Table of Contents

Updated : Dec 17, 2025

Croatia has established itself as one of Europe’s most attractive destinations for short-term rentals. With its Adriatic coastline, historic cities like Dubrovnik and Split, and hundreds of islands, the market thrives on strong seasonal demand. As tourism continues to expand, vacation rentals have become a key accommodation type, competing with hotels and resorts. Amidst this, it has become increasingly important to stay on top of vacation rental trends in Croatia.

In 2025, the Croatian short-term rental (STR) market faces both growth opportunities and new challenges, shaped by evolving traveler behavior, increased supply of listings, and regulatory shifts.

Vacation Rental Trends in Croatia 2025

Tools like World STR Index and PriceLabs Market Dashboard help property managers in Croatia and across the world to draw market insights to inform their revenue management strategies. Using these tools, we have drawn data for the Croatian short-term rental market to identify vacation rental trends in 2025.

1. Occupancy Trends

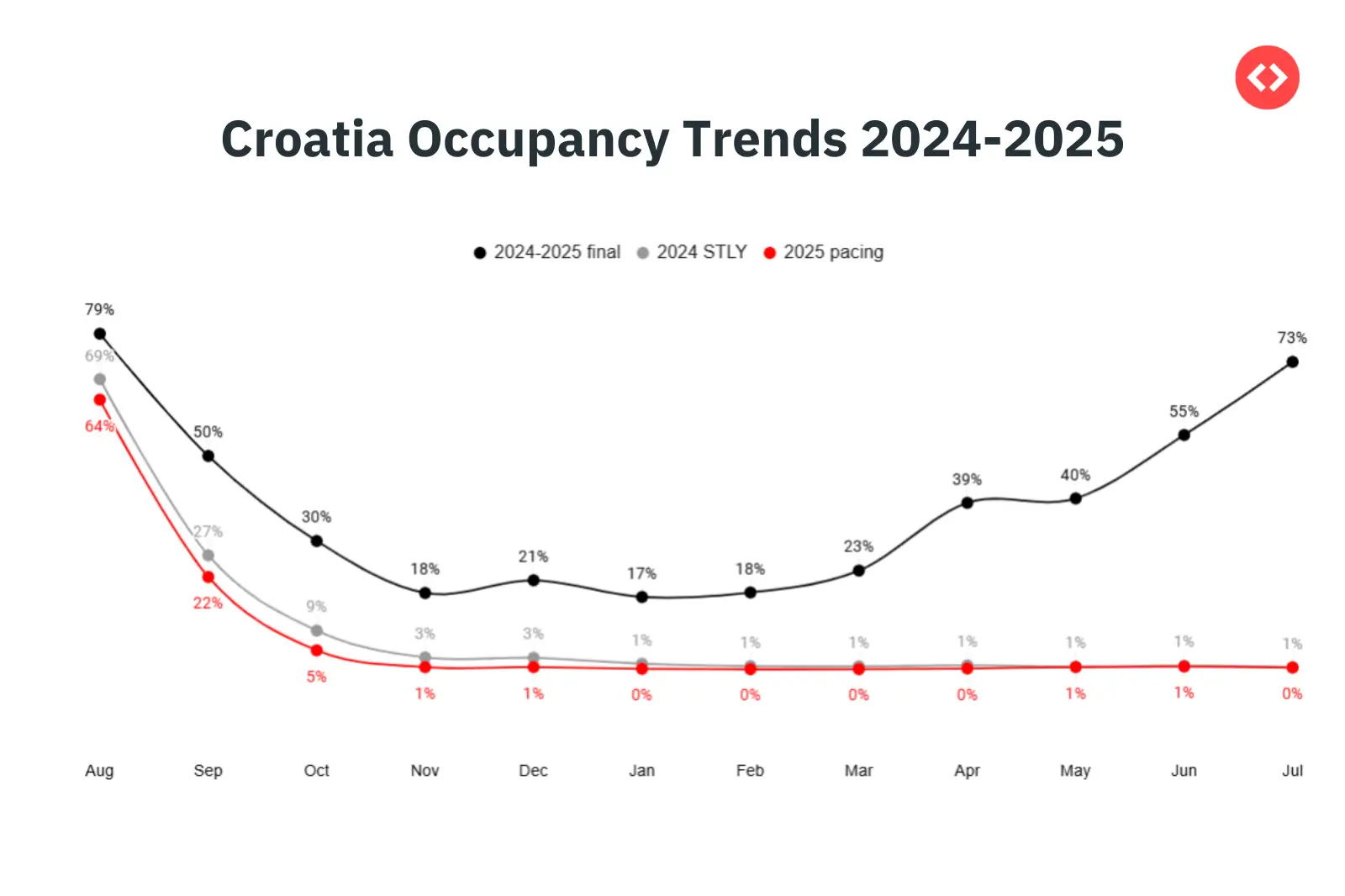

Croatia’s occupancy levels in 2025 show clear seasonality. Peak months such as August (79%), July (73%), and June (55%) continue to dominate, reflecting strong international demand for summer holidays. In contrast, the winter months—January (17%), February (18%), and December (21%)—show significantly weaker occupancy.

