Table of Contents

Updated : Feb 9, 2026

Dynamic pricing in hotels is like a smart thermostat for revenue—raising rates when demand heats up and easing when it cools—so occupancy and Average Daily Rate stay balanced without constant tweaks. By adjusting rates in real time based on demand, competitor moves, seasonality, and booking behavior, fixed-supply hotels fill soft periods and capture higher margins in spikes . In this blog, we outline eight proven strategies—demand signals, competitor monitoring, booking-window tactics, channel rules, last-room optimizations, segmentation, price protection, and AI forecasting—and show how automation turns strategy into daily, market-responsive action with quick steps and examples.

Demand-based Rate Adjustments

Demand-based pricing adjusts rates to occupancy, booking pace, local events, and market signals to stimulate bookings when demand is soft and capture higher margins when it spikes.

Because fixed costs persist even when rooms sit empty, modest reductions can lift occupancy and cover costs; conversely, pricing up during peaks protects ADR and contribution.

A simple demand-trigger flow throughout the booking cycle:

- 60–90 days out: If occupancy lags pace, apply an early soft discount; if citywide demand rises, tighten discounts.

- 30–60 days out: If booking velocity accelerates, scale rates up; if pace stalls, test targeted offers (e.g., LOS discounts).

- 0–30 days out: Use last-minute nudges if inventory is wide; if compression emerges, escalate faster as remaining rooms shrink.

How to implement today:

- Set occupancy bands (e.g., <40%, 40–70%, >70%) and link each to a price move.

- Use pickup reports daily to validate whether changes improved conversion.

- Pair small shifts with fences (member-only, mobile) to protect your BAR.

Practical example:

- At 45% occupancy 45 days out, drop 5% and add a 3-night LOS discount. If occupancy hits 70% in a week, roll back the discount and lift BAR by 3–7%.

How PriceLabs helps:

- Automated demand rules that detect occupancy and pickup changes and push daily moves.

- Event- and market-aware suggestions that prevent underpricing during hidden spikes.

- Visual impact analysis showing ADR/RevPAR effects before enabling automation.

