Table of Contents

Updated : Sep 22, 2025

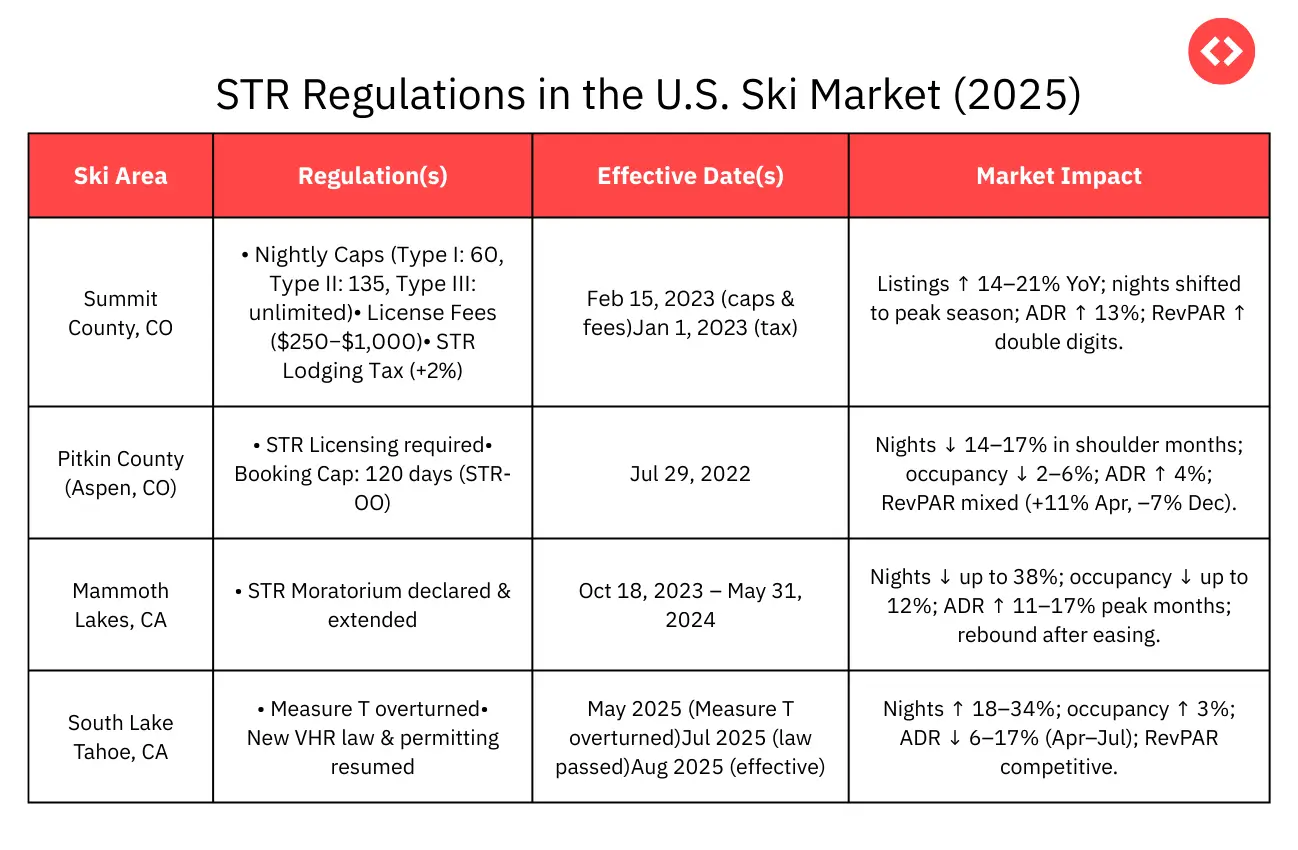

Short-term rental (STR) regulations in U.S. ski towns have always been a balancing act between tourism demand, housing concerns, and community sentiment. As we move through 2025, several ski markets are either tightening or loosening their rules, and property managers are already seeing the effects on performance metrics, such as occupancy, ADR (Average Daily Rate), and RevPAR.

In this guide, we’ll break down what’s happening in the four key ski destinations—Summit County, Pitkin County (Aspen), Mammoth Lakes, and South Lake Tahoe—using the latest data from PriceLabs and regulatory updates. If you manage vacation rentals in these areas, here’s what you need to know to stay compliant and profitable.

