Table of Contents

Updated : Feb 21, 2026

The Australian short-term rental (STR) market is thriving, fueled by a robust domestic travel sector and the resurgence of international tourism. With significant growth in occupancy, ADR (Average Daily Rate), and RevPAR (Revenue per Available Room), the industry is more competitive and profitable than ever. For Airbnb hosts, property managers, and investors, this is a critical time to optimize operations and pricing strategies.

This comprehensive guide explores market performance, seasonal trends, pricing opportunities, future outlook, and practical strategies for success.

Market Performance Overview: Where Does Australia Stand?

Hometime, Australia’s largest collection of professionally managed holiday homes that are expertly cared for by local hosts and beautifully curated for our guests, has published a list of the best Airbnb markets in Australia.

Stay Ahead of the Market and Find the Right Amenities that Your Potential Guests Want Using PriceLabs Market Dashboard.

Use PriceLabs Market Dashboard and Neighborhood Data to track competitor pricing and demand shifts and analyze past performance to set a strong pricing strategy for your property.

Create your Market Dashboard NowActive Listings: Growth Signals Market Confidence

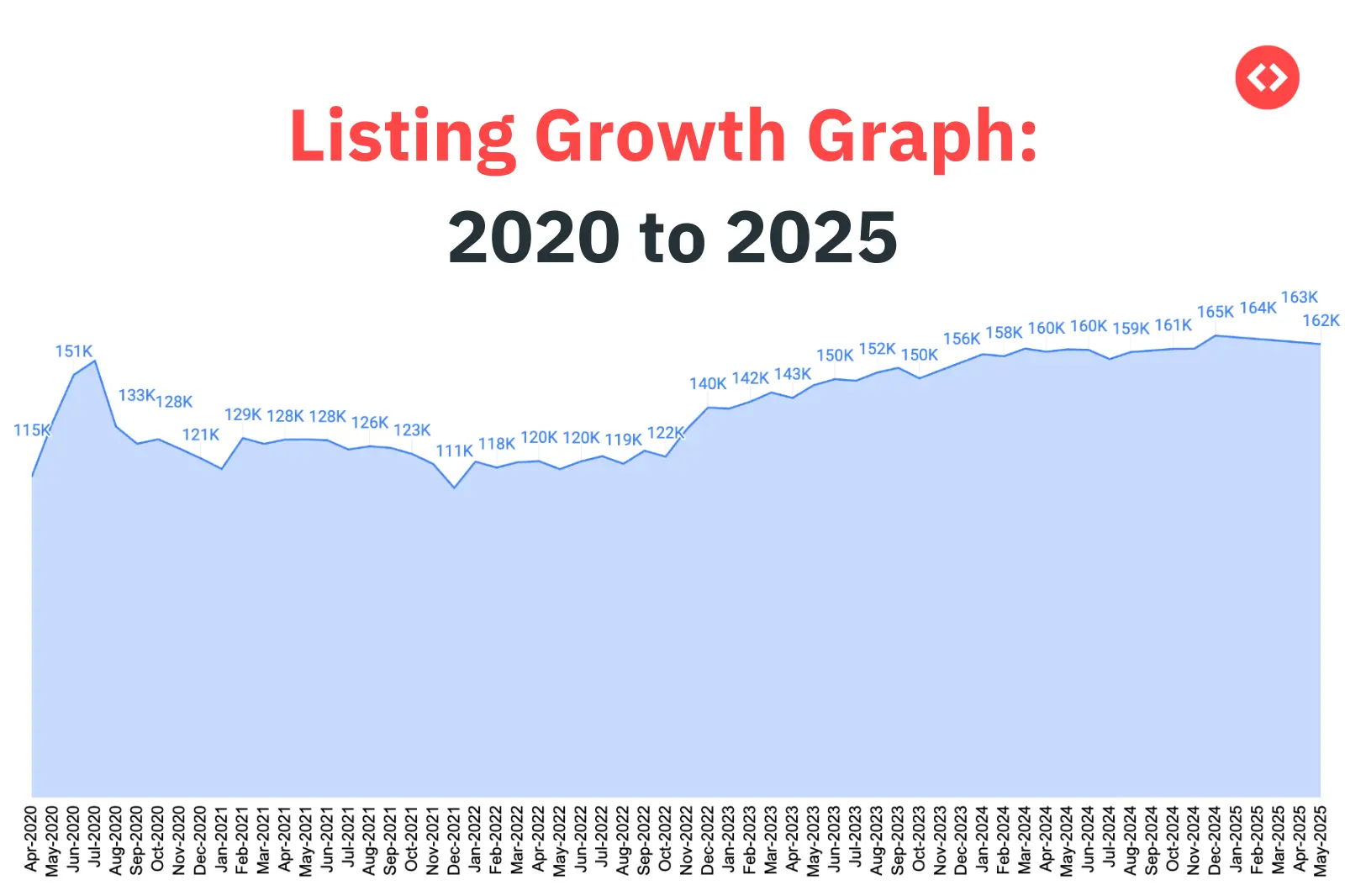

The number of active listings in Australia increased from 152,626 in 2023-24 to 161,296 in 2024-25, representing a 5.6% YoY growth. This surge indicates strong host confidence and higher market participation, but it also means that competition is intensifying.

As supply increases in the Airbnb Australia market, visibility becomes more challenging. Standing out requires professional listing quality, excellent guest reviews, and most importantly, dynamic pricing to stay competitive without undercutting your revenue.

Demand Surge: Booked Nights See Double-Digit Growth

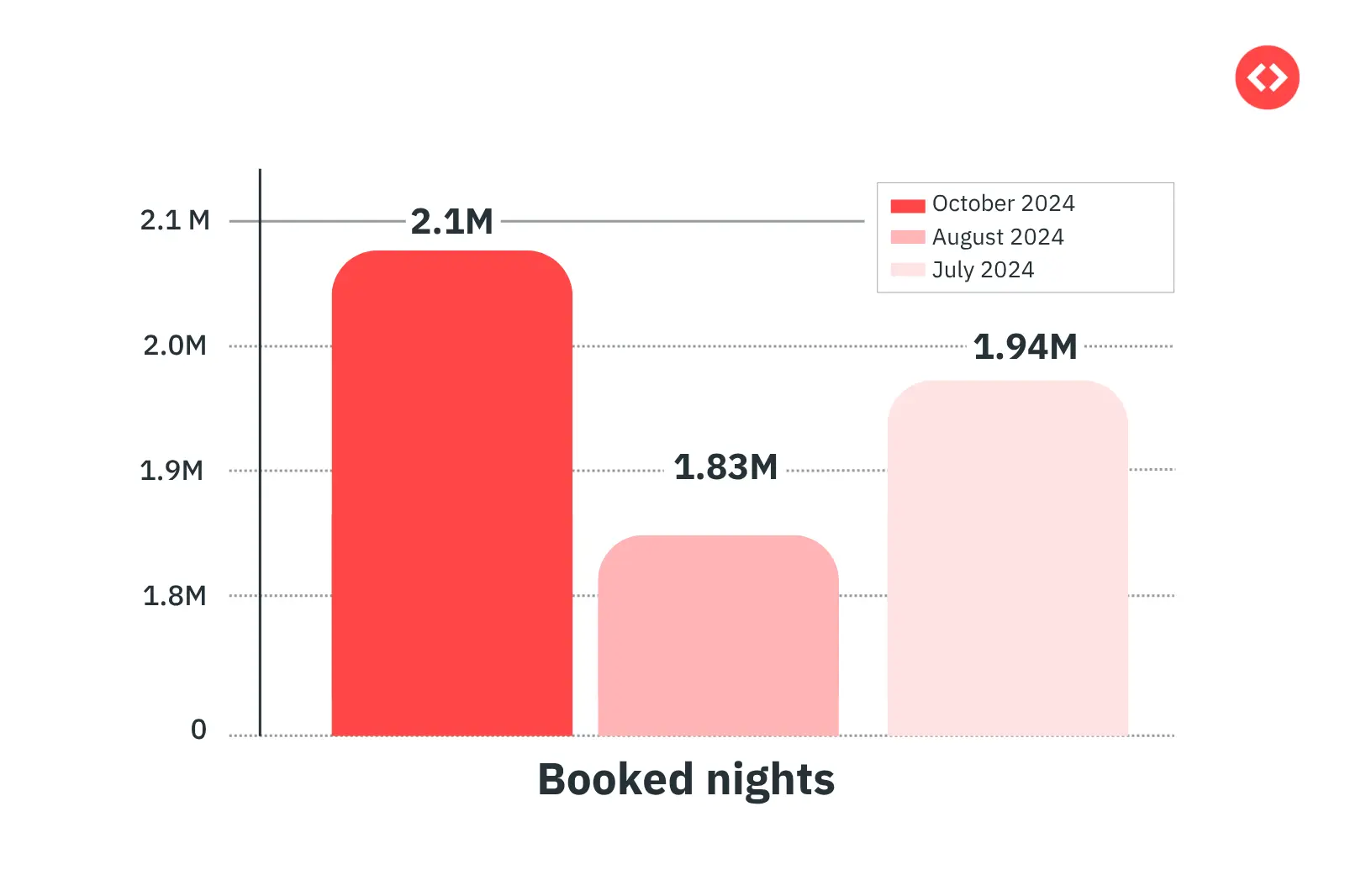

Booked nights have surged across key months, highlighting robust demand.

