Table of Contents

Updated : Feb 16, 2026

Managing a large STR portfolio is a fundamentally different challenge than handling a handful of local listings. As your inventory grows, the manual approach to pricing and operations breaks down, replaced by a need for high-level data theory and systemic workflows.

In a recent episode of the RevLabs series, Preston Smelt, Director of Revenue at Your Pad, shared how he oversees a portfolio of 290+ listings in Charleston, South Carolina. By applying 23 years of hotel experience from brands like Hilton and IHG, Smelt has mastered the art of professionalizing the short-term rental space through rigorous revenue management.

Why Scale Changes the Revenue Game

When you are managing a large STR portfolio, you can no longer afford to be a “button-pusher.” In smaller operations, you might react to a single booking. At scale, you must anticipate market shifts before they happen.

- Theory Over Automation: Systems are reactive. A professional manager uses the software to execute a strategy, not to define it.

- Winning in the Margins: With hundreds of units, a 2% increase in ADR (Average Daily Rate) across the portfolio results in massive revenue gains that smaller operators simply can’t capture.

- Avoiding Self-Cannibalization: A major risk in managing revenue for a large STR portfolio is competing with yourself. If you have 30 four-bedroom homes in one neighborhood, your pricing strategy must be cohesive to ensure every unit hits its target occupancy.

Get the Data-Driven Edge

Want to see the specific pacing and median booked price for your city during the 2026 World Cup? Use PriceLabs Market Dashboards to spot compression before your competitors do.

Start Your Free Trial NowHow to Effectively Manage Large Vacation Rental Portfolio Workflows

To successfully manage large vacation rental portfolio operations, you must move away from ad-hoc adjustments and toward a “thematic” weekly schedule. This ensures that no single property is neglected while you focus on the big picture.

The Weekly Revenue Roadmap

- Monday: The Weekend Retrospective. Analyze weekend booking volume and market pacing. This is the time for holistic changes based on how the market moved over the last 72 hours.

- Tuesday: New Unit Onboarding. Dedicated time for auditing new listings. Establishing a baseline for new inventory is critical to maintaining portfolio health.

- Wednesday: Key Collection Management. Group your properties into “collections” (e.g., luxury beach houses vs. urban condos). This allows you to apply granular strategies to specific sub-markets.

- Thursday & Friday: The 365-Day Horizon. Shift focus from the immediate 30-day window to the long-range view. Ensure your pricing is competitive for peak dates and holidays a full year in advance.

Leveraging Data to Manage Scale

Managing 300+ listings requires a “Command Center” approach. Smelt utilizes PriceLabs Portfolio Analytics and the Report Builder to manipulate data in ways that traditional Property Management Systems (PMS) cannot.

Efficiency Through Analytics

For those managing a large STR portfolio, the ability to filter and segment data is the ultimate time-saver.

Custom Reporting: Build custom reports in PriceLabs Report Builder that track pacing, RevPAR, and occupancy by bedroom count or neighborhood.

75% Time Savings: By using PriceLabs Portfolio Analytics for booking data analysis rather than a clunky PMS, Smelt estimates he completes his deep-dives in a fraction of the time.

