trends shaping Portugal’s short-term rental market in 2025.

1. Occupancy Trends

Summer Peaks Dominate the Market

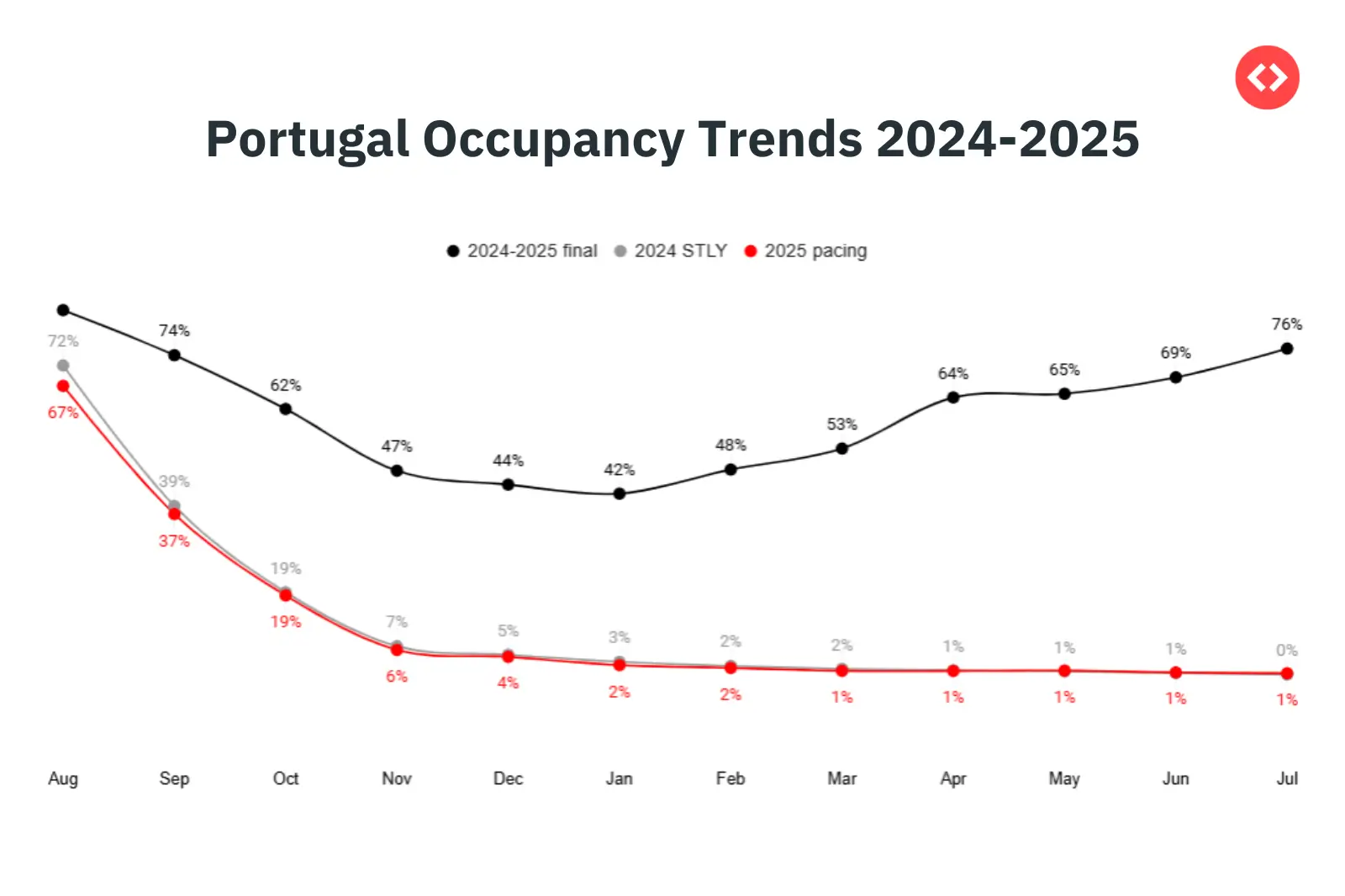

Portugal vacation rental market trends in 2025 continue to be highly seasonal, with the summer months carrying most of the weight. August stands out as the busiest month, reaching an impressive 85% occupancy, followed closely by July (76%) and June (69%). The shoulder months also show solid performance—May (66%) and September (74%)—thanks to cultural tourism and the growing presence of digital nomads.