- Average occupancy across 2025 is 33%, higher than 2024’s 13% but still pacing lower at 9% for 2025 forward bookings.

- Growth compared to the previous year remains fragile, at -4% overall, with gaps especially pronounced in shoulder and off-season months.

Insight: Croatia’s reliance on the summer season is evident, with minimal occupancy outside peak months. This highlights opportunities for destination marketers and property managers to develop off-season tourism offerings (e.g., wellness retreats, conferences, cultural festivals).

Unlock Market Insights with PriceLabs Market Dashboards

Want to stay ahead of the competition? With PriceLabs Market Dashboards, you can track local demand patterns, benchmark against competitors, and spot booking trends before anyone else. From occupancy rates to ADR shifts, get the data you need to set the right pricing strategy and maximize revenue.

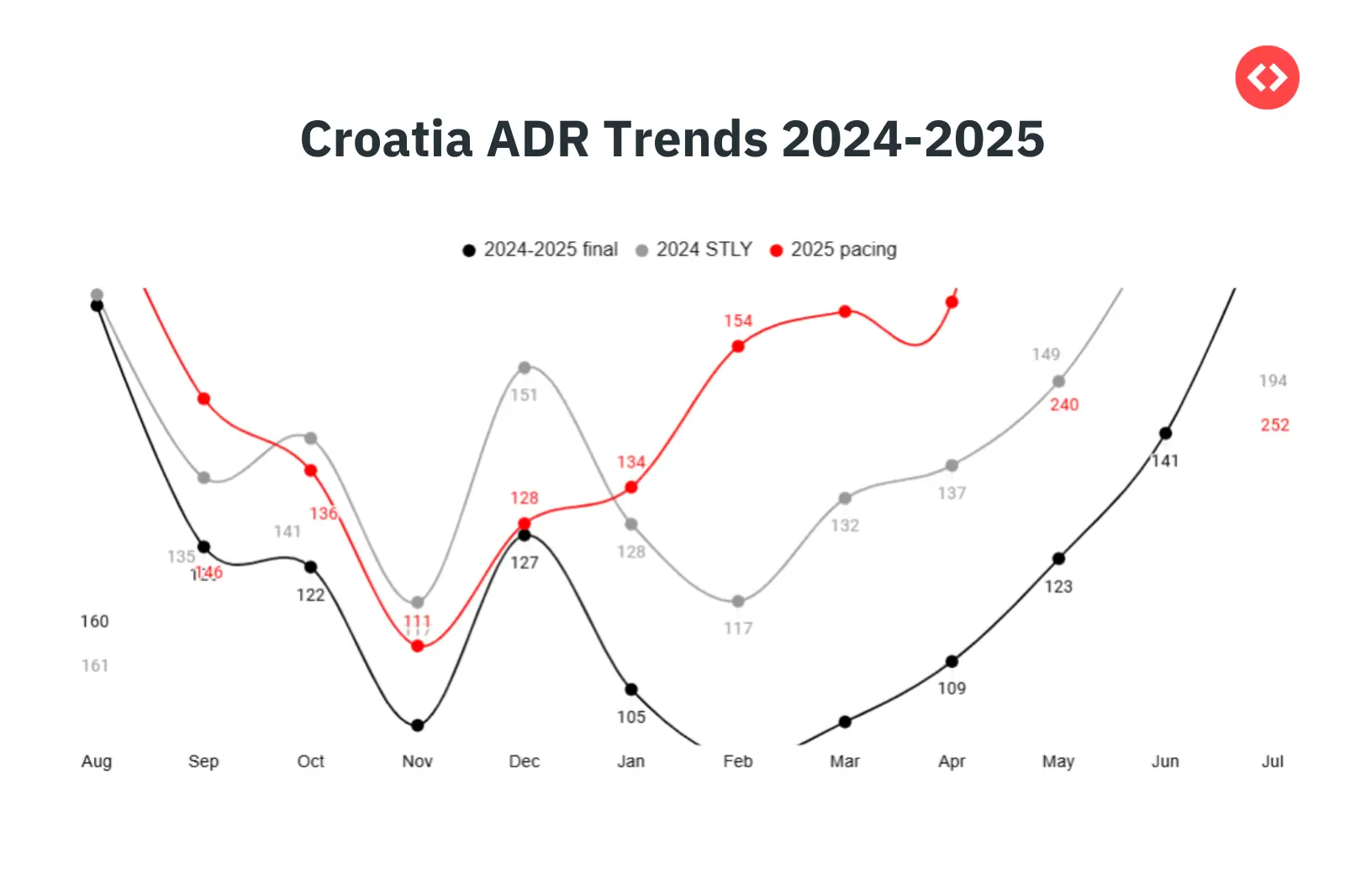

Explore PriceLabs Market Dashboards2. ADR (Average Daily Rate) Trends

In 2025, ADRs in euros remain relatively strong across the year, though highly seasonal:

- Peak ADRs: July (€175), August (€160), and June (€141), reaching up to €252 pacing for July 2025.

