Table of Contents

Updated : Aug 7, 2025

Vacation rental insurance offers essential protection that many property managers ignore – until disaster strikes. In this guide, you’ll learn exactly what this insurance is, what it covers, and why specialist coverage matters. We’ll also include top insurance providers in the short-term rental space and real-world examples about going without insurance.

What Is Vacation Rental Insurance for Property Managers?

Vacation rental insurance is a specialized insurance policy tailored to properties rented on a short-term basis on platforms such as Airbnb, Vrbo, and Booking.com or via direct bookings. It’s designed to cover what’s left out by homeowners’ insurance and landlord insurance. It works as a combination of real estate insurance and commercial insurance.

Alternatives to Short-Term Rental Insurance for Property Managers

Airbnb managers face two options other than getting this specialist insurance:

- Airbnb AirCover: The vacation rental website offers Airbnb AirCover included with all bookings, free of charge. While it protects against a number of risks, its coverage isn’t all-inclusive. For instance, it doesn’t pay for damage resulting from natural disasters or anything not caused by a guest.

- Self-Insurance: STR managers can collect a small fee from guests that goes towards an insurance fund. This can amount to a significant amount of money, sufficing to cover small damages. However, you cannot save up enough to pay for major destruction with self-insuring.

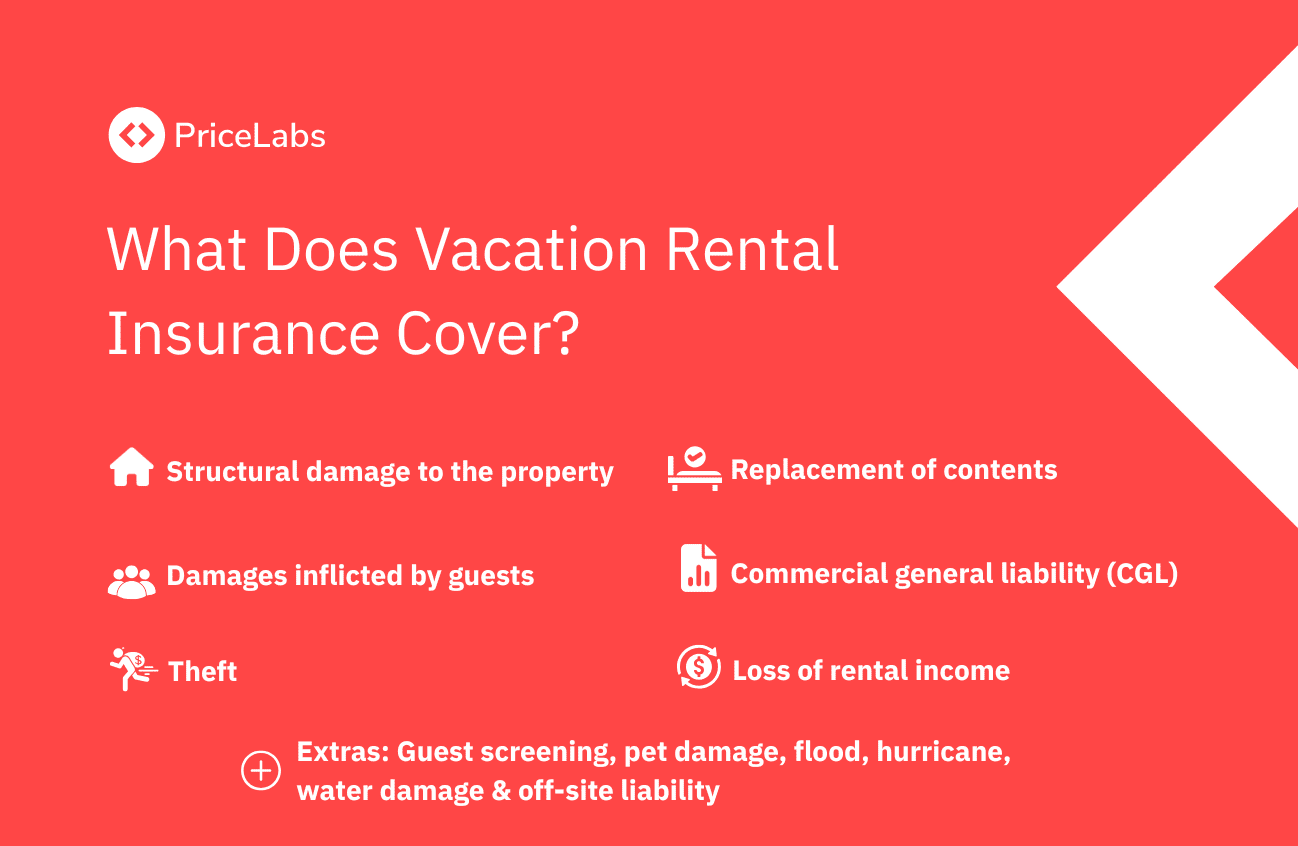

Vacation Rental Insurance Coverage: What’s Included?

Standard homeowner insurance typically doesn’t cover the unique risks associated with vacation rentals. That’s why vacation rental property managers need specialized insurance policies designed for short-term stays, multiple guests, and commercial operations. These policies offer broader protection to help you stay financially secure when things go wrong.

Here’s a breakdown of what vacation rental insurance usually includes:

- Property Structural Damage: Guest-caused, fire, and vandalism

- Property Contents Replacement: Furniture, electronics, and linen

- Guest-Caused Damages

- Theft

- Commercial General Liability: For guest injuries, Airbnb property management staff injuries, and lawsuits; typically $1 million+

