Updated : Aug 20, 2025

There’s a long-held belief that Italy’s iconic cities—Rome, Venice, Florence, and Milan—go quiet in the summer. Locals escape the heat, and tourists head to the coast, leaving urban rentals struggling. But what does the data really show—and how can property managers maximize bookings during the slow summer season in Italy’s top urban markets?”

In 2024, Italy’s national-level data painted a different picture. Tourism demand was strong, with bookings and RevPAR increasing year-over-year. However, early indicators from May and June 2025 show signs of moderation. Growth is still happening—but not at the breakneck pace seen in the previous year. What’s going on?

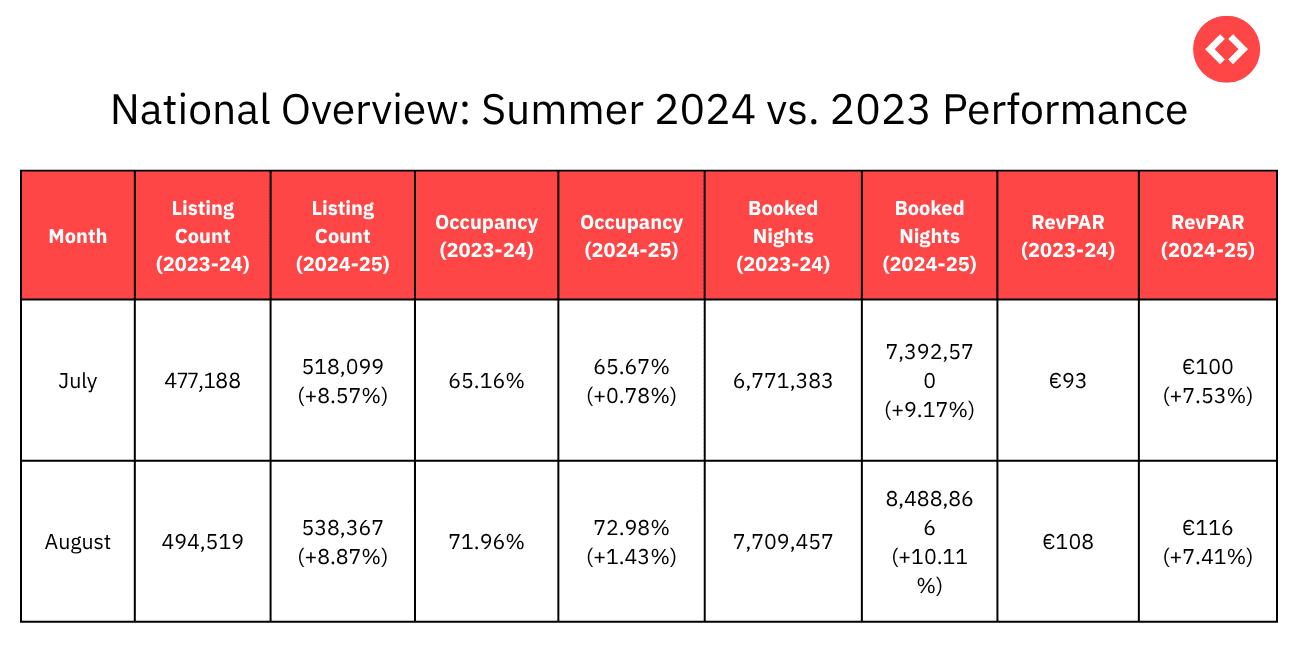

How Did the Italian Market Perform in 2024 vs 2023

The data below shows how the Italian vacation rental market has grown since 2023, indicating a booming tourism sector.

Despite modest growth in occupancy, both booked nights and RevPAR have grown significantly. This indicates a healthy demand curve, with properties capitalizing on increased ADRs. A higher RevPAR without significant occupancy increases suggests pricing power and/or effective revenue management.

