Table of Contents

Updated : Feb 19, 2026

The United Kingdom’s short-term rental (STR) landscape has officially entered a “professional-only” era. As of February 2026, the market is no longer defined by rapid post-boom shifts, but by a steady, mature competition where data-driven strategy is the only way to protect margins.

With a mandatory national registration scheme launching in England in April 2026 and the full impact of tax reforms now being felt, property managers are navigating a “quality filter”. This environment rewards efficient, professionalized property management operations while challenging casual hosts who fail to keep pace with new compliance and pricing standards.

Key Insights from the UK Vacation Rental Market Report

The UK market in 2026 is characterized by stable occupancy and robust rate growth. According to data derived from PriceLabs STR Index and Market Dashboard, total demand (booked nights) saw a minor contraction of roughly 3% over the last cycle. However, professional managers have successfully protected their revenue by leaning into pricing power.

Key Market Headlines:

- Inventory Growth: Active listings in the UK climbed to a record 375,400 by January 2026, marking a steady increase from roughly 344,600 two years prior.

- Revenue Paradox: Despite slightly fewer nights booked, RevPAR (Revenue Per Available Rental) in GBP has remained resilient, supported by strong ADR (Average Daily Rate) performance from professionalized listings.

- The “Last-Minute” Economy: Travelers are booking closer to their stay than ever before, with the average booking window tightening to 25.7 days.

- Regulatory Milestone: The mandatory national register for holiday homes in England is set to go live in April 2026, requiring safety compliance certifications for all active listings.

Performance Benchmarks: UK Short-Term Rental Data (Feb 2025 – Jan 2026)

This table provides a high-level view of the UK market’s performance over the last cycle, incorporating the critical shifts in booking behavior and stay duration.

| Month | Occupancy (%) | ADR (£) | RevPAR (£) | Booked Nights (M) | Active Listings | Booking Window (Days) | Length of Stay (Nights) |

| Feb 2025 | 49% | £126 | £61 | 3.14 | 344,610 | 15.0 | 4.0 |

| Mar 2025 | 48% | £127 | £61 | 3.46 | 352,400 | 17.0 | 4.0 |

| Apr 2025 | 58% | £134 | £77 | 4.00 | 358,900 | 26.0 | 4.0 |

| May 2025 | 59% | £134 | £79 | 4.31 | 362,100 | 31.5 | 4.0 |

| Jun 2025 | 61% | £138 | £84 | 4.40 | 368,400 | 31.0 | 4.0 |

| Jul 2025 | 68% | £149 | £101 | 5.17 | 372,200 | 37.0 | 4.0 |

| Aug 2025 | 70% | £152 | £106 | 5.32 | 369,800 | 38.0 | 4.0 |

| Sep 2025 | 62% | £131 | £81 | 4.36 | 370,323 | 29.0 | 4.0 |

| Oct 2025 | 56% | £131 | £74 | 4.07 | 363,897 | 21.0 | 4.0 |

| Nov 2025 | 48% | £129 | £62 | 3.24 | 367,446 | 18.0 | 4.0 |

| Dec 2025 | 49% | £140 | £69 | 3.45 | 369,930 | 30.0 | 4.0 |

| Jan 2026 | 41% | £125 | £51 | 3.00 | 375,400 | 15.0 | 4.0 |

| Annual Avg | 56% | £135 | £75 | 3.98M | 366,654 | 25.7 | 4.0 |

UK Vacation Rental Market Analysis: Revenue and Rate Resilience

The UK remains a rate-resilient market despite a maturing demand profile. While occupancy has flattened at an annual average of 56%, professional managers have successfully held the line on ADR to offset rising operational costs.

- ADR & RevPAR Trends: The average daily rate stayed firm at £135. This stability is impressive given the continuous growth in supply, which typically puts downward pressure on rates.

- Yield-First Mentality: The average RevPAR of £75 suggests that success in 2026 requires optimizing for the highest possible rate on high-demand weekends rather than simply chasing 100% occupancy.