- Loss of Rental Income/Business Disruption Coverage: In case the property becomes temporarily uninhabitable

- Optional Extra Coverages: Pet damage, flood, hurricane, water damage, and off-site liability

- Guest Screening: Specialized vacation rental insurance companies offer complimentary guest screening.

Why Does a Vacation Rental Manager Need Specialist Insurance?

A special short-term rental insurance will typically cover the following circumstances that will help you, as a property manager, to protect your business from unexpected expenses.

1. Protects Against Lawsuits and Liability

Short-term rentals perform business operations. Without commercial liability coverage, you risk having to cover medical expenses and lawsuit costs for injured guests, neighbors, and your team members. Standard homeowners’ policies exclude business use.

2. Covers Guest-Caused Property Damage

Airbnb rentals are prone to issues such as broken windows and appliances, stains on carpets and linen, and various forms of vandalism. If you don’t get property insurance, your property management company will have to pay out of pocket for these extra expenses, thinning your earnings.

3. Offers Income Protection

Sometimes damage is so severe that you have to shut down operations for an extended period. In this case, the loss of income clause will reimburse your bookings.

4. Provides Goodwill and Competitive Edge

Airbnb property owners feel more confident when their vacation rental comes with guest screening and a solid insurance promise. This allows you to generate more property management leads than your competitors.

5. Streamlines Claim Process

Specialized Airbnb insurance providers resolve claims within days, avoiding disputes between you and the owner.

All in all, short-term rental insurance helps you build healthy relationships with property owners, solve issues quickly, and keep your revenue to yourself.

However, getting vacation rental insurance is not enough for the success of your property management business. To maximize earnings and profit, you need to apply dynamic pricing aligned with your market specifications.

Get More Revenue with PriceLabs’ Dynamic Pricing Tool!

Easily launch a smart pricing strategy that optimizes daily rates dynamically to reflect market conditions, seasonality factors, demand shifts & competitors’ prices. Put pricing & revenue management on autopilot for optimal results.

