Table of Contents

Updated : Sep 9, 2025

Summer months remain the crown jewels of Spain’s short-term rental (STR) calendar, delivering the highest occupancy rates, premium pricing, and unmatched revenue potential.

But in 2025, Spanish short-term rental market data suggest something else. Property managers face a new reality — growing competition, tightening short-term rental regulations, and shifting guest behavior are changing the game.

Armed with the latest Spain short-term rental market data from PriceLabs, along with local context, community insights, and cultural references, this guide shows you how to navigate these changes and turn August and September into your most profitable months.

Spanish Short-term Rental Market Data 2025

Europe’s STR market hit a record 854 million guest nights in 2024, up 19% from 2023. Spain contributed significantly with 171 million guest nights, ranking second in Europe. Andalucía, for instance, emerged as Europe’s leading region for guest nights, recording 44 million in 2024, surpassing even Croatia. Cataluña also remains a strong performer, with 29 million guest nights.

For summer 2025, international tourist arrivals in Spain were forecasted to rise by 2.7%, with spending up 4.2%. Domestic travel was also projected to increase by 1.0%, with spending up 1.1%. Despite this broad tourism growth, STR occupancy is softening.

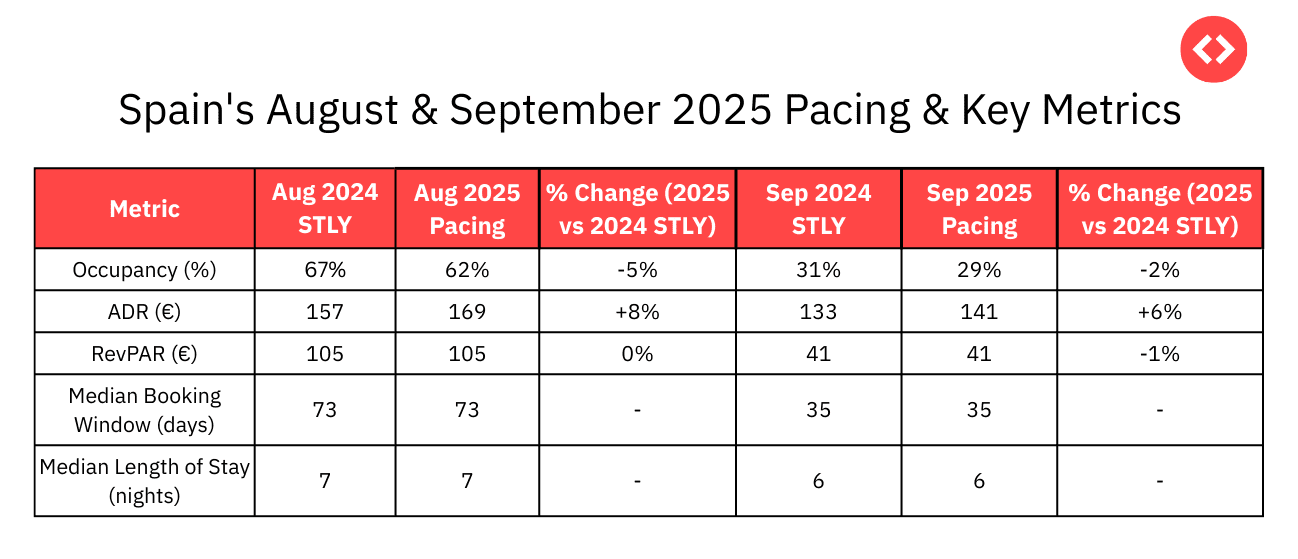

PriceLabs Data: Spain’s August & September 2025 Pacing & Key Metrics

According to PriceLabs STR data, August 2025 occupancy is pacing 62%, down 5% from last year, while ADR is up 8% (€169). Revenue per available rental (RevPAR) is flat or slightly declining due to weakening occupancy. A stable median length of stay of around 6–7 nights indicates consistent traveler behavior in terms of stay duration.

