Table of Contents

Updated : Dec 9, 2025

Using internal PriceLabs data for Lahaina, we can see in numbers what many hosts on the ground have been feeling since the August 2023 wildfires: a market that was shocked almost overnight, then slowly rebuilt with fewer listings and fewer booked nights, yet surprisingly resilient pricing power.

This article walks through what changed across supply, demand, revenue, and pricing, and what any host in a disruption-hit or policy-constrained market can learn from Lahaina’s data story.

How we’re looking at the data

For this analysis, we used monthly data for Lahaina across three 12-month periods:

- 2022–23 – Pre-wildfire baseline

- 2023–24 – The first year after the wildfires

- 2024–25 – The second year of adjustment and early recovery

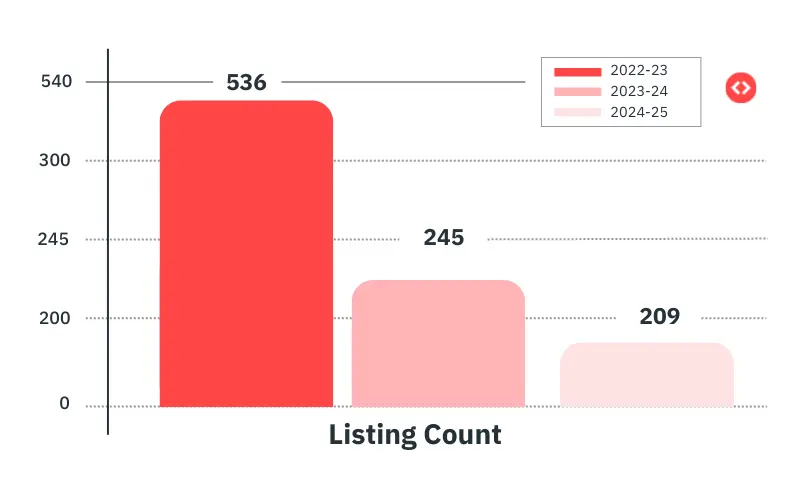

1. A massive supply shock: Lahaina’s listings were cut in half

The first and clearest impact of the wildfires is on supply.

Across the 2022–23 period, Lahaina averaged about 536 active listings. In 2023–24, that dropped to roughly 245 listings – a 54% drop in available supply. By 2024–25, listings fell further to around 209, a 61% decline from the pre-wildfire year.

If you zoom into specific months, the contraction looks even starker:

- In August, listings went from 514 (2022–23) → 559 (2023–24) → 192 (2024–25).

- For much of the year, the 2024–25 supply is 60–65% lower than before the wildfires.

This tells us two important things:

- Lahaina is operating with a structurally smaller STR inventory.

Damage, regulations, and long-term housing priorities have all contributed to fewer short-term rentals. - Any host who is still active is now operating in a very different competitive landscape.

You’re no longer competing in a dense, tourism-heavy market with hundreds of similar listings around you; you’re in a smaller, more supply-constrained environment where each active listing matters more.

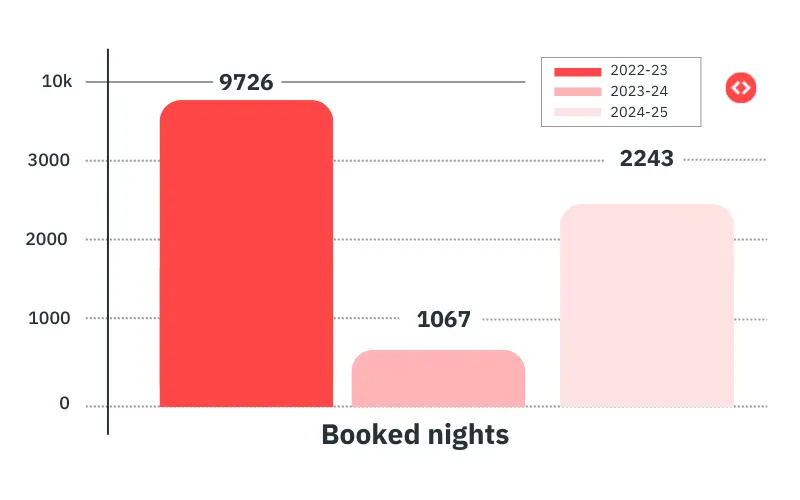

2. Demand collapsed too – booked nights are still ~85% below pre-fire levels

When supply shrank, demand didn’t simply “redistribute”. Bookings also fell sharply.