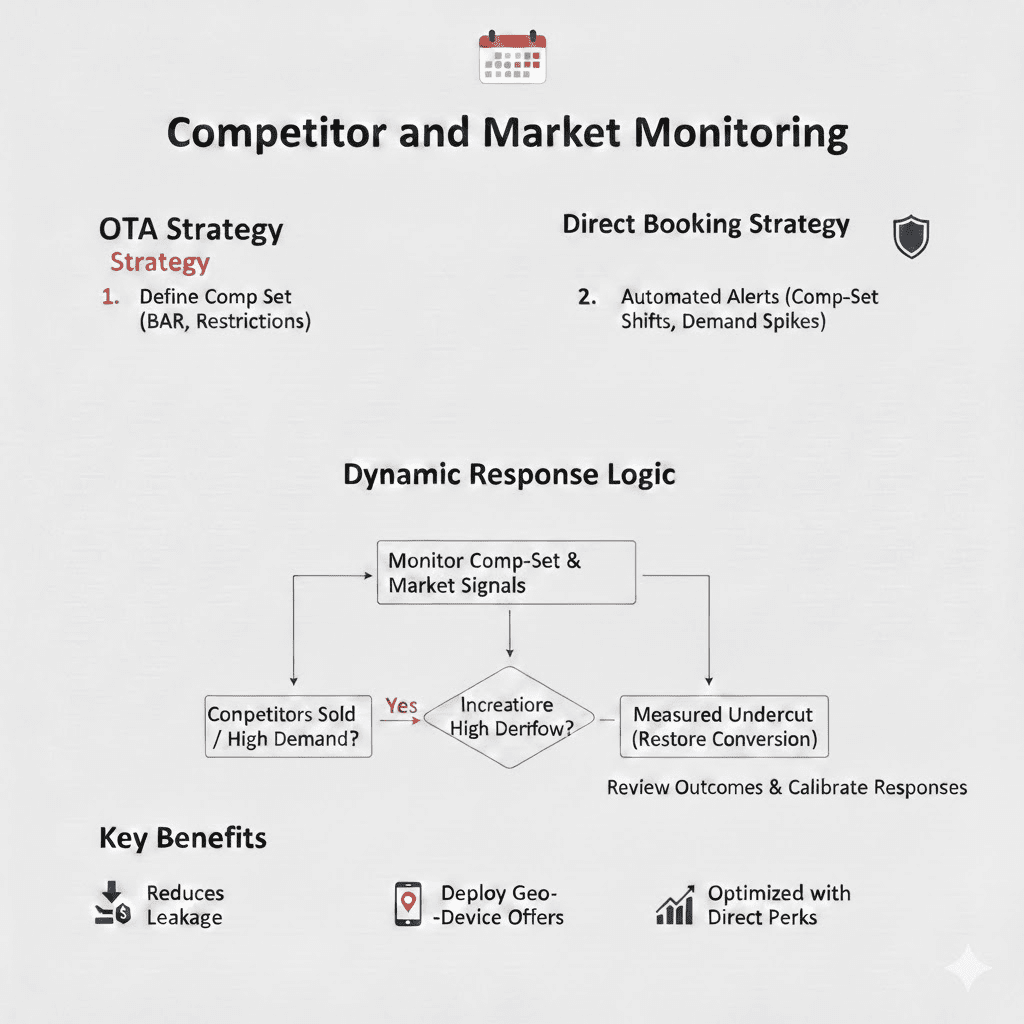

Competitor and Market Monitoring

Track comp-set pricing, availability, and market signals (events, holidays, flight patterns) to keep rates attractive and optimized.

When competitors sell out, push rates to capture overflow; when the market softens, a measured undercut restores conversion. Continuous monitoring reduces leakage and keeps pricing aligned with current realities.

Best practices:

- Define a tight comp set and monitor BAR, restrictions, and sell-out patterns.

- Use automated alerts for sudden comp-set shifts or local demand spikes.

- Calibrate responses (e.g., increase X% when top competitors hit 90% occupancy) and review outcomes.

How to apply quickly:

- Tag 5–8 true competitors; track rate/availability by date and room type.

- Create actions (e.g., “if top 3 raise >8% on a date, raise ours 5–7% within guardrails”).

- Review variances weekly and adjust comp weightings if mix changes.

Example:

- If two key competitors close out a Saturday during a festival, lift BAR by 10–15% and remove discount fences for that night only.

How PriceLabs helps:

- Comp-set dashboards with alerts for rate changes, sell-outs, or new restrictions.

- Rule-based pricing responses tied to competitor occupancy or price deltas.

- Side-by-side pickup vs. competitor moves to confirm what drives results.

Booking-window Pricing Strategies

Booking-window (U-pricing) varies rates by days to arrival: early-booker incentives, mid-window stability, and close-in urgency premiums or nudges. Done well, it smooths the curve and reduces last-minute scrambling.

A simple booking-window map:

| Stage | Days to arrival | Typical action | Example adjustment |

| Early window | 60–120+ | Encourage early commitment | 5–10% advance purchase offer |

| Mid window | 21–59 | Hold value; respond to pickup | Maintain BAR; flex ±3–5% as needed |

| Late window | 7–20 | Nudge or hold, depending on pace | Small lift if pace strong; soft promo if slow |

| Last minute | 0–6 | Price for urgency or clear inventory | +10–25% in compression; -5–10% if wide open |

How to put this in place:

- Map your booking curve by day-of-week and season to set realistic windows.

- Fence early offers (prepaid, member-only) to preserve rate integrity.

- Pair late-window premiums with scarcity messaging and mobile-only nudges.

Example:

- For a beach weekend, open a 10% advance-purchase promo 90+ days out; at 21 days, hold BAR unless pickup lags; within 3 days, add +15% if few rooms remain.