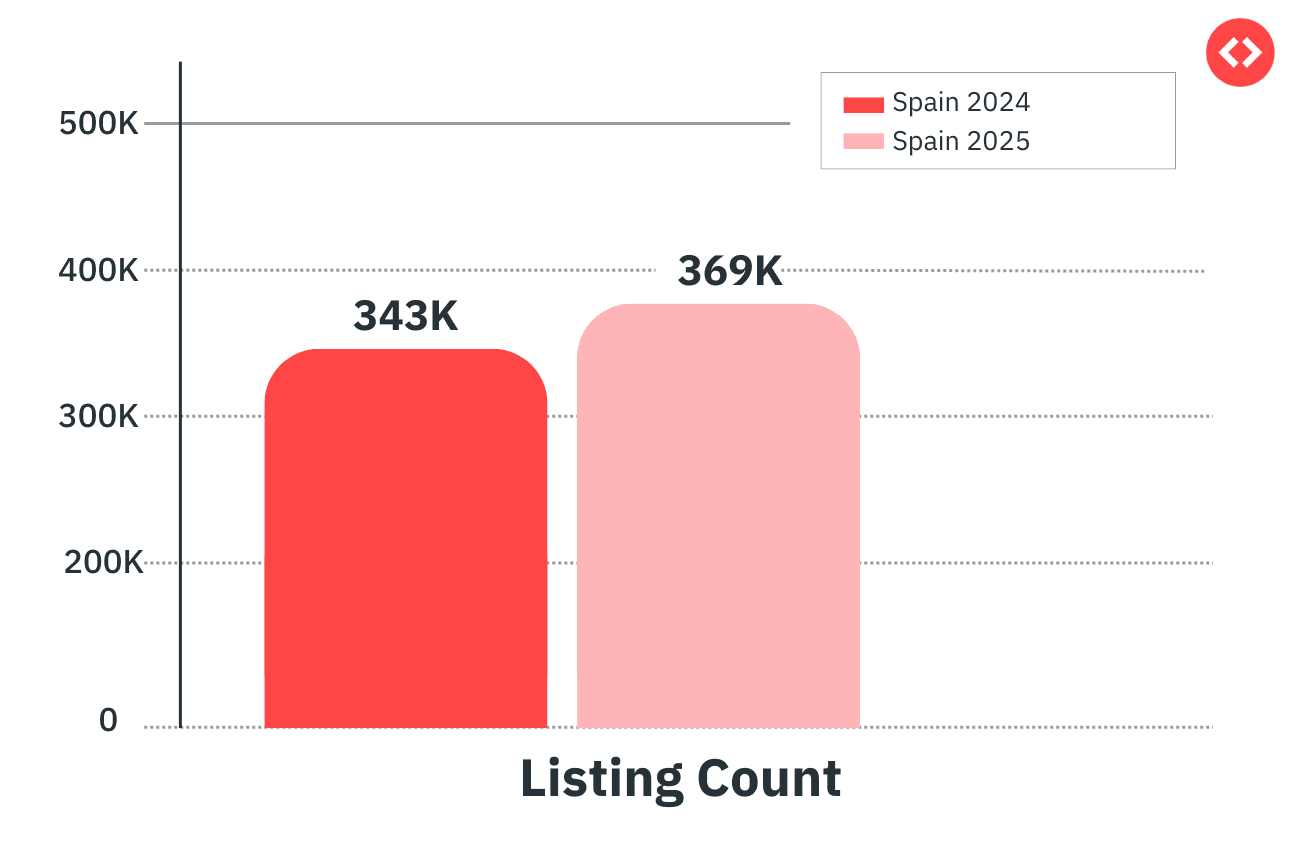

The total number of active STR listings in Spain has surged 8.7% (from 343,049 to 368,893 listings) over the past 12 months, heightening competition among Spanish vacation rentals and putting pressure on occupancy levels.