Average booked nights per month dropped from about 9,486 (2022–23)

→ 1,914 (2023–24)

→ 1,349 (2024–25)

That’s roughly:

- -80% booked nights in 2023–24 vs pre-wildfire

- -86% in 2024–25 vs 2022–23

So even as we move into the second year after the wildfires, total booked nights are still less than 20% of what they used to be.

This reflects:

- Fewer properties operating

- Lower overall tourism demand in Lahaina

- Longer-term stays and housing priorities are taking precedence over STR bookings

Yet, this doesn’t mean every active listing is “empty”.

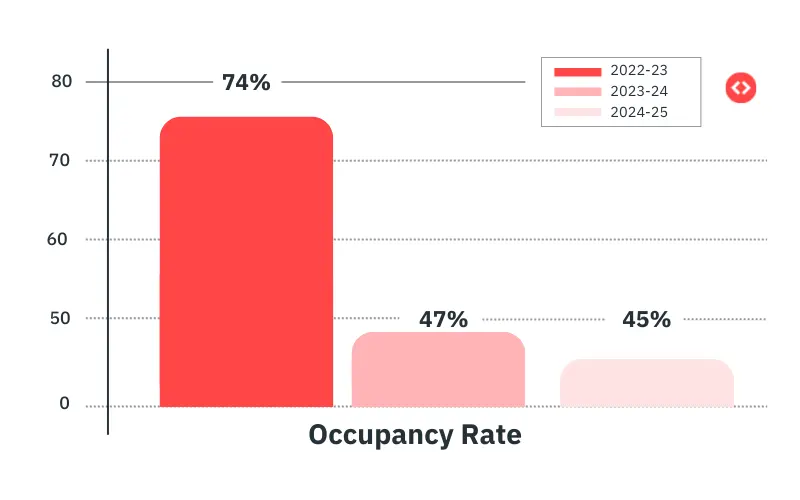

3. Occupancy dipped hard – then stabilised at a new normal

Despite the collapse in booked nights, the occupancy rate for active listings tells a more nuanced story.

From the Occupancy sheet:

- Average occupancy in 2022–23: ~73.7%

- 2023–24: ~46.9% (about 27 percentage points lower)

- 2024–25: ~45.2%, almost flat vs 2023–24 but still ~29 points below pre-fire levels

Month by month:

- The first post-wildfire year shows a consistent 20–30% drop in occupancy vs 2022–23.

- In July 2024–25, occupancy at ~58.5% is noticeably higher than 38.9% in July 2023–24, hinting at seasonal recovery and slowly returning demand.

So, what’s happening?

- There are far fewer listings and far fewer bookings overall, but

- A subset of active listings maintains mid-40s to high-50s occupancy in many months, especially as we move into 2024–25.

For hosts still active in Lahaina (or in any disrupted market), this means:

- You can still attract a meaningful share of demand

- But you’re operating with more volatility and a smaller total demand pool than before

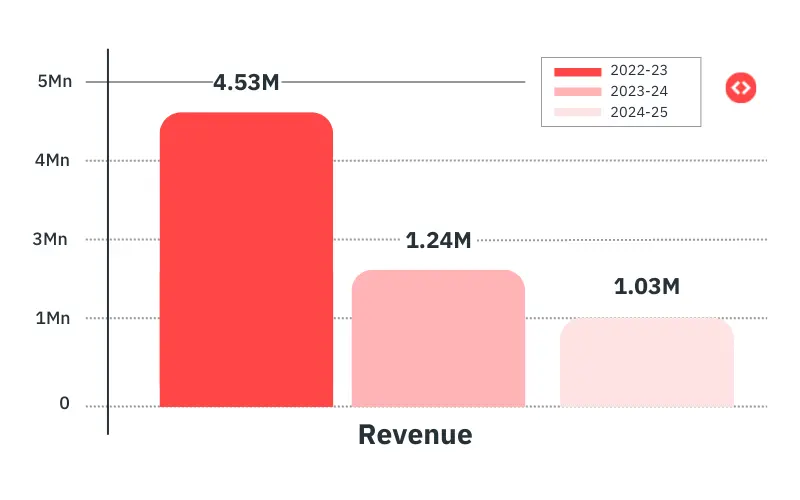

4. Revenue fell ~70% – but RevPAR is surprisingly close to pre-fire levels

When you combine fewer listings and fewer booked nights, total revenue takes a heavy hit.

