Vacation rental pricing factors are the hidden levers that decide whether your Miami listing thrives or struggles. From winter snowbird demand and spring break surges to hurricane-season slowdowns, Miami is a city where pricing strategy can make or break your revenue. Hosts who rely on static rates often miss out on peak earnings—or leave money on the table when occupancy dips.

In this article, we’ll break down the core vacation rental pricing factors in Miami, highlight how 2025 is shaping up month by month, and offer an early look at 2026 trends. More importantly, you’ll walk away with an actionable playbook that shows you how to respond to shifts in demand, booking windows, and competition—so your pricing isn’t just reactive, but strategically ahead of the curve.

Methodology & Scope

Our analysis is powered by STR Index, PriceLabs’ free market analysis tool that gives hosts real-time visibility into occupancy, ADR, and RevPAR across their markets.

By examining Miami’s monthly performance data, comparing year-over-year trends, and layering in pacing insights, we can identify the pricing factors that matter most for 2025 and beyond.

The scope here is market-level, but the recommendations are designed to help hosts translate data into practical pricing strategy.

The Core Vacation Rental Pricing Factors (Miami Lens)

Pricing vacation rentals involves understanding the forces that shape demand and knowing when to adjust accordingly.

These are the primary factors that drive Miami’s market in 2025:

1. Seasonality

Miami’s calendar is sharply divided. December through March sees peak demand as snowbirds, international travelers, and event-goers escape colder regions. ADR climbs significantly during these months, often reaching its annual highs. Conversely, June through September tends to be a slower period due to high heat, humidity, and the hurricane season.

Effective pricing means adjusting to winter premiums while maintaining competitiveness in slower summer months.

2. Events & Holidays

Events are one of the most significant factors influencing vacation rental pricing in Miami. Major events, such as Art Basel in December, spring break in March, and the Miami Grand Prix in May, consistently drive sharp increases in both occupancy and ADR.

For example, PriceLabs’ own analysis of the Miami Grand Prix 2025 shows that demand during race week has already outpaced 2024, with forward bookings pushing occupancy and RevPAR well above seasonal averages.

Read about the Copa América vs Euro 2024’s Impact on Short-Term Rentals, specifically in Miami.

Hosts who updated prices early captured the upside, while those who reacted late risked leaving revenue on the table.

3. Lead Time (Booking Window)

Miami travelers book at very different speeds depending on the season:

- Winter high season: Bookings can come in 2–3 months in advance, especially for premium properties.

- Summer & shoulder months: Shorter booking windows dominate, often 2–3 weeks out.

Understanding these booking windows helps you avoid premature discounts while still being aggressive enough to capture late-booking demand.

4. Length of Stay (LOS) Patterns

Miami attracts a mix of travelers:

- Winter: Longer stays (7–14 nights), especially from international guests and seasonal renters.

- Spring and summer: Shorter weekend stays or 3–4 night trips.

Adjusting minimum-stay rules seasonally allows hosts to optimize occupancy without leaving orphan nights unbooked.

5. Supply Shifts

Miami is one of the largest short-term rental markets in the U.S., and supply growth continues. New condos, professional property managers, and corporate operators are entering the market, which can suppress ADR if demand doesn’t keep pace.

Monitoring competitor performance helps you avoid underpricing or holding too firm against increased competition.

6. Competitive Dynamics

The actions of your comp set shape pricing. If nearby listings drop rates aggressively during the shoulder months, holding firm could result in reduced occupancy. Conversely, disciplined pricing during peak events can protect your ADR without sacrificing bookings if your comp set is constrained.

Tools like Comp Sets in PriceLabs help identify where your property sits against actual competitors, not just the entire market average.

Together, these factors explain the fluctuations in Miami’s vacation rental pricing in 2025. In the next section, we’ll translate these dynamics into a month-by-month breakdown of occupancy, ADR, and RevPAR—so you can see exactly how these forces show up in the data.