Winter Remains the Weak Spot

On the flip side, winter still represents the quietest period. January (42%) and February (48%) record the lowest occupancy levels of the year. That said, Lisbon and Porto manage to keep demand relatively steady compared to coastal regions that rely heavily on summer tourism.

Annual Performance Snapshot

Looking at the year as a whole, Portugal’s vacation rentals average around 61% occupancy. Year-on-year, the market remains stable, with a small boost in spring occupancy largely driven by longer-term stays from digital nomads.

The Big Takeaway for Property Managers

Portugal is still heavily reliant on peak summer months, but the steady demand in urban centers and the rise of digital nomads are helping soften those winter dips. For property managers, this creates a clear opportunity: target mid- to long-term bookings in the off-season to smooth out revenue and reduce reliance on just the summer rush.

Read More: Seasonality in DACH Vacation Rentals: How to Maximize Revenue Year-Round

2. ADR (Average Daily Rate) Trends

ADR levels in Portugal show strong seasonality, with peaks in summer and softer performance in the winter months. July records the highest ADR at €246, followed by June (€216) and August (€161). On the other hand, February (€104) and January (€113) represent the weakest months for pricing resilience.

- Annual Average ADR: €125

- High Season ADRs: €161–€246

- Low Season ADRs: €80–€113

Insight: Portugal’s coastal and leisure markets continue to draw high-paying travelers during peak summer months, with July and June commanding the strongest ADRs. However, in winter, ADRs drop to nearly one-third of summer highs, underlining the importance of using flexible, market-based pricing strategies to sustain revenue performance during low-demand periods.

Read More: Italy Vacation Rentals: Prepare Your Rental For the Summer Surge

3. RevPAR Trends

RevPAR (Revenue per Available Rental) reflects the sharp seasonality of Portugal’s short-term rental market. August dominates at €138, while January and February dip to just €41–€43, showing the steep winter slowdown.

- Annual Average RevPAR: €75

- Peak RevPAR: €138

- Low RevPAR: €69

Insight: RevPAR fluctuations reveal the risks of relying on static pricing. While ADRs stay relatively stable in peak months, off-season occupancy collapses, dragging performance down. Property managers leveraging dynamic pricing strategies can smooth revenue swings, often achieving significantly higher RevPAR compared to those sticking with flat seasonal rates.

Unlock Market Insights with PriceLabs Market Dashboards

Want to stay ahead of the competition? With PriceLabs Market Dashboards, you can track local demand patterns, benchmark against competitors, and spot booking trends before anyone else. From occupancy rates to ADR shifts, get the data you need to set the right pricing strategy and maximize revenue.

Explore PriceLabs Market Dashboards4. Booking Window Trends

Travelers in Portugal are booking closer to their trips, showing a clear shift toward flexibility and last-minute planning.

- Summer Peak: August remains the longest booking window, with reservations made 82 days in advance on average, followed by July at 58 days and June at 43 days. This reflects the high demand and competition for summer stays.

- Shoulder Months: May (42 days) and April (36 days) also show relatively longer booking windows as travelers secure spring trips earlier.

- Winter Lows: The shortest booking windows are in January and February (just 19 days), highlighting the dominance of last-minute trips in the off-season. November (19 days) and December (25 days) also follow this trend.

- Annual Trend: The average booking window is 36.7 days, down from 38 days last year, a modest 3% decline year-over-year.

Insight: This steady shortening of booking windows shows how much more spontaneous and flexible travel has become. For property managers, it means that real-time pricing adjustments and dynamic availability settings are now essential to capture demand—especially in the off-season, where bookings often happen just weeks (or even days) before arrival.

Read More: Vacation Rental Trends in Croatia: Insights from 2025

5. Length of Stay Trends

Portugal’s length of stay (LOS) trends remain steady in 2025, showing only a slight uptick compared to last year (5.13 nights vs. 5). The market continues to be shaped by digital nomads, leisure travelers, and seasonal holiday patterns.

- Summer holidays lead the way – In July and August, guests stay the longest, averaging 6 nights, driven by family trips and extended vacations.

- Shoulder months stay balanced – From September to November, as well as in spring (March–June), the average LOS holds steady at 5 nights, often tied to cultural city breaks or remote workers mixing leisure and work.

- Winter shows variety – January and February average 5–5.5 nights, slightly longer than typical short breaks, while December sits at 5 nights—likely boosted by festive travel.