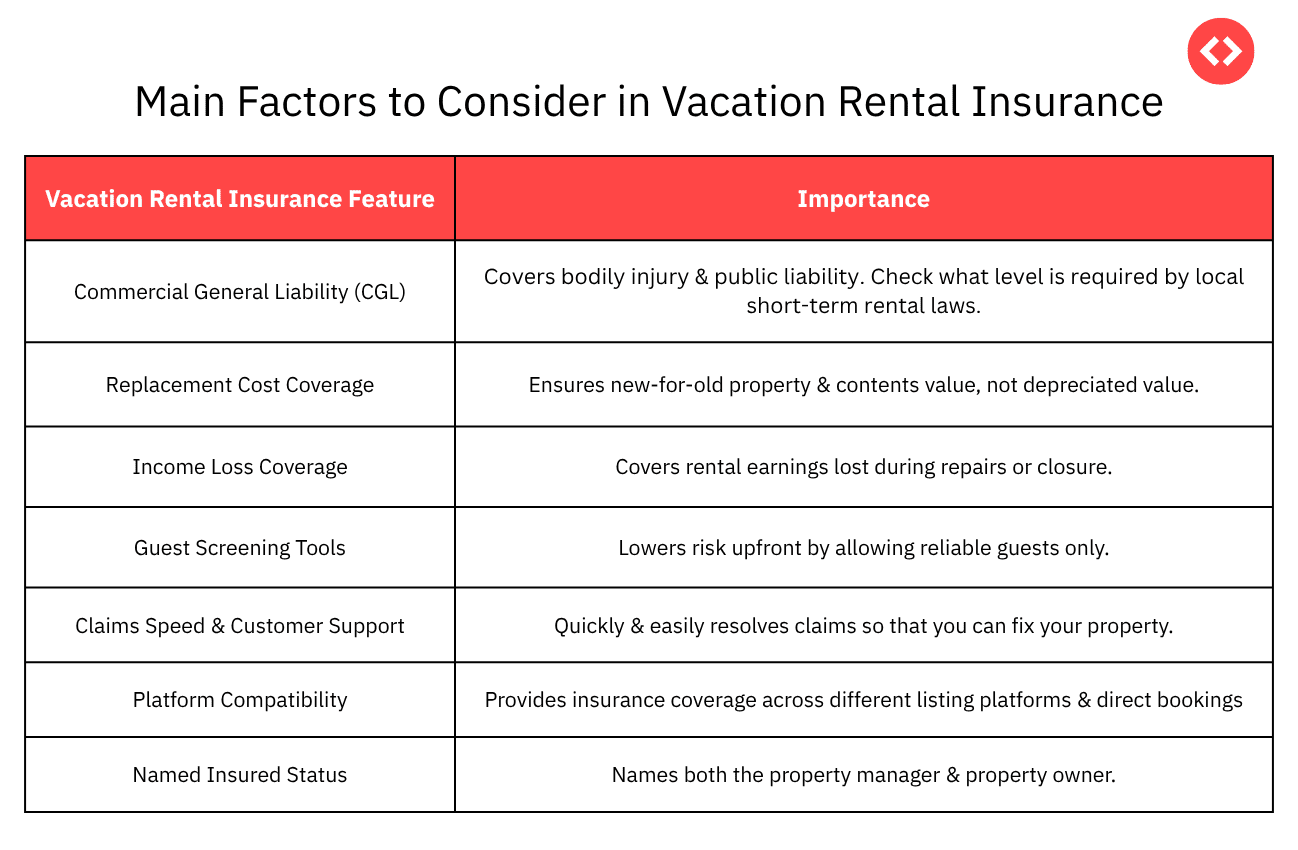

Start Your 30-Day Free Trial NowWhat to Look for in Insurance as a Vacation Rental Property Manager?

When managing a vacation rental, unexpected events—from guest accidents to property damage—can disrupt operations and significantly impact your revenue. That’s why having the right insurance in place is essential. But not all insurance policies are created equal. As a property manager, you need coverage that protects both your business and your homeowners while aligning with your operational needs. Here are the key features to look for when evaluating vacation rental insurance:

3 Best Vacation Rental Insurance Providers for Managers

The top short-term rental insurance companies for professional managers based on coverage, services, and reviews are:

- Structural Damage Coverage: Up to $1 million

- Personal Property Replacement: Up to $10,000

- Liability Insurance Coverage: Up to $1 million

- Built-in guest screening

- Efficient claim process

- Payment of 80% of claims within 4 days

- Coverage for the property manager, owner, and guests

- Flexible price depending on property portfolio size, estimated occupancy, and deductible and coverage limits

- Commercial General Liability: Up to $2 million

- Property Manager Commission Income Protection

- New-for-Old Replacement

- Off-premise liability covering swimming pools, hot tubs, golf carts, and others

- Vrbo’s preferred comprehensive home insurance vendor

- Liability Coverage

- Accidental Damage Protection: Replacement cost value

- Corporate Damage Protection

- Bed Bud Protection

- Protection for the property manager and property owner

- Automated reporting

- Online claims processing

- Electronic invoicing

When choosing the right insurance for your vacation rental management business, consider your portfolio, the specific requirements of each property, your team size, and the most common risks in the area.

