Table of Contents

Updated : Dec 3, 2025

Atlanta, Kansas City, and Seattle are showing major uplift in ADR, RevPAR, and early occupancy pacing. For STR hosts, this is the moment to set strong price anchors and secure visibility before demand spikes even harder.

The FIFA World Cup is divided into two main phases, and understanding them helps hosts predict how fans will travel and how demand will behave.

1. The Group Stage (the first round of the tournament)

This is where all qualified teams begin their journey.

- Teams are divided into groups.

- Each team plays three matches.

- Fans travel in larger numbers because every team is still alive in the tournament.

- Matches are spread across multiple cities, creating a broader distribution of demand.

For hosts, this phase brings steady, early interest. Fans plan ahead, compare listings, and often travel in groups or families. Demand is healthy, but spread out.

2. The Knockout Stage (the elimination round)

This begins after the group stage, and every match becomes a win-or-go-home affair.

- Only the top teams advance.

- Each game eliminates one team.

- Stakes are higher, emotions run hotter.

- Fans book last-minute once they know their team has qualified.

This is the phase where demand compresses and spikes hard. Fans book quickly, stay longer, and are willing to pay more to be near stadiums hosting elimination matches.

The two phases create two totally different pricing strategies:

- Group Stage → early planners, gradual pacing

- Knockout Stage → urgent bookings, high willingness to pay

This is why hosts must treat them as two unique revenue windows, not one long event.

Dynamically Price Your Property and Get FREE Custom Reports Tailored To Your Property!

Use PriceLabs Dynamic Pricing to competitively and dynamically price your property according to demand shifts and analyze past performance to set a strong pricing strategy for your property.

Create your Account NowPricing Framework for Hosts (Simple, Fast, Data-Driven)

For a global event like FIFA 2026, pricing isn’t guesswork — it’s timing. Early pacing across key host cities already shows aggressive lifts in ADR and RevPAR, even where occupancy is still low. This is the clearest signal that hosts must price confidently and avoid reacting to slow pacing too early.

Across the 15 stadium markets analyzed, every single venue shows higher ADR in 2026 vs. the same time in 2025, with several posting triple-digit jumps. RevPAR performance is even stronger, with markets like Atlanta, Kansas City, Seattle, Philadelphia, and Guadalupe reporting extraordinary year-over-year surges driven by World Cup anticipation.

Here’s what those data signals mean for your pricing strategy:

1. Before Teams Are Announced: Anchor High

This is the phase we’re in today — and the numbers already show why hosts should lead with premium pricing.

- Atlanta (Mercedes-Benz Stadium) ADR: $472 vs $107 (+340%)

- Seattle (Lumen Field) ADR: $653 vs $278 (+135%)

- Kansas City (Arrowhead Stadium) ADR: $440 vs $335 (+31%)

- Philadelphia (Lincoln Financial Field) ADR: $240 vs $117 (+105%)

- Guadalupe (Estadio BBVA) ADR: $110 vs $12 (+806%)

Even with low early occupancy (e.g., Atlanta at 29.21%, Seattle at 11.75%), pricing signals are extremely strong across the board.

What this means: Don’t let low pacing trick you. These ADR jumps confirm that demand is forming and guests are willing to pay more. This is the window to set your highest anchor rates, avoid early discounts, and boost your listing’s visibility.

2. Group Stage Pacing: Hold Your Nerve

During the group stage, occupancy rarely fills early—but markets consistently outperform last year’s RevPAR.

Examples from the data:

- Atlanta RevPAR: 138.0 vs 0.1 (+128,383%)

- Kansas City RevPAR: 65.0 vs 3.8 (+1,594%)

- Seattle RevPAR: 76.7 vs 5.8 (+1,213%)

- Philadelphia RevPAR: 19.0 vs 0.9 (+1,911%)

- Guadalupe RevPAR: 6.2 vs 0.0 (+142,781%)

These numbers are wild — but more importantly, they show that revenue lift is happening without high early occupancy.

What this means: Group-stage demand is slow and steady. Resist the urge to cut prices if bookings don’t come immediately. The market is telling you the opposite: prices are rising despite low pacing.

Stay firm. Keep your minimum stays tighter. Trust the demand curve.

3. Knockout Stage Team Qualification: Push Hard

Once teams qualify for knockout rounds, the booking behavior flips:

- Fans book within hours, not days.

- Price elasticity increases sharply.

- International travelers flood the market.

- Proximity to stadiums becomes a premium factor.

Cities with stronger early indicators — especially Atlanta (+29.11% occupancy delta), Kansas City (+13.63%), Seattle (+9.65%) — are likely to see the sharpest knockout-stage compression.