STR Regulations in the U.S. Ski Market at a Glance (2025)

Unlock Hidden Market Opportunities with PriceLabs Market Dashboards

Stay ahead of the competition by tracking real-time demand, pricing trends, and occupancy shifts in your market. With Market Dashboards, property managers like you can make smarter decisions, identify revenue opportunities, and confidently navigate changing regulations.

Start Your Free TrialSummit County, Colorado: Managing Within Nightly Caps

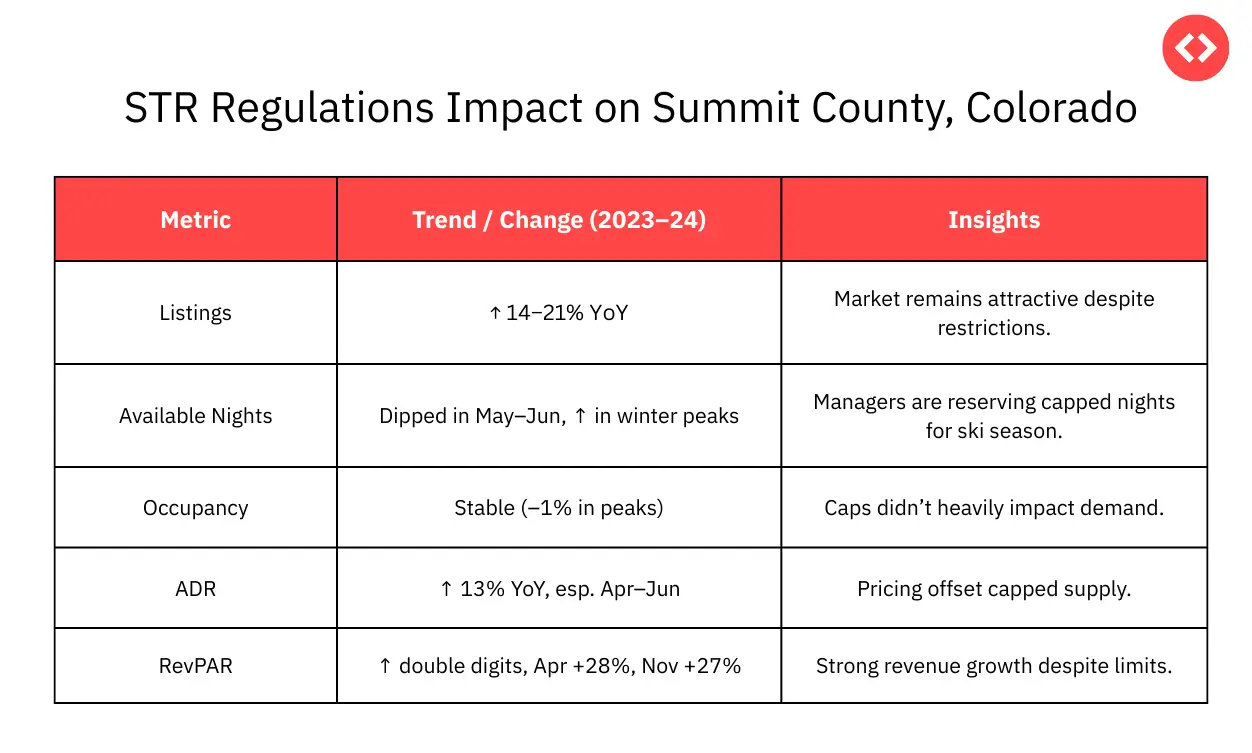

Summit County remains one of the most closely watched U.S. ski rental markets, not only because of its size but also because of how its nightly caps and tax changes are reshaping property manager strategies. The STR regulations in Summit County are reshaping the short-term rental market.

STR Regulation in the U.S. Ski: Market Overview of Summit County, Colorado

- Nightly caps introduced February 15, 2023:

- Type I → capped at 60 nights

- Type II → capped at 135 nights

- Type III → unlimited

- License fees (effective February 15, 2023): range from $250 to $1,000, depending on the number of bedrooms.

- STR-specific lodging tax (effective January 1, 2023): properties must collect and remit an extra 2% lodging tax in addition to standard sales and resort town taxes.