- What this means for property managers: You cannot expect general market momentum to fill your calendar. Revenue growth now comes from extracted value per stay rather than volume.

STOP PRICING BLINDLY: Execute Your Strategy with Dynamic Pricing

Ready to confidently set premium rates in a competitive UK market? Now use PriceLabs' industry-leading dynamic pricing tool tostart optimizing your ADR and short-term rental profitability today.

Start Your Free Trial NowSupply and Demand Dynamics in the UK STR Sector

UK inventory reached record levels in early 2026, but demand is not quite keeping pace.

- Supply Surge: Active listings reached 375,400 in January 2026. New supply is entering the market faster than new demand is being created, leading to “pockets of saturation” in traditional holiday hotspots.

- Demand Contraction: Total booked nights softened slightly throughout late 2025, with September and October seeing year-on-year declines.

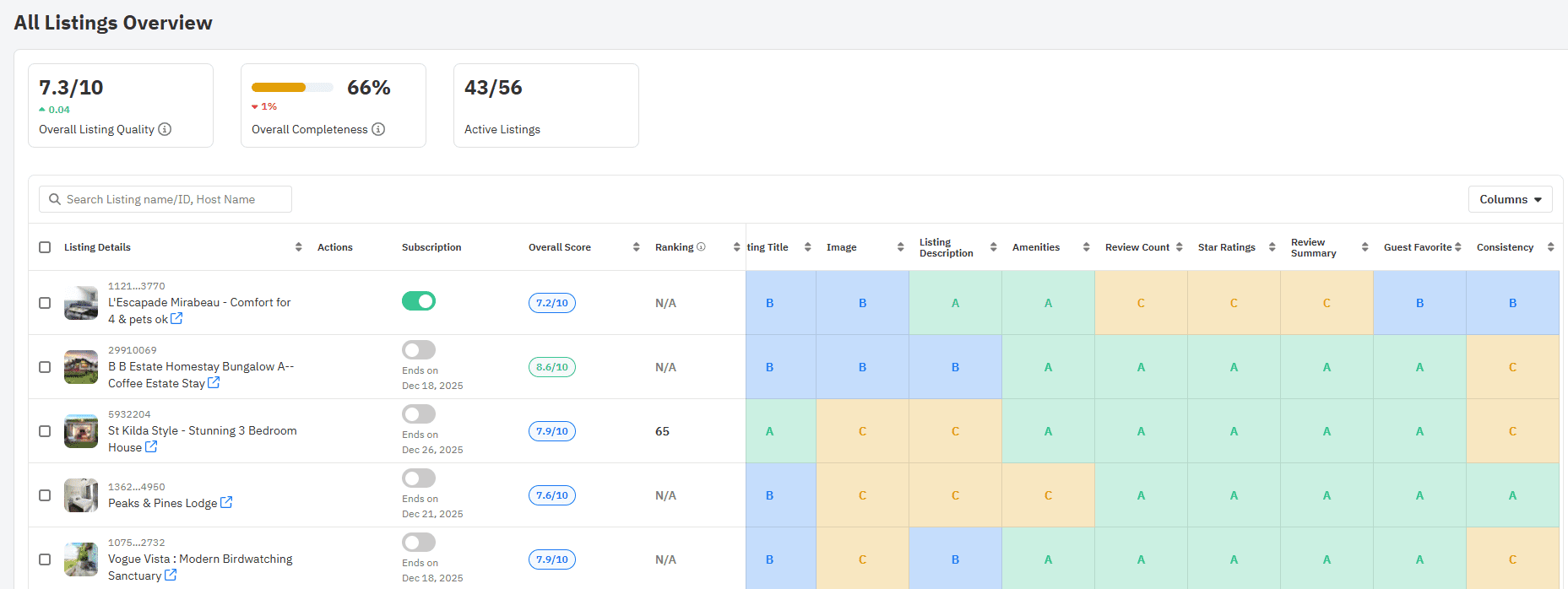

- Operator Strategy: As guests have more options, listing quality is the new battlefield. Properties with high review scores and flexible terms are capturing the bulk of the market. To help you win, the PriceLabs Listing Optimizer uses AI-powered analysis to scan your Airbnb listing, identify “revenue killers”—such as weak titles or inconsistent descriptions—and provide a ranked checklist of high-impact fixes to boost your search ranking and conversion rates.