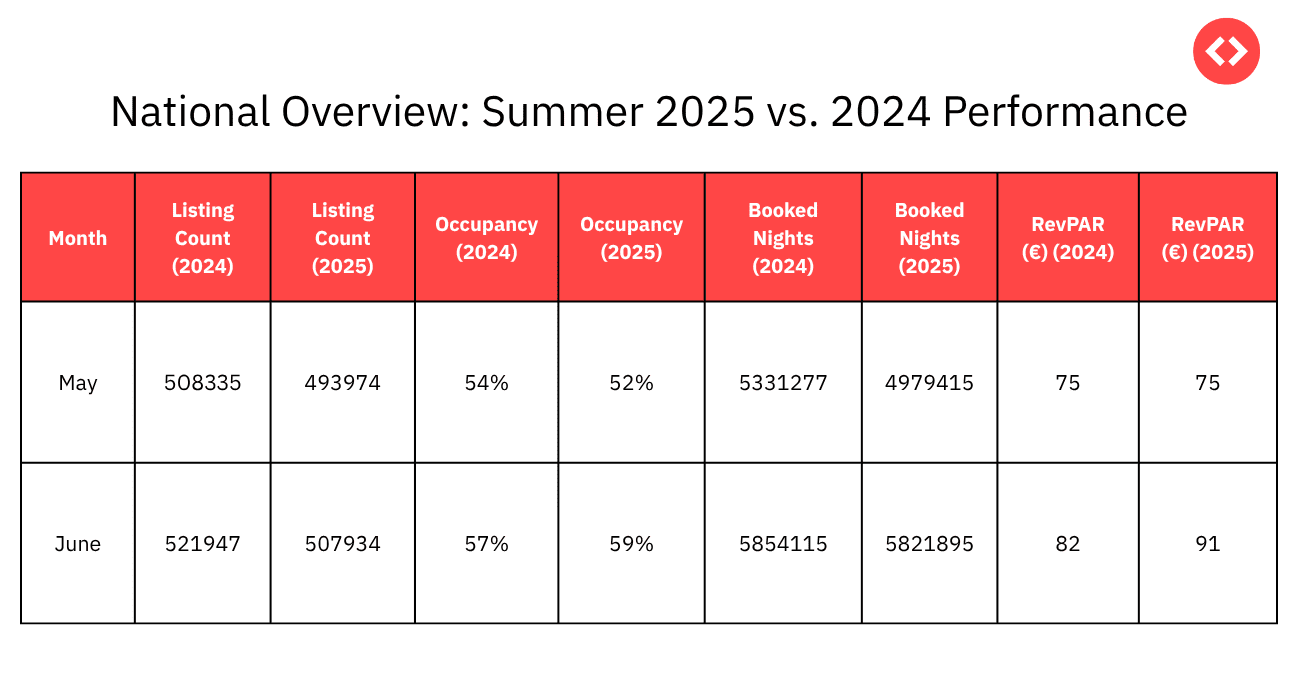

How Has the Italian Market Performed in Summer 2025?

So far, in May and June, the Italian rental market has seen a slight rise in occupancy, which can be attributed to a decrease in the listing count. It did not experience as strong growth as it had in 2024.

Growth is still positive, but it’s noticeably more moderate than the double-digit jumps of 2023–24.

How are the Italian Urban Cities Performing in Summer?

While Italy as a whole shows strength, the city-level story is more nuanced. Below, we examine the vacation rental performance of each city and identify potential factors that may be influencing it.