- Hosts must register annually, follow safety/occupancy/parking rules, and designate a responsible local agent.

- Most restrictions apply in neighborhood zones, while resort overlay zones (like Keystone and Copper Mountain) have more flexible rules and are exempt from nightly caps.

- These rules are regularly reviewed, and enforcement is coordinated through licensing, compliance checks, and marketplace (platform) takedown requests for non-compliance.

What Does This Mean for Property Managers?

Supply compression from nightly caps means property managers can no longer rely solely on filling as many nights as possible—they need to be strategic about when and how those nights are utilized.

- Strategic night allocation: Instead of burning through capped nights in slower shoulder seasons, managers should reserve inventory for high-demand periods, such as ski season and holidays, where nightly rates are significantly higher.

- Focus on yield, not just volume: Since the number of available nights is limited, your pricing strategy should be more focused on maximizing Average Daily Rate (ADR) than simply achieving high occupancy. Capturing premium rates during peak periods can offset the loss of nights in low demand.

- Leverage revenue management tools: Platforms like PriceLabs Dynamic Pricing help managers pace their bookings, forecast demand trends, and adjust prices dynamically. This ensures they don’t underprice premium dates or waste nights too early in the booking window.

By shifting from a volume-driven approach to a yield-driven one, property managers can stay profitable even under stricter STR regulations.

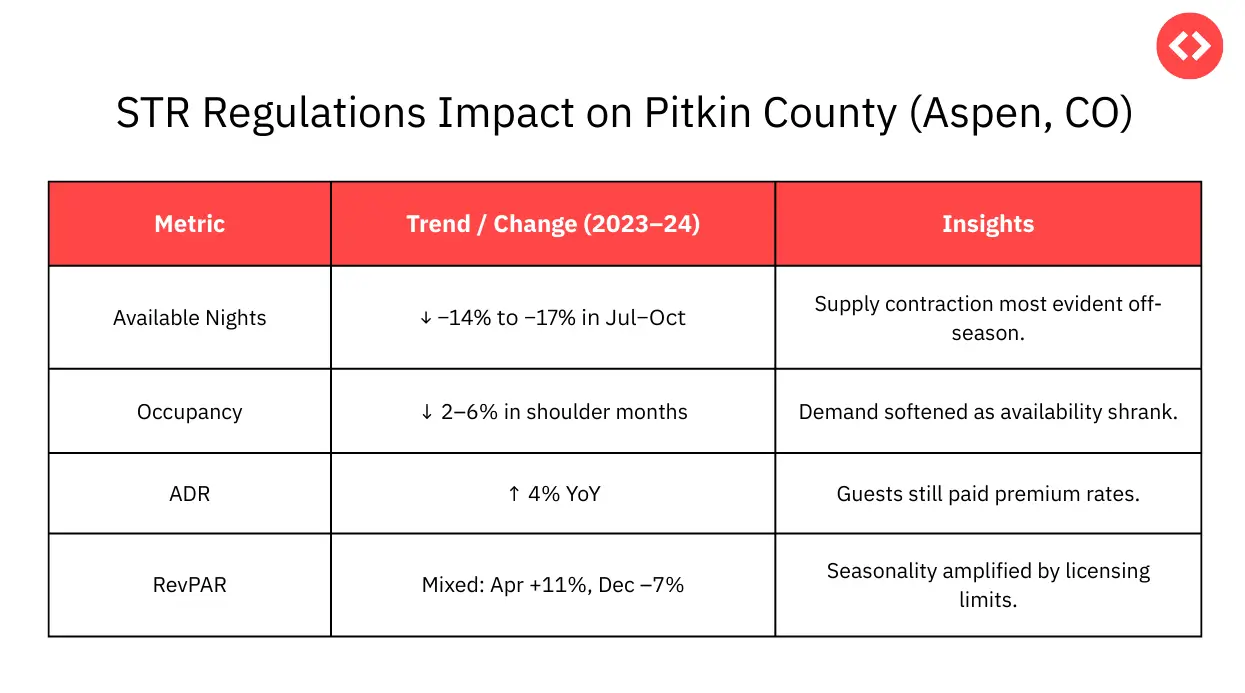

Pitkin County (Aspen, CO): Licensing Brings Seasonal Adjustments

Pitkin County’s licensing requirements reshaped how supply hits the market, particularly affecting the shoulder months. Winter remains resilient, but managers must adapt to operate legally and profitably. Tools like PriceLabs World STR Index help you to see market trends for your city for free.