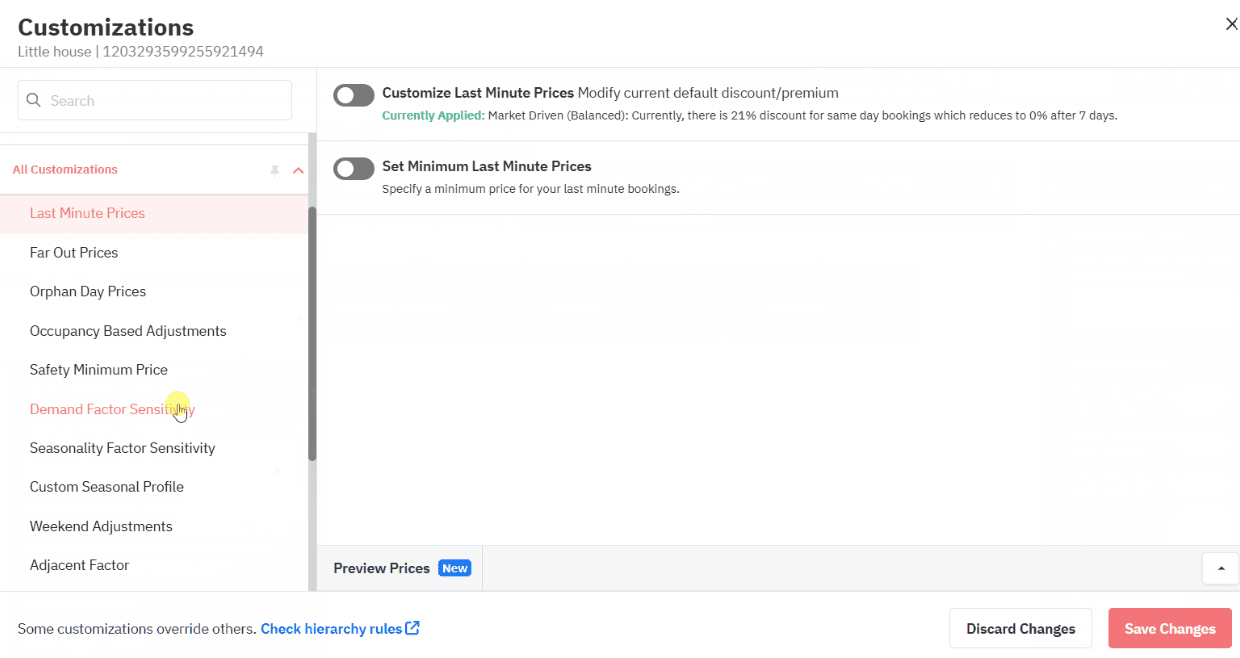

How PriceLabs helps:

- Window-aware rules that auto-shift offers by days-to-arrival and pickup.

- A/B testing via channel-level price adjustments to compare tactics.

- Smart nudges for dates where your curve deviates from the norm.