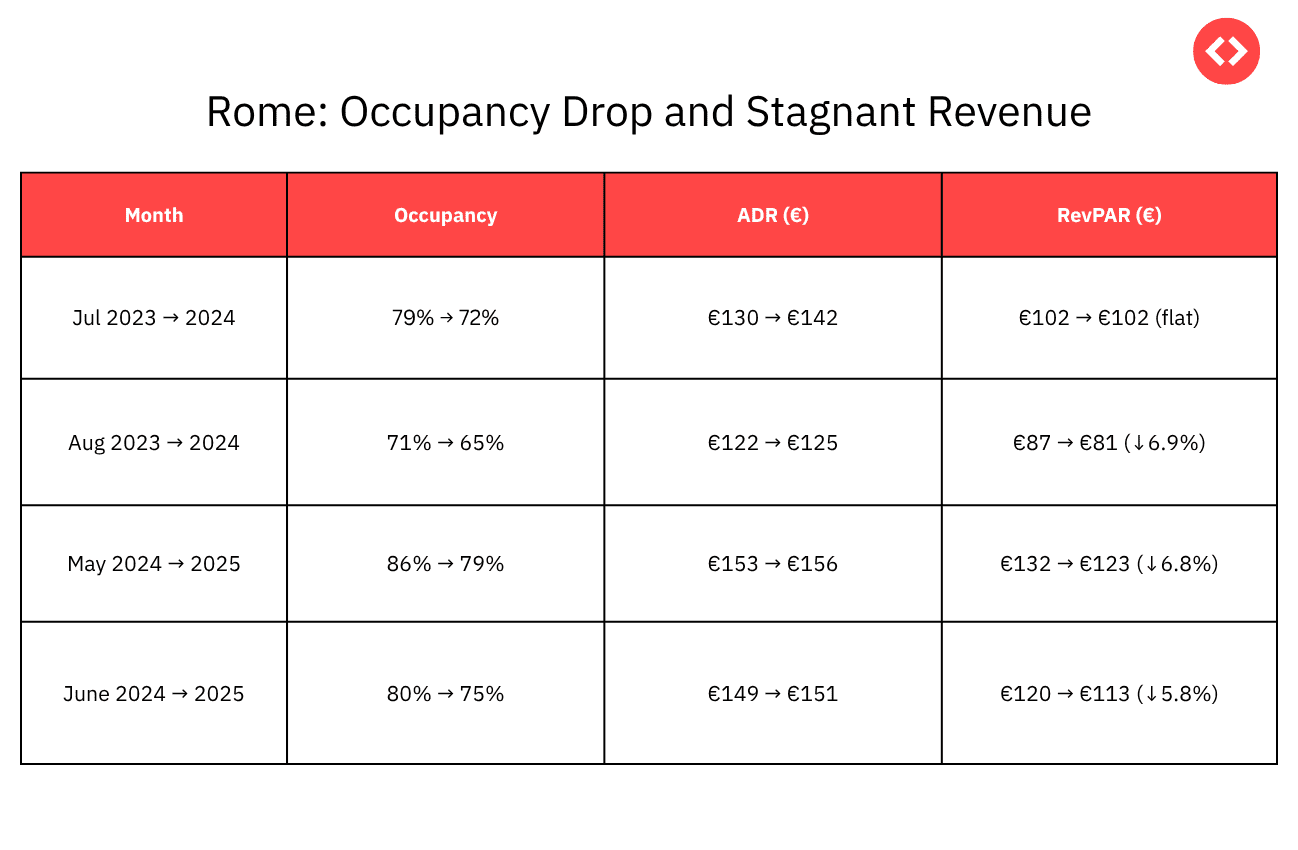

Rome: Occupancy Drop and Stagnant Revenue

Rome experienced a significant drop in occupancy, and the slight ADR increase was unable to offset the resulting revenue loss. This suggests that summer travelers are price-sensitive and perceive limited value at higher prices.