- STR licensing regulations in Pitkin County became effective September 20, 2023, requiring all rental properties under 30 days to obtain an STR license.

- Licenses require applicants to demonstrate a history of STR activity between May 11, 2017, and May 11, 2022, limiting new entrant licenses and controlling market supply.

- A tiered annual fee structure applies, based on market value and rental nights, ranging from 0.05% to 0.07% of the home’s value, depending on the number of allowable rental nights per year.

- License holders must comply with ongoing requirements, including posting the license, maintaining safety equipment, providing local contact info, and ensuring no disturbances or code violations.

- Enforcement is conducted through licensing review, compliance inspections, and penalties or suspensions for violations, coordinated by the County STR Administrator.

- The licensing program is regularly reviewed and updated; the county tracks active licenses and adjusts policies to strike a balance between community impact and economic benefits.

- Private covenants and zoning restrictions remain applicable and may further limit the use of properties as STRs, independent of licensing.

What Does This Mean for Property Managers in Pitkin County?

The strict licensing limits in Pitkin County have reduced the overall supply, creating both challenges and opportunities for property managers.

- Pricing leverage from reduced supply: With fewer properties legally available, licensed managers can command higher nightly rates, especially during peak ski season. This gives compliant operators a competitive edge.

- Intense winters, cautious shoulders: Demand during winter weeks remains extremely strong, but shoulder months require more strategic pacing. Managers should decide whether to offer competitive pricing to attract off-season guests or hold inventory for periods of higher demand.

- Compliance as a business lifeline: Operating without a license isn’t an option—failure to comply risks fines or even being forced out of the market. Staying on top of evolving rules is just as important as revenue strategy.

Competent managers in Pitkin are combining dynamic pricing tools with strict compliance tracking to remain profitable and sustainable in this high-barrier market.