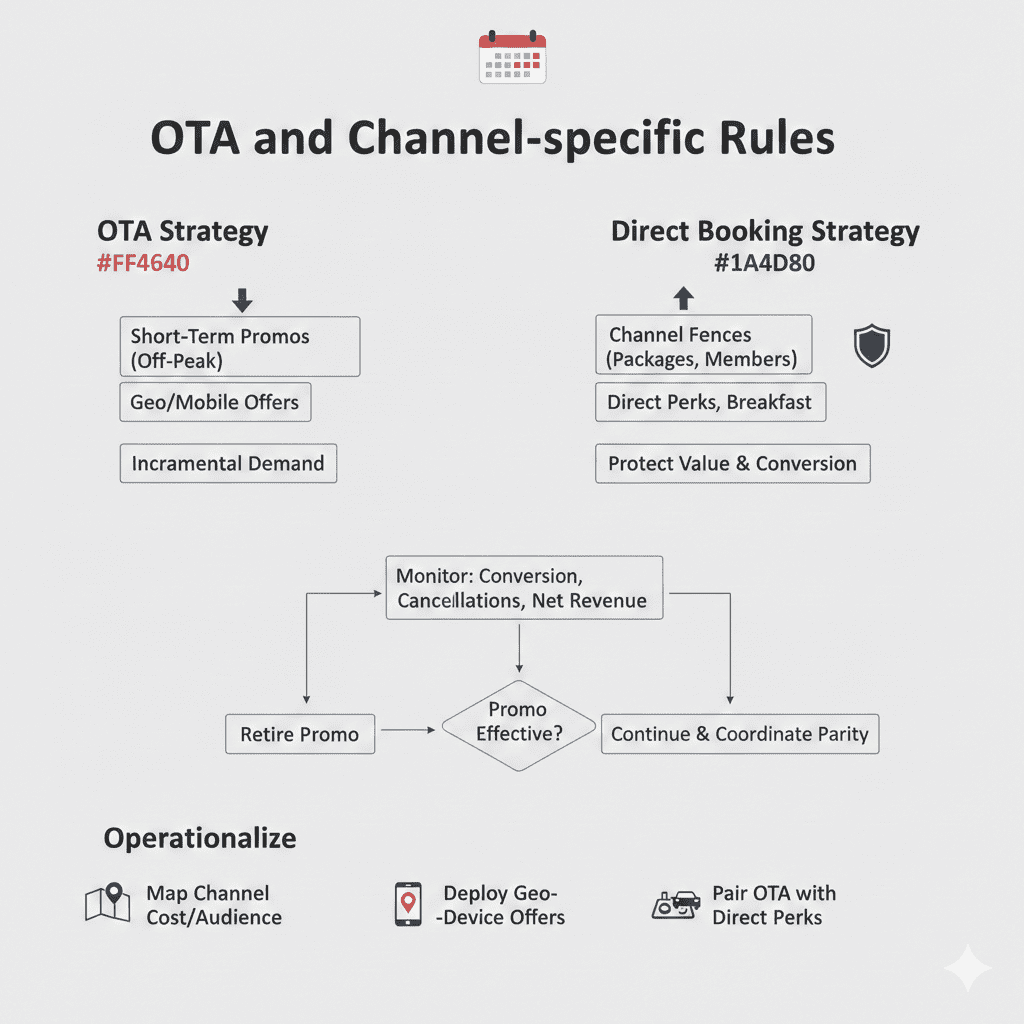

OTA and Channel-specific Rules

Tailor rates and promotions by channel to reach incremental demand without eroding margins or cannibalizing direct bookings. Use limited-duration OTA discounts in shoulder periods, fenced mobile or geo offers, and direct-only value-adds.

Practical steps:

- Run short-term OTA promotions during off-peak periods.

- Use channel fences (packages, member rates) to protect direct value.

- Monitor conversion, cancellations, and net revenue; retire weak promos quickly.

- Coordinate parity rules to avoid conflicts while preserving levers.

For implementation tips on channel strategies within revenue management software, see PriceLabs’ real-time pricing updates overview.

How to operationalize:

- Map each channel’s cost and audience; set uplift thresholds to justify promos.

- Deploy geo- or device-specific offers to reach new guests without lowering public BAR.

- Pair OTA promos with direct-only perks (parking, breakfast) to drive owned conversion.

Example:

- Launch a 7-day mobile-only OTA deal at -8% during midweek shoulder dates while adding a members-only breakfast package on your direct site.

How PriceLabs helps:

- Channel-aware pricing and promo recommendations synced to OTAs and direct engines.

- Net-revenue analytics by channel (after commissions and cancels).

- Real-time parity and performance alerts to prevent margin leaks.

Close-in and Last-room Pricing Tactics

Close-in tactics adjust rates near arrival, while last-room premiums capitalize on scarcity. If occupancy is low a few days out, a measured discount can unlock undecided travelers; if only a few rooms remain, surcharges capture top-of-market willingness to pay.

Dynamic systems should update multiple times per day to keep pace with sell-through and cancellations.

Examples:

- If availability is wide three days out, test a small discount plus a same-day mobile offer.

- When inventory drops to the last rooms during citywide events, add a scarcity premium to ADR.

How to execute reliably:

- Define “compression” triggers (e.g., <10 rooms left or >85% occupancy) with specific lifts.

- Use short-lived promos (6–12 hours) to stimulate same-day demand.

- Refresh prices after notable pickup or cancellation events.

Example:

- At 88% occupancy two days out, switch to surge mode: +12% BAR and remove discount codes; when inventory dips to 3 rooms, add a last-room premium of +8%.

How PriceLabs helps:

- Intraday automated repricing tied to live availability and pickup.

- Last-room premium rules per room type to protect upsell gaps.

- Mobile-only price cues to boost close-in conversion without broad discounting.

Segmented and Personalized Pricing

Customize offers by guest type, stay pattern, and price sensitivity to widen reach without diluting premium BAR or Best Available Rate.

Tactics to consider:

- Corporate: Weeknight-focused rates with flexible terms.

- Leisure: Weekend bundles with breakfast or parking.

- Length of stay: Discounts for 3+ nights in low season; minimum stays during peaks.

- Families: For attracting family guests, package inclusions can be (cribs, late checkout) instead of pure price cuts.

- Long-stay: Weekly/monthly rates to improve base occupancy and cash flow.

Maintain rate integrity with fences (promo codes, member tiers) and track segment profitability to avoid cannibalization.

How to roll this out:

- Identify 3–5 core segments by day-of-week and season; assign fences and KPIs.

- Use LOS-based floors and add-ons to shape mix rather than deep discounts.

- Track segment pickup vs. margin; prune unprofitable offers quarterly.