- Low ADRs: November (€100), January (€105), and February (€95).

- Annual Average ADR: €116, in line with 2024 (€131), showing flat year-over-year growth.

Insight: While occupancy fluctuates heavily, ADR levels remain resilient, especially in the summer. This suggests Croatia continues to attract high-spending travelers during peak months but has limited pricing power in winter.

Read More: Spain Short-Term Rental Market Data 2025: Analyzing Shifting Trends

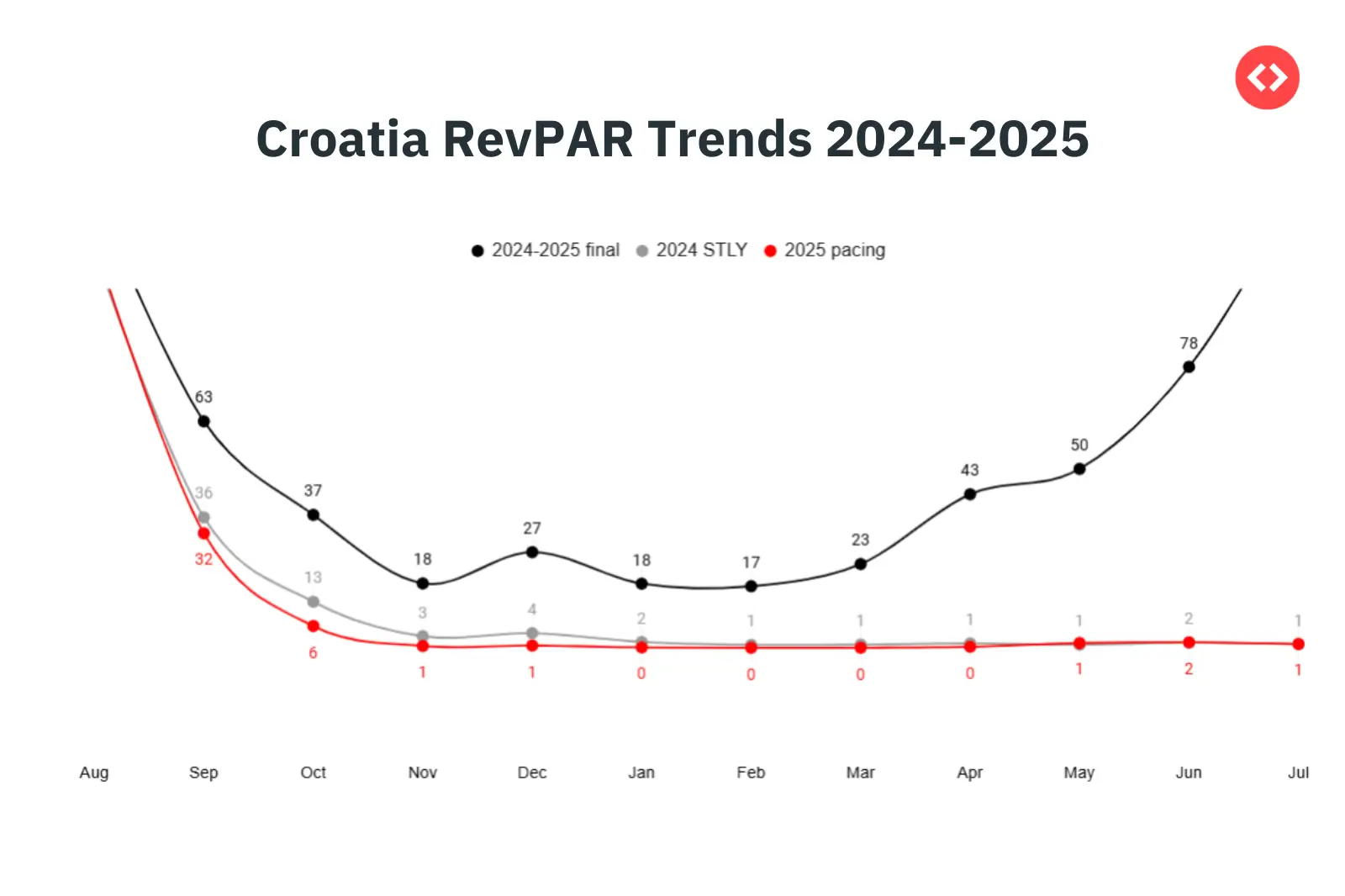

3. RevPAR Trends

RevPAR (Revenue per Available Rental) provides the clearest picture of seasonality in Croatia’s vacation rental market:

- High points: August (€126), July (€127), and June (€78).

- Lows: January and February at just €18–17, underscoring weak winter demand.

- Average RevPAR: €39 in 2025, down from €53 in 2024, marking a -26% decline year over year.

Insight: RevPAR seasonality is sharper than ADR, driven primarily by occupancy swings. Even with steady ADRs, poor off-season occupancy drags overall performance. Targeted promotions and vacation rental marketing in low-demand months could help reduce volatility.

