Table of Contents

Updated : Aug 14, 2025

When investing in real estate, one of the most important questions that investors ask is: What kind of return on rental property can I expect? Understanding your vacation rental return is crucial for making smart, data-driven decisions that boost your profit, build your wealth, and minimize risk.

In this ultimate guide, we’ll go over how to calculate ROI on rental properties, how it compares to other metrics, what is considered a good ROI on rental property, and how to enhance the performance of your investment property. We’ll also show you how tools like PriceLabs can help you optimize pricing and occupancy to maximize your bottom line.

Return on Investment (ROI): What is it in Real Estate Investing?

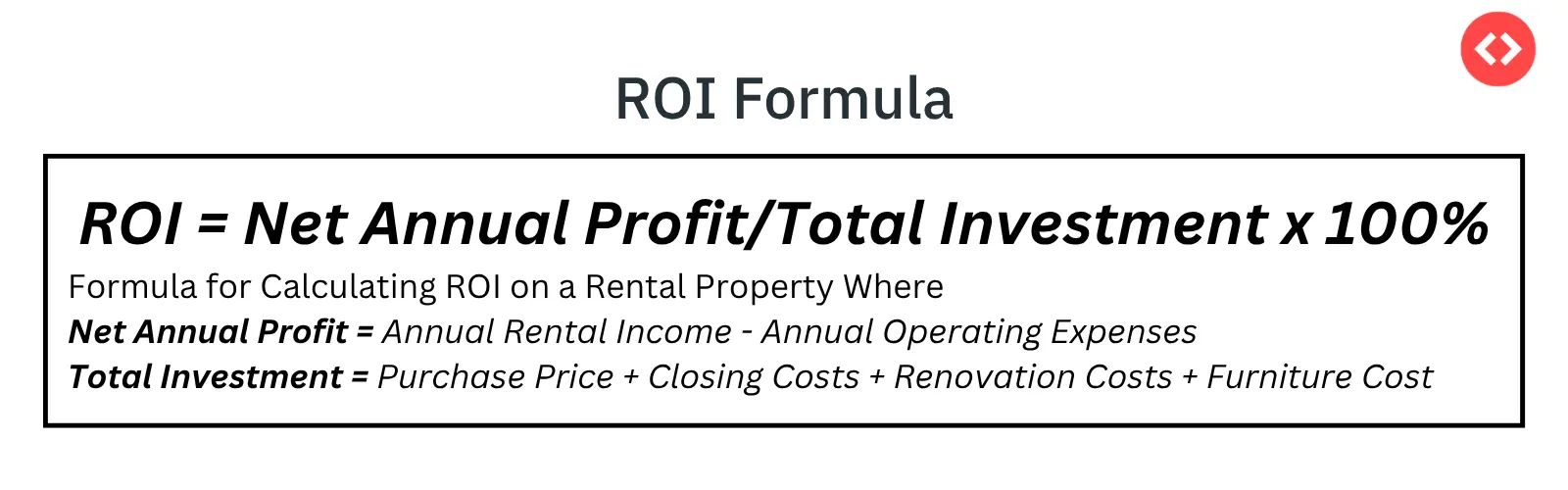

Return on investment (ROI) is a metric commonly used to evaluate the profitability of an investment in relation to its total cost. For rental properties, ROI refers to the profit you’re making from the property relative to how much money you’ve spent on it. It is one of the main vacation rental KPIs.

ROI Formula

ROI = Net Annual Profit/Total Investment x 100%

How Do I Calculate Rental Income?

To calculate the rental income of your Airbnb property, use the following formula:

Gross Rental Income = Average Daily Rate (ADR) x Occupancy Rate

Stay Ahead of the Market and Understand Your Property's Performance in Comparison to the Market.

Use PriceLabs Portfolio Analytics and Neighborhood Data to track competitor pricing and demand shifts and analyze past performanceTo accurately calculate and analyze the earning potential of a short-term rental property before buying it, use the PriceLabs Revenue Estimator Pro.

Get Started Today.To make things clearer for first-time investors, let’s take a look at a concrete example.

ROI Example

Consider the following scenario. An investor buys an Airbnb property and yields these financial results:

- Purchase Price: $350,000

- Closing Costs: $8,700

- Renovation Costs: $15,000

- Furniture Cost: $20,000

- Annual Rental Income: $55,000

- Annual Operating Expenses (including Airbnb management fees, cleaning, restocking, insurance, taxes, and maintenance): $20,000

ROI = ($55,000 – $20,000)/($350,000 + $8,700 + $15,000 + $20,000) x 100%

ROI = 8.89%

So, the return on this rental property is 8.89% per year.