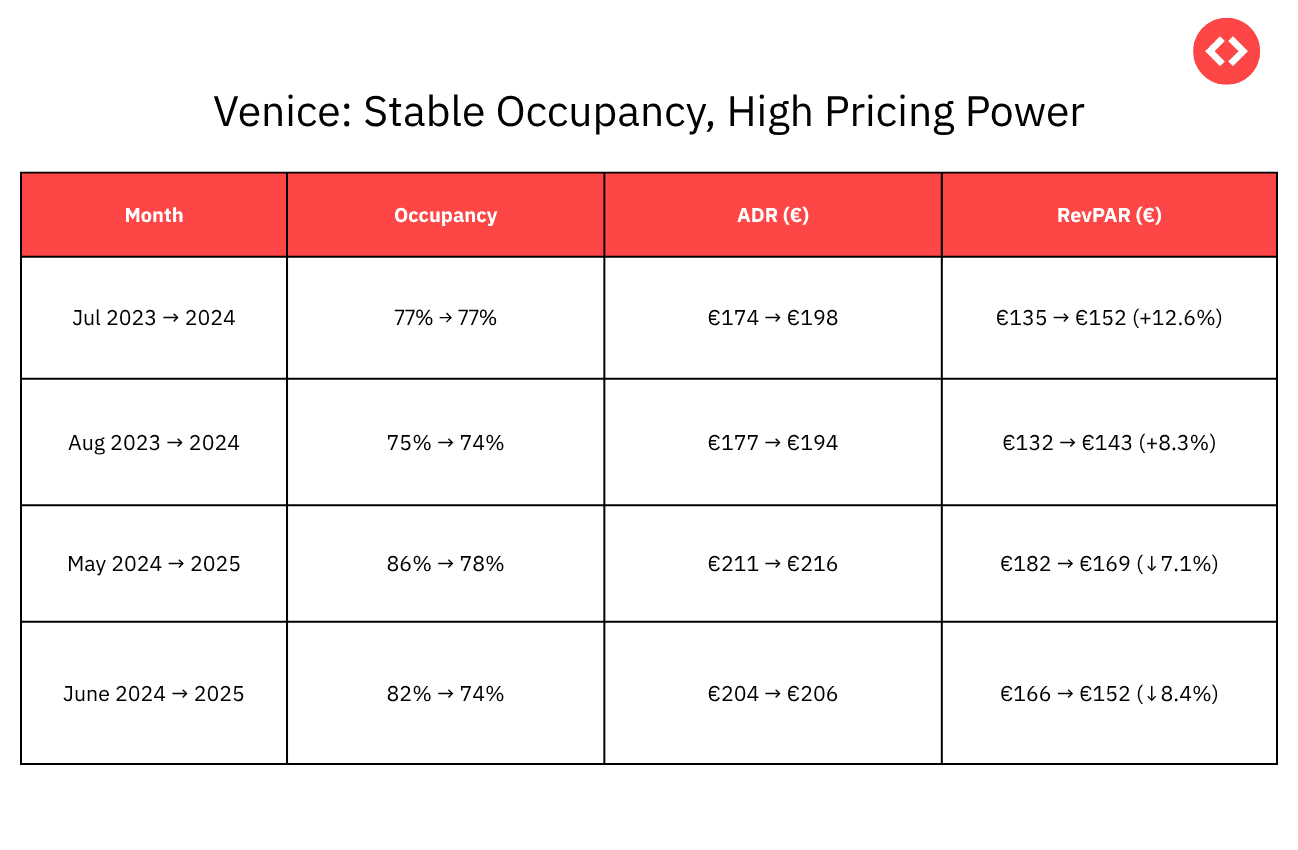

Venice: Stable Occupancy, High Pricing Power

Venice maintained occupancy while increasing ADR and RevPAR, showing a strong value perception and successful targeting of high-value tourists. Local regulations limiting day trippers may be influencing visitors to opt for longer stays.