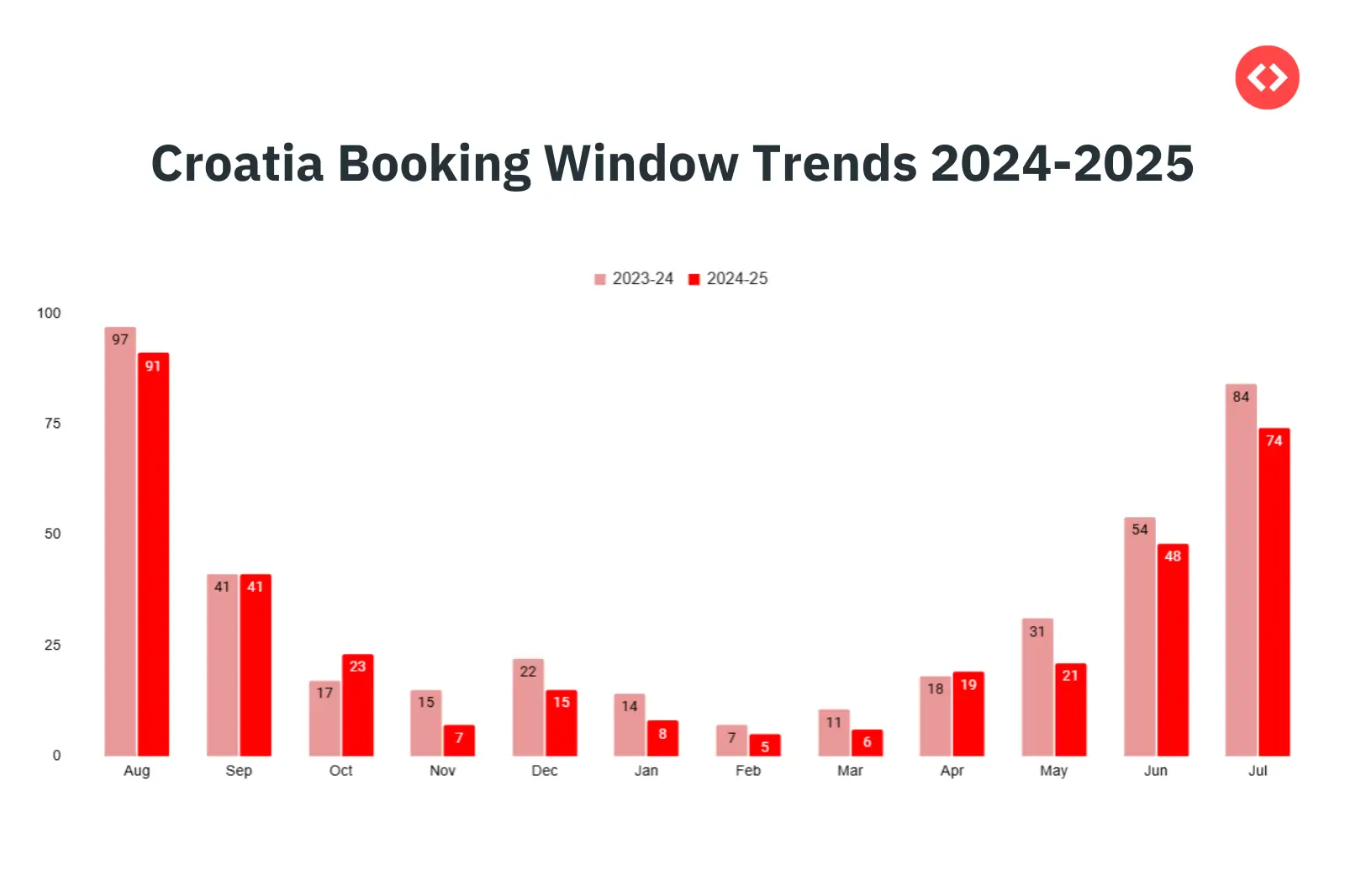

4. Booking Window Trends

Booking behavior in Croatia shows shorter planning horizons in 2025:

- Peak months: August bookings were made 91 days in advance on average, July 74 days, while June averaged 48 days.

- Short booking windows: Winter months like February (5 days) and January (8 days) reflect last-minute domestic bookings.

- Annual average: 29.8 days in 2025, compared to 34 days in 2024, a 13% decrease.

Insight: The shortening booking window signals greater uncertainty and flexibility in traveler behavior. Hosts need to adopt agile pricing strategies and maintain visibility across OTAs to capture late bookers.