Seasonality Trends: Booking Windows and Length of Stay (LOS)

The UK market is firmly entrenched in a “last-minute economy,” which necessitates more agile management strategies and last-minute pricing strategies.

- The Shinking Booking Window: Travelers are booking later than ever. The average booking window has tightened to 25.7 days, with off-peak months like January seeing guests book just 15 days in advance.

- Length of Stay Stability: Despite shorter booking windows, the median stay has remained firm at 4 nights for nearly all of 2025 and 2026.

- Strategic Takeaway: Avoid “panic discounting” too far in advance. With the average guest now booking within a four-week window, holding your price floor longer can capture high-value, spontaneous bookings.

Strategizing for Success: The Dynamic Pricing Advantage

The 2026 UK market has shifted from a period of rapid expansion to one of professional consolidation. Data from the latest UK vacation rental market report reveals that the most significant differentiator between top-performing portfolios and those struggling with tightening margins is the intensity of their pricing strategy.

The performance gap is undeniable: UK listings utilizing high-intensity dynamic pricing are outperforming static properties by an average of £51 in RevPAR per night. In a mature market, dynamic pricing has moved from an “added advantage” to a baseline requirement for professional survival.

Quantifying the Impact: Data-Driven Performance Gaps

Based on recent market performance data (Feb 2025 – Jan 2026), properties that fully automate their pricing with data-driven algorithms significantly lead the market in every major KPI.

| Pricing Intensity | Avg. Occupancy | Avg. ADR (GBP) | Avg. RevPAR (GBP) |

| High Intensity | 62% | £166 | £103 |

| Moderate | 61% | £140 | £86 |

| Low | 60% | £123 | £74 |

| None (Static) | 46% | £113 | £52 |

Key Takeaway: High-intensity dynamic pricing delivers a 99% RevPAR premium over static pricing. While occupancy remains relatively similar across the three dynamic tiers, the High Intensity strategy captures a 47% higher ADR compared to properties with no dynamic pricing.

STOP PRICING BLINDLY: Execute Your Strategy with Dynamic Pricing

Ready to confidently set premium rates in a competitive UK market? Now use PriceLabs industry-leading dynamic pricing tool tostart optimizing your ADR and short-term rental profitability today.

Start Your Free Trial NowRegulatory Outlook: New Compliance Standards for UK Short-term Rentals

The UK’s regulatory environment is undergoing its most significant transformation in decades.

- National Registration (April 2026): Every short-term let in England must soon be registered on a national database. This will require hosts to submit safety compliance documentation, such as gas and electrical certificates.

- Tax Evolution: The Furnished Holiday Lettings (FHL) tax regime was officially abolished in April 2025. Holiday lets are now taxed in the same way as standard residential lets, removing previous mortgage interest advantages.

- Tourism Outlook: VisitBritain forecasts 45.5 million inbound visits in 2026, with spending expected to grow by 7% to £35.7 billion. While the US remains the top market, growth is surging from the Middle East and South America.

Strategic Recommendations: Optimizing Revenue in a Competitive UK Market

1. Professionalize Compliance Now

Use the impending April 2026 national registration deadline as a “quality filter” to get ahead of the competition. This mandatory scheme in England will require all short-term lets (STRs) to be registered, likely mandating proof of safety certifications (fire, gas, electrical) and potentially planning permission.

- Action: Ensure all documentation is centralized and digitized. Prepared operators should view this not as a hurdle, but as a mechanism that will naturally remove non-professional, non-compliant competition from the market.