Cap Rate vs ROI

The capitalization rate (cap rate) is another measure of profitability in real estate investing. Although it is often confused with ROI, these are two distinct metrics that serve different purposes and are calculated differently.

The cap rate evaluates a rental property’s income potential relative to its current market value (CMV). It doesn’t consider the method of financing. Meanwhile, the ROI takes into account the total investment, including mortgage payments. This makes return on rental properties a more comprehensive measure of long-term profit.

Cash on Cash Return vs ROI

Both the cash on cash return (CoC return) and ROI assess rental property performance, but they focus on different aspects.

The cash-on-cash return measures the annual pre-tax cash flow relative to the actual cash invested. This makes it a particularly good metric for financed properties. The return on investment, on the other hand, evaluates total profitability over time. Thus, the average ROI on a real estate property provides a broader picture of the overall investment performance.

What Is a Good Return on a Rental Property?

There is no single best ROI for a rental property as it depends on a number of factors. Still, most real estate experts agree that a good ROI for a rental property is in the range of 5-10%.

A higher return on a rental property – 15%+ – is sometimes possible in high-demand or emerging markets, but it comes along with greater risk.

Lower ROI – 5-7% – might be good if you invest in a property in stable, sub-urban markets where appreciation is the main driver of profit. This lower return brings lower risk too.

Maximize Your Vacation Rental Return with Dynamic Pricing!

Boost occupancy & optimize revenue with PriceLabs’ Dynamic Pricing & Revenue Management tool. Implement a smart pricing strategy based on market conditions, seasonality & competition for excellent ROI.

Get Started Now6 Factors That Affect Rental Property Return on Investment

It is hard to say what a good return on a rental property is because it depends on many factors.

The main drivers of ROI include:

- Location: Where you invest in a rental property is the single most crucial factor determining its performance. It affects everything – from sales price and management costs, to rental demand and rental rates.

- Property type: Single-family homes tend to bring higher ROI than apartments and condos, in most markets.

- Management strategy: Professionally managed short-term rentals perform better, but you have to factor in monthly fees into your ROI calculations.

- Purchase price: The amount you spend on the property directly impacts its profitability, as it is factored into the ROI formula. It’s worth trying to negotiate a better price before settling.

- Financing method: The loan terms, duration, and interest rates affect the return on leveraged rentals as they impact the total investment.

- Occupancy rate: A Higher Airbnb occupancy rate translates into more rental income, which means a higher ROI. Deploy a smart Airbnb pricing strategy to maximize return.

How to Improve the Return on Your Rental Property: 5 Tips

The following proven tips will help you maximize the ROI of your short-term rental:

- Target high-demand markets: Before you buy a property, use real-time, local market data to choose a location with strong potential.

- Invest in property upgrades: Focus on furniture and appliances that attract high-quality guests and increase daily rates.

- Improve your listing: Optimize your Airbnb listing to get more bookings and maximize vacation rental revenue.

- Automate property management: Adopt a property management system (PMS) to cut operational costs and optimize processes.

- Set competitive rates: Use Dynamic Pricing tools like PriceLabs to implement a smart vacation rental pricing strategy. This strikes the right balance between nightly rates and occupancy to maximize rental income.

Maximizing ROI on Short-Term Rental Properties with the Help of Technology

Maximizing your return on rental property boils down to choosing the right market, boosting occupancy, enhancing daily rates, keeping expenses at bay, and making smart, data-based decisions. In other words, your long-term success depends on optimizing both rental income and operating costs.

Technology plays a vital role in this process. You can dynamically adjust nightly prices based on demand and comps with tools like PriceLabs’ Dynamic Pricing. You can benchmark your property’s performance against local trends to increase ROI with Market Dashboards. You can track performance to ensure upward trends with Portfolio Analytics.

By leveraging the power of smart technology, such as PriceLabs, you can increase bookings, reduce vacancy, optimize daily rates, and – ultimately – boost the return on your vacation rentals without extra manual work.

Frequently Asked Questions

1. What Is the 2% Rule for Rental Property?

According to the 2% rule, a rental property is a good deal if the monthly rent is equivalent to at least 2% of the purchase price. For example, a property that costs $200,000 should rent out for at least $4,000 per month.

2. What Is the 50% Rule in Rental Property?

The 50% rule suggests that about 50% of the rental income goes towards operating expenses excluding mortgage. So, if you earn $3,000 in monthly rent, you can expect $1,500 in operating costs.

3. What Is ROI in Simple Terms?

Simply put, the ROI measures how much profit you make from a rental compared to what you spend on the property. It tells you how much money your investment is making.