Read More: Italy Booking Behavior: A Post-2020 Guide for Property Managers

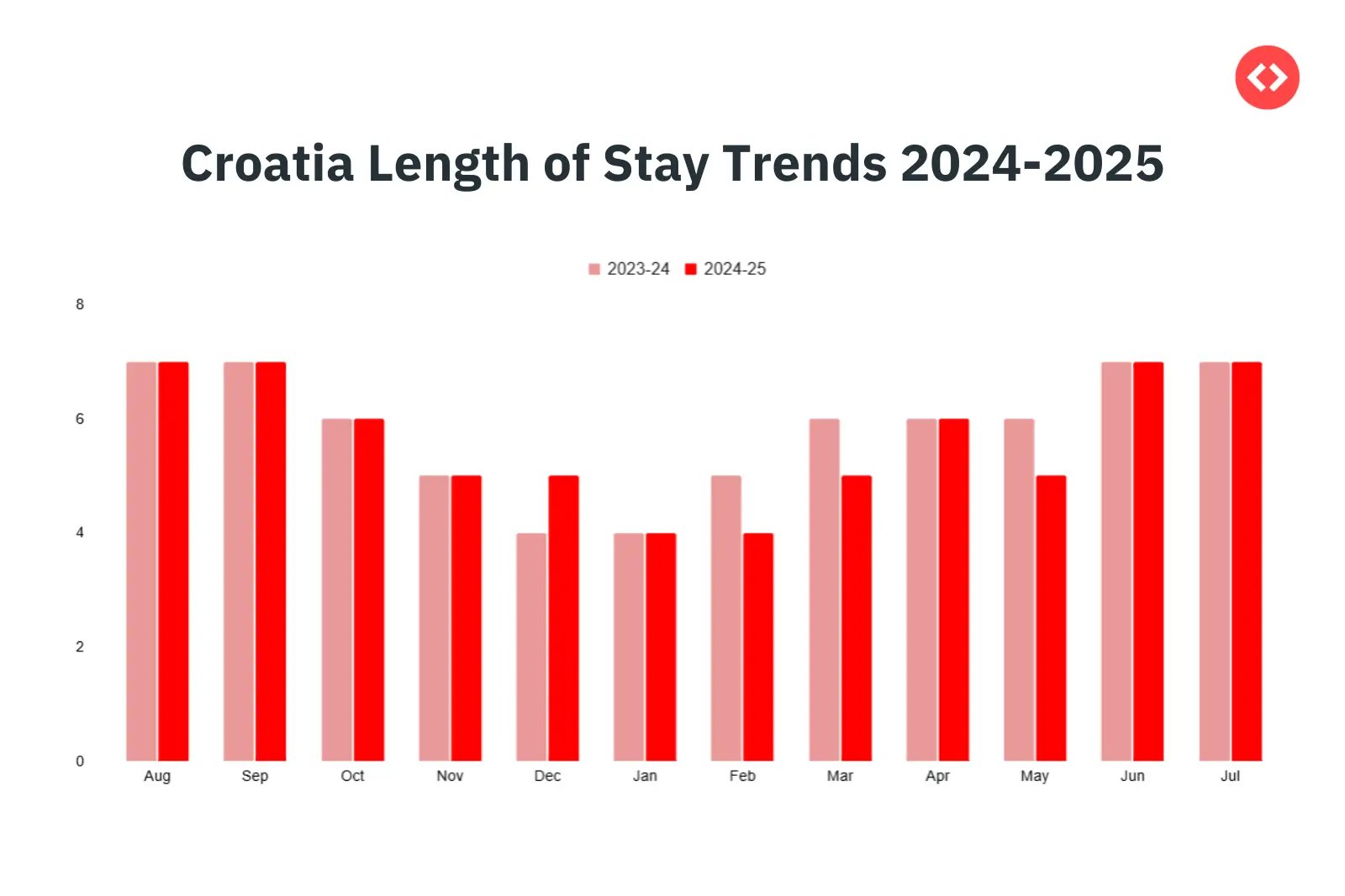

5. Length of Stay Trends

Travelers’ length of stay in Croatia has shortened slightly in 2025:

- Peak stays: July and August still average 7 nights, confirming Croatia’s appeal for week-long summer holidays.

- Shoulder and off-season stays: November through March average 4–5 nights, driven by short city breaks and weekend trips.

- Annual average stay: 5.67 nights in 2025, down from 6 nights in 2024 (a 3% decline).

Insight: Shorter stays suggest budget-conscious travelers and the rise of flexible trips. Adjusting minimum stay requirements—longer in summer, shorter in off-season—can help optimize both occupancy and revenue.