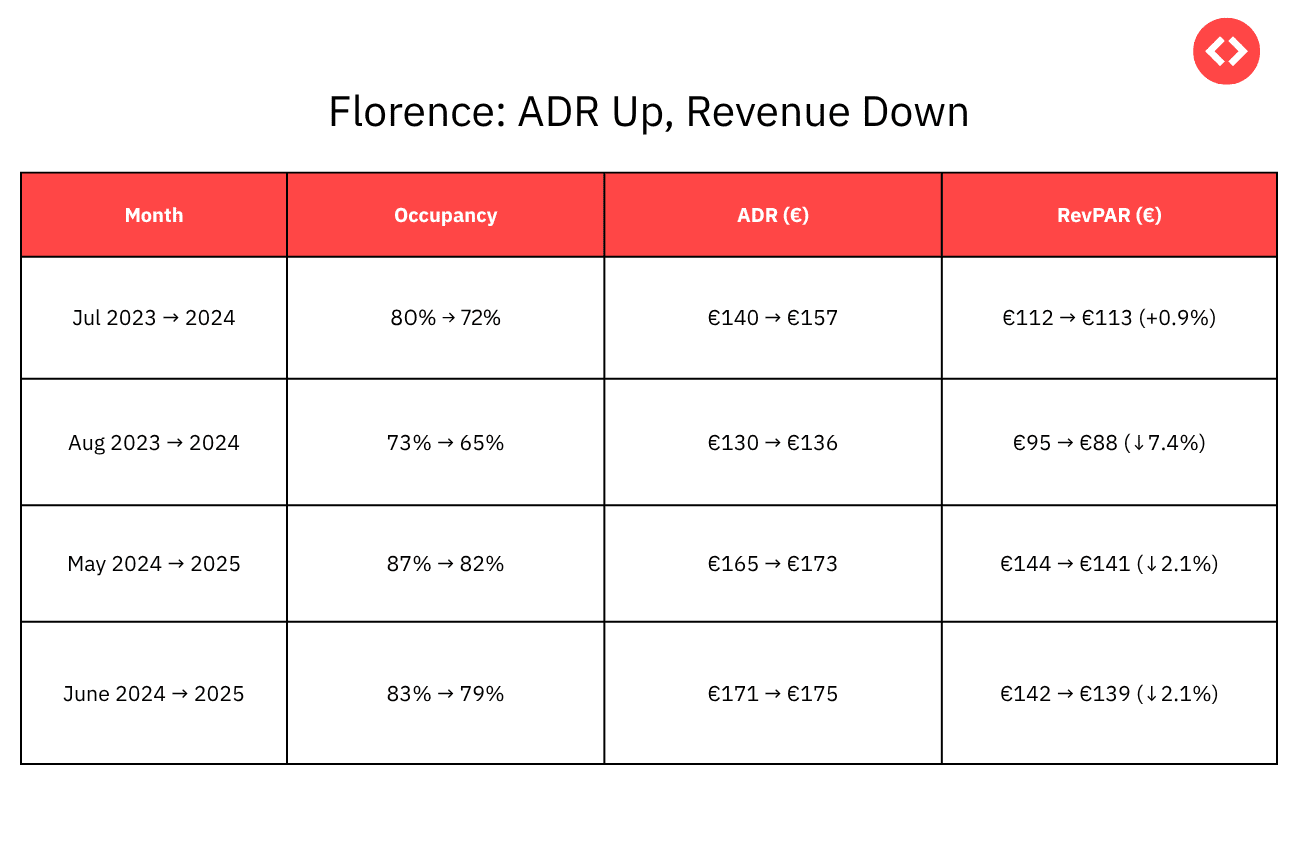

Florence: ADR Up, Revenue Down

Florence mimics Rome: ADR increases couldn’t prevent a drop in revenue. This reinforces that pricing power alone can’t salvage weak demand.