- Average monthly revenue in 2022–23: ~$4.53M

- 2023–24: ~$1.24M (-72% vs baseline)

- 2024–25: ~$1.03M (-77% vs baseline, ~-16% vs 2023–24)

So the market is still far from its original revenue size.

But if you look at RevPAR (Revenue per Available Rental):

- Average RevPAR 2022–23: ~$352

- 2023–24: ~$321 (about -9%)

- 2024–25: ~$344 (only ~2.5% below pre-wildfire)

And in some months, RevPAR in 2024–25 actually exceeds 2022–23:

- March 2024–25: RevPAR ~$534 vs $399 in 2022–23

- April 2024–25: $413 vs $344

- July 2024–25: $489 vs $351

So even though the total pie is much smaller, for the listings that are still active and well-positioned, earnings per available night are now close to (or even above) pre-wildfire levels in several months.

This is an important takeaway for hosts:

In a disrupted market, macro revenue can be down, but unit-level performance can still be healthy if you stay active, visible, and smart with pricing.

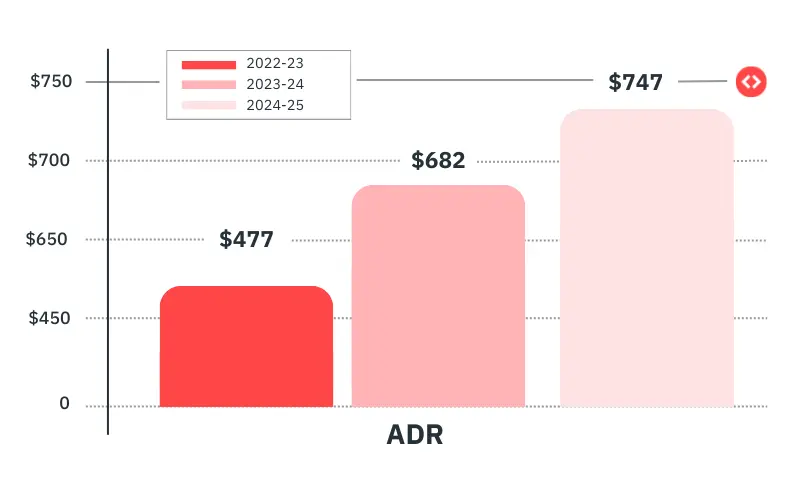

5. ADR surged: fewer listings, higher rates

RevPAR doesn’t recover by magic. A key driver here is ADR.

- Average ADR in 2022–23: ~$477

- 2023–24: ~$682 (+43% vs baseline)

- 2024–25: ~$747 (+57% vs baseline, +9–10% vs 23–24)

Many months show ADR jumping 40–70% compared to 2022–23. This reflects:

- Hosts raising rates to cover higher costs and risk

- Scarcer inventory being able to command a premium

- Travelers who do choose Lahaina are willing to pay more for fewer options

But higher ADR comes with risks:

- Price too high relative to current demand → occupancy drops further

- Price too low in a low-supply market → you leave money on the table

This is exactly where data-driven pricing becomes non-negotiable: you can’t rely on pre-2023 instincts in a fundamentally different market.

6. What hosts in any disrupted market can learn from Lahaina

You may not be in Lahaina, but similar patterns apply in markets hit by:

- Natural disasters

- New STR regulations

- Sudden demand shocks (border closures, airline cuts, major event cancellations, etc.)

Here are the key lessons from Lahaina’s data:

6.1. Expect a multi-year, not single-season, adjustment

Lahaina’s booked nights are still ~85% below pre-fire levels even in 2024–25, and total revenue remains ~75% down. Recovery isn’t linear or quick.

What you can do with PriceLabs: Use Market Dashboards and tools like the PriceLabs STR Index (if available in your region) to track year-over-year changes in:

Dynamically Price Your Property and Get FREE Custom Reports Tailored To Your Property!

Use PriceLabs Dynamic Pricing to competitively and dynamically price your property according to demand shifts and analyze past performance to set a strong pricing strategy for your property.

Create your Account Now- Active listings

- Occupancy

- ADR and RevPAR

This helps you avoid overreacting to one strong or weak month.