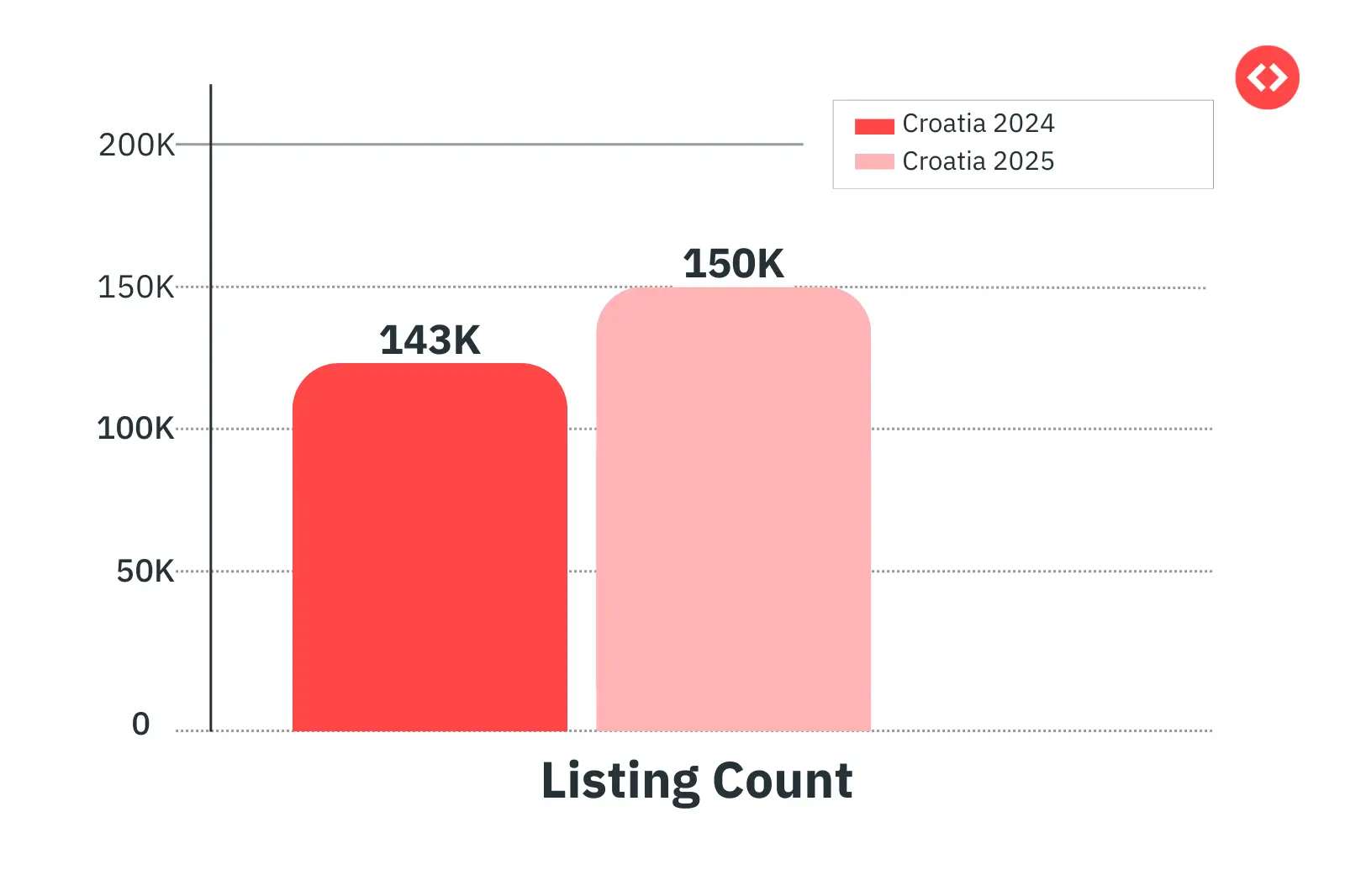

Listing Growth in Croatia

The number of active short-term rentals in Croatia has steadily increased, with 150,000 active listings by July 2025, compared to 143,305 a year earlier.

Key Insight: While growth is moderate (4.7% YoY), Croatia is approaching a saturation point. More supply means more competition for occupancy, making revenue management strategies (like dynamic pricing) even more critical.