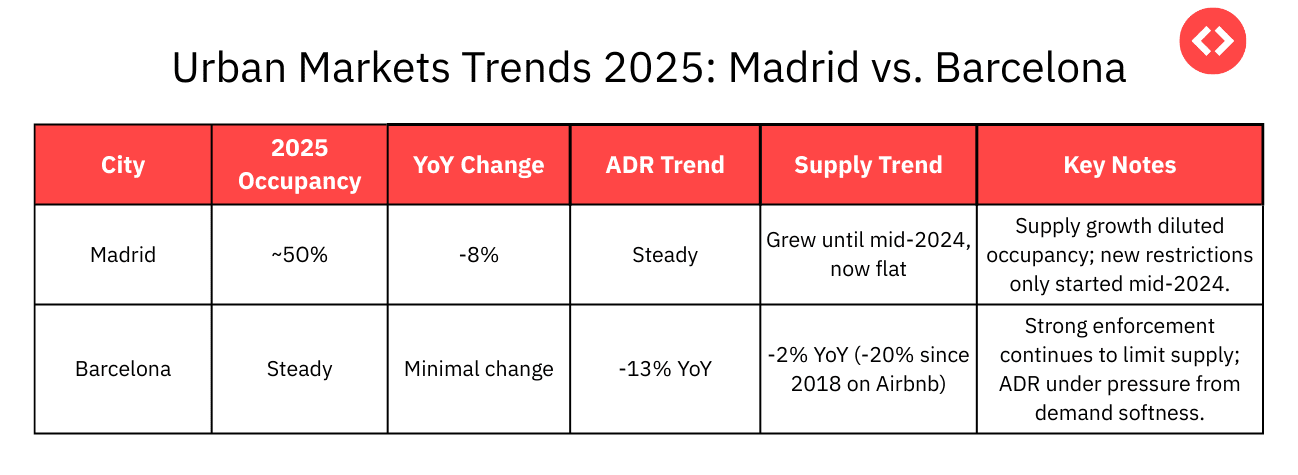

PriceLabs’ city-level data reveals stark differences between Spain’s two biggest urban STR markets:

Madrid: Occupancy has slipped sharply as an expanded listing base outpaced demand. The tightening regulations of 2024–2025 are only beginning to affect supply, so further drops are possible.

Barcelona: Longstanding restrictions have stabilized supply, but ADR has dropped 13% YoY, hinting at weaker demand or a shift toward lower-priced inventory.

Unlock Market Insights with PriceLabs Market Dashboards

Want to stay ahead of the competition? With PriceLabs Market Dashboards, you can track local demand patterns, benchmark against competitors, and spot booking trends before anyone else. From occupancy rates to ADR shifts, get the data you need to set the right pricing strategy and maximize revenue.

Explore PriceLabs Market DashboardsUnderlying Factors Influencing the Spanish Short-term Rental Market

The performance of Spain’s short-term rental (STR) market is shaped by a complex mix of economic conditions, traveler behavior, seasonal trends, and evolving regulations. Understanding these underlying factors is key for property managers and hosts to anticipate market shifts and adapt their airbnb pricing strategy, vacation rental marketing, and operational strategies accordingly.

1. Tourism Growth vs. STR Supply Pressure

- Data link: Despite 2025 being set for record tourism, occupancy pacing for Aug–Sep 2025 is -5% to -2% below STLY.

- Why: Active listings are up 8% YoY, meaning supply growth is outpacing demand in certain regions (e.g., Madrid).

- Implication: Even though ADR is up 6–8% YoY, RevPAR is flat to down (-1% on average) because fewer nights are being sold. This is a textbook case of revenue pressure from oversupply.

2. Stricter Regulations & Policy Changes

- Data link: Cities like Barcelona already cut STR listings by ~2% YoY, but national registry requirements (Ventanilla Única Digital de Arrendamientos) could lead to more removals, particularly of non-compliant units. The regulations require all landlords offering holiday homes or seasonal lets to register their properties, marking a pivotal shift towards centralized control and data-driven enforcement.