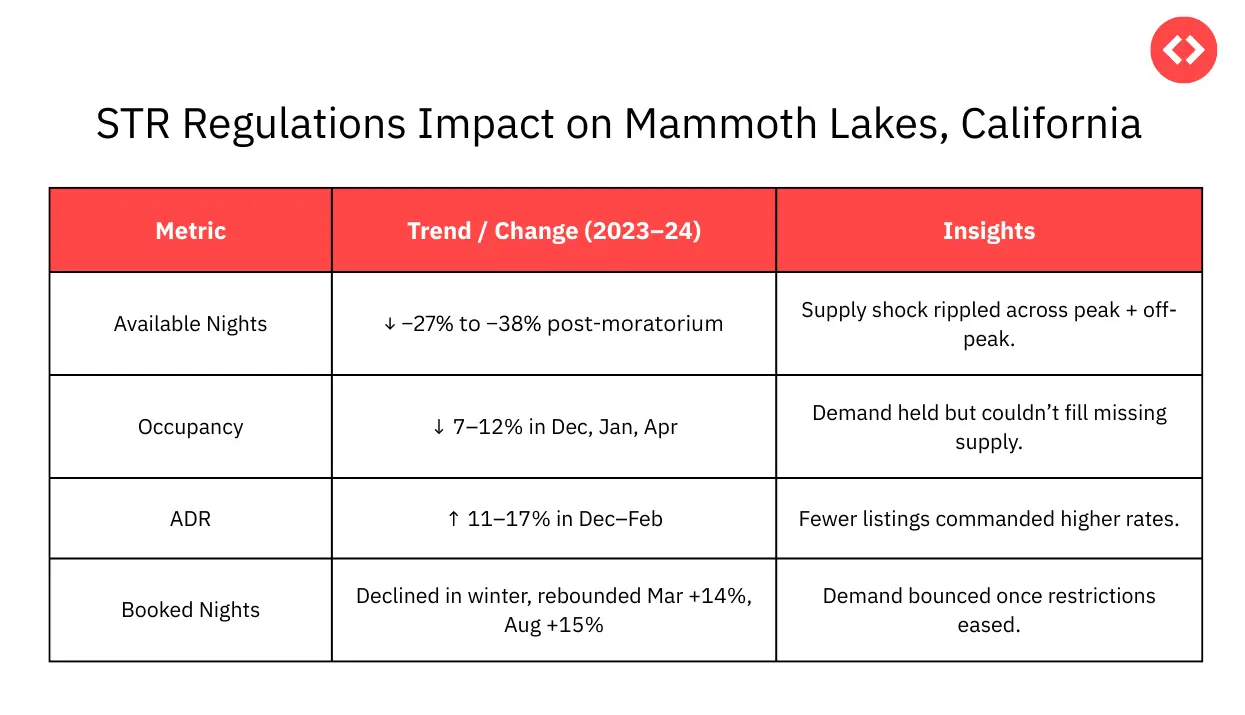

Mammoth Lakes, California: Moratorium Shockwaves

Mammoth faced one of the most disruptive regulatory changes: a moratorium that pulled large chunks of supply offline. While ADR rose sharply, the hit to occupancy and booked nights shows the volatility these sudden restrictions create.

Regulation Overview

- On October 18, 2023, the Town of Mammoth Lakes enacted a moratorium on new short-term rental (STR) certificates in specific zoning areas.

- The moratorium was extended through May 31, 2024, preventing new STR permits and pausing expansion of STR supply for nearly 7 months.

- The goal was to study the impacts of STRs on housing availability and community needs, particularly the shortage of affordable workforce housing.

- During the moratorium, the town created the “Certified Properties” program, replacing the previous TOT certificate system and adding stricter safety, inspection, and management standards for rentals.

- STR units must now be inspected every 4 years, provide local emergency contacts, and share visitor guidelines; violations of regulations incur suspension or significant fines.

- The moratorium ended April 22, 2024, after which STR permits were resumed under the new regulatory framework.

What Does This Mean for Property Managers in Mammoth Lakes, California?

The 2023–24 moratorium created a significant supply shock in Mammoth Lakes, reshaping both demand and pricing dynamics.

- The number of available nights dropped sharply (–27% to –38%) as restrictions reduced inventory. This meant fewer opportunities to capture bookings, even during high-demand ski season.

- Occupancy fell 7–12% in key months (Dec, Jan, Apr)—not because demand disappeared, but because there weren’t enough legal nights to sell.

- ADR climbed 11–17% in Dec–Feb, with limited supply pushing rates higher. Licensed managers who stayed compliant were able to command premium prices.

- Booked nights declined during the moratorium: However, they rebounded strongly once restrictions eased (+14% in March, +15% in August). This highlights how quickly demand returns when supply reopens.

For managers in Mammoth, compliance is non-negotiable, but so is revenue strategy. With supply constraints, maximizing revenue per available night is critical. Tools like dynamic pricing can help determine when to increase rates in winter and when to capitalize on pent-up demand during rebounds.

Maximize Your Revenue with PriceLabs Dynamic Pricing

Stop leaving money on the table. PriceLabs Dynamic Pricing adjusts your nightly rates automatically based on demand, seasonality, and market trends—so you can boost occupancy, increase revenue, and save hours of manual work.