2. Focus on “Micro-Seasons”

Don’t just price for Summer. In 2026, UK traveler behavior is shifting toward a last-minute economy where guests value spontaneity over long-term predictability.

- Action: Build a shoulder-season playbook that moves away from quarterly planning. Use real-time data to identify local events and festivals to capture high-value, last-minute demand. While high seasons remain strong, shoulder seasons between peaks are becoming the new norm, requiring managers to find creative ways to fill calendar gaps through localized demand drivers.

3. Implement Dynamic Pricing

The performance gap is undeniable: UK listings utilizing high-intensity dynamic pricing are outperforming static properties by an average of £51 in RevPAR per night. In a mature 2026 market, dynamic pricing has moved from an “advantage” to a baseline requirement for survival.

Dynamic pricing is the most effective tool to combat tightening margins and shifting lead times.

- Counteracting Tax Pressure: Following the abolition of the Furnished Holiday Lettings (FHL) tax regime in April 2025, UK managers have lost full mortgage interest relief. This pivotal moment requires businesses to modernize accounting and asset classification to protect net profits. Dynamic pricing helps recover these lost margins by extracting maximum value from every booking.

- The Last-Minute Reality: UK booking windows have continued to compress, with the average now at 25.7 days. Static pricing often leads to selling out too early or sitting empty as lead times for Gen Z and Millennial travelers drop as low as 0–7 days before check-in.

- Professional Discipline: Professional managers in the UK are increasingly prioritizing yield over occupancy. By protecting rates for peak dates (like August’s £152 average) and using data to apply “gap-filler” discounts for mid-week stays, they achieve higher revenue despite running lower overall occupancy than “hobbyist hosts.

Execute Your Strategy with PriceLabs Dynamic Pricing: PriceLabs addresses these UK-specific challenges by transforming raw market data into automated, hyper-local pricing recommendations. For UK managers facing the new regulatory and tax landscape, PriceLabs provides the essential tools to protect every pound of profit:

- Hyper-Local Pulse Algorithm: Detects demand shifts in your specific neighborhood—critical for urban markets like London or Manchester, where events can cause hyper-local price surges.

- Market-Driven Last-Minute Discounts: Automatically adjusts your rates as the booking window shrinks, ensuring you stay competitive for that 25.7-day average lead time without manual guesswork.

- Custom Seasonal Profiles: Allows you to master the UK’s pronounced seasonality by setting distinct pricing and minimum stay rules for peak summer vs. winter city-break months.

STOP PRICING BLINDLY: Execute Your Strategy with Dynamic Pricing

Ready to confidently set premium rates in a competitive UK market? Now use PriceLabs industry-leading dynamic pricing tool tostart optimizing your ADR and short-term rental profitability today.

Start Your Free Trial Now2026 Forecast: The Future of the UK Vacation Rental Industry

The outlook for the remainder of 2026 is one of supply consolidation.

- Supply Moderation: Listing growth is expected to slow as new registration requirements and tax burdens lead “hobbyist” hosts to exit the sector.

- Pacing Signals: Early 2026 data shows that while occupancy pacing is slightly behind previous years, ADR for secured bookings remains very strong.

- Risks: Property managers should monitor the potential introduction of local “Short-Term Let Control Zones,” which may allow local authorities to cap property numbers in high-density areas.

Frequently Asked Questions

What is the most important change for UK hosts in April 2026?

The launch of the mandatory national registration scheme for England. You will need to register your property and display a unique registration number on all booking platforms to remain legal.

Is the UK market oversupplied?

Active listings are at an all-time high, surpassing 375,000. While competition is intense, professional operators are still achieving RevPAR growth by focusing on quality and pricing agility.

What is the average booking window in the UK right now?

The average lead time is 25.7 days, significantly tighter than in previous years. This reflects a growing “last-minute” booking trend among both domestic and international travelers.

Should I still use a 1-night minimum stay?

With the average length of stay steady at 4 nights, 1-night stays often increase operational costs without providing significant revenue gains. Most professional managers are finding higher profitability with 2- or 3-night minimums.