- Why it matters now: The Spanish government’s removal orders for 65,000 unlicensed listings, predominantly in Madrid and Barcelona, align with these challenges, reflecting heightening regulation aimed at easing the housing crisis. In oversupplied markets, regulatory enforcement could help compliant STRs by reducing illegal competition and boosting occupancy. The current dip in occupancy due to slower pacing means any supply reduction could materially improve RevPAR.

One Reddit post noted:

“There’s a glut of Airbnbs… property prices are up and you’re now restricted to owning just 2 STRs unless you open a company. The mood is mixed: great for some regions, but city center rules are getting tighter.”

Read More: Short-term Rental Laws in Italy

To help property managers and hosts navigate Spain’s new Single Rental Registry requirement, AvaiBook by idealista (integrated with PriceLabs) has created a Single Lease Registry Guide. It explains the application process, exceptions, and requirements, and provides direct links to complete your registration. Whether you manage one property or an entire portfolio, this guide makes compliance straightforward and helps you continue operating legally on major rental platforms.

3. STR & Long-Term Rentals: A Connected Market

- Data link: In markets where occupancy dips and RevPAR is stagnant, some owners may shift to long-term rentals, reducing STR supply — but also tightening local housing availability.

- Example: If August’s occupancy stays at 62% (down from 67%) despite record tourism, owners may look for stability elsewhere.

- Market ripple: Such shifts could prompt further regulation, as policy-makers track how STR availability impacts rent prices. Amidst local residents expressing anger over STR’s impact on housing and neighborhood quality, it has become even more important to practice responsible hosting as emphasized by this Reddit user.

“Managing guest expectations and keeping neighbors happy is important—city councils are getting tougher every month about noise and permits.”

Read More: Italy Booking Behavior: A Post-2020 Guide for Property Managers

How can Spanish Short-term Rental Property Managers Thrive?

In this increasingly competitive and regulated environment, Spanish hosts must adopt sophisticated, data-driven strategies to maximize their August profitability.

1. Master Dynamic Pricing

Use PriceLabs and similar dynamic pricing tools to adjust nightly rates in real time based on demand, local events, and competitor moves. Static pricing means a loss of revenue in this shifting market. The market’s willingness to pay higher rates during peak season is evident; for instance, ADR in Andalucía consistently peaks in August, reaching €190 in 2023. This approach means optimizing for the highest possible RevPAR, balancing higher per-night rates with occupancy to maximize overall revenue per available unit.

Boost Your Bookings with Dynamic Pricing in Spain

Spain’s short-term rental market is shifting fast—don’t leave money on the table. With PriceLabs Dynamic Pricing, you can automatically adjust rates to match demand, seasonality, and local events. Stay competitive, fill more nights, and maximize your revenue with ease.

Sign Up For Free trial2. Optimize Early for August Bookings

With booking windows averaging 73 days, property managers must prepare listings well in advance—refresh photos, update listings for SEO and AEO (Answer Engine Optimization), and leverage geo-targeted keywords like “family rentals in Andalucía August” or “beachfront apartment Barcelona.” Analyze your listing data to understand what has worked for you before. In an AI-first digital landscape, original data and first-party insights are golden tickets. Property managers can differentiate by creating unique content, such as curated local guides, which are prioritized by AI search algorithms and appear on Google searches. Proactively engage past guests with newsletters or personalized emails, offering incentives for repeat bookings.

3. Enhance Guest Experience

Exceptional guest services drive 5-star reviews, repeat bookings, and referrals. Stand out by offering:

- Streamlined Check-in & Communication: Use smart locks for self-check-in and send clear, advanced instructions. Be responsive to inquiries throughout the stay.

- Thoughtful Amenities & Personalization: Provide high-quality linens, a stocked kitchen, and small extras like welcome snacks or local toiletries. Tailor touches to guest type.

- Local Recommendations: Offer curated lists of local eateries and attractions for an authentic experience, positioning yourself as a local expert.

- Prioritize Cleanliness & Collect Reviews: A spotless property is essential for every stay. Optimize your vacation rental cleaning process to ensure your guests don’t walk into a dirty property. Additionally, actively request feedback and showcase positive reviews to build credibility.

