Table of Contents

Updated : Dec 9, 2025

Revenue management is far more than just adjusting a nightly rate. For property managers handling large Short-Term Rental (STR) portfolios (over 100 listings), the success of their STR portfolio management hinges on aligning the team, technology, and global perspective. It’s about building a revenue culture that drives adoption and consistent results.

In a recent episode of the RevLabs podcast, Joana Pires Coelho, a Solutions Consultant at PriceLabs, shared insights from her decade-plus career in revenue management, spanning from international hotel chains to STR consultancy. Here are the key takeaways—the strategic and cultural lessons every portfolio manager needs to implement today.

4 Strategic Lessons for Large Portfolio Managers

1. Revenue Management is a Culture, Not Just a Tool

One of the biggest challenges in vacation rental revenue management isn’t figuring out the right price; it’s getting the entire team to adopt a revenue-first mindset.

When implementing a new strategy or a dynamic pricing tool, driving cultural alignment is essential. Joana’s experience, particularly with rebrandings, showed that the country or culture doesn’t define success; it’s the people you work with who do. If staff are still focused on “old school” pricing, implementing new data-driven strategies becomes an unnecessary challenge.

- Key Strategy: Ensure training and communication programs emphasise that every department contributes to the final RevPAR and guest experience, thereby fostering a revenue culture.

Your Revenue Strategy Needs the Right Tools

Join thousands of STR managers using PriceLabs to outperform their markets with smart automation and pricing intelligence.

Start Your Free Trial Now2. The Trap of Procedural Bottlenecks

Moving from large corporate structures to a more agile consultancy highlighted a critical pain point: the need for speed and autonomy.

In large structures, seeking multiple approvals often meant that revenue management strategies were implemented too late. If a manager recognizes a sudden shift in demand, they need to act instantly.

- The Problem: Approvals get lost, discussions delay action, and the window of opportunity to capitalize on demand closes.

- The Solution for STRs: Implement a structure that gives the revenue team the freedom to make tactical pricing and inventory decisions quickly. Tools like PriceLabs Dynamic pricing software, by its nature, provide this autonomy, reducing reliance on slow, manual approvals.

3. Escape the ‘Set-It-and-Forget-It’ Mentality

A common, and costly mistake made by managers of large portfolios is believing that a Revenue Management System (RMS) is a “click-and-forget” solution.

While PriceLabs automates the complex pricing work, it does not eliminate the need for strategic oversight. Property management automation is the start, not the end.

- The Mistake: Relying solely on the initial setup without monitoring trends, occupancy rates, or minimum stay settings.