6.2. Supply and demand can shrink together – pricing needs to reflect the new equilibrium

In Lahaina:

- Supply is down ~60%

- Booked nights are down ~80–85%

- But RevPAR is almost back to pre-fire levels, due partly to higher ADR

This is a different market, not just a weaker version of the old one.

With PriceLabs, you can:

- Use dynamic pricing to continuously adjust rates based on real demand patterns, not last year’s assumptions.

- Fine-tune the minimum, base, and maximum prices to reflect both lower competition and lower demand.

- Use date-level customizations for sensitive periods (e.g., anniversaries of the event, major policy updates).

6.3. Seasonality can shift after a shock

In Lahaina, some months in 2024–25 (like March, April, and July) show RevPAR above 2022–23 levels, signalling:

- Returning demand

- Guests concentrating travel into fewer months

- Different trip planning behaviour than before

Inside PriceLabs:

- Track future occupancy and pricing using features like Forward-looking demand indicators (where available) or Market Dashboards.

- Adjust minimum stays and last-minute discounts around new “hot” periods, not just the old high season.

7. Using PriceLabs in a post-disruption market: a practical playbook

If your market has gone through a disruption similar to Lahaina’s, here’s a simple framework you can follow with PriceLabs:

Step 1: Re-benchmark your market

- Open a Market Dashboard for your city or region.

- Compare your market’s current year against 2019 / 2022 or another pre-shock year:

- Active listings

- ADR & RevPAR

- Occupancy

- Lead times

This tells you if you’re in a shrunken, stabilised, or recovering phase.

Step 2: Reset your pricing assumptions

Given Lahaina-style patterns, ask:

- Is supply down more than demand?

→ You may have more pricing power than your occupancy alone suggests. - Has ADR climbed significantly?

→ Don’t anchor too low, but avoid overpricing if demand is still fragile.

In PriceLabs:

- Start with recommended dynamic prices.

- Adjust your base price using their base price help tools (where available).

- Use minimum-stay settings to balance occupancy (2–3 nights) with cleaning/turnover costs.

Step 3: Use rules and overrides to manage uncertainty

- Apply last-minute discounts more intelligently in shoulder or uncertain periods.

- Use Far-out premiums for dates 6–9 months ahead if your market typically books early but now has fewer listings.

- Add event- or date-level overrides for known tourism events that might return ahead of full market recovery.

Step 4: Monitor performance vs the market

Every 1–2 months:

- Compare your ADR, occupancy, and RevPAR vs the market median with PriceLabs’ analytics.

- If you’re lower on ADR but similar occupancy:

→ You can likely raise rates slightly. - If you’re higher on ADR but have much lower occupancy:

→ Consider more aggressive discounts or shorter minimum stays until the demand base grows.

Conclusion: Lahaina shows how fragile – and flexible – STR markets can be

The Maui wildfires turned Lahaina’s short-term rental market into a case study in shock, contraction, and recalibration:

- Supply: ~60% fewer listings than pre-wildfire

- Demand: ~80–85% fewer booked nights

- Revenue: ~70–75% lower total revenue

- Pricing: ADR up >50%, RevPAR nearly back to pre-fire levels for active listings

For hosts, the lesson is clear:

You can’t control disruptions, but you can control how quickly you adapt your pricing and strategy.

Tools like PriceLabs help you base those decisions on real data, not guesswork — whether you’re in Lahaina or any other market going through big structural change.

Frequently Asked Questions

1. How much did the short-term rental supply drop in Lahaina after the Maui wildfires?

Based on PriceLabs market data, active listings in Lahaina dropped by ~60% between 2022–23 and 2024–25. The steepest decline occurred immediately after August 2023, and supply has remained significantly constrained since then.

2. Has tourism demand recovered in Lahaina since the wildfire?

Not fully. Booked nights are still 80–85% lower compared to pre-wildfire levels. While a few months show early signs of recovery, overall demand remains far below 2022–23 levels.

3. Why is RevPAR almost back to pre-wildfire levels even though bookings fell?

RevPAR has recovered mainly because ADR increased 40–70% post-wildfire. With fewer listings available and higher operating costs, active hosts have been able to command higher nightly rates, offsetting the decline in occupancy.

4. Are Lahaina hosts charging significantly higher nightly rates today?

Yes. ADR in Lahaina increased from an average of $477 (2022–23) to $747 (2024–25) — a ~57% increase. This aligns with lower competition, higher risk, and increased operational costs.