Key Seasonal Insights

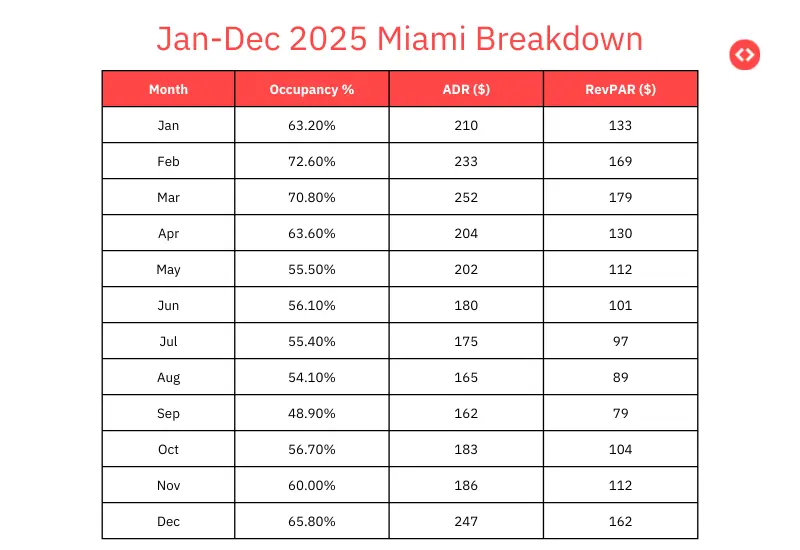

- January–March (Winter peak): Occupancy holds above 63%, with ADR climbing to $252 in March. RevPAR peaks at $179, driven by both high rates and strong demand. This is Miami’s most profitable window, and it’s when disciplined pricing captures the highest upside.

- April: Still healthy at 63.6% occupancy, though ADR moderates to $204. RevPAR drops to $130, signaling the end of peak season. Hosts should begin easing minimum stays and consider LOS discounts to maintain bookings.

- May (Miami Grand Prix impact): Occupancy dips to 55.5%, yet ADR holds near $202. RevPAR lands at $112. PriceLabs’ Miami Grand Prix 2025 analysis shows the event boosting rates locally, but outside race week, demand is softer. Strategic rate adjustments around the Grand Prix week are essential.

- Summer (June–September): Data shows typical softness: lower occupancy and compressed ADR. These months require proactive discounting, shorter LOS requirements, and aggressive orphan-night strategies to avoid gaps.

- October–November: Shoulder season recovery, with occupancy gradually improving and ADR steadying. Forward pacing suggests RevPAR is poised to outperform 2024 benchmarks.

- December (Holiday surge): The year closes strong. December’s occupancy surges (65%+), ADR spikes near $247, and RevPAR crosses $160. Holiday travel plus Art Basel creates one of the most lucrative booking windows of the year.

Early Outlook — Miami Vacation Rental Pricing Factors 2026

The pacing data provides a first look at how 2026 bookings are tracking relative to 2025.

Several clear signals emerge:

1. Early strength in late 2026

- September–December 2026 is already pacing far ahead. Occupancy pacing is unusually strong in September (23.9%), October (11.7%), and December (7.5%), translating into double-digit RevPAR pacing improvements.

- This suggests that Miami’s off-season demand curve may be shifting, with earlier booking activity extending into traditionally weaker months.

2. Premium ADR holding steady

ADR pacing for early 2026 is higher across nearly every month:

- February–March are already pricing above $250–$270.

- May (Grand Prix month) shows ADR pacing at $378, indicating that race week rates are being set aggressively well in advance.

3. Low pacing in H1 2026 (except events)

January through August show relatively thin on-the-books occupancy (all under 5%), which is normal at this horizon. But the ADR levels being loaded are solid—suggesting hosts are maintaining pricing discipline even before meaningful occupancy builds.

Implications for Hosts

- Event anchoring pays off: 2026 ADR pacing for May (Grand Prix) and December (holiday season) is already well above 2025 realized levels. Hosts who price too cautiously now risk underselling as demand firms up.

- Shoulder month opportunity: September–October are showing unusually strong pacing compared to prior years, a sign that Miami’s booking seasonality may be stretching.

- Patience needed for early 2026: With low on-the-books occupancy in Jan–Aug, it’s too early to discount. The key is monitoring pickup via Market Dashboard and adjusting closer to the booking window.

Stay Ahead of the Market and Find the Right Amenities that Your Potential Guests Want Using PriceLabs Market Dashboard.

Use PriceLabs Market Dashboard and Neighborhood Data to track competitor pricing and demand shifts and analyze past performance to set a strong pricing strategy for your property.

Create your Market Dashboard NowActionable Pricing Playbook for Miami Hosts

Data is only useful if it translates into actions. Here’s how Miami hosts can put the 2025 results and early 2026 pacing to work in their own pricing strategy.

1. Set Seasonal Base Price Guardrails

- Winter (Jan–Mar): Your money months. Keep base rates firm — ADR held between $210–$252 in 2025, and 2026 is already pacing higher. Avoid undercutting just to boost occupancy; demand is strong enough to sustain higher nightly rates.

- Summer (Jun–Sep): Occupancy dips into the 50% range, with RevPAR under $100 in Aug/Sep. Drop base prices earlier and stay flexible, but use orphan-night discounts rather than broad cuts.

- December: Treat this like a mini-high season. ADR peaked at $247 in 2025 and pacing shows strong December 2026 already. Raise base rates 30–60 days out, especially around Art Basel and the holidays.