Insight: Portugal’s annual average LOS is holding firm at just over 5 nights, confirming its pull as a leisure-heavy destination. For property managers, this means:

- Setting longer minimum stays in peak summer to maximize revenue.

- Offering shorter stays in the shoulder and winter months to capture weekend city travelers and last-minute domestic bookings.

This flexible approach can help smooth occupancy across the year while catering to different traveler types.

6. Listing Growth in Portugal

Portugal’s short-term rental market has seen consistent growth over the past five years, despite regulatory headwinds in urban hubs like Lisbon and Porto.

- Back in April 2020, there were just under 80,000 active listings.

- By mid-2023, supply had passed the 100,000 mark, reaching over 100,900 in September 2023.

- Growth continued steadily into 2024, peaking at around 107,000 listings in August.

- As of July 2025, Portugal counts more than 111,000 active rentals—the highest on record.

While expansion slowed in early 2025 due to seasonal churn and tighter licensing rules in Lisbon and Porto, the coastal and leisure-heavy regions continued to drive supply growth.

Key Insight: With supply now exceeding 111,000 listings, competition in popular markets—especially coastal destinations—is intensifying. Property managers who differentiate through dynamic pricing, compliance readiness, and tailored guest experiences will be best positioned to stand out in this crowded market.

The Impact of Regulation

Portugal’s vacation rental market is shaped not only by traveler demand but also by evolving regulations that directly impact how property managers operate and plan for the future.

The Mais Habitação Package (2023–2024)

The government temporarily suspended new short-term rental (STR) licenses in high-demand areas such as Lisbon, Porto, and the Algarve. Existing licenses, however, remained valid and transferable during property sales. The primary goal was to protect affordable housing for locals while balancing tourism activity.

Market Effects of the Suspension

The suspension led to a decline in property prices, particularly for small apartments in restricted areas, as STR investments became less attractive. The policy also created uncertainty among property owners and investors, slowing down sector growth.

Decree-Law 76/2024: Adjustments and Flexibility

In late 2024, Decree-Law 76/2024 revised the earlier restrictions. It lifted the blanket ban on new STR registrations in some areas and returned licensing authority to local municipalities, allowing for more tailored decision-making. It also limited automatic license cancellations and reduced the ability of condominium associations to block STR operations—bringing greater stability and flexibility for owners and investors.

EU Regulation (EU) 2024/1028: Single Rental Registry

From mid-2025, EU-wide rules require property owners to obtain a unique registration number for all listings and contracts under the new Single Rental Registry. A digital one-stop shop has also been introduced to streamline compliance. These measures aim to increase transparency, ensure tax and safety compliance, reduce fraud, and ease housing pressures in tourist-heavy areas.

Overall Market Impact

Portugal’s combination of national reforms and EU-wide regulations reflects a clear shift toward balancing tourism growth with housing protection. With decentralized licensing and an EU-backed registration framework, the STR market is moving toward greater sustainability, transparency, and long-term stability.

The Role of Dynamic Pricing

The most striking insights from the Portugal market lie in the comparison between properties using dynamic pricing and those that do not.

The data highlights three clear advantages:

- Occupancy improves dramatically for vacation rentals that heavily utilize dynamic pricing, with 30 percent more filled nights than static-priced listings.

- ADR is stronger for dynamic pricing users, averaging 19 percent higher than non-dynamic pricing users.

- RevPAR nearly doubles with dynamic pricing, growing by 93 percent compared to static-priced properties.

Dynamic pricing not only boosts revenue during peak periods but also cushions operators during off-season troughs by helping them capture last-minute demand at competitive rates.

Boost Your Bookings with Dynamic Pricing

Portugal’s vacation rental trends show just how much occupancy, rates, and booking behavior can improve with Dynamic Pricing. With PriceLabs Dynamic Pricing, you’ll always stay one step ahead—automatically adjusting your prices to capture demand, boost RevPAR, and keep your calendar full, no matter the season.

Sign Up For Free trialHow Property Managers Can Maximize Revenue in Portugal’s 2025 Market

Portugal’s short-term rental market in 2025 is more competitive and regulated than ever before. To thrive, property managers need to go beyond standard pricing tactics and actively position their rentals to capture demand across seasons. Here are the strategies that can make the most significant impact:

1. Embrace Dynamic Pricing for Every Season

Static pricing leaves money on the table. With ADR swings from €104 in winter to €246 in summer, dynamic pricing ensures rates are optimized daily based on demand, competition, and events. Adjusting your pricing strategy according to seasons protects occupancy during slow months while maximizing revenue in peak season.