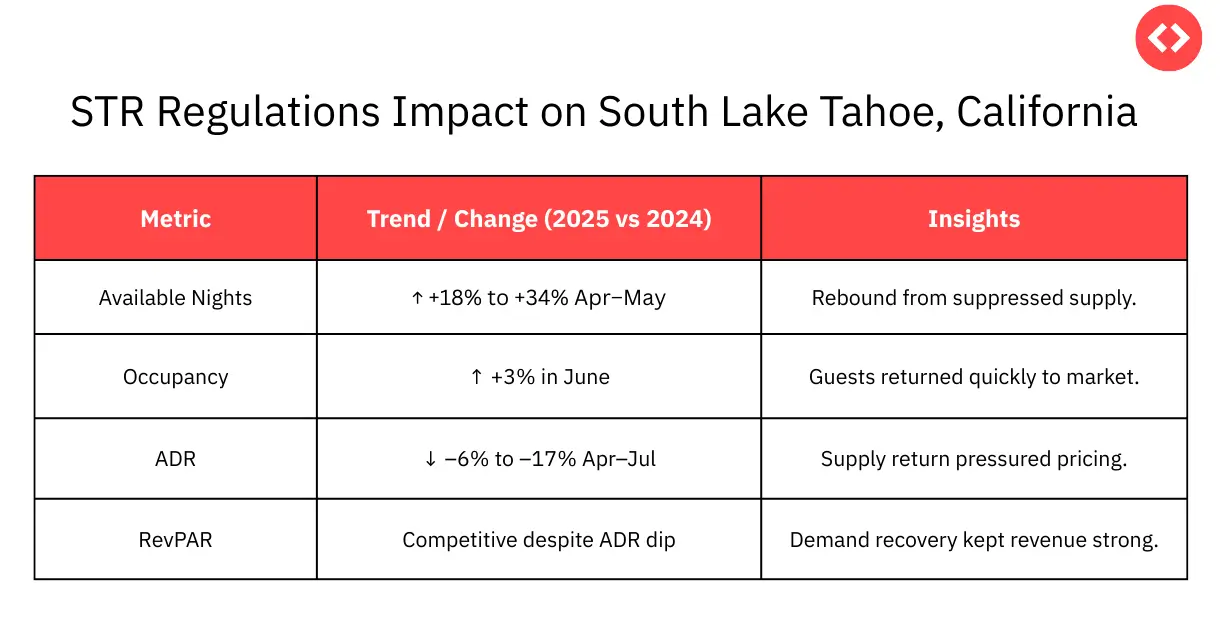

Start Your Free TrialSouth Lake Tahoe, California: A Fresh Start After Measure T

After years under Measure T restrictions, South Lake Tahoe reopened in 2025 with a new VHR law. The market is already showing signs of recovery, with a sharp rise in available nights and bookings—though increased supply is pushing ADR down.

Regulation Overview

- Measure T, which restricted new VHR permits and expired most existing residential permits, was overturned in March 2025 due to constitutional issues.

- The City passed a new Vacation Home Rental (VHR) ordinance in July 2025, reopening permitting with updated rules.

- Initial permit applications opened in June 2025 for prior permit holders; general applications began in August 2025.

- Key rules include:

- 150-foot buffer zone between VHRs outside the Tourist Core.

- Occupancy limits: two guests per bedroom plus up to five children under 13.

- Mandatory local manager check-in (in-person or virtual) and 24/7 complaint response.

- Noise and video monitoring required.

- Ban on large events, amplified outdoor music after 10 pm, parking on unpaved surfaces, and camping outside designated areas.

- Animal-resistant trash storage required.

- Permits are renewed annually; violations can lead to fines or revocation.

- The updated regulations aim to balance tourism, neighborhood quality, and housing.

What Does This Mean for Property Managers in South Lake Tahoe?

South Lake Tahoe is experiencing a market reset as supply rebounds and demand returns, creating both opportunities and challenges for property managers.

- Available nights rose 18–34% (Apr–May) as previously suppressed supply came back online. This expansion reopens growth potential but also intensifies competition. You need to focus on your vacation rental marketing, market-based pricing, and providing an exceptional guest experience to attract more bookings and repeat bookings. Highlight unique amenities, flexible cancellation policies, or bundled services (e.g., ski passes, gear rentals) to stand out in a crowded market.

- Occupancy increased by 3% in June, indicating that guests were quick to return once availability improved.

- ADR dropped 6–17% (Apr–Jul) under the weight of expanded supply, signaling that managers can’t rely on rate growth alone. Avoid discounting too heavily early in the season—hold inventory for peak weeks when demand spikes.

- RevPAR held competitive despite ADR declines, thanks to strong demand recovery, proving that well-positioned properties can thrive even in a more crowded market.

Managers in South Lake Tahoe should view the supply rebound as an opportunity to capture new demand—but success depends on striking a balance between competitive pricing and strategic pacing. Closely monitoring how the new law is enforced will be essential for long-term stability and profitability.

Final Thoughts

For U.S. ski markets, 2025 is shaping up to be a year of both regulatory pressure and opportunity. Summit is refining its cap system, Aspen is adapting to a license-driven supply, Mammoth is navigating the aftershocks of a moratorium, and South Lake Tahoe is reopening to vacation rentals.

For property managers, the path forward is clear:

- Stay compliant to avoid fines and gain competitive leverage.

- Stay flexible with pricing and pacing strategies.

- Stay data-informed with real-time insights to maximize performance.

Those who adapt fastest to these shifting rules will be best positioned to capture revenue—no matter how the snow falls.