What this means: When teams advance, raise rates 20–40% immediately and widen your last-minute price rules. This is your highest-earning window of the entire tournament.

The Framework in One Line:

1) Anchor high 2) Hold steady 3) Push aggressively when teams qualify.

Hosts who follow this rhythm will capture the full revenue potential of FIFA 2026 without chasing occupancy or underpricing during the biggest sports event of the decade.

We used STR Index and PriceLabs Market Dashboards to make these analyses for various markets in the FIFA 2026 schedule.

Create Data Analyses For Various Markets Using STR Index and Market Dashboards Like the Analysis In This Article.

Use STR Index and Market Dashboards with PriceLabs Dynamic Pricing to competitively and dynamically price your property according to demand shifts and analyze past performance to set a strong pricing strategy for your property based on real-market trends.

Create your Account NowTop 5 Stadium Markets to Watch (Highest Occupancy Delta)

While every FIFA 2026 host city is showing stronger pricing signals than last year, five stadium markets stand out for one reason: they’re already pacing far ahead of 2025 in occupancy, even before teams are assigned and fixtures are finalized. This early demand is a strong indicator of future compression and typically aligns with the markets where hosts capture the highest ADR and RevPAR premiums.

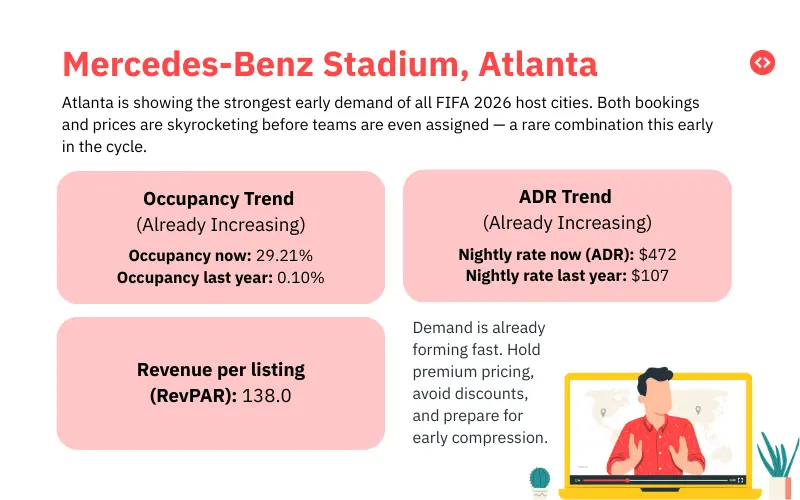

1. Mercedes-Benz Stadium, Atlanta — +29.11% Delta

Atlanta is the clear front-runner, showing the single largest occupancy surge of any host city.

- Occupancy: 29.21% (vs 0.10% LY)

- ADR: $472 (vs $107)

- RevPAR: 138.0 (vs 0.1)

This combination — high pacing + high pricing — is extremely rare this early. It signals that Atlanta will likely be one of the most competitive and high-value markets during both the group and knockout phases.

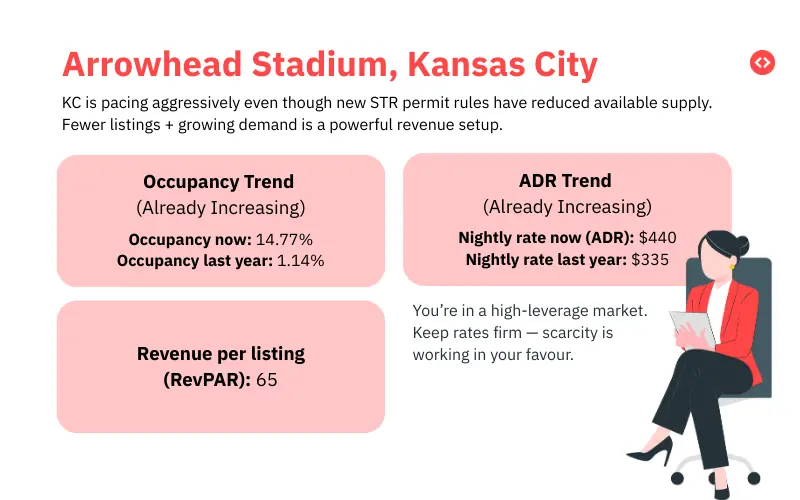

2. Arrowhead Stadium, Kansas City — +13.63% Delta

Despite local regulatory constraints and permits limiting some STR activity near downtown, Kansas City is showing the second-highest demand acceleration.