Action: Utilize automated pricing tools, such as PriceLabs’ Dynamic Pricing tool, to adjust nightly rates in real-time and apply last-minute discounts when demand softens.

2. Target Long-Stay Guests in the Off-Season

Digital nomads and remote workers are filling the seasonal gaps. With an average LOS of 5+ nights, offering attractive weekly and monthly discounts can lock in consistent income during low-demand months. You also need to dynamically adjust your minimum stay restrictions according to changing seasonal trends.

Action: Develop “work-from-anywhere” packages that include Wi-Fi upgrades, ergonomic desks, and flexible check-in options to attract longer bookings in January–March.

3. Optimize Minimum Stay Policies by Season

Summer demand justifies more extended minimum stays (5–7 nights), but strict rules in winter may block shorter weekend bookings. Adapting stay policies seasonally improves occupancy and turnover.

Action: Set more extended minimum stays in July–August to maximize revenue per booking, and shorter stays in winter to capture spontaneous city breaks.

4. Differentiate Listings with Experience-Led Positioning

With over 111,000 active listings in Portugal, standing out is critical. Properties with strong vacation rental marketing and optimized listings with professional photos, curated descriptions, and unique amenities (pools, workspace setups, eco-friendly features) consistently outperform generic listings.

Action: Invest in professional photography and highlight experiences (beach holidays, wine tours, cultural city stays) instead of just the property features.

5. Leverage Early-Bird and Last-Minute Promotions

Booking windows are shortening (36 days on average), but summer trips are still reserved months ahead. Capturing both early planners and last-minute bookers ensures year-round demand.

Action: Offer early-bird discounts for summer 2026 while using last-minute deals (up to 20% off) to fill winter gaps.

6. Stay Ahead of Regulatory Compliance

With new EU registration rules and Portugal’s evolving STR licensing framework, compliance is not optional. Short-term rentals that are licensed, transparent, and professionally managed are more appealing to both guests and platforms. Keeping a close eye on regulatory changes and staying compliant will also safeguard your business from crises.

Action: Promote your compliance status in listings to build trust and avoid costly penalties.

Conclusion

The Portugal vacation rental market in 2025 presents both opportunities and challenges. Demand remains strong, particularly in summer, but heavy seasonality requires careful management to avoid revenue gaps in the winter months. Regulations are adding pressure, especially with the introduction of the EU’s Single Rental Registry, making compliance more critical than ever.

Above all, the data underscores the critical role of dynamic pricing. Properties using dynamic pricing consistently outperform static-priced listings across every key performance metric—occupancy, ADR, and RevPAR. For property managers looking to stay competitive and profitable in Portugal’s evolving STR landscape, adopting dynamic pricing is no longer optional but essential.

Frequently Asked Questions

1. What are the peak vacation rental seasons in Portugal?

Portugal’s peak season is in July and August, when international tourists and domestic travelers flock to the beaches and coastal towns. Demand is also high during Easter and spring holidays.

2. How does seasonality affect vacation rental pricing in Portugal?

Pricing in Portugal is heavily influenced by seasonality—rates are highest in summer, moderate in shoulder months like September and October, and drop in winter when city breaks dominate.

3. What is the average length of stay (LOS) in Portugal vacation rentals?

The annual average LOS is 5.1 nights, with 6 nights in summer, 5 nights in spring and fall, and 3–4 nights in winter. Longer summer stays are often linked to holidays, while shorter ones are tied to city breaks.

4. Who are the main travelers driving Portugal’s rental market?

Portugal attracts a mix of international tourists, digital nomads, leisure travelers, and domestic visitors. Summer stays are led by families and beachgoers, while winter months see weekend city breaks.

5. How can property managers maximize occupancy in Portugal?

Property managers can optimize performance by:

- Using dynamic pricing to adjust rates to seasonality.

- Setting longer minimum stays in summer and shorter stays in winter.

- Catering to digital nomads with discounts for monthly stays.

6. Is Portugal’s vacation rental market still growing in 2025?

Yes. Despite new regulations and competition, Portugal continues to see strong demand. The average LOS increased by 1% YoY, and international interest in coastal and urban rentals remains high.