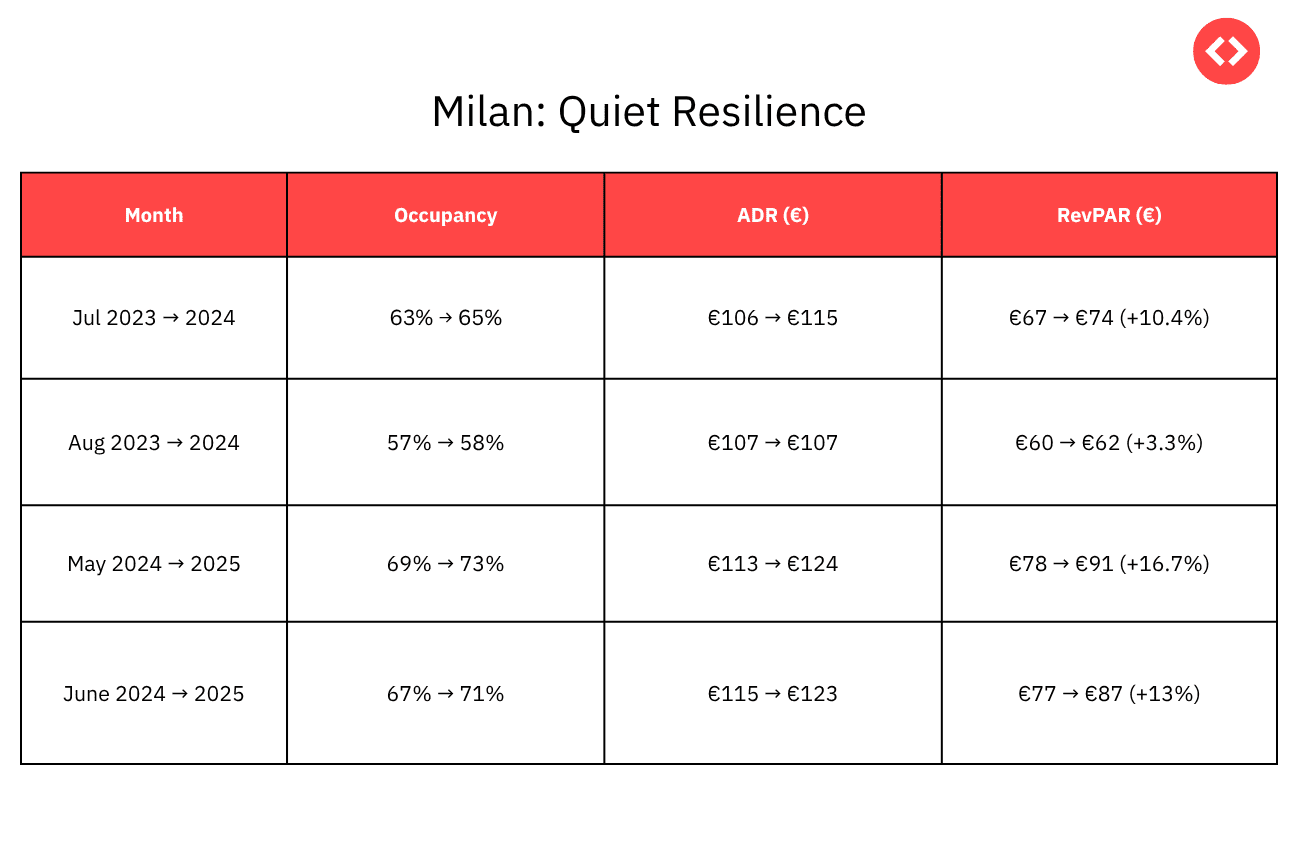

Milan: Quiet Resilience

Milan defies the trend with slight increases across all KPIs. Due to its business-tourism mix, fashion events, and improved air connectivity, Milan’s demand remains steady.

PriceLabs Market Dashboard

Ready to unlock the power of data? Try PriceLabs Market Dashboards today and turn insights into action for your vacation rental success!

Try Now!Key Takeaways: Occupancy, ADR, and RevPAR Relationships

- High ADR without stable occupancy (Rome & Florence) = flat or falling RevPAR

- Stable occupancy + rising ADR (Venice) = RevPAR growth

- Small occupancy increases + modest ADR growth (Milan) = modest RevPAR gains

Lesson: Price increases must be backed by strong perceived value or differentiated experiences. Raising prices during a “slump” without compensatory value-adds leads to lower conversion.

What’s Driving These Changes?