4. Automate Operations & Manage Costs

Operational automation and cost optimization are fundamental for scalability and protecting profit margins.

- Automation: Use Property Management Systems (PMS) to automate property management tasks like centralizing communications, managing channels, automating cleaning schedules, and preventing double bookings. A well-designed booking engine integrated with a PMS can also significantly increase direct bookings, boosting profit margins by eliminating third-party commissions.

- Energy Efficiency: Invest in smart appliances and thermostats to reduce utility costs. Systematize appliance management routines for diagnostics and preventive maintenance, potentially saving 50% or more on energy costs. These investments allow hosts to maintain competitive pricing without sacrificing profit margins.

Read More: Off-Season Upgrades and Maintenance for Dubai Vacation Rentals

5. Engage Responsibly with Community & Regulations

Stay compliant with new registration laws, such as Spain’s “Ventanilla Única Digital de Arrendamientos”. Actively communicate with neighbors and guests about noise and waste policies to maintain goodwill amid regulatory scrutiny. Responsible property management mitigates risks, reduces complaints, and protects the host’s “social license to operate,” making their business more resilient against future regulatory changes or social backlash.

Your Path to a Successful Autumn in Spain

August and September are prime opportunities for Spanish STR property managers. Success requires smart, data-driven strategies and adapting to evolving conditions. While Spain’s overall tourism is robust, urban centers like Madrid and Barcelona face localized challenges from supply saturation and regulations.

To thrive, property managers must:

- Leverage dynamic pricing to capture August’s peak demand and optimize revenue. Current data indicates a higher ADR, but lagging occupancy, making dynamic adjustments vital for RevPAR.

- Optimize listings for guests and AI with professional visuals, compelling descriptions, and strategic SEO, AEO, and LLM optimization for maximum visibility.

- Prioritize exceptional guest experiences via streamlined check-ins, thoughtful amenities, local recommendations, and impeccable cleanliness. This builds loyalty and differentiates properties.

- Embrace automation and energy efficiency for streamlined operations and cost savings. PMS and smart home tech reduce errors, save time, and protect profit margins.

- Stay informed on regulations and foster positive community relations. Addressing public sentiment on housing and overtourism is crucial for long-term sustainability, especially with increased listings.

Spain’s STR market is vibrant yet complex. By implementing these strategies, adapting to nuances, and committing to responsible property management, Spanish property managers can maximize the August surge and build resilient, profitable businesses.

Frequently Asked Questions

1. What is the high season for short-term rentals in Spain in 2025?

In Spain, the high season for short-term rentals is during July and August, with August being the peak month. These months record the highest occupancy rates and rental prices, especially in popular destinations like Barcelona, Madrid, Valencia, and coastal cities such as Málaga and Alicante.

2. How is the short-term rental market in Spain performing in 2025?

The Spanish short-term rental market in 2025 shows strong demand during summer, with high occupancy in August. However, data also reveal shifting booking patterns, longer lead times, and growing mid-term rental demand, especially in urban centers. Property managers are advised to adapt pricing and marketing strategies to capture revenue across both peak and shoulder seasons.

3. Which cities in Spain have the strongest demand for short-term rentals?

Top-performing cities for short-term rentals in Spain include Barcelona, Madrid, Valencia, Málaga, Alicante, and Seville. Coastal regions and island destinations such as Ibiza and Mallorca also experience strong demand during summer, while major cities maintain steady occupancy throughout the year.

4. What are the average occupancy rates for Spanish short-term rentals?

In 2025, Spanish short-term rentals show average occupancy rates of 60–70% annually, with coastal and tourist-heavy cities peaking at over 80% in August. Seasonal variations are significant, so dynamic pricing is key to maximizing returns.

5. How can property managers in Spain maximize revenue from short-term rentals?

Property managers in Spain can maximize revenue by using dynamic pricing tools like PriceLabs, monitoring local market trends, adjusting minimum stays, and targeting both leisure and mid-term rental guests. Leveraging market dashboards helps identify demand shifts and set competitive pricing.