This consistent increase reflects greater traveler confidence and an extended booking season that extends beyond the traditional peak summer months.

Occupancy: Improving Utilization Across the Board

Occupancy rates climbed steadily:

- July 2024: 59.4% vs. 55.2% last year

- October 2024: 62.4% vs. 57.4%

Occupancy rates are rising which means that more and more stays are getting in this competitive landscape. This 4–5 percentage point improvement means better asset performance and higher booking probabilities for hosts who adopt smart pricing strategies.

ADR and RevPAR: Stronger Revenue Performance

- ADR:

- July 2024: USD 170 / AUD 260 (up from USD 161 / AUD 246)

- October 2024: USD 182 / AUD 279

- RevPAR:

- July 2024: USD 101 / AUD 154 (up from USD 89)

- October 2024: USD 114 / AUD 174

Higher occupancy does not mean that hosts are reducing prices. Higher ADR and RevPAR signify guests’ willingness to pay more, but with increased competition, hosts need to align rates with market demand to avoid missed bookings.

Regional Performance: Where Is Demand Strongest?

While the national picture is positive, demand varies regionally:

- Urban Markets (Sydney, Melbourne): Higher ADR but intense competition. Business travel and events boost weekday occupancy rate.

- Coastal Destinations (Gold Coast, Byron Bay): Premium rates during holidays and school breaks. Strong domestic demand continues.

- Regional Escapes (Tasmania, Outback): Longer booking windows and steady occupancy, ideal for targeting with early-bird discounts.

The Airbnb Australian market exhibits clear seasonal variations, although the 2024-25 period showed some interesting shifts in demand patterns.

Here’s how the numbers stack up:

Winter (June–August)

Traditionally considered off-peak, winter now shows robust performance:

- July 2024

- Occupancy rate: 59.4% (vs. 55.2% in July 2023)

- ADR: USD 170 / AUD 260 (up from USD 161 / AUD 246)

- Booked Nights: 1.94M (+11.6% YoY)

- August 2024

- Occupancy: 56.8% (vs. 51.7% last year)

- ADR: USD 162.8 / AUD 249

- Booked Nights: 1.83M (+13.4% YoY)

Takeaway: Winter travel is becoming popular, likely driven by regional getaways, ski destinations, and short domestic trips.

Spring (September–November)

- September 2024

- Occupancy: 61.1%

- ADR: USD 170.4 / AUD 260.8

- Booked Nights: 1.93M (+6.4% YoY)

- October 2024

- Occupancy: 62.4%

- ADR: USD 182.7 / AUD 279.6 (highest ADR in this period)

- Booked Nights: 2.13M (+11.2% YoY)

- November 2024

- Occupancy: 63.8%

- ADR: Approx. USD 180 / AUD 276

- Booked Nights: 2.00M (+7.8% YoY)

Spring offers strong demand, with October hitting peak ADR. This is the best time for hosts to use premium pricing strategies.

Booking Behavior

- Average Length of Stay (LOS): 4–5 nights in winter; 5–6 nights in spring.

- Lead Time: Shortening significantly; many bookings occur within 30 days of check-in.

- Domestic vs. International Mix: Domestic travelers dominate, but international arrivals (mainly from New Zealand, the US, and Europe) are rising, driving higher ADRs in urban markets.

Future Outlook: 2025 Booking Pacing and What It Means for Hosts

The forward-looking data for the Airbnb Australian market paints a nuanced picture. While overall demand fundamentals remain strong, booking behavior and pacing trends are shifting, creating both challenges and opportunities for hosts.

Key Pacing Metrics

- Occupancy pacing for July 2025: Currently at 36.8%, which is slightly behind the 39.9% occupancy at the same time last year. This indicates that fewer bookings are being locked in early compared to 2024.