2. Leverage Event & Holiday Uplift

- Miami Grand Prix (May): In 2025, ADR held firm near $200 despite softer occupancy. For 2026, pacing already shows $378 ADR loaded — evidence that event-anchored pricing works. Raise base rates months in advance, then layer in min-stay rules for premium nights.

- Other key drivers: Art Basel (Dec), Ultra Music Festival (Mar), and long weekends (Memorial Day, Labor Day) consistently lift demand. Use PriceLabs’ Dynamic Pricing to automatically capture these spikes.

Dynamically Price Your Property and Get FREE Custom Reports Tailored To Your Property!

Use PriceLabs Dynamic Pricing to competitively and dynamically price your property according to demand shifts and analyze past performance to set a strong pricing strategy for your property.

Create your Account Now3. Optimize Minimum Stay Rules

- Winter: Travelers often stay 7–14 nights. Raise your minimum stay to 4–5 nights to maximize occupancy efficiency.

- Shoulder & summer months: Switch to 2–3 night minimums to capture weekenders and shorter bookings.

- Event weeks: Enforce 3–4 night minimums around major events to avoid filling high-demand nights with one-night stays.

4. Discount Tactically — Not Broadly

Last-minute discounts: Let PriceLabs’ automation fill gaps inside a 0–7 day window.

Orphan-night discounts: Target 1–2 night gaps between longer stays to keep your calendar full without slashing overall ADR.

Length-of-stay discounts: Offer weekly/monthly discounts in low season (Jul–Sep) to lock in longer bookings rather than juggling multiple short ones.

5. Watch Booking Windows & Pacing

- High season: Guests book 60+ days out. Hold firm early, then reassess 30 days before arrival.

- Low season: Many bookings land inside 2–3 weeks. Keep rates competitive and flexible closer in.

- Pacing alerts: If PriceLabs Portfolio Analytics shows your occupancy pacing behind last year 30 days out, adjust discounts sooner rather than later.

6. Monitor Your True Comp Set

Don’t just track Miami’s citywide average. Use PriceLabs Comp Sets to benchmark against listings that mirror your property type and neighborhood. If they’re raising rates ahead of an event, you should too.

FAQs: Miami Vacation Rental Pricing Factors

Q1. How should I balance occupancy vs ADR in Miami?

Focus on RevPAR (revenue per available night), not just occupancy or ADR alone. For example, in 2025, ADR dipped slightly in some months, but higher occupancy lifted RevPAR overall. If your calendar is filling at strong rates, resist the urge to discount for 100% occupancy. Instead, track RevPAR in PriceLabs Portfolio Analytics — it’s the clearest measure of whether your pricing is working.

Q2. What should I do if pacing is soft 30 days out?

If your listing shows you’re behind last year’s occupancy with a month to go , take action quickly:

- Add last-minute discounts for the 0–14 day window.

- Loosen min-stay restrictions to capture shorter trips.

- Use orphan-night discounts to fill small gaps without cutting all rates.

Don’t wait until the last week — Miami’s booking windows are short in low season but longer in peak months. Early adjustments protect your RevPAR.

Q3. Are Miami’s summer months worth discounting aggressively?

Yes — but do it tactically. Occupancy fell to ~55% in June–August 2025, with RevPAR dropping under $100. That’s the time to offer weekly/monthly discounts to attract longer stays and last-minute deals to catch short-term demand. Keep base prices aligned with the season, but let automation handle the micro-adjustments so you don’t over-discount.

Closing the Loop: Turning Data into Dollars

Miami’s vacation rental market is shaped by clear pricing factors: sharp seasonality, event-driven surges, shifting booking windows, and a constant balance between occupancy and ADR. The 2025 data shows how RevPAR climbs when hosts align their strategies with these rhythms, while the 2026 pacing outlook suggests even stronger opportunities if pricing discipline holds.

For hosts, the message is simple:

- Stay firm in peak months (Jan–Mar, Dec).

- Get tactical in the summer slump (Jun–Sep).

- Anchor pricing to events like the Grand Prix and Art Basel.

- Lean on PriceLabs Portfolio Analytics and Market Dashboard to benchmark pacing and spot when to adjust.

By blending seasonal guardrails with event-based strategies, tactical discounts, and comp-set monitoring, Miami hosts can turn insights into measurable revenue gains. And with PriceLabs’ STR Index and Market Dashboards alongside its Dynamic Pricing automation, you don’t need to chase every shift manually — the tools do the heavy lifting, while you stay strategically in control.

The takeaway: Miami’s vacation rental pricing factors aren’t just data points. They’re actionable levers. Pull them right, and you’ll not only fill your calendar — you’ll maximize every night booked.