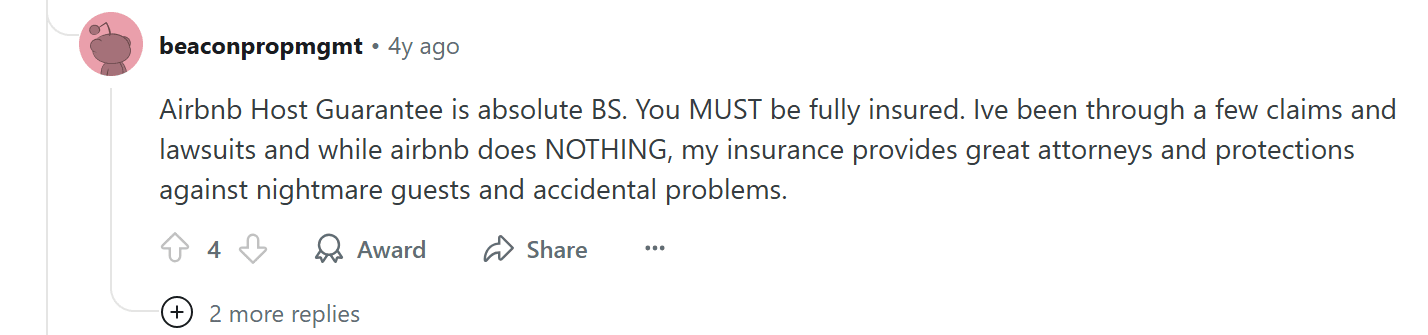

Skipping Vacation Rental Home Insurance: Risks & Real-Life Experiences

If you’re feeling tempted to skip the specialist insurance to save on the cost, check out what experienced vacation rental operators say about the risks of not having proper insurance:

High Costs Incurred by Bad Guests

A Reddit user with significant STR experience explains that Airbnb AirCover alone does not provide enough coverage. Based on their experience with a number of claims and lawsuits, without vacation rental insurance, you have to pay exorbitant property damage costs and attorney fees.

Loss of Rental Income

Another Reddit user highlights the risks of not having full coverage, including costly repairs and lack of revenue in case of bed bugs, for example.

Insufficient Coverage

Yet another experienced Airbnb operator shares on Reddit how not having the right policy is as bad as not having any policy. It’s important to opt for new-for-old replacement, as otherwise the money you get in case of burglary, for instance, might not be enough to buy new items.

Protecting Your Business with Vacation Rental Insurance

As a successful property manager, your job is to minimize risk, protect assets, and maintain trust with owners and guests. That’s why vacation rental insurance isn’t just nice-to-have. It is a must for additional protection that fills the gaps left by homeowners’ insurance, platform programs, and security deposits. From guest injuries to major property damages and lost income, specialist insurance covers the most costly risks in the profession.

To protect your business against suboptimal nightly prices, check out PriceLabs’ Dynamic Pricing & Revenue Management tool!

Frequently Asked Questions

1. Is Vacation Rental Insurance Worth It for Property Managers?

Yes, vacation rental insurance is key to running a well-protected property management business. The extra coverage that it provides is more than enough to offset the premium.

2. What Is the Best Insurance for Short-Term Rentals?

Safely, Proper Insurance, and Rental Guardian offer some of the best options for vacation rental property managers. However, to choose the right fit for your business, you need to consider your properties, your market, the typical risks, and your budget.

3. Why Should an Airbnb Manager Not Self-Insure?

While self-insuring can help cover small property damages, it cannot take care of expensive liability claims, costly medical treatments, lawsuit fees, and major property repairs. Without vacation rental insurance, you can easily go bankrupt in case of any of these occurrences.

4. What Coverage Options Are Not Provided by Airbnb and Vrbo?

Airbnb and Vrbo don’t cover loss of rental income, off-site liability, and named insured manager status. Moreover, they don’t protect direct bookings.