1. Regulatory Pressures

Cities like Rome and Florence have tightened regulations around short-term rentals, especially in historic districts. New rules often require stricter licensing, reporting, and compliance. These additional administrative and financial burdens may discourage smaller or individual hosts from listing their properties. As a result, the total number of available listings have shrunk in 2025 as compared to 2024, and property managers may find it harder to scale.

2. Travel Behavior

Modern travelers are more conscious of when and where they travel. There is growing interest in avoiding the peak summer months due to high temperatures and the influx of tourists to the Italian coastal regions. Additionally, travelers are increasingly opting for shoulder seasons, such as spring and fall, or seeking out quieter, coastal, or rural destinations. Additionally, more guests are choosing longer stays to combine work and leisure, contributing to shifts in booking patterns.

3. Market Saturation

For the past few years, ADRs have steadily increased across urban Italian markets. While this helped boost RevPAR, it’s now reaching a point where guests—especially domestic travelers—are becoming more price-sensitive. The result is a slower growth curve, even if occupancy remains stable or slightly down.

4. Global Events

2024 marked a significant rebound year following the pandemic. With that surge behind us, 2025 is facing new economic headwinds. Rising airfare, inflation, and global uncertainty may be making travelers more cautious about where and how much they spend. This dampening effect is being felt in many European cities, not just Italy.

What are Some City-Specific Tactics to Follow to Maximize Bookings During the Slow Season?

Rome:

- Promote night events and outdoor cinema

- Underground tours of the catacombs, crypts

- Neighborhood experiences in Trastevere or Monti

Venice:

- Multi-night packages with exclusive access

- Promote lesser-known islands like Giudecca and Burano

- Lean into new regulations as a quality guarantee

Florence:

- Pre-booking with timed museum access

- Partner with Tuscan vineyards and artisans for unique stays

- Highlight parks and gardens

Milan:

- Package day trips to Lake Como

- Promote fashion and trade fairs

- Highlight urban nightlife and lakeside escapes

What Can Property Managers Do to Maximize Bookings During the Slow Season?

1. Adjust Minimum Stays Smartly

Encourage longer bookings by offering discounts for stays of 7 nights or longer. Having a minimum night restrictions strategy attracts digital nomads, slow travelers, and hybrid tourists who combine work and leisure. It also helps reduce turnover costs and increase occupancy rates during slower periods.

2. Optimize Pricing Dynamically

With shifting travel patterns and market demand, static pricing is no longer effective. Tools like PriceLabs’ dynamic pricing solution enable property managers to adjust rates in real-time based on current market data. This ensures your listings stay competitive and reflect actual demand, even as it fluctuates.

3. Reposition Urban Listings

Urban travelers today are not just vacationers—they include remote workers, event attendees, and couples looking for quick getaways. Tailor your listings to these niche segments by highlighting relevant features, such as fast Wi-Fi, air conditioning, blackout curtains, and proximity to business centers or transportation hubs. Highlighting comfort and location can help beat the “summer fatigue” factor.

4. Use Data to Inform Owners

Transparent communication with owners is important, especially when performance begins to soften. Use PriceLabs’ Report Builder to provide clear, visual insights into how a listing is performing month-over-month and year-over-year. These data-driven reports help set realistic expectations and foster trust.

5. Improve Guest Experience

In hot summer months, comfort can be a deciding factor. Offer thoughtful amenities like portable fans, ice machines, or curated city guides to enhance the summer experience. Flexible check-in and check-out policies, as well as flexible cancellation policies, can also increase your booking conversion rate by offering guests more peace of mind.

Final Thoughts: Summer in the City Isn’t Dead—But It’s Changing

While the national narrative remains largely positive, the pace of growth is slowing in Italy’s urban centers, particularly in cities facing regulatory hurdles. Property managers who adapt to these shifts—by leveraging data, pricing tools, and guest behavior—can maximize bookings during the slow season and thrive even in the quieter summer months.

Tools like PriceLabs offer the flexibility, automation, and intelligence needed to navigate the urban summer. From dynamic pricing to reporting and strategy, they help you stay a step ahead of your competition.