- Occupancy: 14.77% (vs 1.14%)

- ADR: $440 (vs $335)

- RevPAR: 65.0 (vs 3.8)

Regulations aren’t dampening interest; they’re compressing supply, strengthening prices, and intensifying market conditions for hosts who can operate legally.

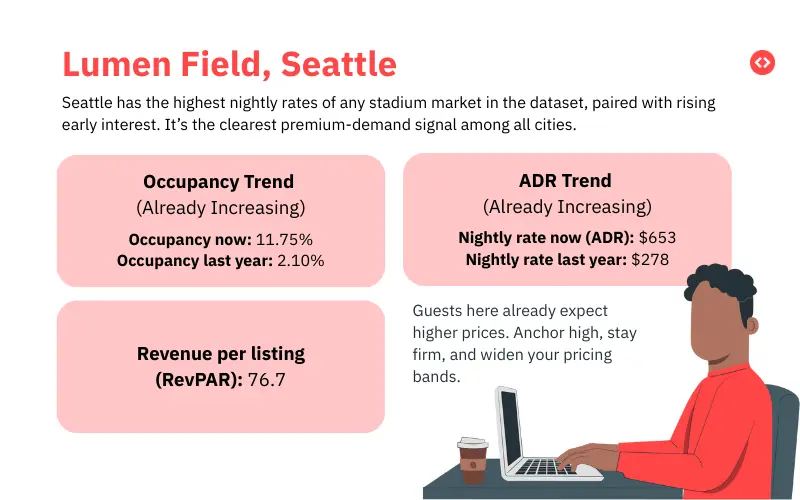

3. Lumen Field, Seattle — +9.65% Delta

Seattle stands out as a premium ADR market with rising occupancy and one of the highest rate increases in the dataset.

- ADR: $653 (highest among all stadium markets)

- RevPAR: 76.7 (vs 5.8)

- Occupancy: 11.75% (vs 2.10%)

This mix of premium pricing and steady pacing suggests Seattle could become one of the most profitable markets during the tournament.

4. Lincoln Financial Field, Philadelphia — +7.11% Delta

Philadelphia’s occupancy uplift is notable because the market historically fills later — yet revenue performance is already surging.

- ADR: $240 (vs $117)

- RevPAR: 19.0 (vs 0.9)

This early RevPAR jump indicates strong price acceptance, even with modest occupancy.

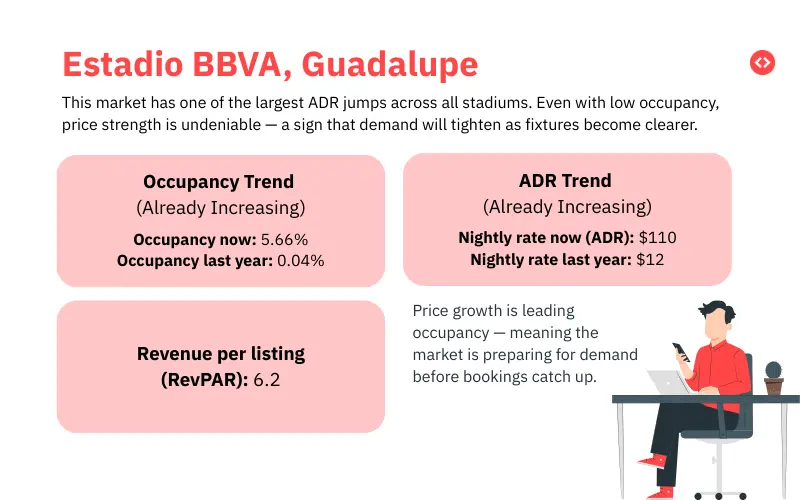

5. Estadio BBVA, Guadalupe — +5.62% Delta

Guadalupe offers one of the most dramatic rate shifts in the entire analysis.

- ADR: $110 (vs $12)

- ADR growth: +806%

- RevPAR: 6.2 (vs 0.0)

Low occupancy but extreme pricing uplift suggests demand is forming quickly and will likely tighten as Mexican teams are placed in the match schedule.

Why These Markets Matter

These top five cities provide hosts with a preview of where the strongest opportunities lie. When a city shows high occupancy delta + high ADR delta before fixtures, it almost always becomes one of the strongest tournament performers. Hosts in these markets should plan tighter minimum stays, premium pricing, and more aggressive knockout-stage strategies.

Closing: The Smart Host Advantage for FIFA 2026

FIFA 2026 will bring millions of fans, thousands of matches across three countries, and unprecedented pressure on accommodation supply. The hosts who win will be the ones who trust the data, maintain premium anchors, and use pricing automation to stay responsive when demand accelerates. The groundwork is already laid — now it’s time to turn insight into action.