Read More: Short-Term Rental Laws in Italy in 2025

Dynamic Pricing: Adoption and Impact

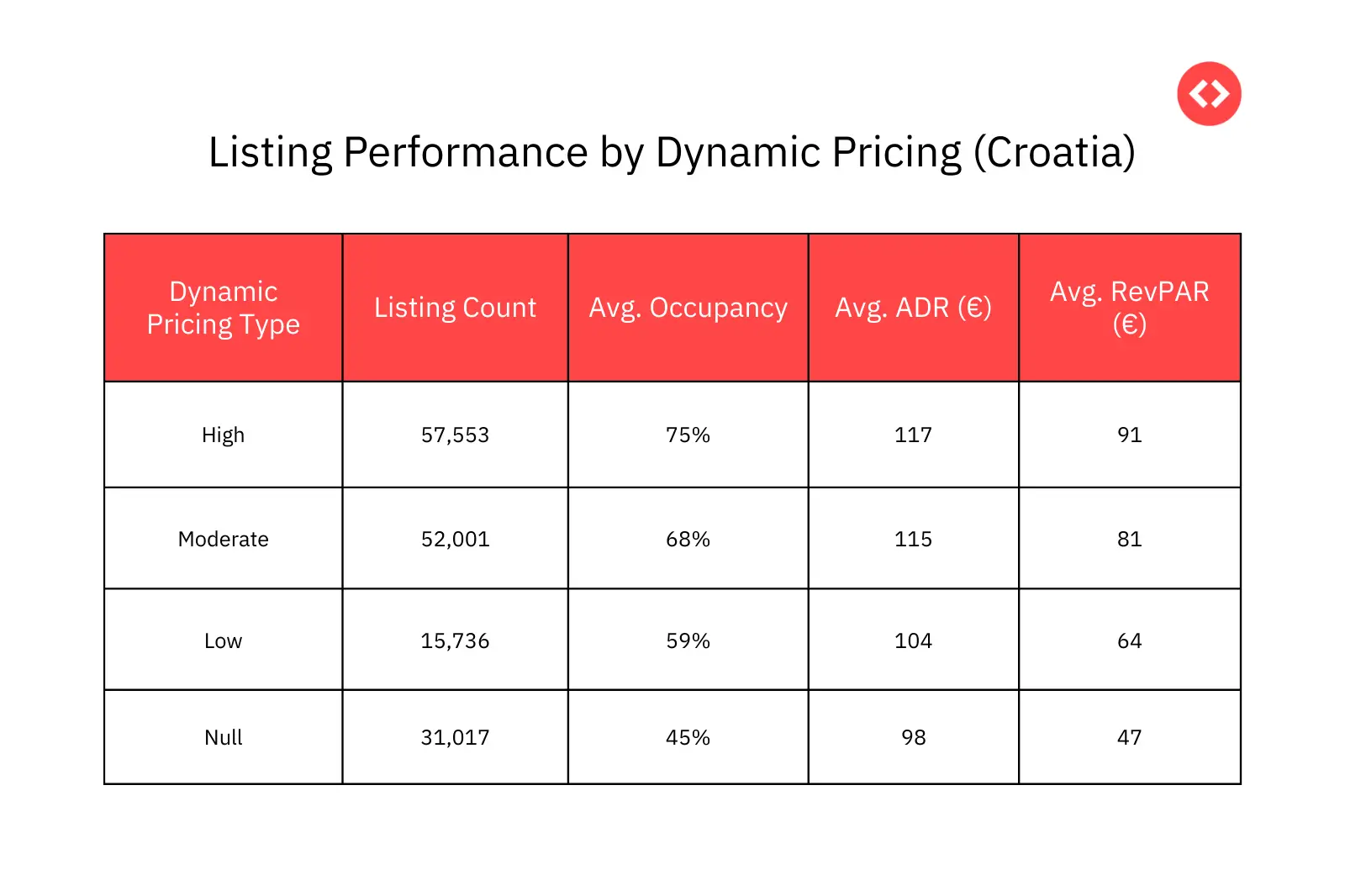

Dynamic Pricing (DP) tools such as PriceLabs are increasingly used in Croatia. These tools adjust rates in real-time based on demand, seasonality, and market competition.

Adoption Levels

From July 2025 data:

- 17% of listings don’t use dynamic pricing.

- Among those using it: 29% Low, 30% Moderate, 12% High.

Performance Impact of Dynamic Pricing

Listings using DP show higher occupancy, ADR, and RevPAR, with the difference most pronounced in peak season.

Occupancy Rates Rise with DP Adoption

- Listings with high dynamic pricing adoption enjoy an impressive 75% occupancy, compared to just 45% for listings without DP.

- Even moderate dynamic pricing boosts occupancy to 68%, showing that fine-tuned pricing strategies keep calendars consistently filled.

ADR Increases with Smarter Pricing

- Hosts using high dynamic pricing achieve the highest ADR at $133, compared to $112 without DP.

- Interestingly, even though low dynamic pricing has some effect, it caps ADR at $118, showing that under-utilized dynamic pricing doesn’t maximize rate potential.

RevPAR is Where the Gap Widens Most

- Revenue per available room (RevPAR) is the clearest indicator of DP’s value.

- Properties with high DP earn $103 RevPAR, almost double the $54 RevPAR of listings without DP.

- Moderate DP still delivers strong returns at $92 RevPAR, showing that even partial adoption significantly improves revenue outcomes.

The Takeaway: Full DP Unlocks Competitive Edge

- High dynamic pricing strikes the best balance: higher occupancy + higher ADR = maximum RevPAR.

- Properties not using dynamic pricing leave substantial revenue on the table, both in occupancy gaps and nightly rates.

Boost Your Bookings with Dynamic Pricing

Croatia’s vacation rental trends show just how much occupancy, rates, and booking behavior can improve with Dynamic Pricing. With PriceLabs Dynamic Pricing, you’ll always stay one step ahead—automatically adjusting your prices to capture demand, boost RevPAR, and keep your calendar full, no matter the season.

Sign Up For Free trialHow Property Managers Can Apply These Insights?

To turn these insights into action, property managers must think beyond traditional hosting and embrace a data-driven approach across all aspects of their business.

1. Advanced Revenue Management

- Adopt or Upgrade Your Dynamic Pricing Tool: The data is unambiguous: a high-performing listing in 2025 is a dynamic pricing listing. Choose a tool like PriceLabs Dynamic Pricing tool that offers deep market insights and allows you to customize minimum stay rules and discount strategies.

- Implement a Tiered Pricing Strategy: Don’t just set a price; set a strategy. For example, during summer, set a high base rate with a 7-night minimum stay. In the off-season, lower your base rate and offer last-minute discounts for bookings within a 14-day window to capitalize on the shorter booking trend.