Example:

- Introduce a 5-night “work-from-hotel” package with late checkout and a modest discount to anchor shoulder weeks.

How PriceLabs helps:

- Segment-aware rules that adjust by stay length, day-of-week, and room type.

- Member/promo code fences synced across channels.

- Profitability reporting at the segment level to spotlight winners and laggards.

Price Rules and Surge Protection

Price rules set smart boundaries—min/max price limits, room-type guardrails, and surge-protection protocols—to align automation with strategy and mitigate volatility.

Guardrails prevent brand damage from prices that are too low and missed revenue from rates that are too high or too late.

Common rules and their benefits:

| Rule type | Purpose | Example | Benefit |

| Min/max BAR limits | Protect brand and margins | BAR never below $X or above $Y | Prevents value erosion or overpricing |

| LOS-based floors | Encourage longer stays | Higher floor for 1-night stays | Optimizes occupancy mix |

| Event surge caps | Prevent runaway rates | Cap daily increase to +20% after a spike | Maintains guest trust, avoids volatility |

| Room-type differentials | Preserve upsell gaps | Suites maintain a $Z spread vs. standards | Keeps upgrade path clear |

How to configure with confidence:

- Set different min/max by room type and season to reflect brand positioning.

- Add event-day caps to smooth big moves and reduce guest price shock.

- Review exceptions weekly and fine-tune rules where automation hits limits.

Example:

- For holiday weekends, cap daily increases at 18% with a 2-night min-stay floor; keep suites at a fixed $60 spread above standards.

How PriceLabs helps:

- Flexible rule engine for min/max, LOS floors, and room-type spreads.

- Event-aware surge caps that dampen volatility while preserving RevPAR.

- Simulation tools to preview outcomes before rules go live.

Machine Learning and Automated Forecasting

Machine learning analyzes historical and real-time data—bookings, occupancy, competitor rates, events, even weather—to recommend rate changes multiple times per day.

Predictive analytics elevates forecasting accuracy, reduces guesswork, and frees teams to focus on strategy and distribution.

Typical model inputs include:

- Forward occupancy and pickup by segment and room type

- Competitor prices and availability

- Local event and holiday calendars

- Weather and flight capacity trends

- Channel performance and cancellation patterns

Best practice: review automated suggestions against business goals (brand positioning, group wash, owner targets) and refine rules as your market evolves. For small and independent hotels, PriceLabs’ primer on predictive analytics shows how to deploy these capabilities without a large data team.

How to adopt ML step by step:

- Start with one cluster of dates (e.g., weekends next quarter) to compare human vs. ML recommendations.

- Calibrate guardrails, then expand to all room types and channels.

- Track forecast error and pickup improvements to prove ROI.

Example:

- The model detects a spike in searches and competitor sell-outs for a concert weekend 45 days out, recommending a +12% lift now, then +3% every 5 days as pickup accelerates.

How PriceLabs helps:

- Always-on ML models tuned to local demand signals, comp-set changes, and pickup velocity.

- Transparent explanations (“why the price moved”) to build team trust.

- One-click automation to apply suggestions across channels in real time.

Conclusion and Way Forward

Dynamic pricing works best when it’s systematic, data-driven, and automated. Start with demand triggers and booking-window tactics, layer in comp-set monitoring, protect your brand with price rules, and let ML-based forecasting do the heavy lifting. Next step: connect your PMS to PriceLabs, set guardrails, and turn on automation for a pilot set of dates—then expand as pickup and profitability improve.

Frequently Asked Questions

What is dynamic pricing in hotels?

Dynamic pricing adjusts room rates in real time to reflect demand, competitor rates, events, and booking behavior—raising prices when demand is high and softening them during slow periods to enhance revenue and occupancy.

How does occupancy-based pricing enhance room sales?

It increases rates as rooms sell to capture higher margins in strong demand and lowers prices when occupancy is soft to stimulate bookings and utilization.

What role does length-of-stay pricing play in occupancy management?

LOS pricing encourages longer bookings in slow periods with discounts and applies minimum stays during peaks to protect total revenue over key dates.

How do hotels use forecast-based pricing to optimize revenue?

They analyze historical patterns, current pickup, and market indicators to anticipate demand, pushing rates ahead of expected peaks and softening prices early when outlooks weaken.

Why is competitor pricing monitoring important for hotels?

It keeps your rates aligned with the market to maintain conversion during soft periods and to confidently push ADR when competitors fill up, reducing revenue leakage.