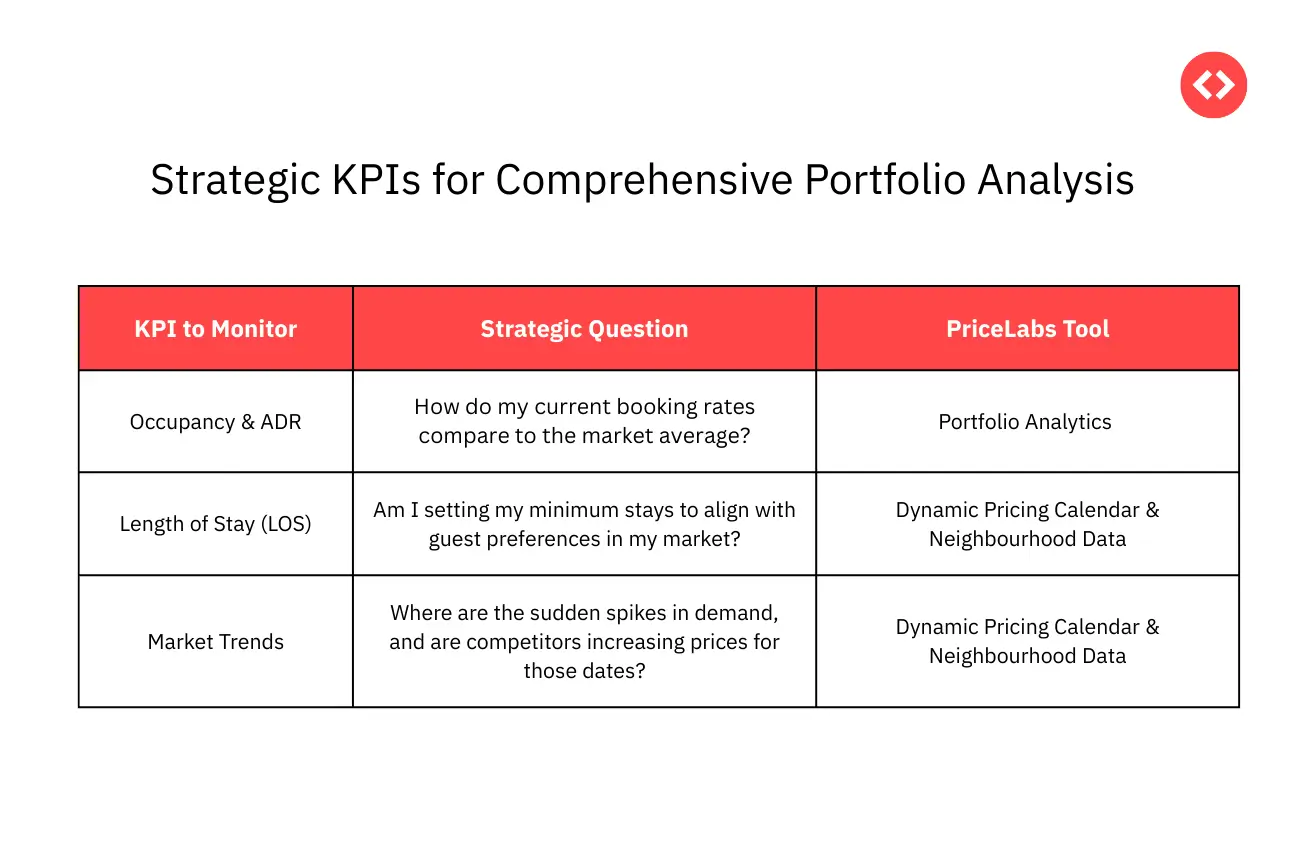

- The Correct Approach: Managers must constantly monitor their property management KPIs and allow the data to “speak” to them. Use the data to inform strategic actions beyond daily pricing, such as optimising marketing spend or adjusting minimum-stay requirements.

4. Maximizing Value Beyond Daily Pricing

The most significant value of a robust RMS lies in its ability to provide comprehensive reporting and trend analysis. For a large portfolio, merely seeing a price change is not enough; one must understand the why and the impact.

The most effective revenue managers leverage the entire feature set, not just the base price automation.

The PriceLabs Connection: Data-Driven Oversight

As a property manager, you need to ensure you are getting the most out of your revenue management system by moving past the first setup and dedicating time to ongoing analysis. PriceLabs provides market insights and demand forecasts for the vacation rental industry.

Utilizing PriceLabs Market Dashboards for Strategic Decisions

The PriceLabs Market Dashboards are the dedicated resource for understanding the “story” behind your numbers. They provide the data points to answer the complex questions that differentiate market leaders from the rest:

- Benchmarking Performance: Compare your property’s key metrics—Estimated Revenue, Average RevPAR, and Average Occupancy—with the market average to quickly identify whether a slowdown is isolated to your properties or a broader trend.

- Tracking Booking Behaviour: Analyse charts that map the Length of Stay (LOS) versus the Booking Window. This helps determine whether your current pricing strategy, particularly for far-out dates, is limiting potential longer stays.

- Identifying Amenity Demand: The amenity charts help you invest smartly. You can see which amenities have a high percentage of associated bookings but may be underrepresented in your local area, thus identifying your competitive advantage for property upgrades.

By regularly leveraging these market insights, you are transforming yourself from a price setter into a strategic revenue manager.

Bottom Line

Managing a large portfolio requires constant adaptation to market changes. Whether dealing with dynamic international markets or the intricacies of local demand, the core lesson remains: Revenue management is a culture. You must equip your team with data-driven solutions and the strategic autonomy to track and improve your performance. Technology like PriceLabs exists to streamline your business and eliminate pricing guesswork, allowing you to focus on the strategic oversight that drives profit and growth.

Frequently Asked Questions (FAQs)

What is the single biggest mistake property managers make with large portfolios?

The biggest mistake is the “set-it-and-forget-it” mentality. While dynamic pricing automates daily rates, property managers must still actively monitor their Key Performance Indicators (KPIs), analyse trends in the PriceLabs Market Dashboards, and strategically adjust non-pricing elements, such as Length of Stay restrictions and minimum prices.

What is “Revenue Culture” and why is it important?

Revenue Culture means that everyone in the organization—from front-line staff to management—understands that their role impacts the property’s financial performance. It is crucial because it ensures that pricing strategies and inventory decisions are understood and supported across the entire company, preventing internal resistance and procedural bottlenecks.

Where can I find the best information to adjust my pricing?

The best information comes directly from your market data. You should use tools like PriceLabs to analyse competitor rates and future occupancy trends in your local area. Specifically, PriceLabs Neighbourhood Data and the Market Dashboards provide granular, real-time insights for competitive analysis.

How does a property manager gain the freedom to act quickly on pricing?

This can be achieved by adopting a dynamic pricing tool like PriceLabs. The tool uses algorithms to analyse market demand, competitor pricing, and booking trends, automatically adjusting your nightly rates, giving you the autonomy to respond to market shifts without needing constant manual approval for every rate change.