- Optimize Minimum Stay Rules: Utilize a tool to automatically adjust minimum stays. In July and August, a 7-night minimum reduces turnovers and operational costs. In the winter, drop this to 2-3 nights to attract weekend getaways and short breaks.

2. Strategic Marketing

- Create Off-Season Packages: Marketing “sun and sea” in November is a losing game. Instead, pivot your messaging to highlight the local attractions for specific seasons.

- Wellness & Foodie Retreats: Partner with local spas, restaurants, and wineries to create all-inclusive packages. Market your property as a cozy base for a relaxing off-season escape.

- Digital Nomad Stays: With shorter stays and remote work on the rise, position your property as a perfect “work-from-anywhere” hub. Highlight fast Wi-Fi, a dedicated workspace, and local cafes with great coffee.

- Culture & Festival Tourism: Research local events like the Rijeka Carnival in February or the Zagreb Festival of Lights in March. Promote your listing as the ideal base for these cultural experiences, which attract travelers outside of summer.

3. Operational and Compliance Strategies

- Streamline Operations for Faster Turnovers: The drop in average length of stay means more frequent cleanings. Automate property management tasks, such as guest communication (check-in instructions, welcome messages), to save time. Consider an optimized vacation rental cleaning process to handle the increased workload efficiently.

- Stay Ahead of Regulations: Starting in 2025, Croatian short-term rental regulations have become much stricter and now require apartment owners in residential buildings to obtain consent from at least 80% of co-owners before a property can be registered for tourist rental—a change aimed at curbing the rapid conversion of homes to short-term rentals and easing pressure on local housing availability. The government has also introduced a clear legal distinction between “hosts” (those renting out rooms in their primary residence or small-scale family accommodation) and “landlords” (commercial operators or those whose primary income comes from short-term rentals); these categories now face different tax rates and compliance standards, with landlords subject to higher taxes and more rigorous checks. Property owners must now also register officially, keep proper guest records, and adhere to local zoning rules, which can vary by city or region in Croatia. Ignoring these changes is a significant business risk. Actively monitor local regulations, as they can vary by city, and ensure your property is fully compliant. This will help you to future-proof your STR business from crises.

The Future of Croatian Property Management is Professional

The Croatian vacation rental market in 2025 is at a crossroads. While the allure of its coastline and islands remains, the era of passive, “set-it-and-forget-it” pricing strategy is over. The data is precise: competition is intensifying, traveler behaviors are becoming more erratic, and regulatory changes are introducing new complexities.

Success is no longer about strong seasonal demand alone. It’s about a professional approach to property management, revenue, and marketing. Property managers who embrace dynamic pricing will not only outpace their peers in ADR and occupancy but will also build a more resilient business model. Those who strategically market their properties in the shoulder and off-seasons will unlock new revenue streams, turning winter’s traditional weakness into a year-round strength.

Ultimately, the market is rewarding sophistication and technology. The most successful listings will be those managed by operators who treat their property as a business, not a hobby. By leveraging data, adapting to new regulations, and embracing a proactive, agile strategy, property managers in Croatia can secure their place at the forefront of this vibrant and evolving industry for years to come.

Frequently Asked Questions

1. What are the peak and off-peak seasons for vacation rentals in Croatia?

Peak occupancy months in Croatia are June, July, and August, with occupancy rates reaching up to 79% in August. Off-peak months like January, February, and December see much lower occupancy, often below 20%.

2. How has the average daily rate (ADR) for vacation rentals in Croatia changed in 2025?

ADRs remain relatively strong during the summer peak months, with July averaging €175 and August €160. In the winter months, ADRs drop significantly, with November, January, and February staying around €95-€105.

3. What is dynamic pricing, and how does it impact rental revenue in Croatia?

Dynamic pricing tools adjust rental rates in real-time based on demand, seasonality, and competition. Listings that actively use high dynamic pricing see higher occupancy (up to 75%) and increased ADR and RevPAR, significantly boosting revenue.

4. Why are booking windows in Croatia shortening, and what does this mean for hosts?

Travelers are booking closer to their travel dates now, with average booking windows dropping by 13% to about 30 days. Property managers must adopt agile pricing and marketing strategies to capture late bookings and remain competitive.

5. How have regulations in Croatia affected the short-term rental market in 2025?

New laws require consent from a majority of co-owners in residential buildings before listing a property, and distinguish between “hosts” and “landlords” for tax purposes. These regulations have increased compliance requirements and slowed supply growth, affecting profitability.

6. What strategies can property managers use to improve off-season occupancy in Croatia?

Developing off-season tourism offerings such as wellness retreats, cultural festivals, experiential travel, and digital nomad packages can attract guests outside the summer months. Marketing around events like the Rijeka Carnival and Zagreb Festival of Lights is recommended.

7. How is the length of stay changing for vacation rentals in Croatia?

The average length of stay has decreased slightly to around 5.67 nights in 2025, driven by more flexible trips and budget-conscious travelers. Property managers should consider adjusting minimum stay requirements seasonally.