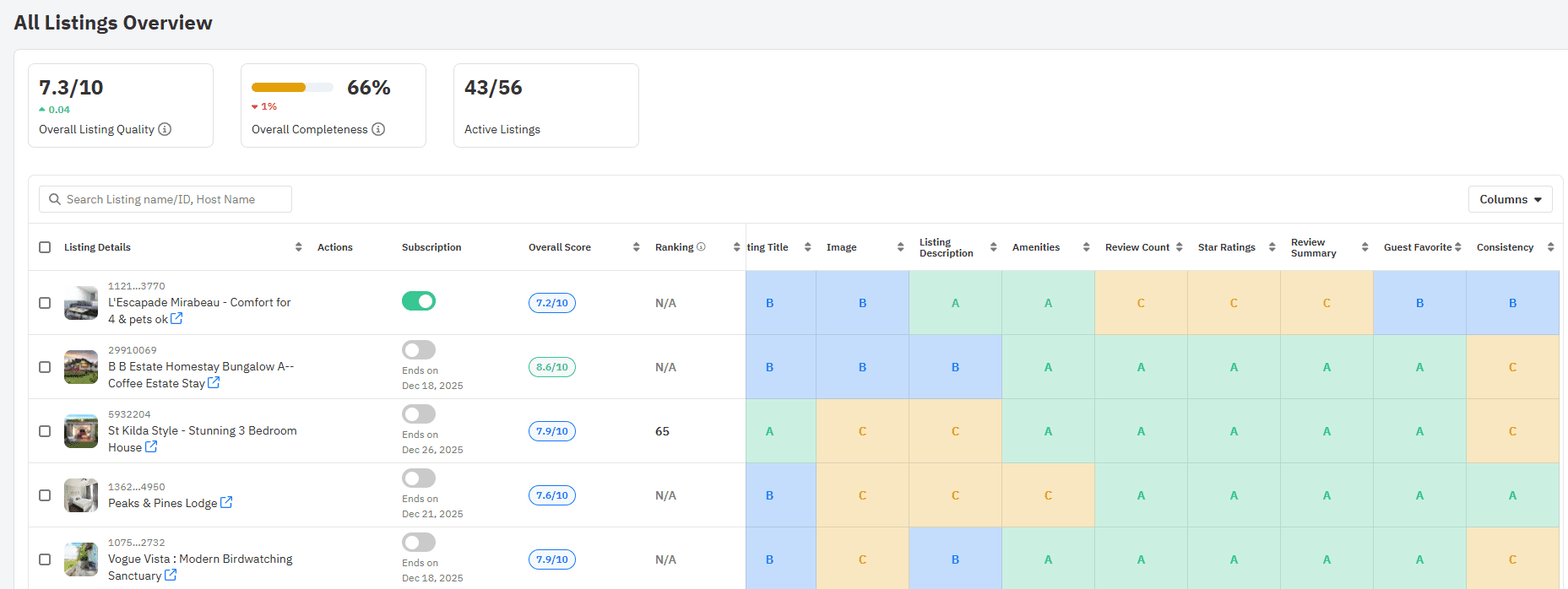

The Listing Optimizer: When managing at scale, some units will inevitably go “stale.” Use the PriceLabs Listing Optimizer to identify health scores and content issues before they impact your bottom line.

The Role of AI in Scaling Operations

As you manage large vacation rental portfolio assets, the “human eye” can’t catch every outlier. This is where AI becomes a force multiplier.

AI tools should be used to find the “needle in the haystack”—the 1% of listings that are underperforming. By automating the identification of these outliers, you can provide “high-touch” service to owners by fixing problems they hadn’t even noticed yet.

The Professionalization of Short-term Rentals

The industry is moving toward a “hotel-fication” model. Professional managers are no longer just “managing houses”; they are building hospitality brands.

- Market Consolidation: Professional operators with sophisticated revenue strategies will continue to displace marginal, part-time hosts.

- Increased Guest Expectations: From professional housekeeping to chef-grade kitchens, the standard for a managed property is rising.

- Net Revenue Focus: Experienced managers are now looking at Net Accommodation Fare—analyzing revenue after channel fees—to understand the true profitability of their distribution strategy.

3 Actionable Takeaways for Large Portfolio Managers

- Transition to a Thematic Calendar: Stop reactive pricing. Assign specific days of the week to focus on different segments of your portfolio to ensure 100% coverage.

- Use Portfolio Analytics for Faster Decisions: Don’t rely on your PMS for revenue data. Use PriceLabs Portfolio Analytics to group, filter, and analyze your inventory 75% faster.

- Audit Listing Health Monthly: Use an automated tool, such as the Listing Optimizer, to catch underperforming listings early. A “stale” listing is often a content or photo issue, not just a price issue.

Frequently Asked Questions

What is the biggest challenge in managing a large STR portfolio?

The primary challenge is fragmentation. Ensuring consistent pricing, listing quality, and guest experience across hundreds of unique units requires robust systems and a structured weekly revenue workflow.

How do I manage a large vacation rental portfolio of owners?

Transparency is key. Using advanced reporting tools to show owners how their property is pacing against the market—and being proactive about “listing health”—builds the trust necessary to retain clients at scale.

Does dynamic pricing work for large portfolios?

Yes, but it requires human oversight. Algorithms are excellent at handling the volume of daily changes, but a revenue manager must set the strategic guardrails based on market knowledge and portfolio goals.