- ADR pacing for July 2025: Stands at USD 178 (AUD ~273) compared to USD 173 (AUD ~266) last year, showing a 2.9% YoY increase despite slower occupancy pacing.

Travelers are booking later but are willing to pay higher rates, particularly for premium properties or peak dates. This shift toward shorter booking windows may be influenced by:

- Greater price sensitivity and the use of deal-hunting strategies.

- Uncertainty in travel planning due to economic or event-related factors.

- Increased reliance on last-minute trips by domestic travelers.

Challenges for Hosts and Property Managers in 2024-25

While the Airbnb Australia market is growing rapidly, this growth comes with significant challenges for hosts and property managers. Understanding these hurdles is the first step to overcoming them and maintaining profitability in an increasingly competitive landscape

1. Intense Competition: Standing Out Is Harder Than Ever

The number of active Airbnbs in Australia rose by 5.6% YoY, reaching an average of 161,296 listings in 2024-25. This influx of new supply makes visibility on platforms like Airbnb and Vrbo more challenging. Even experienced hosts now face:

- Lower organic visibility: With more listings competing for guest attention, appearing on the first page of search results requires excellent pricing strategy and strong reviews.

- Pressure on ADR: In saturated areas like Sydney or Melbourne CBD, underpricing to attract bookings can erode profitability, while overpricing risks low occupancy.

2. Pricing Volatility: Static Rates Are No Longer Sustainable

Market conditions change rapidly, influenced by:

- Seasonality shifts: ADR in October 2024 reached USD 182 / AUD 279, while July averaged USD 170 / AUD 260.

- Special events: Concerts, festivals, and sports events can spike demand unexpectedly.

- Booking behavior changes: Guests are booking closer to check-in, creating unpredictable pricing scenarios.

Hosts relying on fixed seasonal rates risk:

- Underpricing during demand surges: Missing out on peak revenue when events drive up occupancy.

- Overpricing during soft periods: Leading to empty calendars and lost income.

3. Shorter Booking Windows: The Rise of Last-Minute Travel

Data shows that booking lead times are shrinking, especially for domestic travelers.

- Many reservations are now made within 14–30 days of arrival, compared to 60 days or more pre-pandemic.

- Last-minute bookings are common during off-peak periods or for weekend getaways.

This trend creates uncertainty for hosts:

- Dropping rates too early can lead to unnecessary revenue loss.

- Holding rates too high for too long can result in missed bookings as the check-in date approaches.

What This Means for Hosts and How PriceLabs Helps You Win in Australia

The Airbnb Australia market is evolving quickly. To stay profitable, hosts must adapt to changing booking behaviors, rising competition, and fluctuating demand.

Lower early pacing numbers often cause concern, but historical trends show that bookings surge in the final 30 days before check-in, especially in peak months like July and August. Dropping prices too early can lead to lost revenue. Instead, use small, strategic adjustments closer to arrival dates to maintain ADR while securing occupancy.

Travelers are also willing to pay more for quality stays as check-in approaches. This makes flexibility essential. For example:

- Set longer minimum stays for early bookers to lock in higher-value reservations.

- Relax those rules closer to check-in to capture last-minute demand.

Hosts should also prepare for demand spikes around events like school holidays and major sporting fixtures, which can trigger booking surges just 2–4 weeks in advance. Capturing these opportunities manually is tough—automation is key.

How PriceLabs Makes This Easy for the Airbnb Australia Market

Provide a Great Experience & Generate 5-Star Reviews with Competitive Prices!

Static pricing hurts your Vrbo listing. Boost occupancy & revenue with PriceLabs’ Dynamic Pricing & Revenue Management tool. Optimize your pricing strategy based on market conditions, seasonality & competition for outstanding guest reviews.

Get Started NowPriceLabs takes the complexity out of revenue optimization with:

Dynamic Pricing adjusts rates based on demand, competitor pricing, seasonality, and events.

Market Dashboards to track ADR, occupancy, and booking pace trends in real time.

Neighborhood Data and Comp Sets to benchmark against similar properties in your area.

Advanced controls, such as minimum and maximum price limits, last-minute and orphan-night discounts, and dynamic minimum stay adjustments.

Conclusion: Growth Requires Smart Moves for Airbnb Australia Market

The Airbnb Australian market is thriving, but growth brings complexity. Hosts and investors who rely on static pricing risk losing out in a dynamic environment. By leveraging tools like PriceLabs’ Dynamic Pricing and market analytics, you can stay ahead of competitors, maximize revenue, and ensure long-term success.