Table of Contents

Updated : Feb 21, 2026

As a professional property manager handling 100+ listings, you are no longer just an operator—you are a wealth manager. Your owners trust you to steward their real estate investments, and in a market where 98% of operators have lost revenue to rate misuse, your strategy must be flawless. You can’t afford to make revenue management mistakes that will cost your owner trust and their wealth.

However, scaling a portfolio brings a unique set of challenges. What worked for five listings will break at one hundred. In a recent strategy session, Joaquin Lozada, a solutions expert at PriceLabs, highlighted the most critical revenue management mistakes to avoid if you want to protect your margins and outperform the market in 2026.

1. Falling into the “Customization Trap”

The most common mistake large-scale managers make is over-complicating their pricing logic. When you manage a massive inventory, it is tempting to create hyper-specific rules for every scenario.

- The Error: Applying dozens of overlapping “Last Minute,” “Far Out,” and “Orphan Day” discounts without realizing they are cannibalizing each other.

- The Consequence: You end up with “rule overlap” where conflicting settings override one another, leading to pricing that doesn’t actually reflect real-time market demand.

- The Fix: Adopt a minimalist approach. Start with fewer customizations and only add layers as the data proves they are necessary.

Default Title

As a wealth manager for your owners, you can’t afford to let overlapping rules and static pricing erode your margins. Join the world’s most successful property managers who use PriceLabs to transition from reactive management to data-driven strategy.

Start Your Free 30-Day Trial2. Neglecting the “Base Price” Foundation

Your Base Price is the heartbeat of your dynamic pricing strategy. A common error is setting this number once and “forgetting it.”

- The Error: Underestimating the impact of listing health on your base price. New listings without reviews cannot command the same base price as a 5-star veteran property.

- The Consequence: Setting a base price too high for a new unit leads to a “booking drought” that kills your momentum on OTAs.

- The Fix: For new or underperforming properties, start with a lower base price to gain initial scores and reviews. As your listing’s “pricing power” grows, incrementally increase the base price.

3. Ignoring “Pacing” Data Against the Market

Many managers focus solely on their own occupancy, but high occupancy is a “vanity metric” if your rates are too low.

- The Error: Only looking at your internal year-over-year data rather than benchmarking against the current market.

- The Consequence: You might feel successful because you are 80% booked, but if the market is at 90% and your ADR is 20% lower than your competitors, you are leaving thousands on the table.

- The Fix: Use Portfolio Analytics to monitor your “pacing”. If you are booking faster than the market, your prices are likely too low. If you are lagging, you may need to adjust your minimum stay or base price.

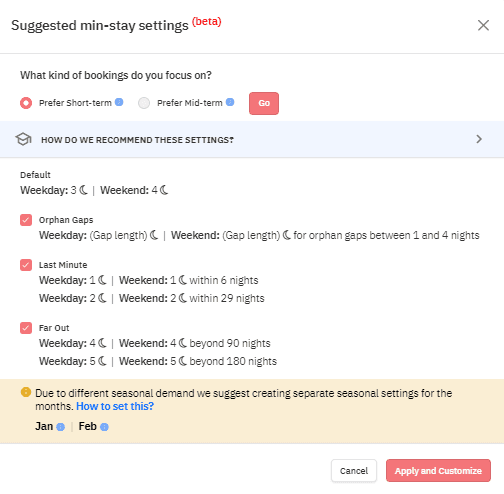

4. Setting Static Minimum Stays for Peak Periods

In 2026, the “set it and forget it” model of stay restrictions is dead.

- The Error: Keeping a flat 2-night minimum year-round, even during high-demand local events or holidays.

- The Consequence: A guest might book a 2-day stay in the middle of a 7-day festival, creating “orphaned gaps” that are impossible to fill at a premium.

- The Fix: Use a Minimum Stay Recommendation Engine to automate restrictions based on booking windows. This allows you to capture longer stays far in advance and open up shorter stays only as the dates approach.

How PriceLabs Solves the “Large Portfolio” Problem

Managing 100+ units requires tools that provide macro visibility without sacrificing granular control.

Use Portfolio Analytics to Stop the Guesswork

When you manage over 100 units, a 5% drop in portfolio-wide occupancy might seem small, but it could be driven by 10 specific properties that are completely flatlined. Portfolio Analytics allows you to move from reactive management to exception-based management.

- Inventory Performance Heatmaps: Instead of clicking into individual listings, a heatmap shows you which neighborhoods or property types (e.g., all 3-bedroom villas) are underperforming so you can apply bulk adjustments instantly.

- Pacing Reports: These show you how many room nights you have booked today versus the same time last year. If your “Booking Curve” is too steep, you’re booking too fast (and leaving money on the table). If it’s too flat, you’re overpriced.

Market Dashboards for Owner Reporting

Owners of high-value assets are often highly analytical. If their revenue is down, they want to know why. PriceLabs Market Dashboard provides external context that demonstrates your strategy is sound.

- Understanding Future Occupancy vs. Competitor ADR: This specific chart is the “smoking gun” for revenue management. It plots two critical data points on a forward-looking timeline:

- Competitor ADR (The Price): What your direct competitors are charging for those same dates.

- Market Occupancy (The Demand): How many units in your area are already booked for future dates (e.g., a festival three months away).

Final Thoughts: The Wealth Manager Mindset

To succeed at scale, you must move from being a tactical executor to a strategic leader. Avoiding these revenue management mistakes isn’t just about making more money this month; it’s about ensuring the long-term sustainability of your business and your owners’ assets.

Frequently Asked Questions

1. What is the biggest mistake in setting up pricing software for large accounts?

The most common mistake is applying too many conflicting customizations without understanding how they override one another.

2. How do I know if my base price is positioned correctly?

Monitor your pacing data. If you are booking significantly faster than your competitive set (Comp Set), your base price is likely too low.

3. Why is RevPAR more important than Occupancy for large portfolios?

Occupancy only tells you how many rooms are occupied; RevPAR tells you whether you are actually making a profit after accounting for the operational costs of each stay.